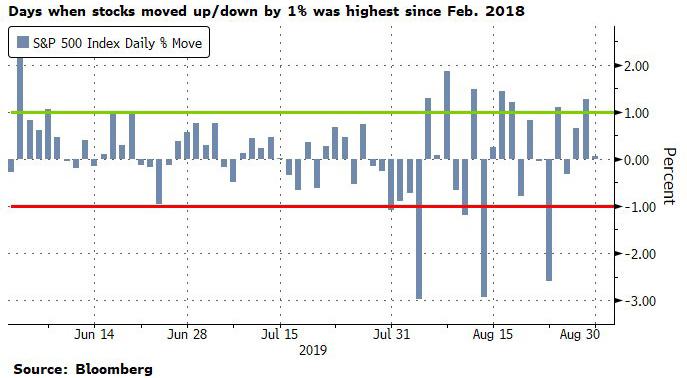

For equity markets, August was the most violent month of 2019, with the S&P tumbling 2.6% or more on at least three occasions, the same as the number of instances when the Dow plunged almost 1000 points – the worst since Q4 of 2018 when the S&P briefly entered a bear market – only to rebound furiously after Mnuchin’s infamous Christmas Eve phone call. Worse, in August the number of days when the S&P moved up or down by more than 1% was the highest since the February 2018 inverse VIX ETN implosion.

Which is why markets will be happy to see the back of August given how unpredictable the month has been on an almost day to day basis. Of course, as Deutsche Bank’s Craig Nicol notes, trade war fatigue was a big factor as investors contended with noise versus signals. However economic data has continued to deteriorate in Germany and China in particular, while the inversion of the 2s10s Treasury curve heightened concerns about recession risk in the US.

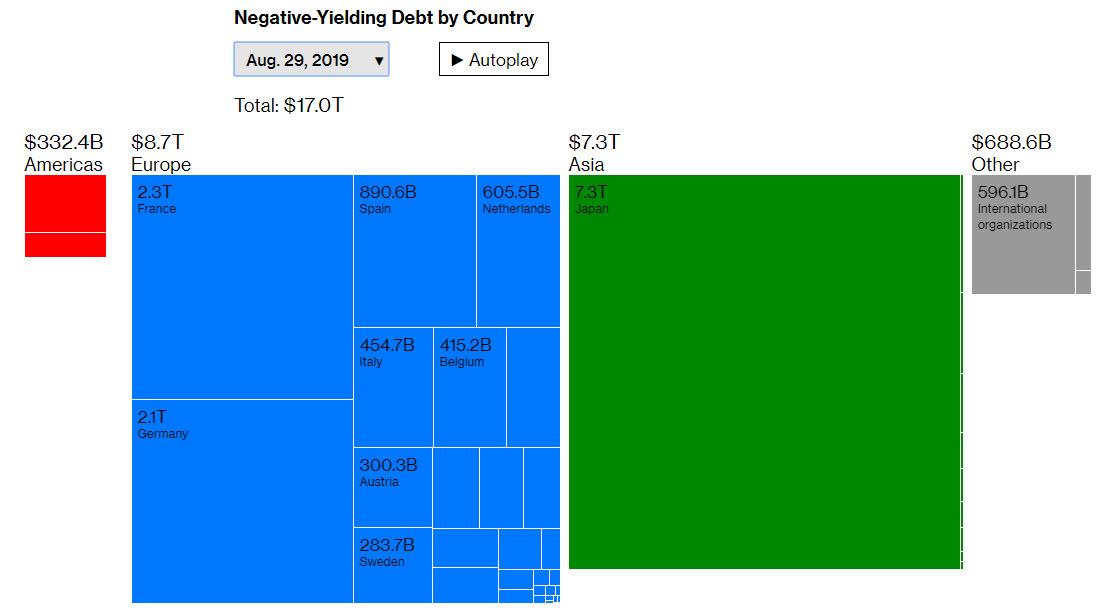

One constant in August for markets however was the unstoppable rally for government bonds. Indeed last month saw the amount of negative yielding debt in the world touch a new all-time high above $17 trillion, as the majority of European countries saw their 10y yields hit new record lows with BTPs even closing below 1.00% for the first time ever.

