As Morgan Stanley’s bearish US equity strategist, Michael Wilson writes, at this point, the argument between bulls and bears really comes down to one question–are we mid cycle or not, a question which Jerome Powell answered three weeks ago in a way that was not satisfactory to the market?

As Wilson notes, 4 months ago, the bulls were arguing that the Fed’s dovish pivot was all we needed because the underlying US economy was in very good shape, with some still suggesting the Fed could raise rates again later this year. When the global economy showed signs of weakness in April and May, the bullish narrative changed to Fed cuts offsetting concerns about trade tensions and spillover to the US economy and markets. There was little mention of any endogenous risk to the US economy at the time and so it was couched as an “insurance cut.” This led many to call for a meltup, and for a few weeks that call seemed correct, however that’s when the trade war with China escalated sharply, just as many had expected would happen.

Which brings us to today: with the Fed having cut 25bps last month and ending QT 2 months earlier than planned, the bulls are saying the Fed did not do enough and they are now behind the curve. They suggest that the Fed will quickly catch up and economy will be fine because we are still mid cycle and the consumer remains so strong. This, as Wilson sarcastically notes, “is what we call thesis creep in the investment world.”

Unlike such “thesis creepers”, Morgan Stanley’s view on the fundamental picture has been consistent all year. Consistently bearish that is. Here is Wilson again:

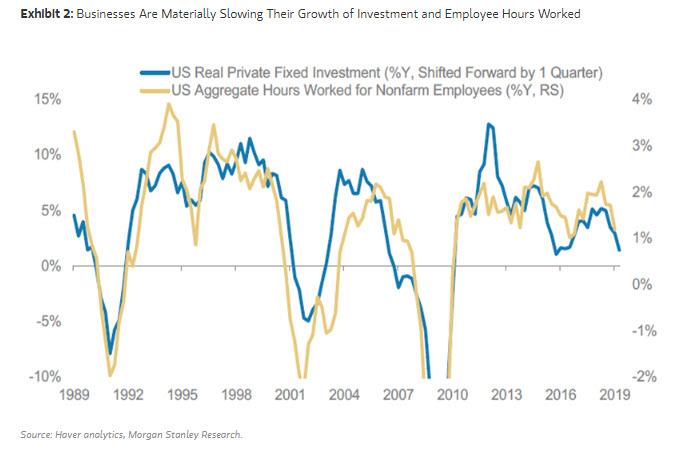

We’ve argued all along that the economy would continue to slow and that the second half recovery most were expecting would fail to materialize for a multitude of reasons. The most differentiated part of our view has centered around the US corporate profits recession that is now happening. If we are going to slip into an economic recession we believe it will be because this profits recession worsens to the point where companies will decide it is time to reduce head count. Part of our call this year was that companies would cut capex and inventory from bloated levels reached last year and that labor looked vulnerable at some point due to the rapidly deteriorating margins we expected. This call was not predicated on the trade situation getting worse although we never expected any grand bargain as some were forecasting.

As Wilson also cautions, at this point the evidence is clear that significant number of companies are now at a critical juncture where they need to make a decision on head count:

While we can’t say with any certainty whether companies will pull that lever or not, the probability of such an outcome has risen considerably and we have written about this extensively in prior notes. Perhaps the most compelling argument that companies are moving in this direction is the fact that hours worked have declined materially which is what typically happens before head count reductions occur in large numbers

This is shown in the chart below:

The bottom line, at least to Morgan Stanley, is that “it is very hard to argue mid cycle from the real data we are seeing, the fact that the unemployment rate is well below NAIRU, and profit margins and growth are outright declining on a y/y basis for the majority of companies, both public and private.“

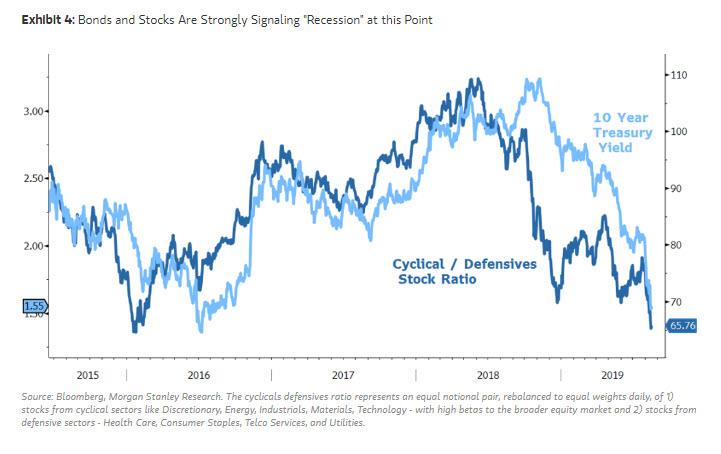

It is not just the bank’s bearish assessment that leads it to conclude that Powell’s “mid-cycle” assessment is wrong: the market evidence is also compelling that “we are not mid cycle, or even late cycle, but rather, end of cycle”, according to Wilson, who notes that over the past year, markets have essentially traded as if we are heading into a recession. Exhibit A: Bond yield have fallen at a rate rarely seen outside of a recessionary outcome while the yield curve has been inverted for over 3 months continuously. Here, Wilson focuses on the Fed Fund-10 year curve as the most accurate reflection of what the bond market thinks about Fed Policy, something Chair Powell has cited himself. “On this score, the message is quite clear–Fed policy is too tight for the economy.”

