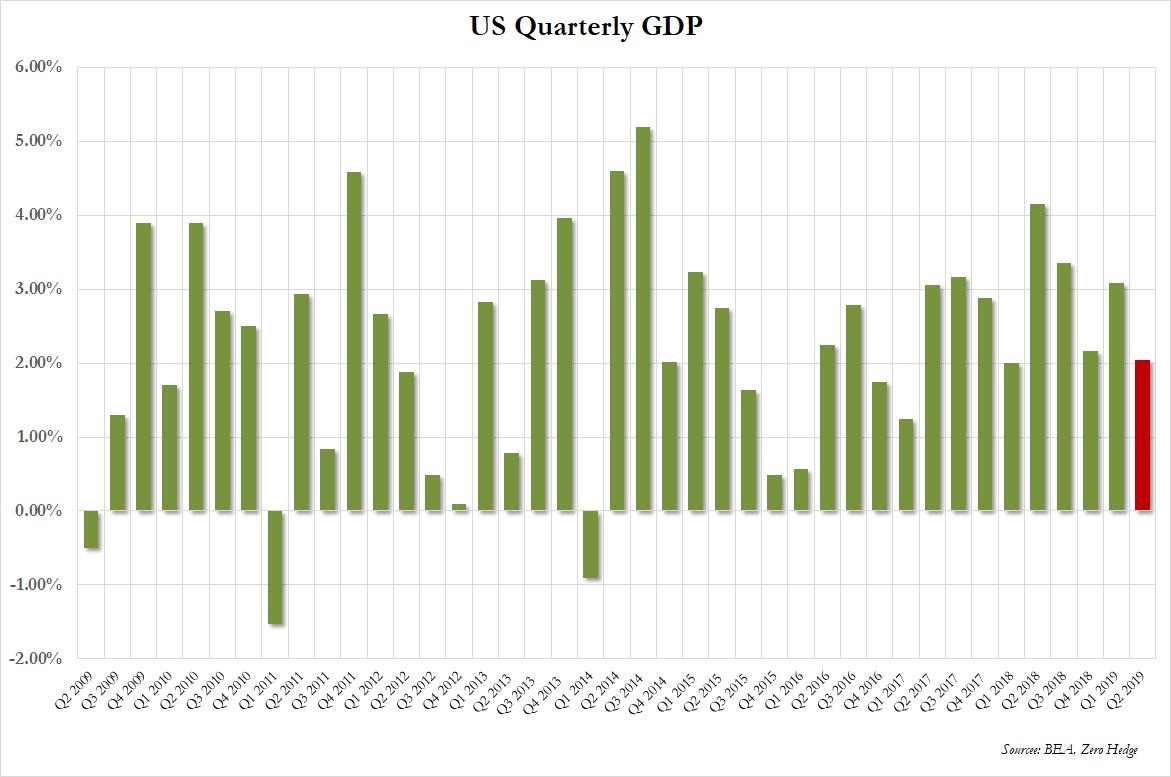

There were no surprises in today’s first revision of Q2 GDP, which the BEA reported moments ago printed at 2.0% (2.040% to be precise), just as expected, and down modestly from the 2.1% (2.060%) initial estimate; the number was also down from the 3.1% annualized GDP growth in Q1.

