While Lam’s promises started the optimism, and China PMI improved marginally, and another BoJo defeat helped sentiment…

The market held the overnight gains as a procession of Fed Speakers all toed the narrative line that rate-cuts are coming and The Fed needs to watch the world when it decides on policy…

Williams (Dovish): “Ready to act as appropriate”, July cut was right move, economy mixed (admitted consumer spending not a leading indicator), international news matters, low inflation biggest problem.

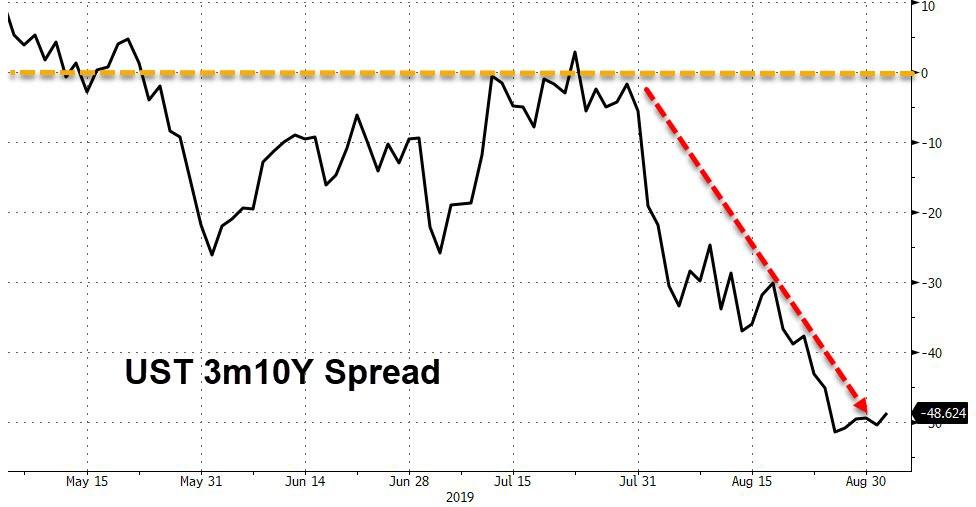

Kaplan (Dovish): “Monetary policy a potent force”, worried about yield curve inversion, economy mixed (factories weak due to trade, consumer strong), watching for “psychological effects” on consumers, “if you wait for consumer weakness, it might be too late.”

Kashkari (Dovish): Tariffs, “trade war are really concerning business”, job market not overheating, slower global growth will impact US, most concerned about inverted yield curve. Fed’s policy is “moderately contractionary.”

Bullard/Bowman (Looked Dovish): Took part in “Fed Listens” conference but made no comment on policy but then again when has Jim Bullard ever not been dovish.

Beige Book (Mixed): Moderate expansion but trade fears are mounting, but optimism remains, despite what Kashkari says: “although concerns regarding tariffs and trade policy uncertainty continued, the majority of businesses remained optimistic about the near-term outlook”

Evans (Dovish): Trade policy increases uncertainty and immigration restrictions lower trend growth to 1.5%, Auto industry especially challenged

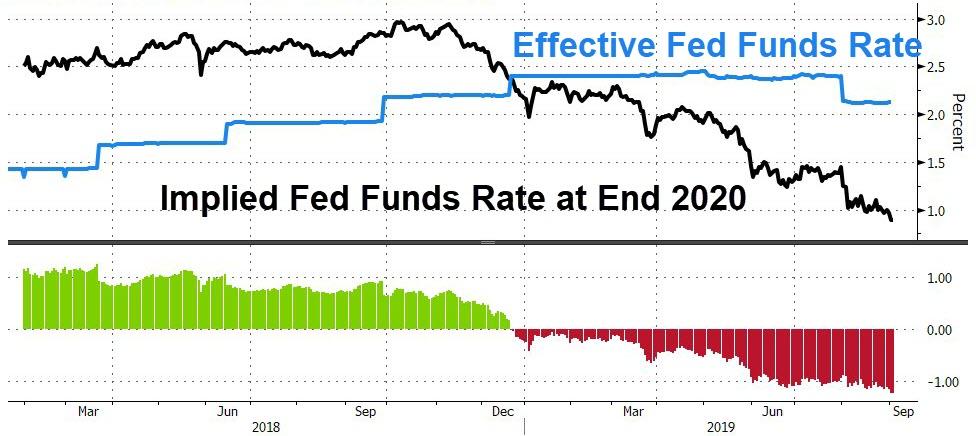

And the market is now pricing in a stunning 124bps of cuts through the end of 2020…

