Two days ago, we reported that the Russell Clark, the CIO of Horseman Global, “the world’s most bearish hedge fund”, had one big question in his latest investor letter: “why are people not more bearish?” Here one could argue that just like Ray Dalio (whose Pure Alpha fund has been suffering from a variety of wrong-way bets), Clark is merely talking his book: after all, being down 22% YTD would certainly prompt questions why more people don’t see the world in a similar way.

And yet his question is legitimate: after all between Hong Kong, the US-China trade war, Germany in recession, Europe on the verge of recession, a no-deal Brexit, renewed Italian political chaos, a record amount of negative yielding debt, and central banking facing an existential moment, one may also ask how anyone has a bullish view on risk assets.

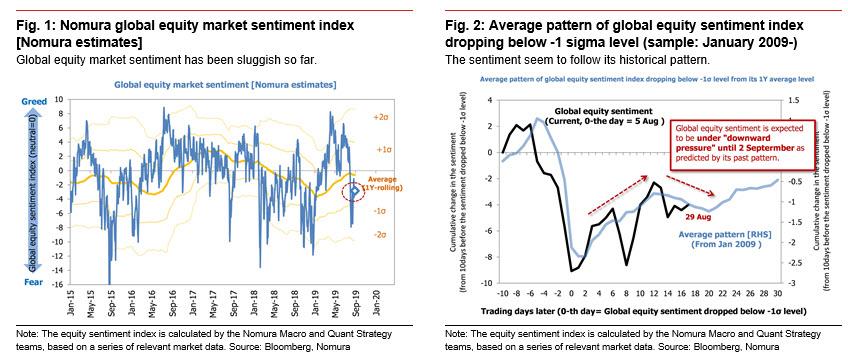

Addressing just this issue is Nomura’s quant strategist, Masanari Takada, who in a note published overnight asking “Why a risk-off mood is not gaining traction”, points out that investor sentiment has been ebbing and flowing (although he does caution that if historical patterns in sentiment are anything to go by, we think sentiment is at risk of heading lower through around 2 September). That said, his impression is that it is hard to get a good read on the direction of sentiment, “as there seems to be just as little incoming negative news as positive news.”

In an attempt to answer this overarching question, one has to look at the positioning of the various speculative actors in the market. Here, a survey of the supply/demand landscape among various short-term market participants reveals that “trading stances are still far from uniform even within a given strategy.”

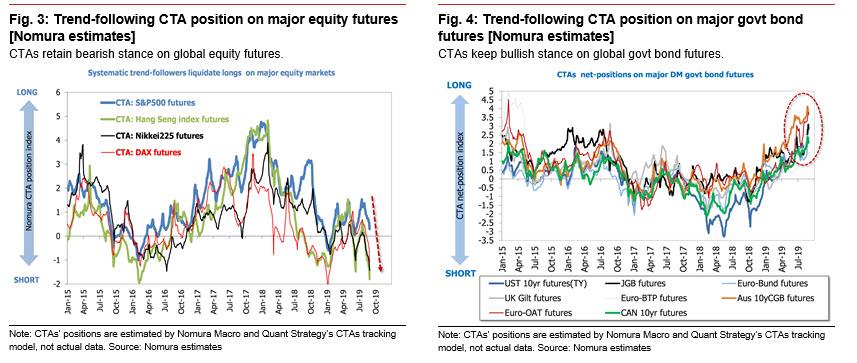

Instead, “a precarious balance has emerged”, with pessimistic trades by CTAs (selling stocks, buying bonds) at the moment being “neatly countered by opposing trades made by global macro hedge funds and other investors that trade mainly on fundamentals”, according to Takada.

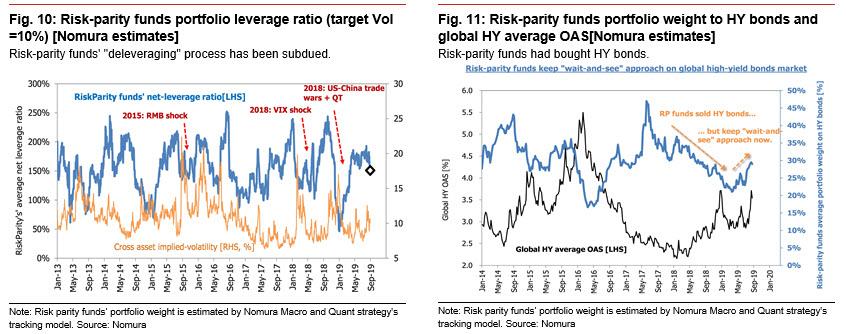

Meanwhile, the fact that risk-parity funds are refraining from deleveraging seems to be lending some stability to the credit market. What this tells Nomura, is that a risk-off mood that might otherwise have developed is failing to gain traction on account of:

- surprisingly healthy incoming macroeconomic data; and

- the risk of a credit crunch being systematically contained.

A deeper dive into the positioning of key market players reveals the following:

The stance of trend-chasing CTAs is still to sell equity futures and buy bond futures. The volume of trend-following trading is gradually increasing. Of course, the short positions in Hong Kong equities and the long positions in US bonds are starting to look like cases of momentum herding. Nevertheless, we do not expect to see much systematic unwinding of these positions unless the Hang Seng index approaches 26,640 (our estimate of the break-even line for net selling since late July) or 10yr UST yields approach 1.56% (the break-even line for net buying of TY since the beginning of August).

