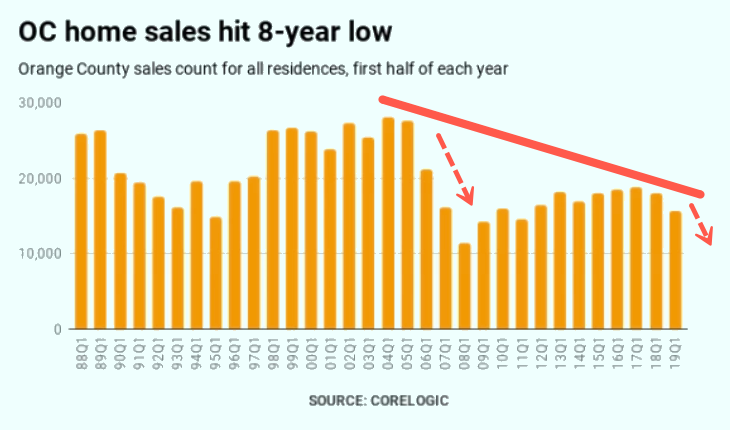

Orange County homebuying in the first six months of this year was awful, signals the top could be in as a correction in the overall California housing market could be nearing.

CoreLogic homebuying data shows 1H19 sales in and around Huntington Beach, Fountain Valley, Garden Grove, and Westminster fell 12% to the slowest pace since 1H11, just after the Great Recession ended, reported Orange County Register.

The report noted how the countywide median selling home price plateaued in 1H19, indicating a resistance level with what homebuyers are willing to pay for properties has been met.

Another concern is that lower interest rates over the last two quarters didn’t spark a revival in homebuying. It’s becoming more evident that a cyclical downshift in the regional housing market is gaining momentum.

Countywide, 15,792 homes were sold, down 12% in 1H19 YoY. It marked the slowest first half for selling since 2011. Sales were up in only 17 of the county’s 83 zip codes. The median home price of $735,000 was flat in 1H19.

Single-family home sales sank 9% in 1H19 YoY, with 9,912 sold, the slowest since 1H11. The median price fell 2% in the period to $780,000.

Condo sales in the county were down 11% in the first two quarters, with 1,572 sold — the slowest since 1H09.

Newly built home sales were down 34% in 1H19 YoY, with 1,572 sold, the slowest first half since 2013. However, the median price was up 6% in the period.

CoreLogic data pointed out several interesting neighborhood trends:

-

Seven-figure neighborhoods: 12 zip codes out of 83 with median selling prices at $1 million or more vs. 14 ZIPs a year ago. Sales in these high-end ZIPs totaled 1,900 — down 27% in a year.

-

Sub-half-million communities: Just six zip codes medians were below $500,000 compared with four ZIPs a year ago. Sales in these more-affordable ZIPs totaled 651 — up 5% in a year.

Here are more homebuying trends for Huntington Beach, Fountain Valley, Garden Grove, and Westminster:

-

Fountain Valley 92708: $805,000 median, up 2.9% in a year. Price rank? 24th of 83. Sales of 234 vs. 266 a year earlier, a decline of 12% over 12 months.

-

Garden Grove 92840: $552,500 median, down 4.5% in a year. Price rank? No. 72 of 83. Sales of 197 vs. 196 a year earlier, a gain of 0.5% over 12 months.

-

Garden Grove 92841: $615,000 median, down 0.8% in a year. Price rank? No. 62 of 83. Sales of 94 vs. 92 a year earlier, a gain of 2.2% over 12 months.

-

Garden Grove 92843: $560,000 median, up 4.7% in a year. Price rank? No. 67 of 83. Sales of 96 vs. 118 a year earlier, a decline of 18.6% over 12 months.

-

Garden Grove 92844: $485,000 median, down 14.5% in a year. Price rank? No. 79 of 83. Sales of 64 vs. 83 a year earlier, a decline of 22.9% over 12 months.

-

Garden Grove 92845: $659,000 median, down 0.9% in a year. Price rank? No. 53 of 83. Sales of 100 vs. 100 a year earlier, flat in the period.

-

Huntington Beach 92646: $742,750 median, up 0.4% in a year. Price rank? No. 38 of 83. Sales of 314 vs. 369 a year earlier, a decline of 14.9% over 12 months.