Source: Bloomberg

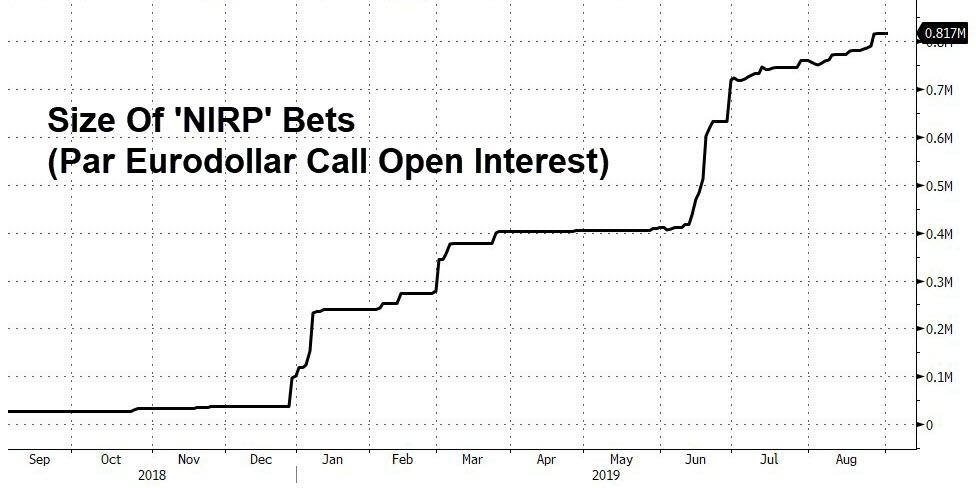

With an increasing number of traders betting on US rates going negative before the end of 2021…

Source: Bloomberg

China ramped in the afternoon session…

Source: Bloomberg

Hong Kong stocks exploded around 4% higher – best day since Nov 2018…

Source: Bloomberg

Europe opened exuberantly…and clung to those gains…

Source: Bloomberg

US equities were all higher on the day, with Nasdaq and S&P erasing yesterday’s losses but Small Caps are the biggest laggards…

NOTE – Dow and Transports were desperately lifted again and again to try and get green on the week, but failed.

It is clear that US equities are only supported by The Fed now as a trade deal is almost entirely priced out…

