USTR confirmed that additional tariffs will be put on China next week… and The Dow roars 400 points off the lows as bond yields hit record lows…

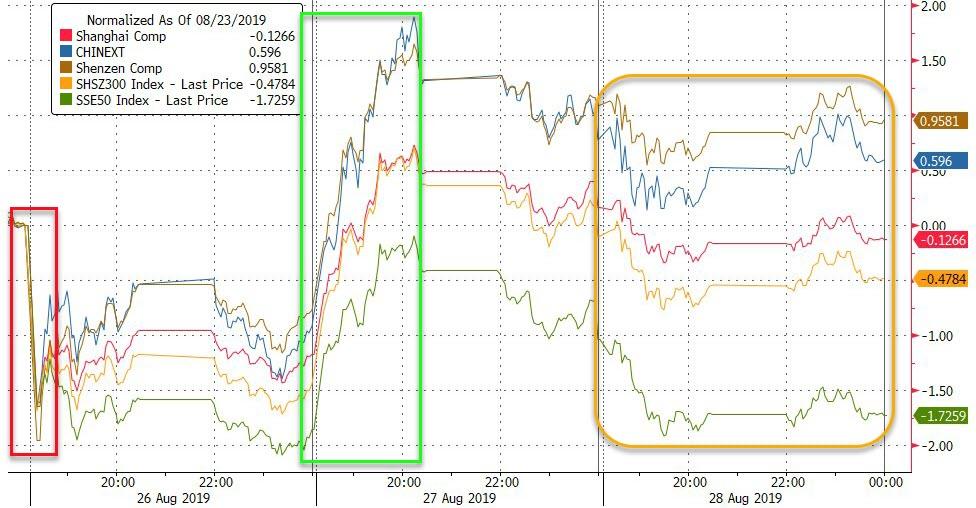

Chinese stocks went nowhere overnight…

Source: Bloomberg

European stocks dipped and ripped as Italy headlines spurred risk-on after US opened…

Source: Bloomberg

Italian markets ripped higher (yields and spreads lower) as signs of political agreements emerged (ITA 10Y yields tumbled to a new record low below 1.00%)…

