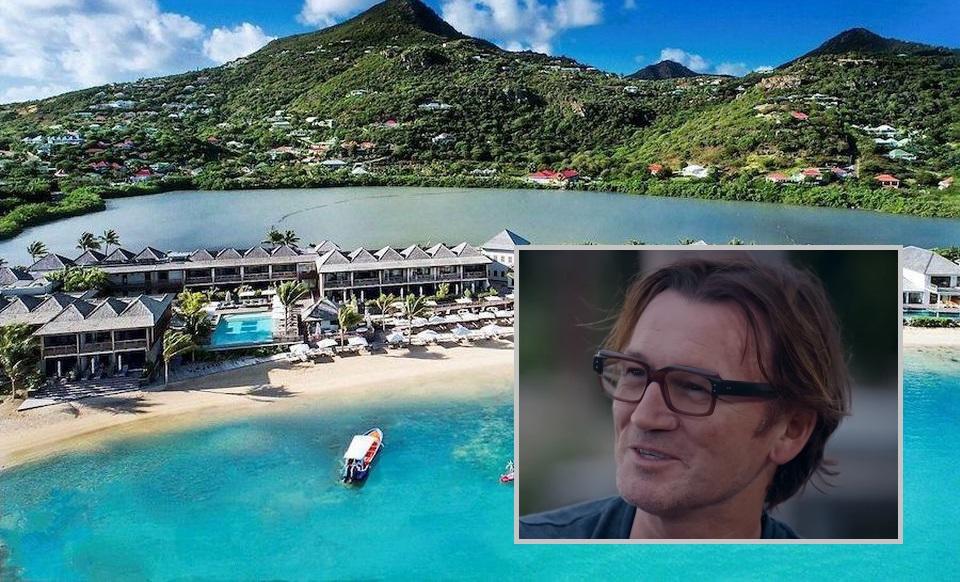

After underestimating the power of unlimited monetary Kool-Aid, former Eclectica asset management co-founder Hugh Hendry has reinvented himself – this time developing properties in the celebrity island playground of St. Barts.

The 50-year-old contrarian who made a killing going into the 2008 crisis only to be outdone by ‘the greatest experiment’ is now looking to provide investors annualized returns of at least 10% by cashing in on growing demand for real-estate on the Caribbean island. Hendry seeks to raise $50 million to buy land and renovate existing properties, according to Bloomberg.

In addition to building high-end luxury villas, Hendry also plans to build affordable homes to help address what he called a “housing crisis for the working community” on the island. The fund, based in Luxembourg, could deliver annualized returns of at least 10% for investors, he said. –Bloomberg

“This place is one of a kind,” said Hendry – who compared St. Barts to Galt’s Gulch in “Atlas Shrugged.” “It’s where all the rich folks are going to end up at the end of this mammoth return-on-capital cycle,” he added.

Villas on the island range from $500 per night for a room to well over $100,000 per week, according to the former hedge fund manager, who lives on St. Barts.

“St. Barts is like a ski village with a 10-month season — lots of young kids who work hard and play hard,” said Hendry. “No one can normally afford to buy a house; there is no such thing as affordable homes.”

St. Barts was severely damaged during Hurricane Irma in 2017, which reduced the housing stock and pushed rents even higher.

“There is a clear and evident demand for capital to come in and eliminate the shortage,” said Hendry.

Years of mediocre returns and investor withdrawals have diminished job prospects in the $3 trillion hedge-fund industry, forcing some of its best-known names to quit. While many return after a break to launch new funds, others have branched out into everything from picking winners in the marijuana industry to selling sandwiches.

Hendry’s hedge fund churned out a 31% return by betting against U.S. and European banks during the 2008 financial crisis. He also attracted attention for his bearish view on China in 2009, when he posted videos on YouTube in which he toured cities and identified office buildings that he said had no tenants. Then in 2017, Hendry packed it in, saying the macro hedge fund model was broken. –Bloomberg

Hendry started out working for Edinburgh investment manager Baillie Gifford before moving to Credit Suisse Group AG. He then joined Crispin Odey’s hedge fund in 1999 before finally forming his own firm – Eclectica Asset Management.

via ZeroHedge News https://ift.tt/30LMfJF Tyler Durden