Source: Bloomberg

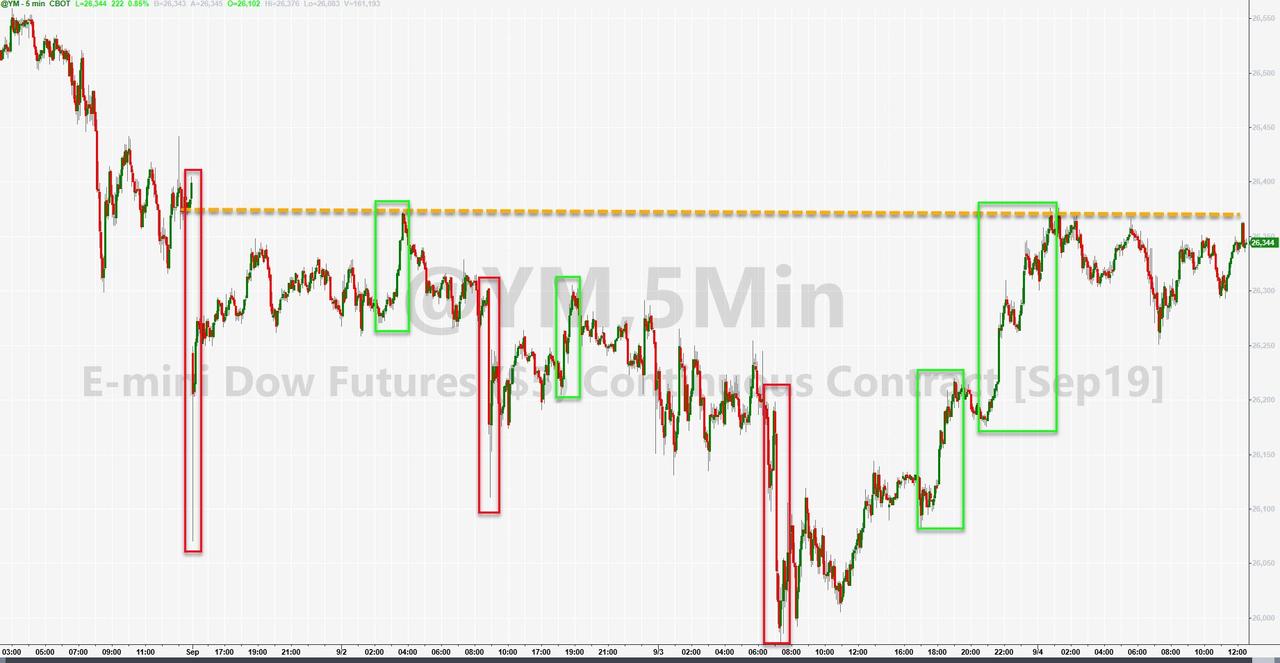

Futures ramped overnight – filling the gap from Sunday night’s open – then making lower highs for the rest of the day…

Most Shorted stocks massively squeezed at the open and ramped after Europe closed to get back to unch on the week…

Source: Bloomberg

As sextuple top for the S&P…

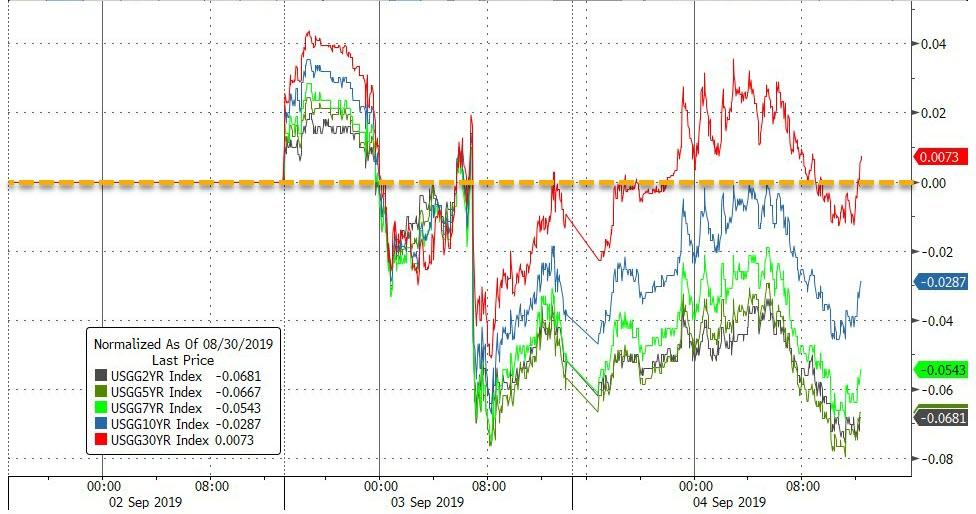

Treasury yields were mixed today with the long-end underperforming (30Y +2bps) and back higher on the week, while the short-end compressed around 2bps on the day…

Source: Bloomberg

30Y Yields tested 2.00% once again but, once again, quickly caught a bid (despite heavy rate-lock buying on the back of massive issuance)…