-

Huntington Beach 92647: $740,500 median, down 1.9% in a year. Price rank? No. 39 of 83. Sales of 168 vs. 197 a year earlier, a decline of 14.7% over 12 months.

-

Huntington Beach 92648: $988,000 median, up 4.9% in a year. Price rank? No. 13 of 83. Sales of 231 vs. 303 a year earlier, a decline of 23.8% over 12 months.

-

Huntington Beach 92649: $790,000 median, up 1.3% in a year. Price rank? No. 29 of 83. Sales of 182 vs. 196 a year earlier, a decline of 7.1% over 12 months.

-

Midway City 92655: $665,000 median, up 5.6% in a year. Price rank? No. 51 of 83. Sales of 24 vs. 13 a year earlier, a gain of 84.6% over 12 months.

-

Stanton 90680: $425,500 median, down 1.0% in a year. Price rank? No. 81 of 83. Sales of 91 vs. 95 a year earlier, a decline of 4.2% over 12 months.

-

Westminster 92683: $659,000 median, down 3.2% in a year. Price rank? No. 53 of 83. Sales of 228 vs. 277 a year earlier, a decline of 17.7% over 12 months.

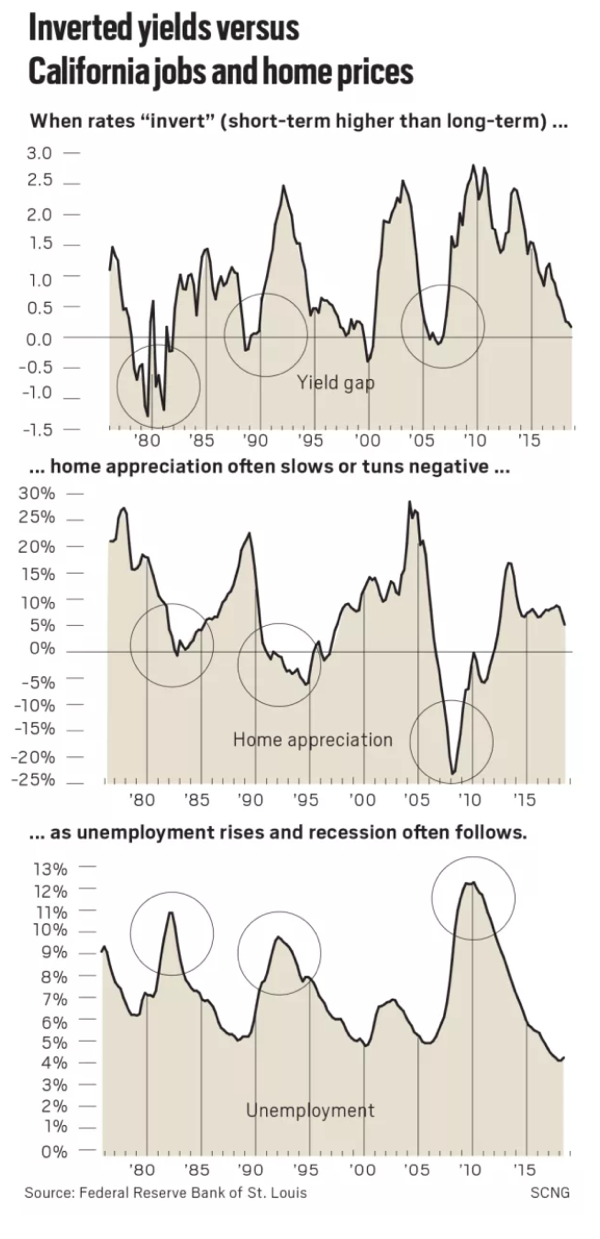

Housing markets across California and much of the West Coast have been deteriorating in the last 8 to 12 months. On the East Coast, it’s much of the same, with Manhattan condos and Hamptons mansions stagnating in the past year.

The downturn in real estate isn’t just centralized to Orange County or West Coast markets, but it’s very board, from coast to coast to be exact, and hitting more luxurious markets the hardest.

The real estate market downturn could be one of the reasons why President Trump is begging the Federal Reserve for 100bps rate cuts, quantitative easing, and even trial ballooning headlines of emergency payroll tax cuts.

To sum up, the housing downturn is here.

via ZeroHedge News https://ift.tt/2KUzQNZ Tyler Durden