Authored by Mike Shedlock via MishTalk,

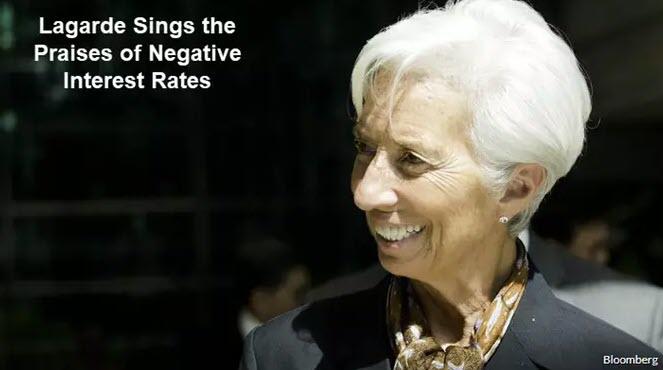

Incoming IMF chief Christine Lagarde says negative rates have helped Europe more than they’ve hurt. I disagree.

The nearly always wrong Christine Lagarde is wrong once again.

Today she claims Negative Rates Have Helped Europe More Than They’ve Hurt.

The next head of the European Central Bank, Christine Lagarde, appears to be as much of a fan of negative interest rates as the current chief, Mario Draghi.

European banks have complained about the impact on profitability, but even there the current managing director of the International Monetary Fund defended the move.

“On the one hand, banks may decide to pass the negative deposit rate on to depositors, lowering the interest rates the latter get on their savings,” she wrote. “On the other hand, the same depositors are also consumers, workers, and borrowers. As such they benefit from stronger economic momentum, lower unemployment and lower borrowing costs. All things considered, in the absence of the unconventional monetary policy adopted by the ECB – including the introduction of negative interest rates – euro area citizens would be, overall, worse off.”

Negative Rates Actually Cut Lending

Research shows Negative Rates Actually Cut Lending.

Central banks’ negative interest rates were supposed to increase spending, stop deflation and stimulate the economy. They may have done the exact opposite.

According to research from the University of Bath, central banks charging commercial banks to hold excess cash reserves have actually decreased lending. That’s because the additional costs reduce banks’ profit margins, leading to a drop in loan growth.

“This is a good example of unintended consequences,” said Dr. Ru Xie of the university’s School of Management, one of the study’s authors. “Negative interest rate policy has backfired, particularly in an environment where banks are already struggling with profitability.”

Xie also said that sub-zero rates appear to have acted against other unconventional forms of central bank policy, such as quantitative easing, introduced in the wake of the great recession.

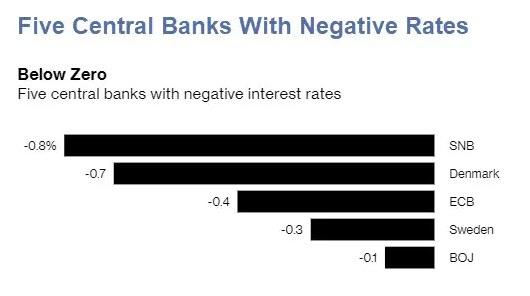

Five Banks With Negative Rates

Where’s the Evidence Negative Rates Help?

There is no evidence negative rates produce a stronger economy or lower unemployment.

There is evidence banks are hurt.

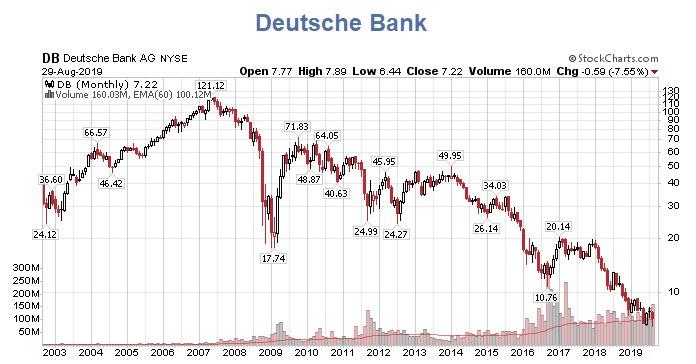

Look at Deutsche Bank, French banks or Italian banks.

Deutsche Bank

Deutsche Bank allegedly has 1.63 trillion in assets as of June 30, 2019. The market questions those assets and so do I.

Fed vs ECB

Whereas the Fed bailed out US banks by paying interest on excess reserves, the ECB charged banks interest on excess reserves draining bank profits.

Negative interest rates unquestionably hurt EU banks and there is no evidence of Lagarde’s proposed counter-benefits.

A European banking crisis awaits.

via ZeroHedge News https://ift.tt/30QrlJ4 Tyler Durden