Source: Bloomberg

The yield curve remains dramatically inverted…

Source: Bloomberg

The dollar index plunged today – 2nd biggest drop in 2019…

Source: Bloomberg

Yuan surged for the second day, back up to last Friday’s highs…

Source: Bloomberg

Cryptos faded overnight but were bid during the US day session…

Source: Bloomberg

Commodities were all higher on the day

Source: Bloomberg

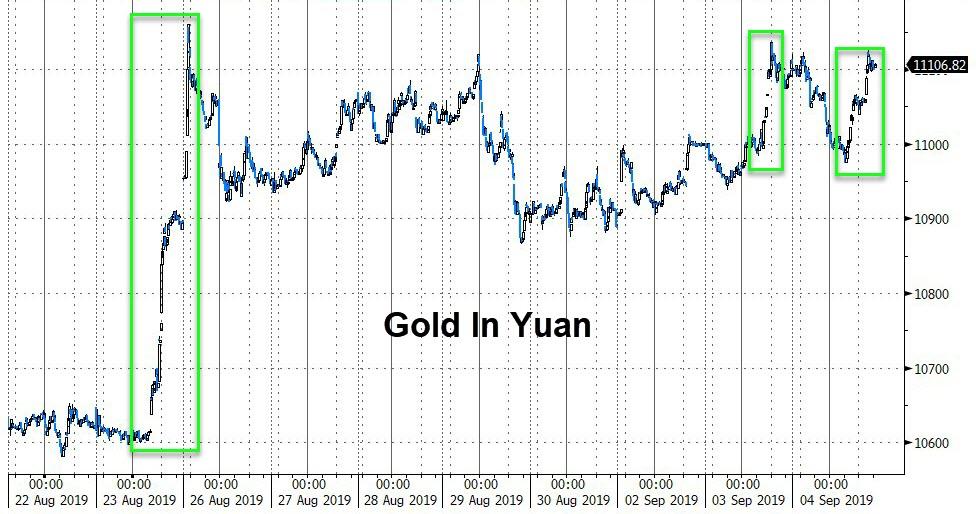

Gold futures jumped back above $1565…

And Silver outperformed again, spiking back above $19.50…

Oil surged manically higher today to tag $56.50 (from $54) after U.S. announced plans to intensify sanctions on Iran and Russia said it would trim production in September.

But once the machines had tagged that $56.50 stop-run, oil started to tumble…

API reports inventories after the close tonight.

Gold in Yuan reversed early losses, bouncing off 10,000, despite the gains in yuan today…

Source: Bloomberg

Finally, some fun charts for your consideration.

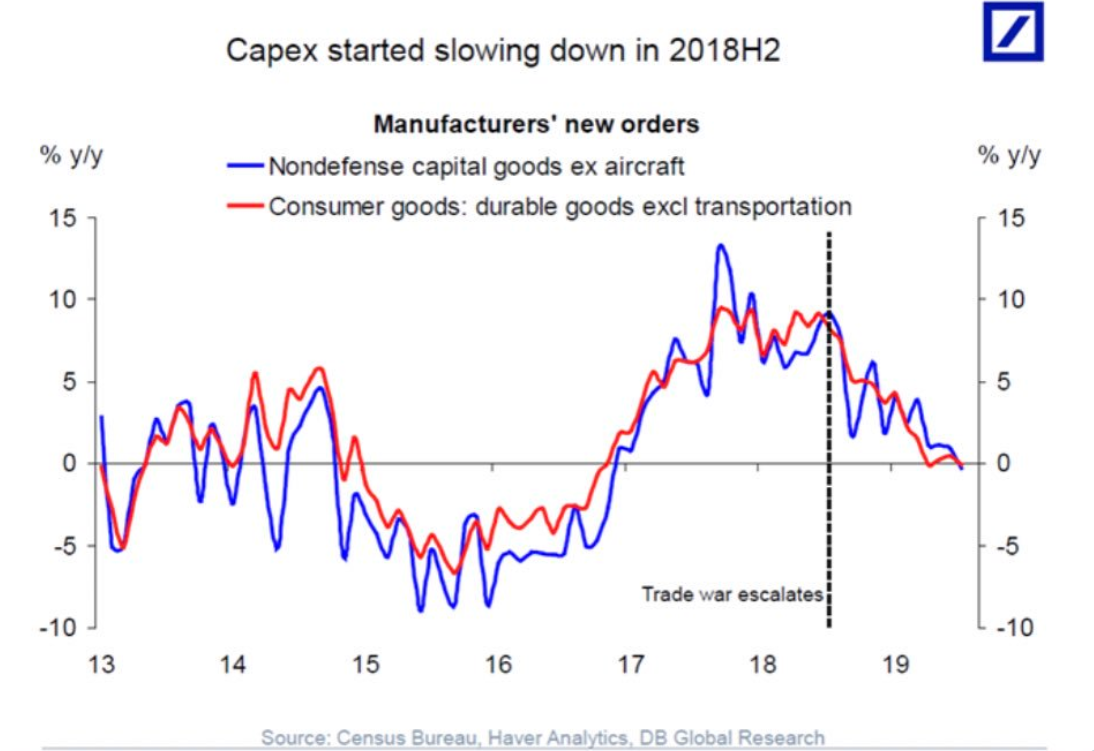

CapEx is collapsing, Deutsche: “We are getting more and more worried about the impact of the trade war on capex spending”…