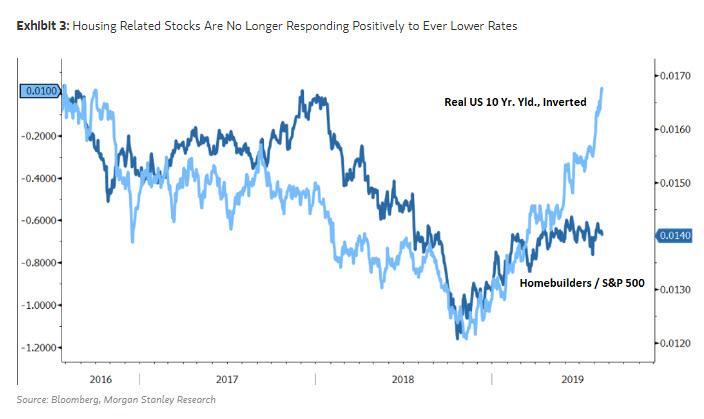

Meanwhile, in the clearest indication that something is very wrong, the most interest rate sensitive parts of the economy have failed to rebound even though rates have fallen sharply over the past year suggesting this is not a cost issue for consumers, but an issue of weak demand. Of particular note is housing – the fact that housing related stocks have not been able to outperform since April as rates collapsed is once again indicative of the market’s view on whether we are mid cycle or not.

Another clear market signal that we are end cycle is the relative underperformance of cyclical stocks at this point in the cycle, while last week’s accelerated move lower in the performance of cyclicals/defensives was as striking as the blow off move in bonds, suggesting the market is likely getting more convinced of the recession outcome.

This can be seen in the next chart, the accelerative move lower by the ratio of cyclical/defensive stocks and 10 year Treasury yields is completely in lock step at this point and arguably even more than in early 2016, the last true recession scare. Here, Wilson reminds readers that back then he held the opposite view, claiming that we were actually mid cycle… and that turned out to be the case. However, as he cautions, it is different this time for numerous reasons, including the the output gap, unemployment gap, consumer confidence, capex cycle, inventory cycle, Fed cycle all of which are in a much different place than in early 2016.

So… what then?

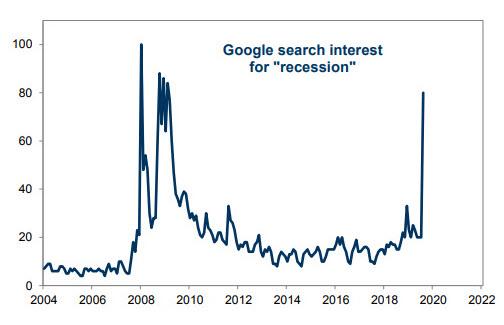

Given that the markets and the general public are clearly well aware of the rising risk of recession…

… the natural question is what should an investor do at this point? Isn’t is too late to buy bond proxies or sell cyclical stocks? The answer to that question, according to Morgan Stanley, is probably, “yes”. However, in what is likely a mean reversion trade, at this stage it is likely that Defensives will outperform the other part of the safety barbell–Growth.

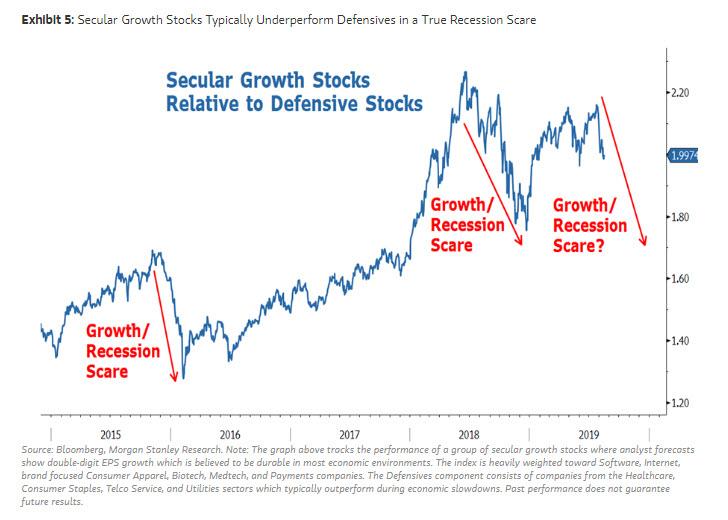

To this point, Morgan Stanley published a chart last week showing how growth stocks underperform defensives at the very end if a recession is going to get fully priced. In other words, while it may seem obvious that Defensive bond proxies and Growth stocks are where valuations remain egregious, Defensives tend to hold onto those valuations longer than Growth stocks as the growth / recession scare gets priced. As a result, Wilson’s advise to investors is to reduce their risk in the Growth bucket if they have outsized exposure there, in particular the expensive secular growth stocks.

via ZeroHedge News https://ift.tt/2zp7mVK Tyler Durden