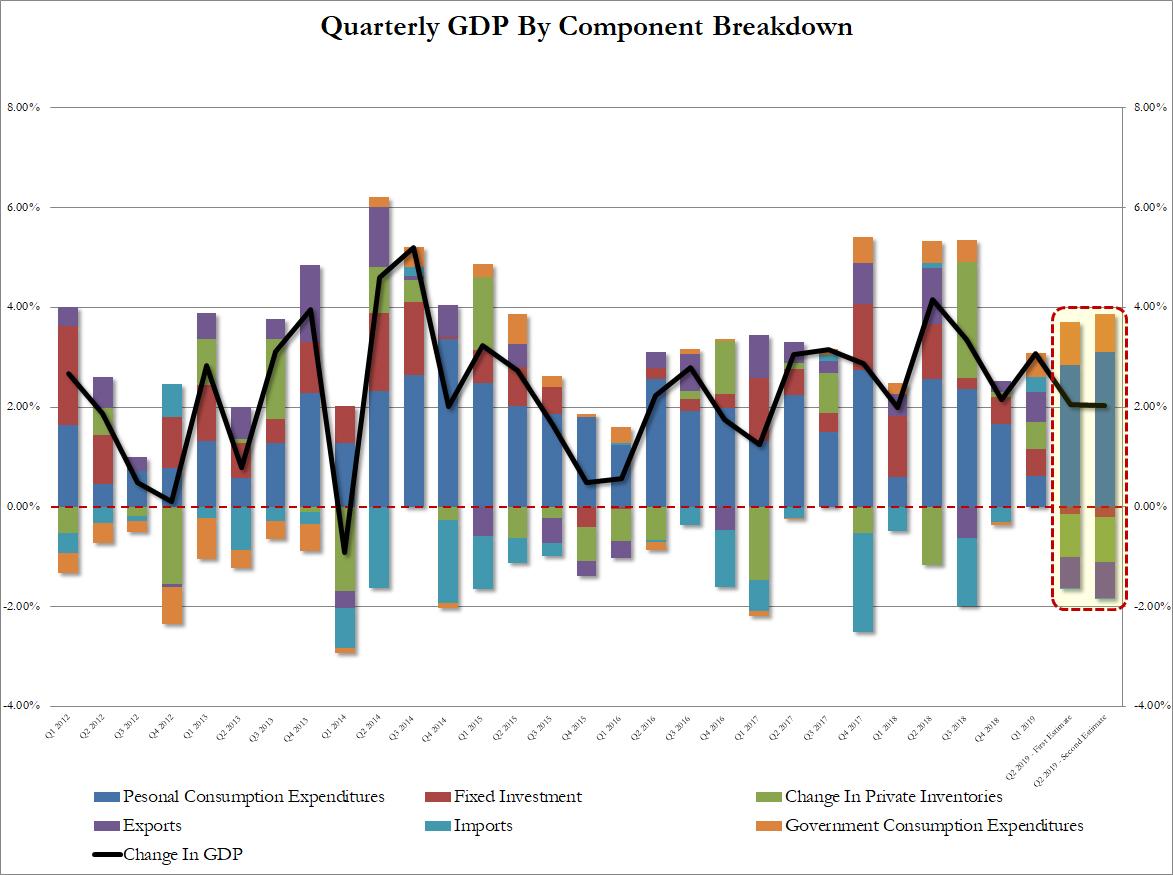

The Q2 increase in real GDP reflected an even greater increase in consumer spending and government spending, while inventory investment, exports, housing investment, and business investment decreased. Imports, which are a subtraction in the calculation of GDP, increased. The increase in consumer spending reflected increases in both goods and services that were widespread across major categories. The increase in government spending reflected increases in both federal and state and local government spending.

The decrease in inventory investment reflected decreases in manufacturing, retail trade, and wholesale trade industries. Goods led the decrease in exports.

Curiously, even as overall GDP growth eased somewhat, personal consumption jumped, rising from 4.3% in the first estimate to 4.7% currently: this was the highest PCE in almost five years, since Q4 2014, and up shaprly from just 1.1% in Q1:

As detailed by he BEA, the revision to GDP growth reflected downward revisions to state and local government spending, exports, inventory investment, and housing investment. These revisions were partly offset by an upward revision to consumer spending. Broken down by item, the Q2 GDP of 2.04% looked as follows:

- Personal Consumption: 3.10%, up from 2.85% in the first estimate

- Fixed Investment: -0.20%, down from -0.14%

- Change in Private Inventories: -0.91%, down from -0.86%

- Net Exports: -0.72%, down from -0.64%

- Government consumption: 0.77%, down from 0.88%

Inflation remained stable, with the GDP price index rising 2.4% in 2Q, in line with expectations, after rising only 1.1% prior quarter; there was some weakness in core PCE, which rose rose 1.7% in 2Q, missing expectations of a 1.8% increase, after rising 1.1% prior quarter.

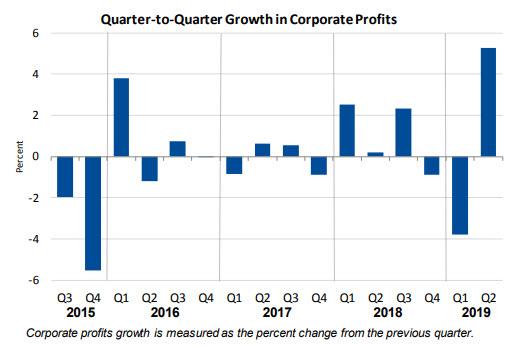

Finally, the BEA also reported that in Q2, profits increased 5.3 percent at a quarterly rate in the second quarter after decreasing 3.8 percent in the first quarter. Specifically:

- Profits of domestic non-financial corporations increased 4.0 percent after decreasing 9.0 percent.

- Profits of domestic financial corporations increased 1.0 percent after increasing 5.8 percent.

- Profits from the rest of the world increased 11.7 percent after increasing 1.5 percent.

via ZeroHedge News https://ift.tt/2Le6064 Tyler Durden