While we shared an extended preview of Jerome Powell’s Jackson Hole speech overnight, which in light of the latest trade war development which saw China impose tariffs on another $75BN in US goods, may have to be rewritten as an even more forceful response from Trump is now virtually assured, here is a summary snapshot of what Wall Street expects from today’s main financial event.

As we noted yesterday, following surprisingly hawkish comments from Philly Fed president Harker, Kansas City President Esther George and Boston Fed president Eric Rosengren, all of whom voiced their opposition to additional cuts, the market-implied odds of a 50bps rate cut in September has tumbled to just 2% as of this afternoon, down from 41% a week ago, resulting in yet another inversion in the 2s10s curve as 2Y Treasury yields spiked.

If anything, Thursday’s hawkish tone was a reminder that it is premature to expect a signal on the size of the Fed’s September move something which the market desperately wants; In fact, as Morgan Stanley writes, Powell will certainly choose to maintain flexibility on size by reminding us the Fed “will act as appropriate to sustain the expansion.”

Furthermore, there’s been no gathering since the July FOMC, the few policymakers who have since spoken publicly have either been surprisingly hawkish, or have underscored that there is no pressing need to take additional action… and there’s still more data to get through ahead of the next meeting.

Key risks: As Morgan Stanley’s Ellen Zentner writes, watch for the use of “somewhat” when Powell is describing further adjustments. Investors may associate the word “somewhat” with 25bp. Acknowledgment that downside risks have increased with no characterization of “somewhat” could be taken as confirmation that it is likely the Fed makes a larger cut in September, although that now appears unlikely.

Some additional details courtesy of RanSquawk.

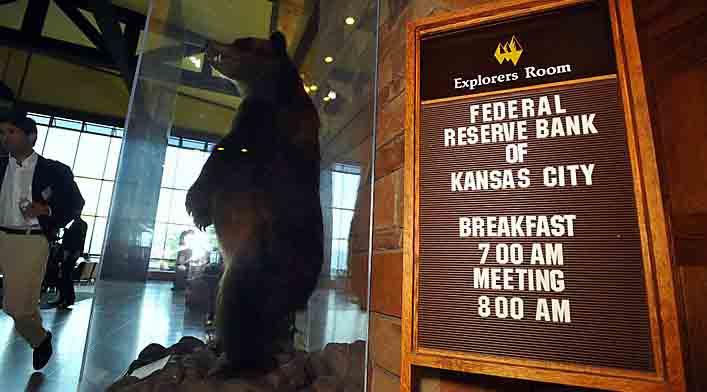

The theme of the economic symposium at Jackson Hole this year is “Challenges to monetary policy”, the same as in 1999. The theme is broad enough to cover the task of bringing inflation to target (policy framework related themes), the challenge of central bank independence, and of course of administering monetary policy at a time of heightened global trade risks and softening global growth.

The Jackson Hole presentation schedule, released late on Thursday, reveals that neither Kuroda nor Draghi would be present, and instead Mark Carney is the only other prominent fixture on today’s calendar, delivering the Luncheon Address at 2pm ET. Another notable, if very confused, central banker present will be RBA governor Philip Lowe, who will headline a Saturday morning panel.

There are also geopolitical themes that the Fed will need to navigate (US/China is the obvious one, but also Japan and South Korea, while the Fed has noted Brexit risks in the past, which seem to be resurfacing again now). Concerns around

these themes are now manifesting themselves in the yield curve, where recent inversions portend recessions ahead, leaving the Fed facing arguments that it is either is behind the curve, or does not have the tool set to tackle the issues it faces. Given that a cocktail of these issues have been keeping a lid on inflationary pressures, the messaging from Fed officials will set the stage for the 18th September FOMC, where the market is pricing 30bps of easing (implying a cut is fully priced, and there is some probability of a 50bps move).

Amid the market turmoil, and dovish actions by many global central banks, the Fed may emphasize that QT is over, and Fed policy is now accommodative; the market may be especially attuned for any insight on the magnitude of a rate cut, while 50bps is still a scenario on some bank desks; some of the dovish elements have dismissed the notion of a single 50bps rate cut in the past (see Bullard, who has not signalled any panic about the risk sell-off/yield curve inversion, preferring to judge the data, while noting it has been coming in decent recently). More generally, it may be an opportunity for central bank officials to calm the market after its recent rout (the full agenda is not released until the day before the event gets underway, however, the event is usually attended by bigwigs from other major central banks too). One criticism the Fed and ECB faced after their respective July policy meetings was the lack of clarity – with the two dissents on the FOMC, and Draghi clearly unable to have the GC unanimously back his views on looser policy made in the run up to the meeting.

Some desks have said they would prefer Fed Vice Chair Clarida and FOMC Vice Chair Williams to attend and make remarks, both of whose messaging may be more distinct than that of Chair Powell’s was after the July FOMC, and despite the criticisms levelled at Williams recently, both of those are also able to provide more academic insight than Powell might be capable.

via ZeroHedge News https://ift.tt/33Y83Ur Tyler Durden