For months, Wall Street banks were holding off on making major (downward) adjustments to their US GDP forecasts, waiting to see if trade war with China escalates or another ceasefire emerges. And now that the latest round of tariffs is facts as of September 1, banks are finally opening the floodgates to a barrage of negativity – which appears validated by today’s first contractionary ISM print in 3 years – with UBS leading the parade, publishing a note in which it writes that it is now incorporating the latest round of trade war escalation in its forecast.

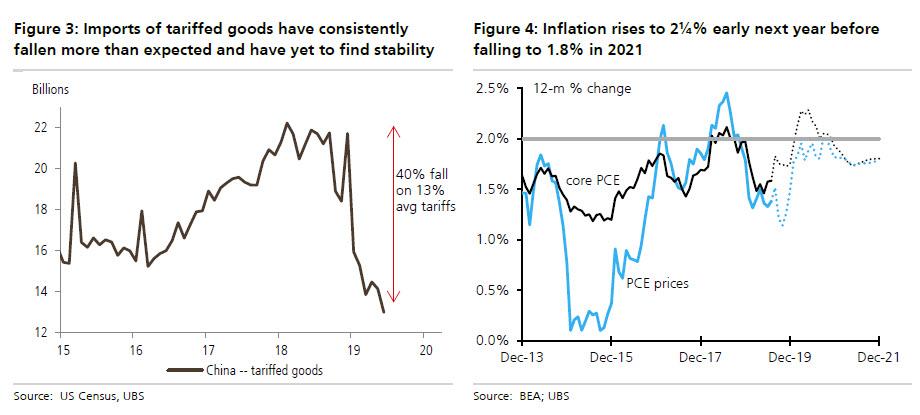

Specifically, UBS’ chief economist Seth Carpenter eyes the Trump admin’ latest trade war round which includes an additional 5% of tariffs on previously announced or enacted tariffs, and claiming that “tariffs have taken a heavy toll and the latest escalation is substantial” UBS writes that the slump in 2018Q4 and the continued weak domestic spending in 2019Q1 largely reflect the tariffs enacted last year. As tariffs have mounted, economic challenges have grown, with available data showing that imports of goods under tariffs have fallen by 40%…

… while the direct and indirect effects of the tariffs have been large.

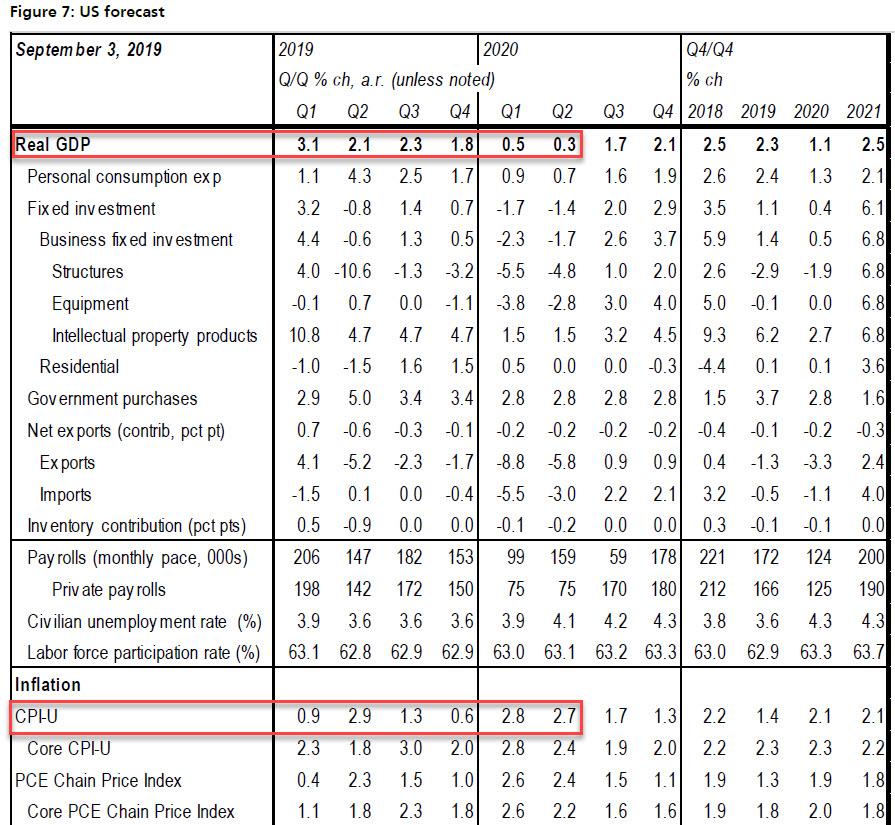

How large? Large enough to make UBS slash its 2020 GDP forecast to just above recession, while expecting the Fed to cut rates to around 1%, to wit:

We are revising down our US economic forecast to incorporate the latest escalation of the trade war. On August 23 Trump announced a 5 percentage point increase on existing and new tariffs on imports from China. Those 5 percentage points are applied to essentially all imports — both the roughly $250 billion already subject to tariffs as well as the $270 billion that is scheduled to have tariffs implemented in September and December; the increment is quite large. Moreover, the move clearly shows that 25% is not a ceiling on tariffs and thus must increase materially the uncertainty about the outlook for the trade war for businesses. On September 1, $113 worth of imports get 15% tariffs and on December 15, 15% tariffs are applied to another $157 billion. Existing tariffs rise from 25% to 30% October 1.

Of course, since tariffs work with a lag, these increases will have only a small effect on Q4 growth, when UBS forecasts real GDP growth to be about 1.8% in, a modest deceleration from the growth in Q3, but still about in line with the Fed’s estimate of potential growth. Things, however, get ugly fast in 2020, when the Swiss Bank now expects GDP to slow notably to 0.5% (a.r.) in Q1 and decelerates further to 0.3% in Q2.

Compared with its previous forecast, UBS notes that 2019 Q4 GDP growth is revised down only by 0.2pp. In 2020 Q1 and Q2, however, real GDP growth is revised down by 1.1% and 1.2%, respectively. That revision takes 0.6% from the Q4/Q4 growth rate for real GDP for next year. In contribution terms, most of the downward revision comes from consumption, but business fixed investment is also important.

Some more details on how the latest round of tariffs will impact the economy:

Consumption is almost 70% of the US economy, so its path largely determines the path of GDP. Tariffs have two effects on consumption. There is a direct effect, where higher prices lead to less consumption overall. We have seen imports of goods—including consumer goods—fall substantially in the wake of tariffs. However, money not spent on tariffed Chinese goods can be spent on other goods and services so the overall direct effect on consumption is small. The indirect effect comes from disruptions to businesses and other nonlinearities. Disruption to production disrupts employment. Both investment spending and consumption spending are hurt.

The 15% tariffs on the last tranche of imports will disproportionately hit finished consumer goods and thus the retail sector. We know that the retail sector is vulnerable. The revisions to the BLS data on payrolls shows that the retail sector was shedding jobs in 2018. Our equity analysts have long called for consolidation with retail closings and layoffs. The tariffs will accelerate this consolidation, and the loss in jobs and income will hurt spending.

The effect of the tariffs on business will be apparent in investment spending. Structures investment has been negative for much of this year, partly reflecting distress of malls and a softening in the energy sector. But the hit to the manufacturing sector is also weighing on this spending, so we have structures investment spending at roughly -5% in the first half of next year. We see little scope for near-term recovery, as demand for oil will continue to be muted with the softening economy, so the recovery in structures is hardly noticeable in 2020H2.

Equipment investment was part of the rebound in Q2 this year, but with additional tariffs on intermediate goods hitting the economy, we see contraction in this category from 2018Q4 through 2020Q2. Beyond direct effects from tariffs, additional weight on equipment investment comes from the oil sector; fracking requires a flow of investment spending. With the global slowing in economic activity and the hit to domestic manufacturing, demand for oil will fall. Part of the supply elasticity in the market comes from changing production in fracking, so we have some reduced investment through that channel, as well. As was the case with the rebound in Q2, however, we see a rebound in equipment investment in 2020Q3 as firms eventually work around the tariffs.

This weaker path for the economy also has implications for the unemployment rate and for inflation, and thus for the future of Fed rate cuts. Specifically, job growth slumps heavily in the first half of next year in UBS’ forecast, and the Swiss bank projects the unemployment rate to rise to 3.9% in Q1. Job growth remains weak in its forecast at 75k per month on average in the first half. The sharp slowing means that the unemployment rate continues to edge up and reaches 4.3% at the end of 2020.