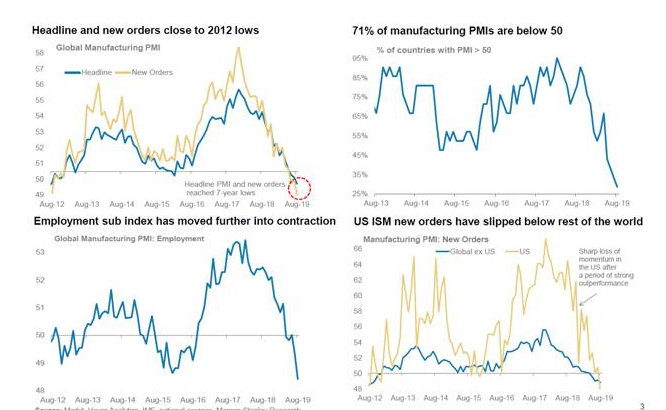

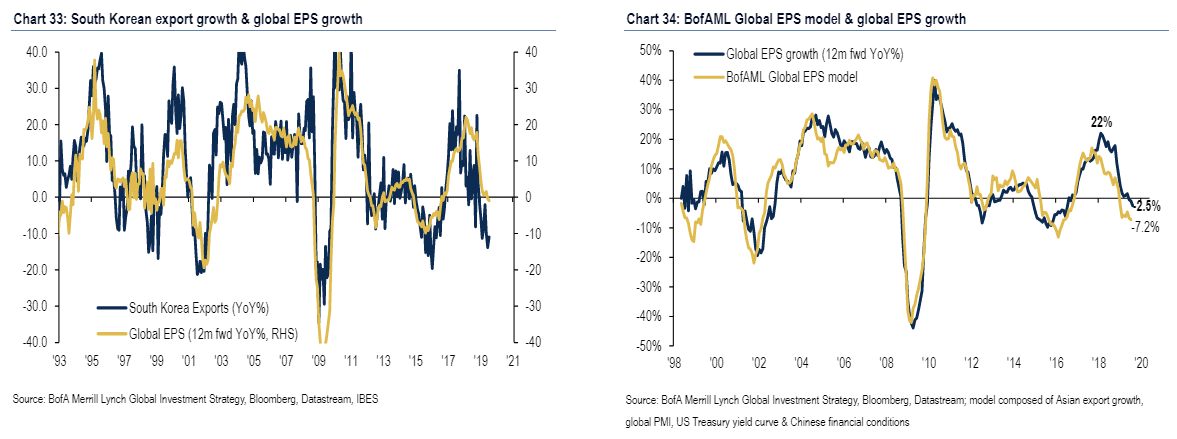

Global Manufacturing is a bloodbath…

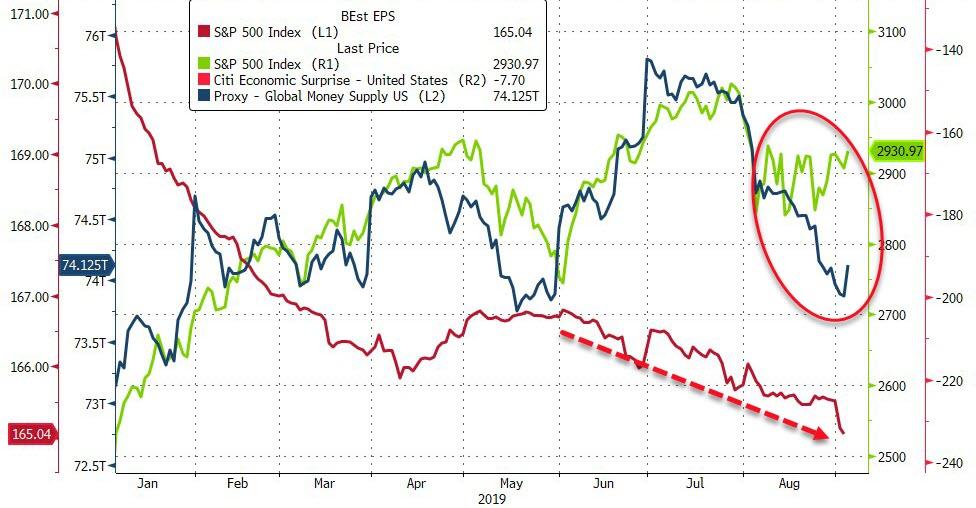

And, as earnings expectations have collapsed this year, only global liquidity has saved stocks (but even that is diverging now)…

Source: Bloomberg

And doesn’t look likely to improve anytime soon…

via ZeroHedge News https://ift.tt/2ZImEQo Tyler Durden