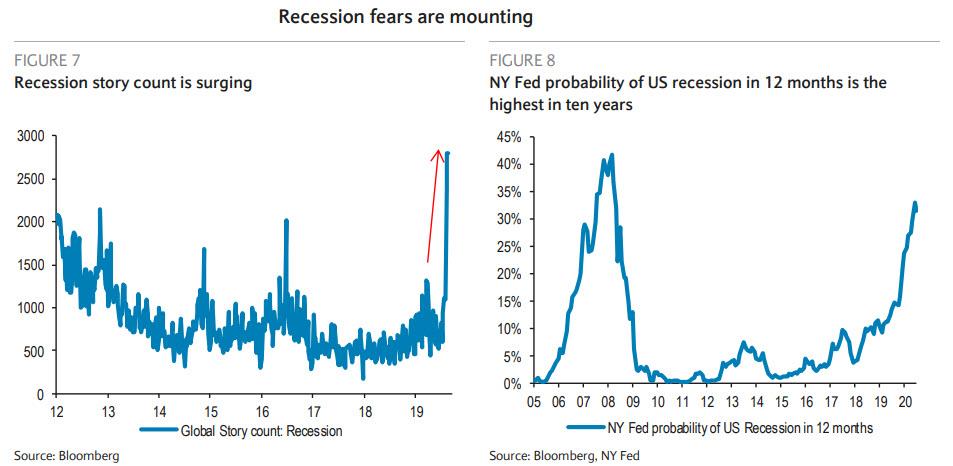

Amid weakening fundamentals, an earnings recession, increasingly unpredictable geopolitical developments and Trump’s twitter timeline, investors appear to be “positioning for the worst”, according to Barclays’ equity strategist Emanuel Cau, who points out what everyone – and certainly BofA – knows: that as a recession seems to be on everyone’s lips…