In terms of factor trends, factor-oriented investors are staying away from high-beta names (although trading on 28 August marked an exception to the pattern). It appears they are quietly and gradually adjusting their positioning on the assumption of a coming global economic slowdown.

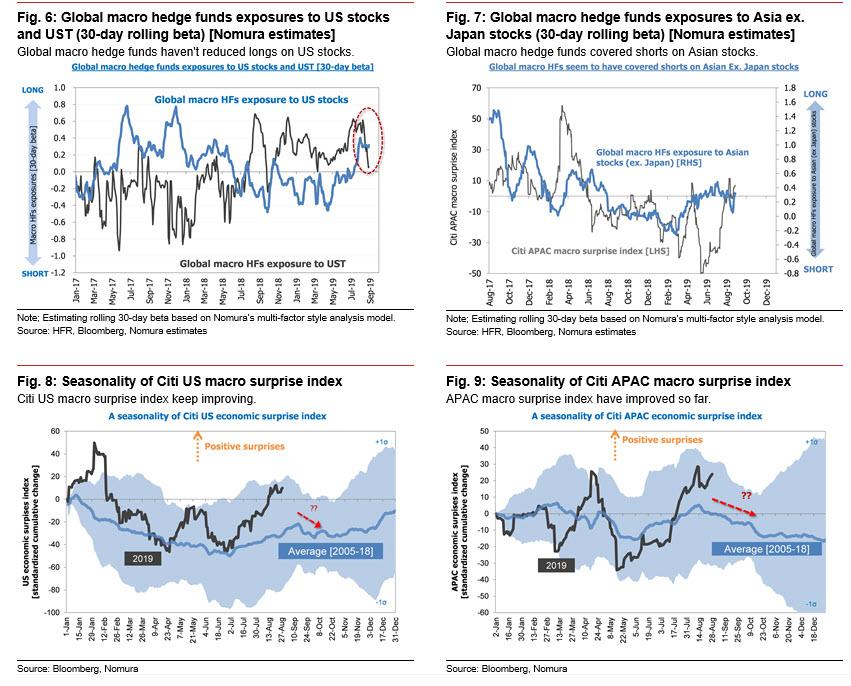

Global macro hedge funds, on the other hand, are still bullish on fundamentals, seemingly skeptical of the idea that a global recession is on the way. One reason for this, presumably, is that macroeconomic indicators have been holding up surprisingly well in the US and in the Asia-Pacific region (manifesting in improvement in the economic surprise index). Global macro hedge funds are for the moment closing out existing short positions in Asian equities (Japan excepted).

It appears that risk-parity funds are not engaging in much deleveraging. By increasing what they allocate to high-yield bonds, risk-parity funds are making purchases that appear to be keeping the credit market less agitated than it might be otherwise.

So with major trading groups apparently deadlocked, how can one assess the risk of a second “vol-up” wave, of the kind Nomura predicted last week, is coming?

While it is true that trading signals are not perfectly consistent within any given trading strategy, Takada writes today that “it does seem that thin trading has allowed opposing strategies to leave the market deadlocked.” As a result, any second vol-up wave would depend on trend-following players getting out in front with pessimistic trades, in response to either fresh negative news or a combination of a pullback in the bullish stance of fundamentals-oriented investors and deleveraging by risk-parity funds. However, if a second vol-up wave were to stay away, then CTAs and other investors waiting for a stock sell-off could lose patience and wind down some of their pessimistic trades.

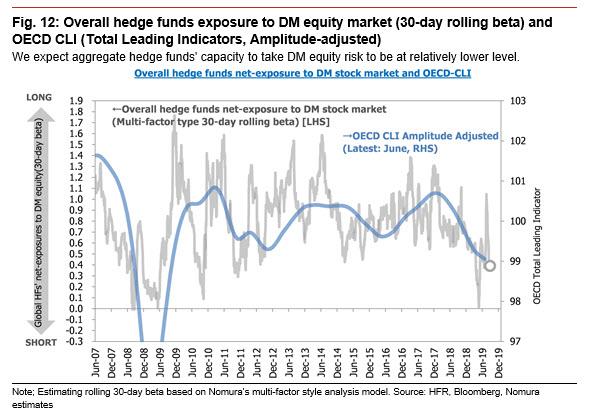

So absent negative shocks is the market set to soar? Not necessarily, because one of the key marginal price-setters, hedge funds, are unlikely to go all in as their “risk appetite seems likely to remain low.” According to Nomura, when looking at hedge funds as a whole, “risk appetite is likely to remain low.” That is unlikely to change as Takada is not seeing any of the three events that would likely be interpreted as game changers, namely i) realistic expectations for a US-China trade agreement, ii) a virtual promise from the Fed to cut its policy interest rate by 50bp or more, or iii) the cobbling together of a coordinated fiscal policy response.

Meanwhile, with the market stuck in a tight range…

…. a growing number of short-term investors also look to be waiting on the sidelines, and as the bearish Nomura quant trader concludes, “we continue to believe that these investors are more likely to chase trends in a risk-off direction than in a risk-on direction.”

via ZeroHedge News https://ift.tt/2HxSDML Tyler Durden