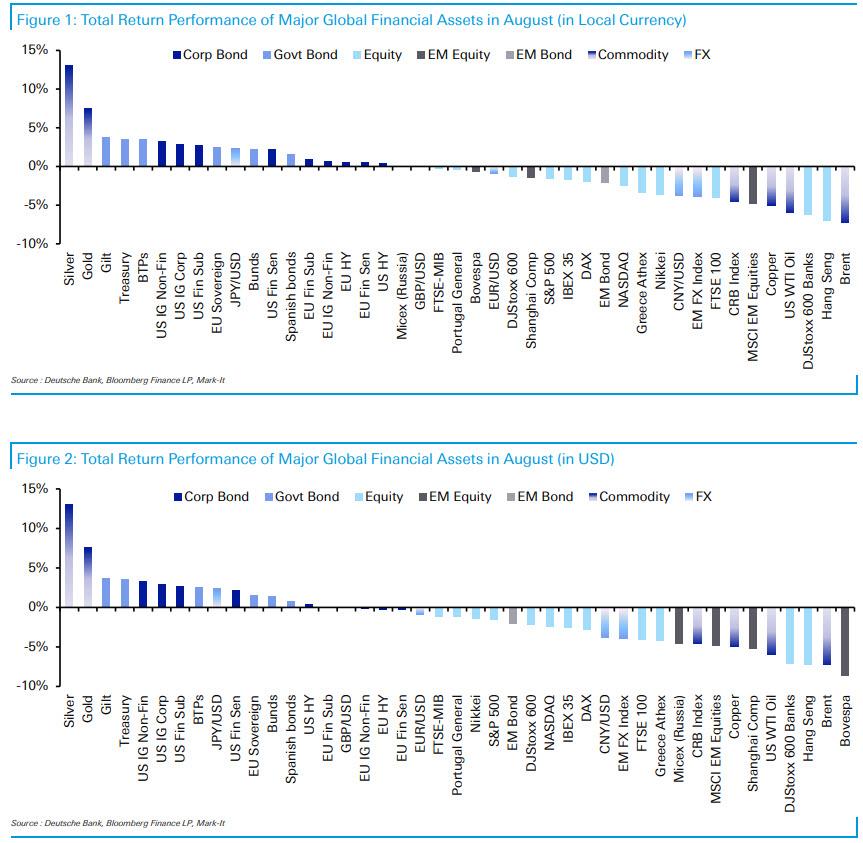

Meanwhile 10y and 30y Treasury yields at one stage passed below 1.50% and 2.00% respectively, the latter for the first time ever. Unsurprisingly then its bonds which make up the majority of assets which delivered a positive total return in August. Indeed that was the case in local currency terms for Gilts (+3.8%), Treasuries (+3.6%), BTPs (+3.5%), EU Sovereigns (+2.5%), Bunds (+2.3%) and Spanish Bonds (+1.6%). The last time Bunds had a stronger month was June 2016 while for Treasuries you have to go all the way back to November 2008.

As Deutsche Bank further notes, the big rally in rates also helped investment grade credit to strong total returns last month. Indeed USD IG returned +3.3% while sub and senior financials returned +2.7% and +2.2% respectively. EUR IG on the other hand returned a more modest +0.7%. Wider spreads in HY limited returns with USD and EUR HY returning +0.4% and +0.6% respectively.

While credit and government bonds made up the bulk of the assets which delivered positive total returns last month, Silver (+13.0%) and Gold (+7.5%) actually occupied the top two spots on the returns leaderboard as precious metals benefited from the risk-off in equity markets. All-in-all, 18 out of 38 assets (excluding FX) in Deutsche Bank’s asset scorecard that finished with a positive total return in local currency terms while 14 did so in dollar terms.