Source: Bloomberg

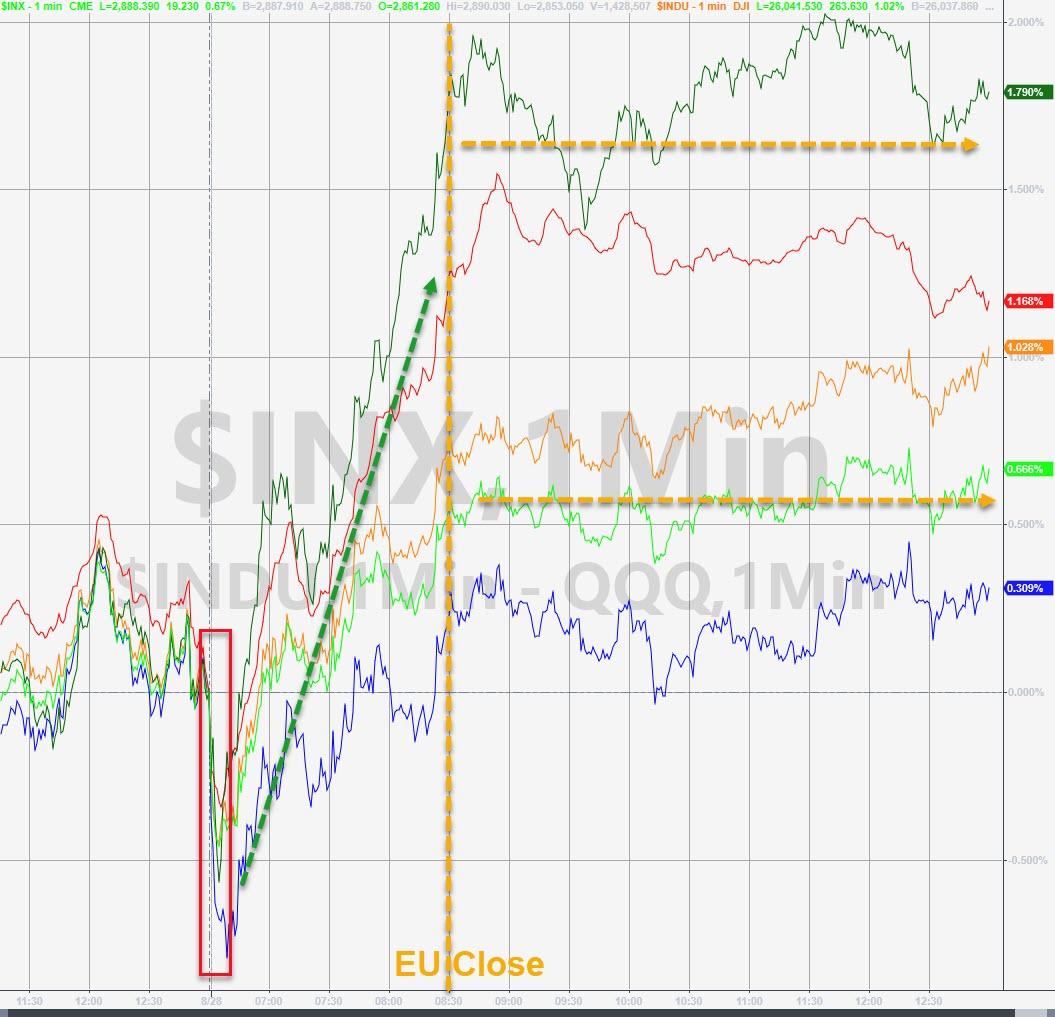

US equities opened weak, then exploded higher into the European close, after which they went sideways…

All thanks to another VIX monkeyhammering…

Big surge in cyclicals relative to growth today…

Source: Bloomberg

The momentum of small caps versus blue chips is at levels not seen since the financial crisis. The ratio between the Russell 2000 and the S&P 500 has fallen to the lowest since March 2009, with RTY declining almost twice as much as SPX this month.

Source: Bloomberg

Dow remains tightly rangebound between the 100- and 200-day moving averages…

Major short-squeeze today…

Source: Bloomberg

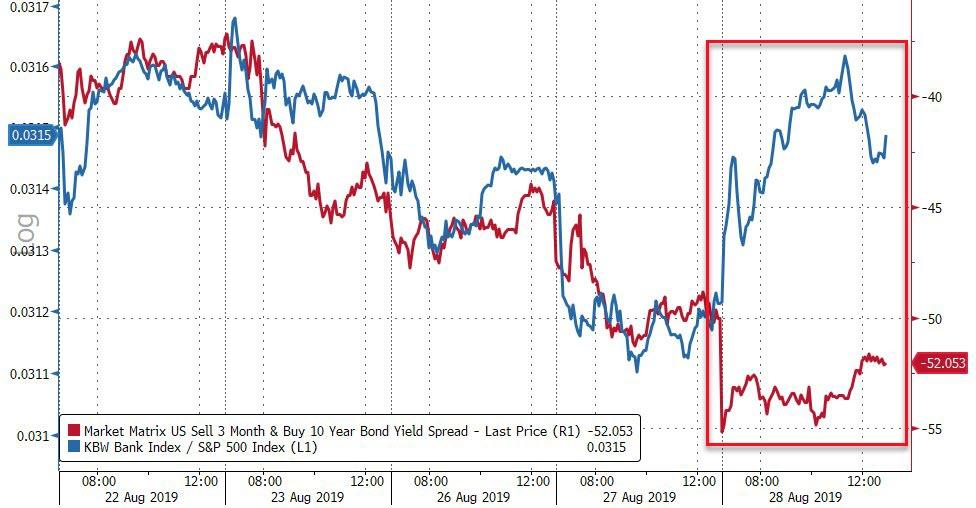

Bank stocks outperformed today, despite a flattening curve…

Source: Bloomberg

Notably, from the US open, it appeared pension rebalancing was impacting markets with stocks suddenly bid and bonds offered, but that stopped ahead of the EU close and bond yields and stock prices began to diverge…

Source: Bloomberg

Pension rebalancing and last-second buybacks ahead of blackouts likely prompted the decoupling of stocks from bond yields.