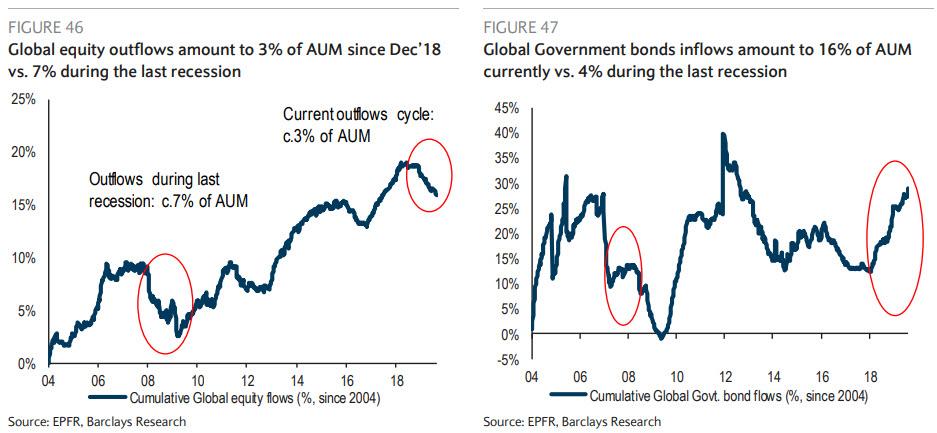

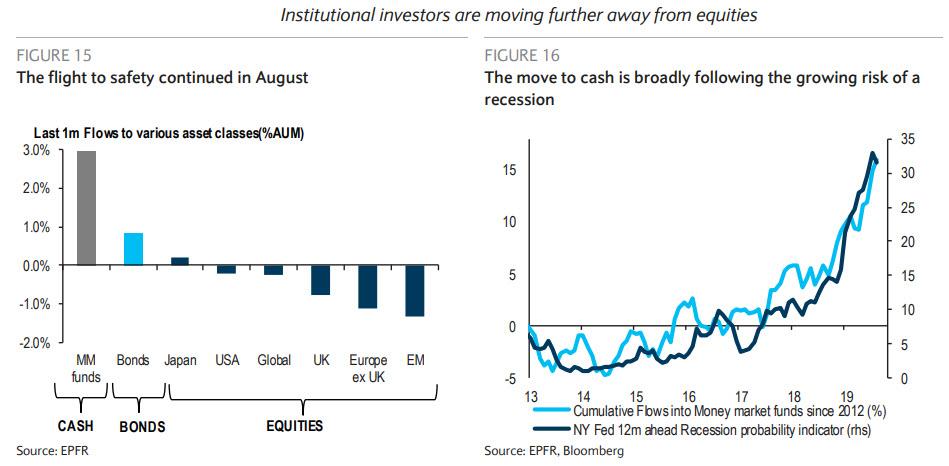

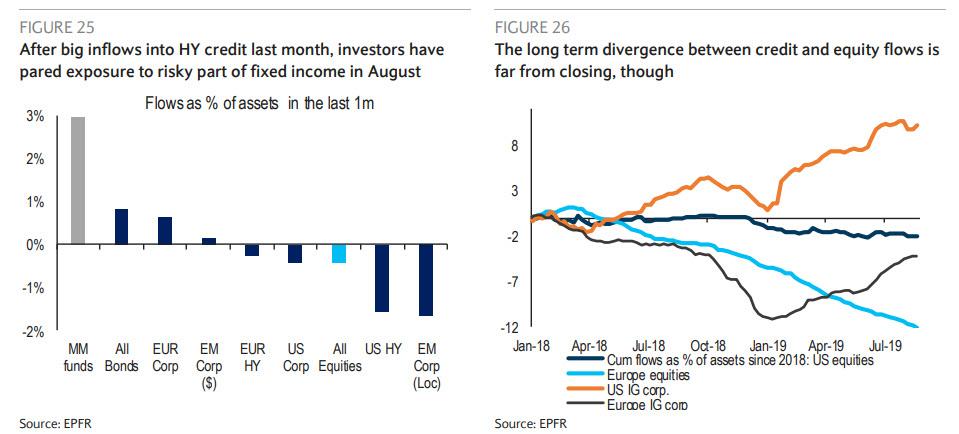

…allocation to bonds and cash keeps growing, while equity outflows amount to a significant 3% of AUM since Dec’18, almost half of the outflows seen during the last downturn.

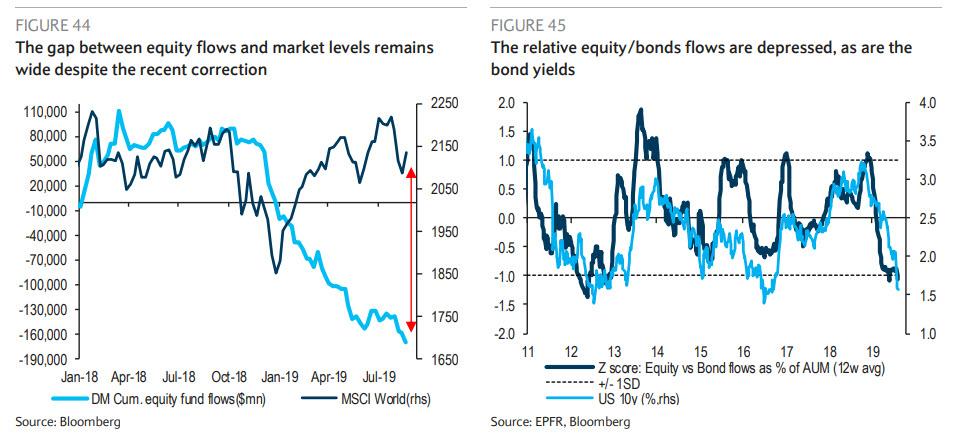

Which, to say the least, remains a giant paradox when considering the unprecedented outflow from equity funds in 2019, even as global stocks trade just shy of all time highs.

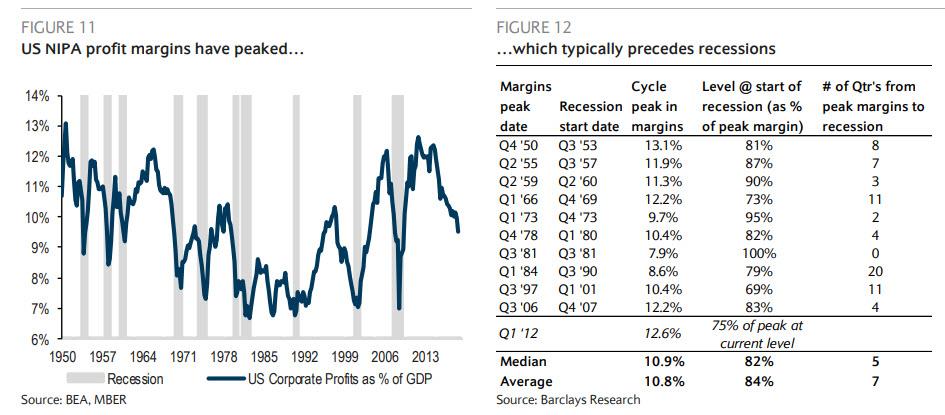

That said, one can’t blame the sellers: the warning signs of an upcoming recession are numerous with the biggest red flag emerging one month ago, following the latest annual revision to US NIPA estimates by the BEA, which as we noted at the time, showed that US profit margins were much weaker than initially thought. Indeed, the revisions subtracted income from corporate profits and boosted employee compensation, resulting in a lower corporate profit share of GDP.