Unsurprisingly therefore it was equity markets which made up the bulk of those with negative returns. The Hang Seng (-7.1%) – roiled by the protests in Hong Kong – was bottom of the leaderboard while European Banks (-6.3%) struggled with the bond moves. All things considered, the decline for the S&P 500 (-1.6%) was fairly contained in the end especially considering it was down -4.5% just a few days into the month. The STOXX 600 returned -1.3% while EM equities were down a steeper -4.9%. It’s worth noting that Italy’s FTSE MIB (-0.4%) outperformed most other equity markets after political developments at month end in Italy helped to avoid snap elections.

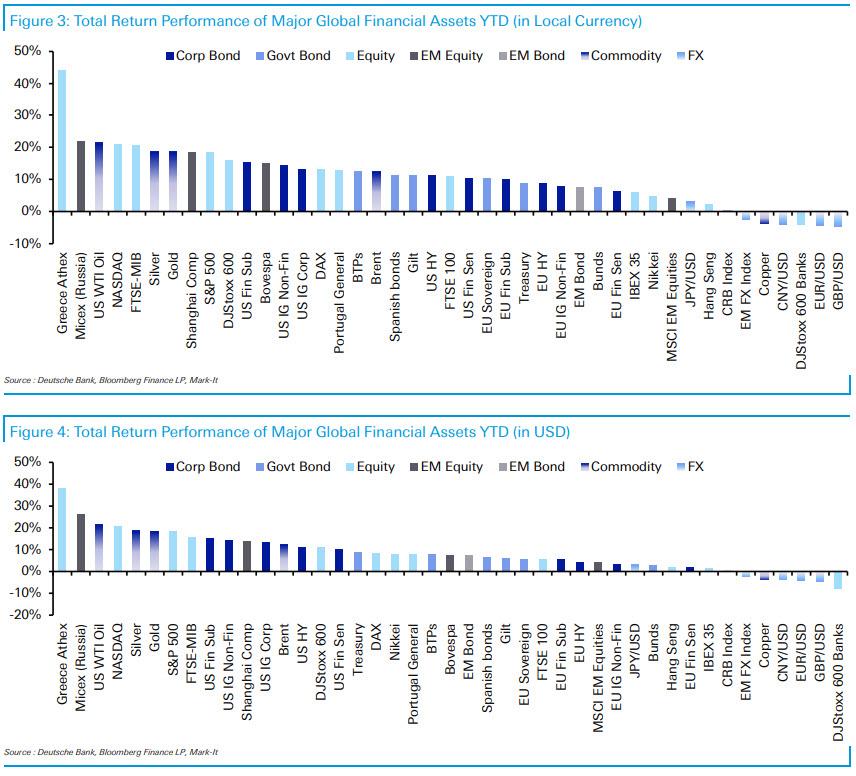

In terms of where that leaves us year to date, there are still 36 out of 38 assets with a positive total return in both local currency and dollar terms. The two laggards are Copper (-3.7%) and now European Banks (-4.0%) following the move in August. Top of the leaderboard is the Greek Athex (+44.1%) which is a fair way ahead of the next equity market in Russia’s MICEX (+22.0%). The S&P 500 and STOXX 600 have returned a solid +18.3% and +16.0% respectively.

Meanwhile, USD credit is up +10.5% to +15.3% with IG outperforming HY while EUR credit is up +6.4% to +10.2%. As for bonds, BTPs (+12.5%) lead the way while Treasuries and Bunds have returned +9.0% and +7.6% respectively. Finally in commodities, outside of the decline for Copper, Gold (+18.5%) and WTI Oil (+21.3%) have seen a big rally this year.

via ZeroHedge News https://ift.tt/2UmcOCL Tyler Durden