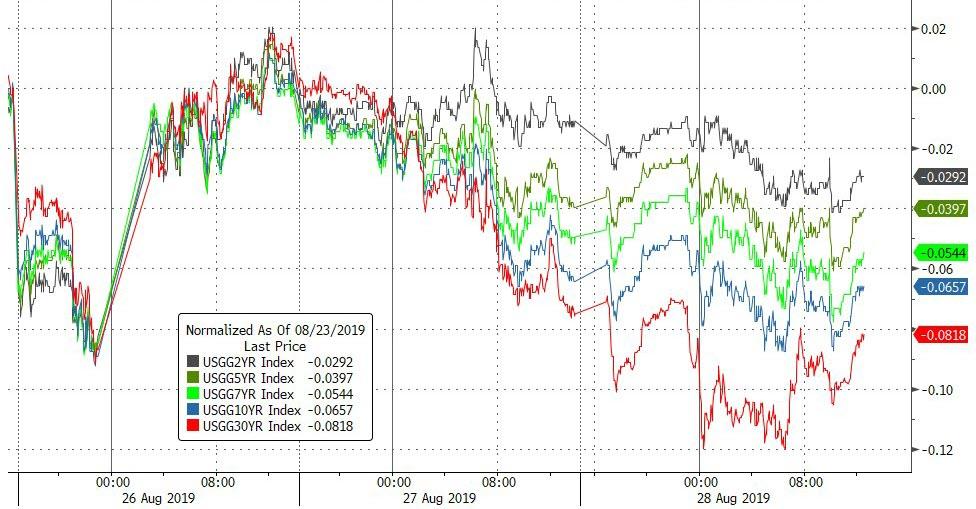

Treasury yields slipped lower once again today…

Source: Bloomberg

10Y (and 30Y) yields closed at record lows…

Source: Bloomberg

The yield curve remains inverted (2s10s steepened very modestly but below 0 as 3m10Y flattened to new cycle lows once again…

Source: Bloomberg

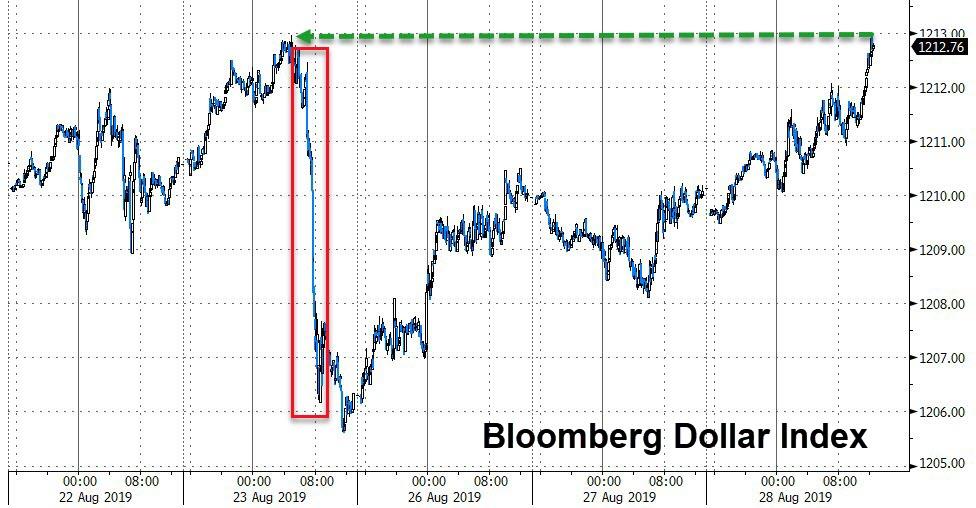

The dollar index rallied once again, perfectly erasing the plunge from Trump’s tariff tantrum last Friday…

Source: Bloomberg

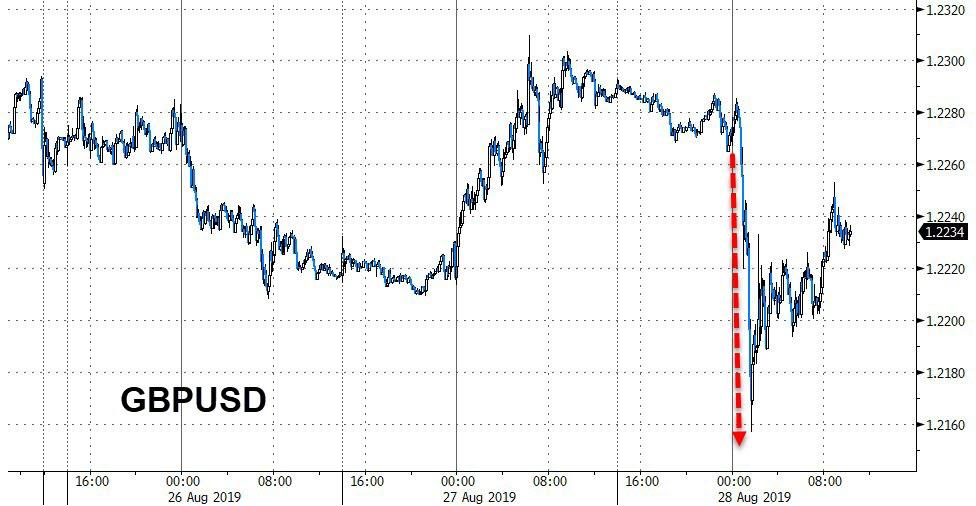

Cable crashed early on as BoJo pushed to suspend parliament but rebounded as various officials jawboned the tensions down…