Such a peak in profit margins always preceded past US recessions, by seven quarters at least on average. This time around, margins appear to have peaked long back in Q1 ’12, which is thirty quarters ago. In short: a recession is just over 4x overdue.

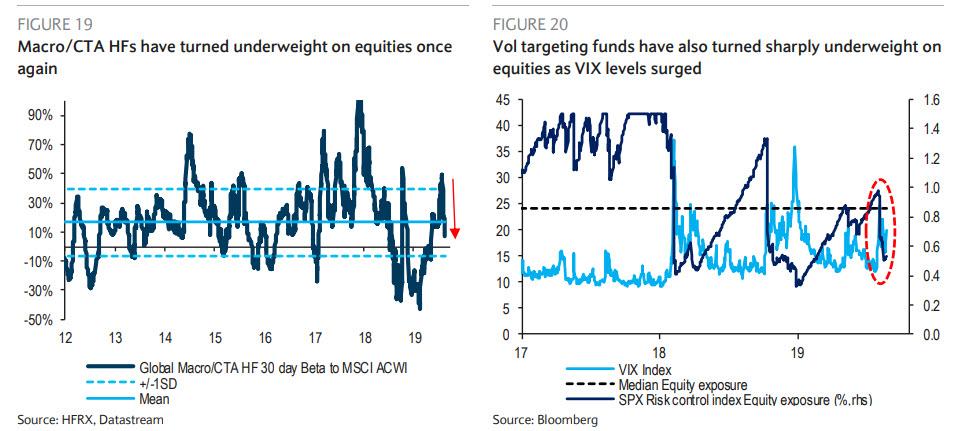

To be sure, none of this is lost on the “smart” or at least “fast money”, and according to Barclays, some of the biggest marginal price setters such as macro HFs/CTAs/and vol targeting funds are short equities again…

….as “institutional investors are moving further away from equities” amid a scramble for safe assets including cash…

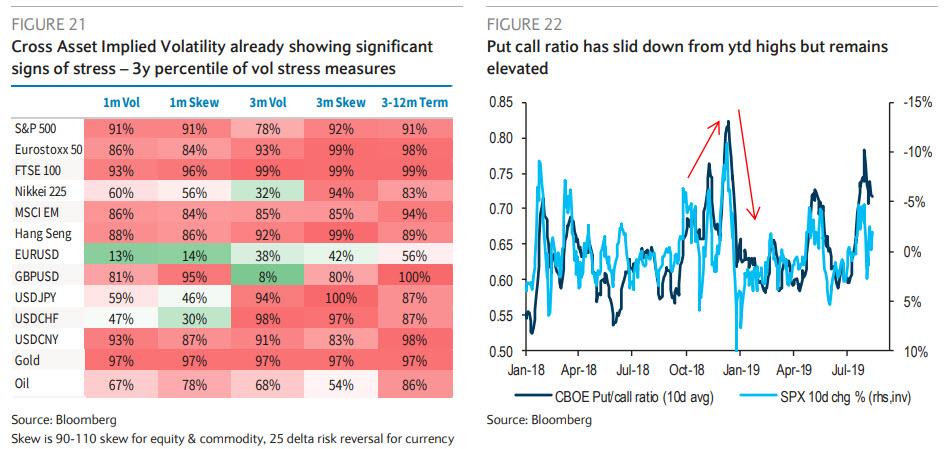

…. and as equity volatility spiked during the latest market correction, vol targeting funds also turned sharply UW equities. Their equity exposure is not far away from the previous two lows of early 2018 and 2019, while hedging has spiked as the put/call ratio is elevated…

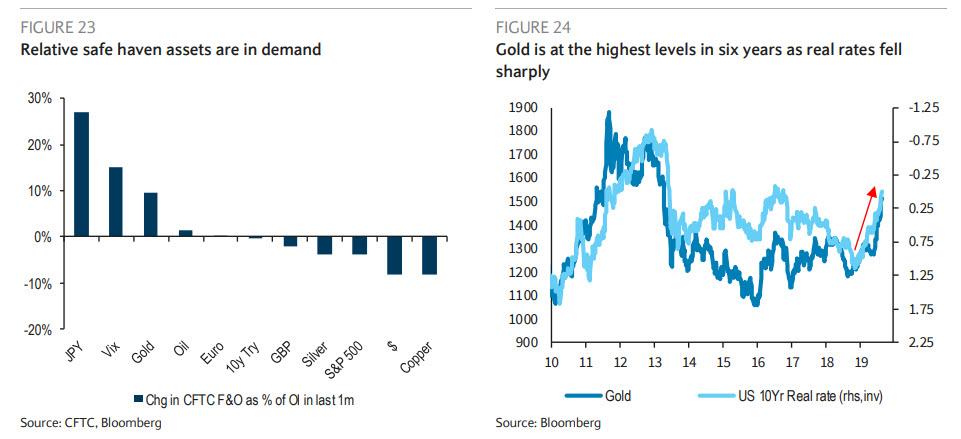

… while CFTC data provides further evidence of a widespread flight to safety. Speculative positioning on JPY, VIX and gold futures increased during the last month, while investors reduced exposure to base metals, equities and USD. Gold is at the highest level in six years, and its recent rally has almost perfectly matched the fall in US real rates.

