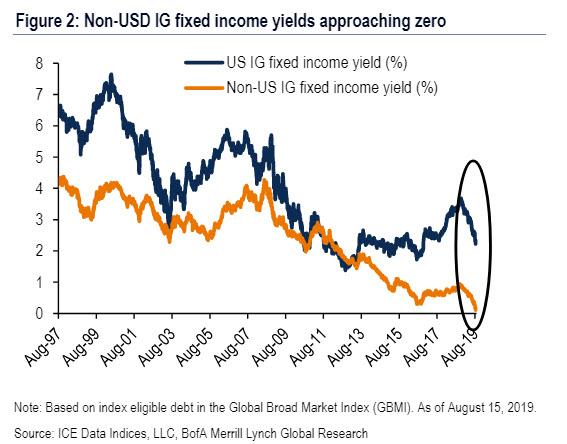

In a world with $17 trillion in negative yielding debt, and the US increasingly the only source of safe, positive yielding debt…

… it’s not surprising that foreigners have found US Treasury paper especially attractive. But that’s not all: apparently foreigners have been attracted to all kinds US “paper” especially America’s currency.

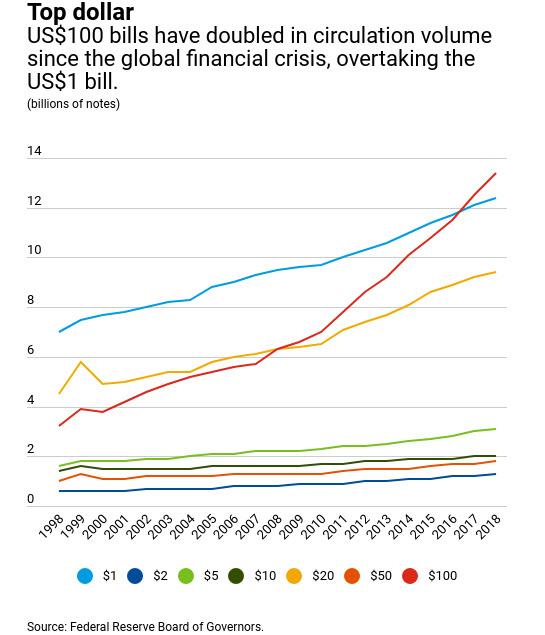

As the IMF’s blog points out, a curious thing has happened in US currency: the $100 bill recently overtook the ubiquitous $1 bill in circulation volume, for the first time in history. In other words, the most valuable banknote in the United States has also become the most widely circulated.

As shown in the next chart based on the latest Fed data, there are now more $100 bills circulating now than ever before, roughly doubling in volume since the global financial crisis.

The $100 bill became the most circulated currency in the world in 2017, overtaking the $1 bill for the first time ever.