Source: Bloomberg

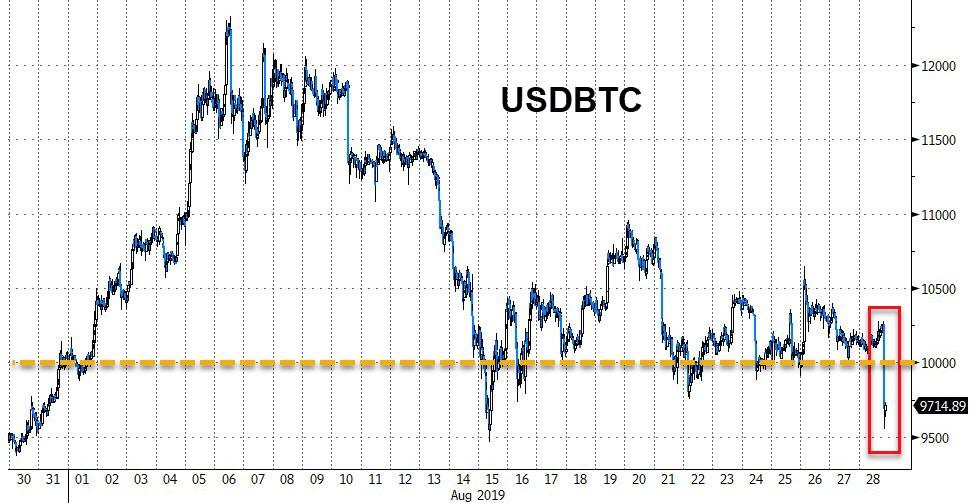

Cryptos were a bloodbath today…

Source: Bloomberg

Pushing all cryptos red for the month (litecoin down a stunning 33% in August)…

Source: Bloomberg

As Bitcoin blew back below $10,000…

Source: Bloomberg

Gold was flat today as silver and crude rallied (silver leads the week)…

Source: Bloomberg

WTI spiked above $56.50 in early trading but despite a huge crude draw, oil prices slipped back intraday…

Gold was slammed once again from significant resistance…

Quite a different picture for silver over the same period…

Silver’s recent surge has erased all gold’s relative outperformance for 2019…

Source: Bloomberg

Silver in Yuan hit a new 3 year high…

Source: Bloomberg

And finally, the 30-year Treasury bond is yielding less than what the S&P 500 pays in dividends (on a trailing 12-month basis), something we’ve only seen in about three months over the past four decades.

Source: Bloomberg

It appears that Bitcoin has decoupled from the safe-haven from policymaker pandemonium trade…

Source: Bloomberg

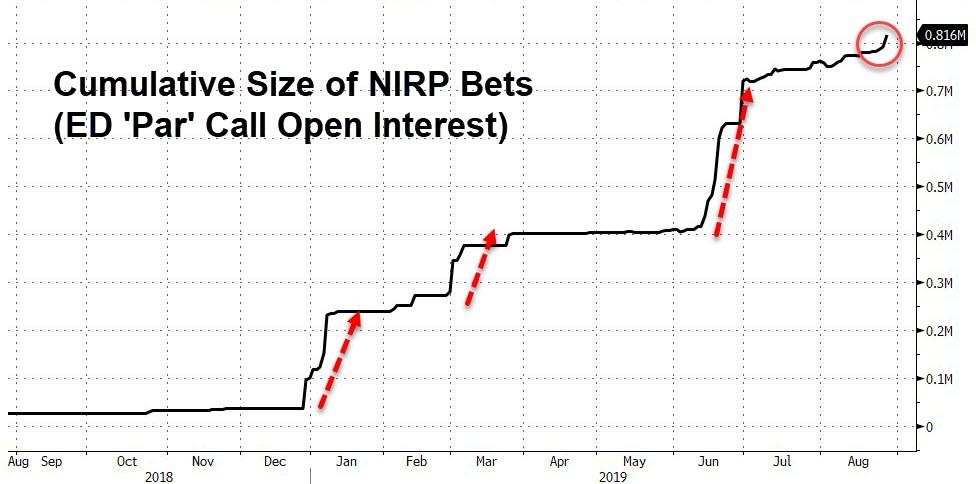

Despite stocks rebounding and being only 4% from record highs, traders are piling into bets that The Fed will cut rates to negative before this is over…

Source: Bloomberg

via ZeroHedge News https://ift.tt/30IpvKf Tyler Durden