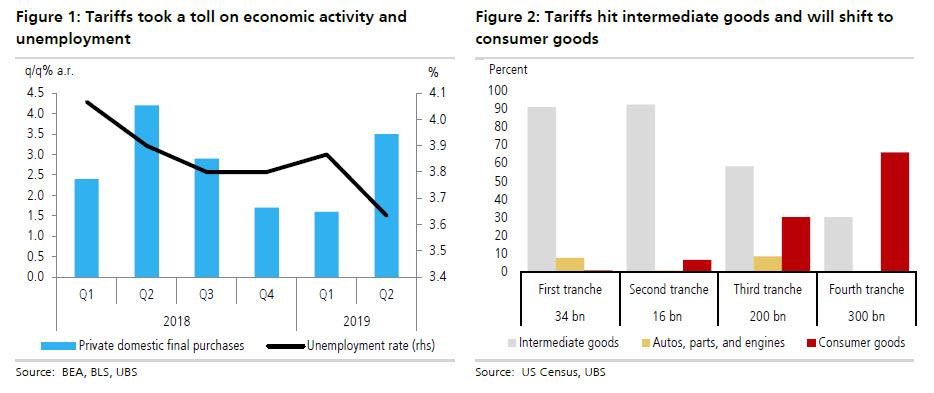

Then there is the sudden spike in prices as a result of pent up tariffs:

We see core PCE inflation as running a bit hot in 2019Q3, based on data in hand. But we expect a slowing to 1.8% in Q4, in part as transitory strength fades and residual seasonality in the data remains. The tariffs, especially those on consumer goods, show through in our forecast to a surge to 2.6% core PCE in Q1 next year. Some of that strength owes to residual seasonality, as well.

On net, UBS sees core PCE inflation at 2% next year, which may well push the US into a a stagflation, although with the rise in the unemployment rate, UBS now forecast core PCE inflation to edge down in 2021 to 1.8%. That rate of inflation is consistent with the underlying trend in inflation moving only gradually from its 1¾% pace in recent years and the additional slack from the slowdown.

So with the economy on the verge of recession just a few months ahead of the 2020 presidential elections, when Trump will do anything to avert an economic contraction which would crush his re-election chances, does UBS make a recession its new base case scenario? Not quite: as Carpenter explains, his forecast skirts a recession, “but there are clear downside risks. A further shock to the economy could result in contraction. There are already significant strains in the energy and retail sectors; they may deteriorate further and faster than we anticipate. And, political risks abound.”

Given the slowing GDP growth, rising unemployment, and declining inflation in this projection, UBS now expects additional rate cuts from the Fed. The rate cut at the July FOMC meeting was clearly contentious. Data received between the June and July meetings were stronger than optimistic expectations. Half, and perhaps slightly more, of the FOMC participants did not want to cut rates, and among the voting members, two dissented. The minutes from that meeting show a fractured Committee, but public communication from Powell and Clarida, as well as the minutes, suggest a continued emphasis on a deteriorating global economy and the escalation of the trade war. Consequently, UBS sees the FOMC cutting rates again in September, with the leadership of the Committee stressing the risks to the outlook and not the data.

With that mindset, we think the Committee will likely need to see actual deterioration in the data before they cut rates again after September. Consequently, we forecast they will hold off cutting until the slowdown begins to show up in the data. In March, available data for Q1 will be limited, but there should be sufficient information to warrant a bit more easing and we think they could cut by 25bp at that meeting. We see additional 25bp cuts at each of the May, June, and September meetings as incoming data continues to come in weak. That path implies a total of 150bp of policy easing, leaving the top of the target range at 1.00 percent.

And just in case it wasn’t clear, while UBS still does not make a recession its base case, it pretty much makes clear that that is the most likely outcome:

This forecast puts the specter of a recession front and center. If we consider that 2018 Q4 real GDP was revised from 2.6% on the initial print to 1.1% now, our forecast of below 0.5% for the first half of the year is hard to differentiate from contraction. Moreover, with global growth slowing, there is a clear risk that oil prices drop. We have estimated that the collapse in oil in 2014 could have taken off over a percentage point from real GDP in 2015 and 2016. Such a collapse is not in our baseline, but makes a recession a clear possibility. Similarly, a faster or sharper consolidation in the retail sector could cause mass layoffs, pushing us into recession. Indeed, the slower the growth of the economy, the smaller the shock of any kind is needed to tip an economy into a recession. Our forecast skirts a recession, but the risks abound.

And if there is one thing traders have learned to anticipate in the current abnormal environment, it is that a “shock” – ostensibly one emerging from Trump’s twitter account – is virtually guaranteed.

via ZeroHedge News https://ift.tt/2LgtvMM Tyler Durden