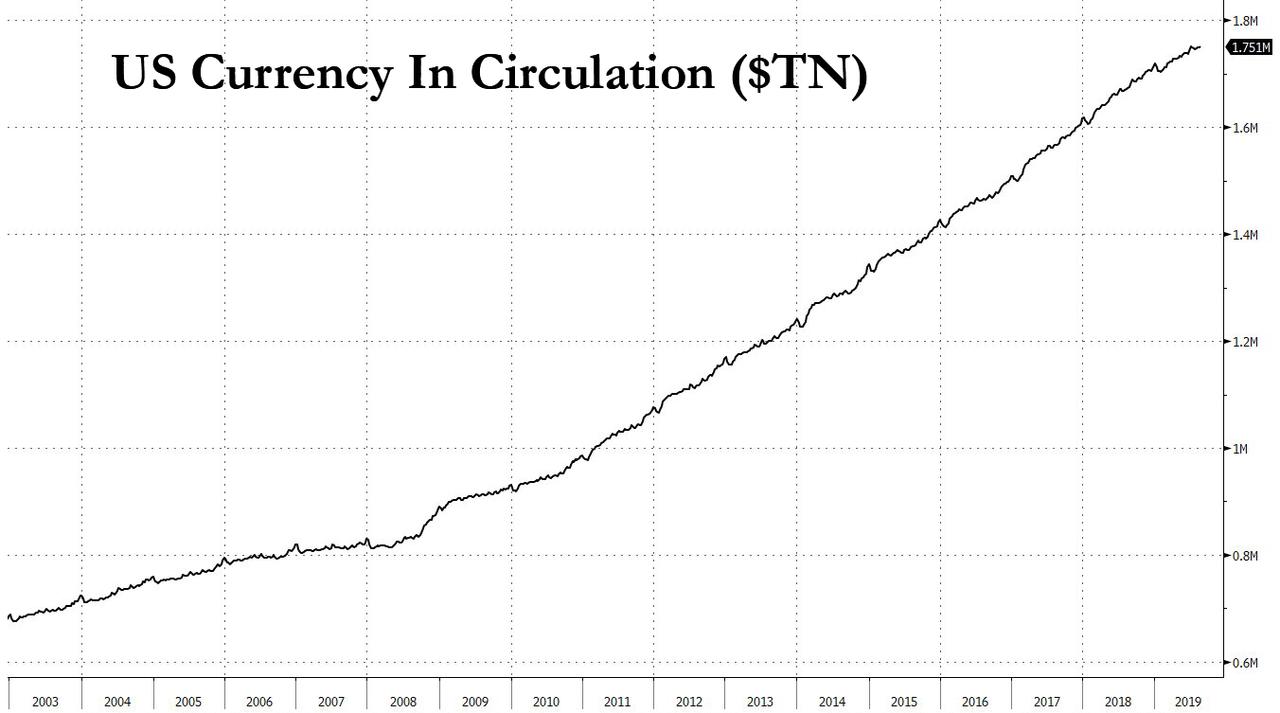

Looking at broader aggregates reveals that while the amount of total currency in circulation – the value of all dollar bills outstanding – had plateaued around $800BN heading into the Global Financial Crisis, since then the pace of currency growth has almost doubled, and as of today there is roughly 1.75 trillion dollars in the form of various banknotes.

What explains this boom in Benjamins, as the bills are known, especially when considering the establishment’s push to herd as many people as possible into cashless and other electronic “options”? Or, as the IMF asks, “in this age of digital everything, are Americans suddenly growing nostalgic for greenbacks in high denominations?”

The answer is two fold: i) no, it is not Americans who are nostaglic for cash, in fact it is not Americans who are behind this surge in currency demand; and ii) the real reason why the world is suddenly drowning in hundred dollar bills is the desire to evade punitive, negative interest rates.

Indeed, while overall demand for US currency is indeed on the rise, most $100 bills are held abroad. According to the Federal Reserve Bank of Chicago, nearly 80% of $100 bills—and more than 60% of all US bills—are overseas, up from roughly 30% in 1980.

Besides drug money – by one estimate in the early 1980s, several percent of all outstanding US currency was to be found in the estate of one Pablo Escobar – geopolitical instability could be a reason behind the surge in $100 bills, according to Fed economist Ruth Judson. “Overseas demand for US dollars is likely driven by its status as a safe asset,” Judson told the Richmond Fed’s Econ Focus in 2018.

According to a 2017 paper by Judson, international demand for US dollars increased over the 1990s and into the early 2000s, and then stabilized or declined after the 2002 debut of the cash euro. This decline in demand continued until late 2008, when the global financial crisis triggered renewed demand for US banknotes.

Of course, that doesn’t mean that all this cash demand is strictly legal: Harvard University’s Kenneth Rogoff says big banknotes and illicit activity are closely linked. “Worldwide, high-value currency notes are mainly used to avoid taxes and regulation, and for illegal activity,” he observes. “Apartments and houses in major cities all over the world are paid for with suitcases of cash every day, and it is not because the buyers are afraid of bank failures.”

One other reason for suitcases of cash: to avoid parking your money in a bank that will impose negative interest rates on it and lead to the total amount shrink year after year. As such, foreigners are simply parking their money in US bank notes to avoid NIRP, which is nothing but legal wealth confiscation. Rogoff agrees: “Underground demand for paper currency has been surely rising in part because interest rates and inflation are exceptionally low.”

But why the dollar? Its role as the dominant international reserve currency may be the key, according to Rogoff. Of course, if Mark Carney (and Donald Trump) gets his way, that won’t last very long…

via ZeroHedge News https://ift.tt/32cN2mW Tyler Durden