Additionally, in contrast to the trend observed in recent months, US corporate credit and EM debt funds have also seen outflows along with equities last month, suggesting that the de-risking was broad based. However, the divergence in equity and credit flows over the last two years remains intact and still looks extreme in the historical context.

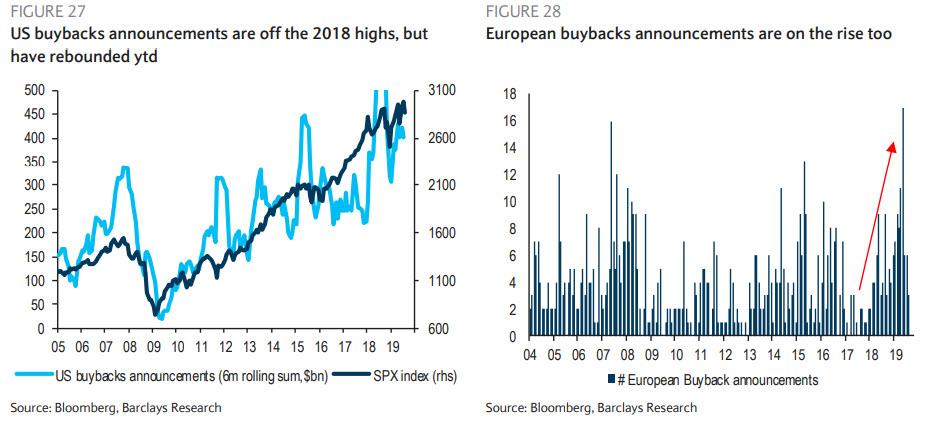

So if institutions and the smart and fast money are all selling ahead of the coming recession, who is buying? Why the usual suspects of course: stock buybacks and mom and pop investors.

As Barclays notes, “while institutional investors are moving away from equities, corporates still provide a bid to the market. As we discussed in our Q2 earnings wrap from 13 August, buybacks announcements have gained momentum ytd, not only in the US but in Europe too.”

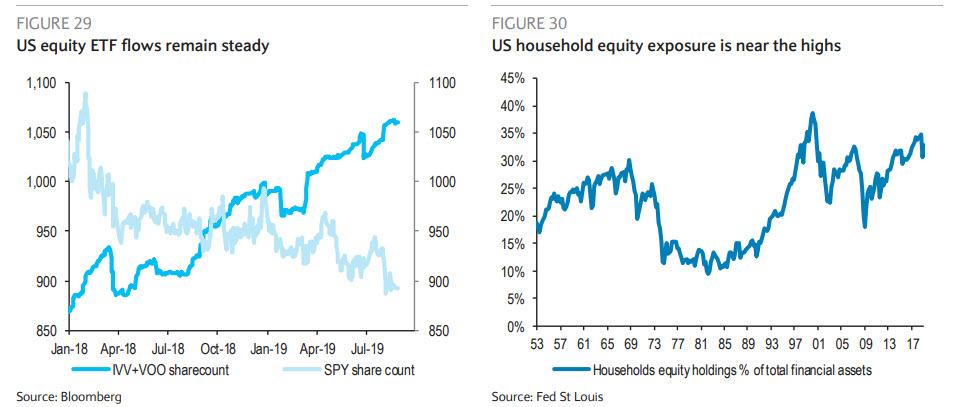

Finally, there is the most reliable “bagholder” in the world to sell to: retail investors. Barclays also notes that retail investors have not reduced equity exposure during the recent correction; in fact quite the opposite. Flows into the most popular US equity ETFs, which are a good proxy for retail exposure, have remained steady in August, while they fell during the previous corrections of February ’18, December’18 and May ’19. In other words, when it comes to believers in BTFD, it’s most retail that is left.

To Barclays, this lack of retail investors selling likely provided some cushion to equities and remains a positive for now. However, as the bank warns “if US household were to sell equities, it could lead to significant downside to the market as their exposure is near the top of the historical range at present.” Which also explains why to both Trump and the Fed, the biggest and most important task at this moment is one: to keep retail investors not only invested in stocks, but to keep buying… especially since means giving all the institutional and fast money investors a comfortable and painless way to cash out before the recession finally hits.

via ZeroHedge News https://ift.tt/2ZEA8g0 Tyler Durden