On the eve of the Jackson Hole meeting, this week’s big event, investors are watching closely, as prices for the various types of risk assets are expected to rush sharply up or down depending on what comes out of the meeting. Considering these event-driven risks, Nomura’s quant team led by Masanati Takada lays out its views on three questions frequently asked by readers.

(1) Is it safe to conclude that the risk of a second bottom in global equity has been avoided?

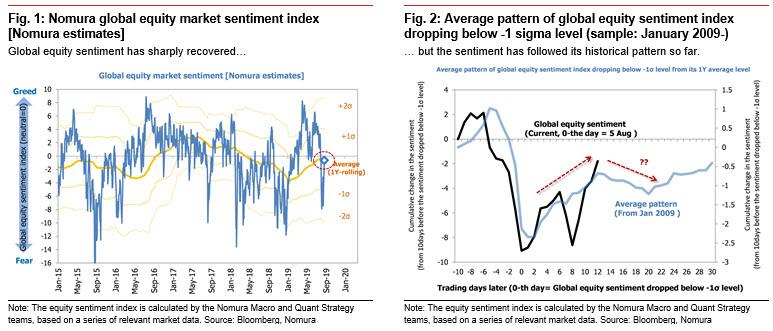

Although the likely magnitude of any second bottoming looks to have declined, the risk of a vol-up scenario playing out at the end of August or early September has not been completely eliminated. The past week has certainly seen developments that raise expectations for the final two of the three prerequisites we see for avoiding vol-up—(1) a trade agreement between the US and China, (2) a 50-100bp rate cut by the Fed (or a promise to do so in September), and (3) coordinated fiscal outlays by major governments—and this has lightened the risk of a collapse in sentiment. But the current equity rally seems largely driven by wishful thinking, and for (2) in particular, investors should be on their guard until it becomes clear just how dovish Fed Chair Jerome Powell will lean in his comments at Jackson Hole. The current recovery in global equity sentiment is also still within the average range for natural rebounds observed since 2009 (the average trajectory after sentiment drops by one standard deviation). Simply applying this average pattern to the current sentiment trend suggests that sentiment could turn downward again from around 26 August.

(2) Have hedge funds stopped selling off US equity?

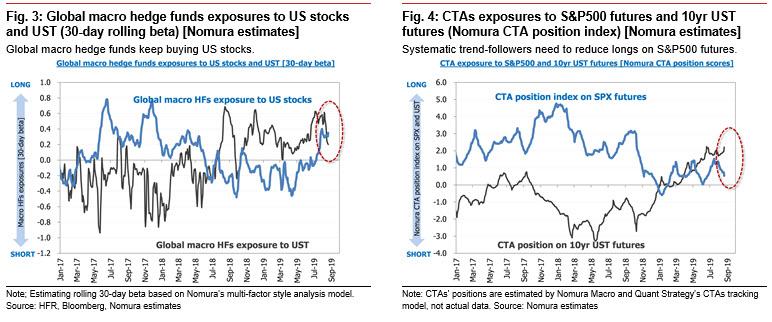

Hedge funds vary in their investment behavior. (1) Global macro hedge funds, which are bullish on fundamentals, are still buying on dips, while (2) trend-following algo players (CTAs and risk-parity funds) are sitting on the sidelines, but could be obliged to unwind their long positions if the VIX heads upward again. CTAs are still sounding out the market by closing out longs when the S&P 500 is below around 2,960. CTAs have currently unwound only 60% of the long S&P 500 future positions they held at the recent peak (16 July). We maintain our view that 2,920-2,960 is the zone in which to sell the rally. If the global macro hedge funds are disappointed by the outcome of the Jackson Hole meeting and Powell’s speech, the S&P 500 could fail to break above 2,960, which could cause CTAs to put off their shift toward equity buying.

(3) Is there no chance of another share price correction triggered by another inversion of the UST 2yr-10yr curve?

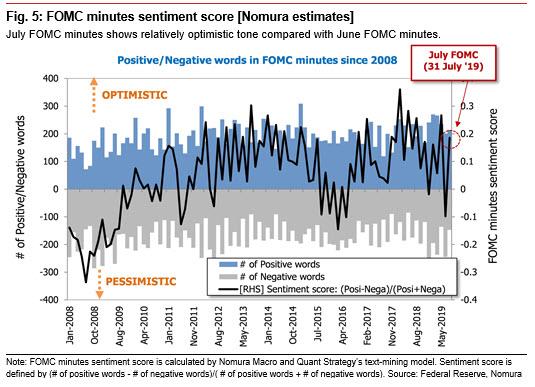

Some market observers have concluded that last week’s plunge in share prices (on 14 August) following the inversion of the UST 2yr-10yr yield curve was a temporary phenomenon, and that mechanistic investors were the main culprit. And, in fact, the equity market did not overreact yesterday (21 August) when the UST 2yr-10yr curve temporarily inverted. But this may be because yesterday’s inversion seems to have been mainly caused by wild swings in prices for 2yr USTs in reaction to the optimism expressed in the July FOMC meeting minutes.

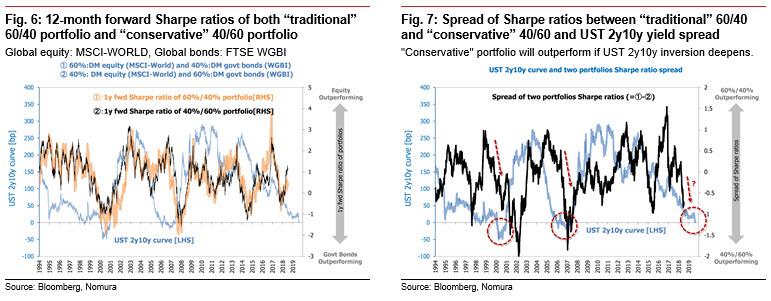

The majority of investors are waiting to see the outcome of upcoming events, and are unlikely to move much until Powell reveals his current stance. It still seems possible that longer-term investors could shift to more conservative investment stances if the 2yr-10yr curve inverts again, and more deeply. It is difficult to directly measure the behavior of longer-term players, but when comparing a portfolio of 60% equity and 40% bonds, often seen as a standard pattern for longer-term investment, with a more conservative portfolio of 40% equity and 60% bonds, we see that the latter tends to perform better when the yield curve is inverted. What this suggests is that longer-term players could gradually shift their investment weightings from stocks toward bonds if concerns over a global economic slowdown persist.

via ZeroHedge News https://ift.tt/2ZkYUps Tyler Durden