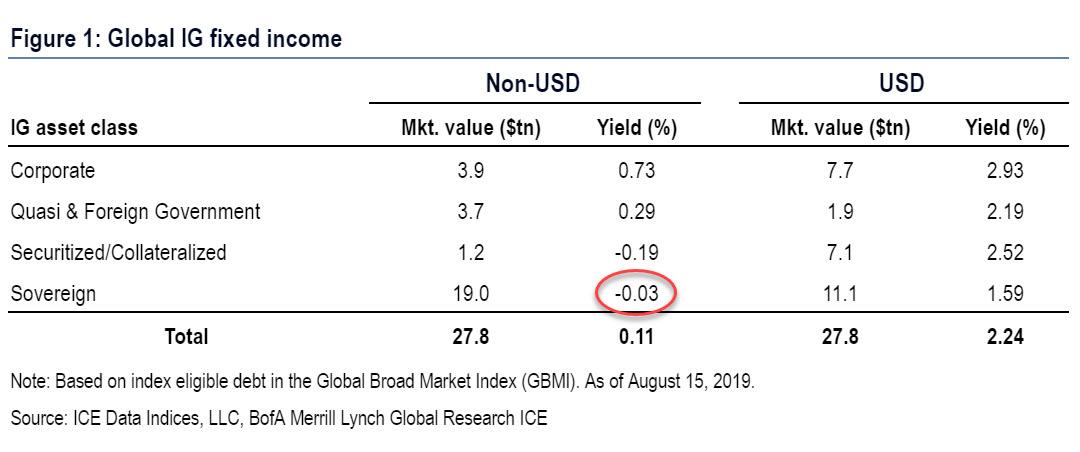

Back in August, we wrote that after decades of waiting, for Albert Edwards vindication was finally here – if only outside the US for now – because as per BofA calculations, average non-USD sovereign yields on $19 trillion in global debt had, as of Monday, turned negative for the first time ever at -3bps.

So now that virtually every rates strategist is rushing to out-“Ice Age” the SocGen strategist (who called the current move in rates years if not decades ago) by forecasting even lower yields (forgetting conveniently that just a year ago consensus called for the 10Y to rise well above 3% by… well, some time now), we reported what man who correctly called the unprecedented move in global yields – which has sent $17 trillion in sovereign debt negative – thinks happens next (for those who missed it, the summary was “There is a lot more to come.“)

Of course, it ain’t easy being a permabear – even when your global “Japanification” thesis, 30 years in the making, has been validated – for the simple reason that there are haters always and everywhere, and for some odd reason Edwards decided that responding to them in his latest letter is a prudent use of his time. In this particular case, Edwards takes umbrage at the criticism of a fellow “financial advisor” who inexplicably, spends more time on CNBC and on twitter than, well, providing financial advice, but that’s Albert’s prerogative (our advice: ignore them).

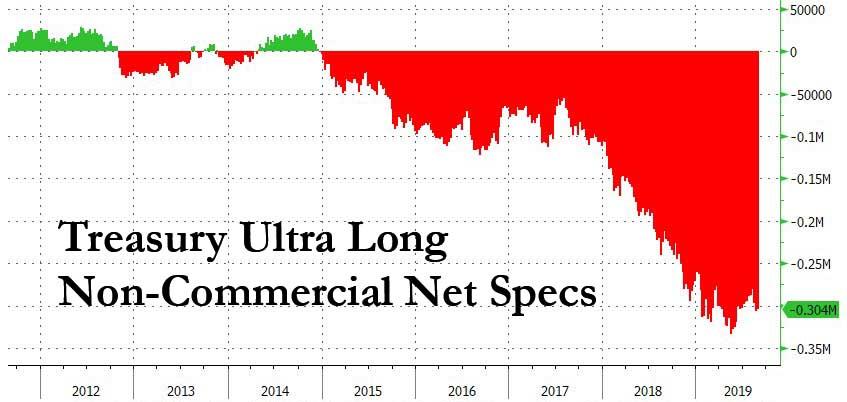

So instead of diluting Edward’s message with trivial tangents, we focus on several key points, the first of which is why if Edwards got the bond bull market so spectacularly right at a time when virtually everyone remains short bonds…

… has he been wrong on stocks, with his calls to short the equity market, which is also explains the genesis of his “permabear” moniker (alternatively, Edwards is the biggest bond permabull in existence). This is what Edwards said:

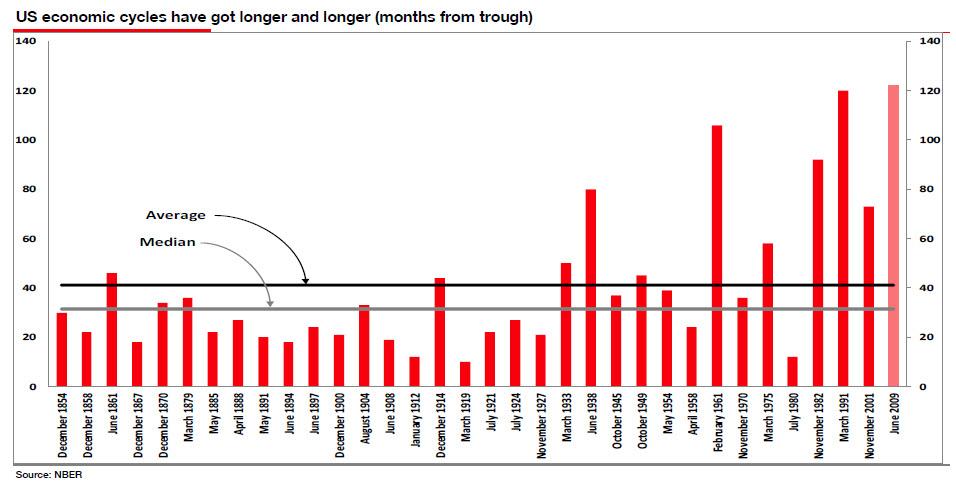

… my biggest Ice Age mistake was to assume that the US would be like Japan and that subsequent to the 2008 GFC, US policymakers would find it much harder to manipulate the economic and credit cycles. I thought we would return to normal economic cycles with lengths nearer to 40 months.

And if I was right, perceptions of increased EPS volatility would cause the equity or cyclical risk premium to rise ie the increased volatility of the economic cycle would cause PEs to decline for any given level of bond yield.

However a funny thing happened on the way to normalcy: central banks decided that they need to unleash more central planning that the USSR, and effectively kill the business cycle, so rather than seeing shorter cycles of around 40 months, the US is still enjoying the longest economic cycle in its history of 122 months and counting!

“How wrong can one be?” Edwards asks rhetorically, adding “Yes, I know it is also one of the weakest in history, but thats not the point.”

For I had pencilled in the next US recession as the time when we see the next intensification of the Ice Age (as occurred in Japan), where equity prices and PEs would fall to new lower lows and where new and unprecedented monetary measures would need to be taken in the face of outright deflation. That is why I have been so wrong for so long and that also goes for my bearish view on bonds, articulated in 2011 (see reference to blog criticism, page 3). I had by now expected the helicopters to have already dropped hundreds of trillions of confetti dollars onto the US economy and CPI inflation to have already begun to twitch into life like Frankensteins monster.

Don’t worry Albert: one look at the campaigns of potential socialist US presidents, and it becomes abundantly clear that helicopter money, i.e. MMT, is coming. And once said socialists promise enough free shit, it is only a matter of time before they are elected. After all, everyone likes free shit.

Which brings us to the logical next question: having discussed what next happens to bond yields two weeks ago, Edwards now tackles the question of “what might happen in the next recession?”

Will equity yields continue to grind lower (PEs higher) in line with US bond yields falling into negative territory, and as the printing presses are started up again and running at such a frenzied pace you will be able to hear them from Mars? Or will, as I suspect, a slide into recession again be accompanied by the bursting of credit and asset bubbles and the ensuing recession be as surprisingly deep as the 2008 GFC?

The answer coming from the equity permabear deflationista will hardly be a surprise: he maintains his view that the US equity market will fall to a new low in the next recession as investors witness yet another credit-induced, economic implosion. “And, at the same time as the economy implodes, expect President Trump to explode with rage. Indeed, even before his election I felt it very unlikely that the Fed would be able to maintain its independence if it is the midwife for yet another credit-induced deep recession.”

Oh sure, the Fed will try to fight it, and it will, culminating with the endgame for every central bank – the release of helicopter money in hopes of terminal currency debasement sparking debt hyperinflation. But to the SocGen strategist, that won’t be enough.

Wont [helicopter money] fill the swimming pool and cushion the equity markets descent? Wont an activist Fed, with President Trump screaming with rage in the background, be able to prevent any potential collapse in the equity market? I believe not. Why will the next recession be any different from the last one, which saw equities collapse despite massive monetary stimulus?

As a reminder, yesterday we noted that policy impotence is one of the reasons behind BofA’s contention that policy impotence is why the cycle finally ends in 2020. Edwards agrees:

I would expect renewed rounds of QE, and/or helicopter money, as MMT is embraced as a desperate solution to the next slump. But this liquidity is not guaranteed to flow into equities or indeed any risk asset while the economic downturn is in full force. I use the example of commodity prices after the GFC, which initially behaved just like equities, benefitting massively from QE. Then, as you can see in the chart below, industrial commodities de-coupled from rising equity markets, primarily because the fundamental backdrop deteriorated as the Chinese economy slowed. Ample liquidity cannot be guaranteed to flow into any particular risk asset if its fundamentals turn negative. Liquidity will initially flow into whatever momentum trade is still standing at the time, backed by fundamentals, and that will most likely be government bonds.

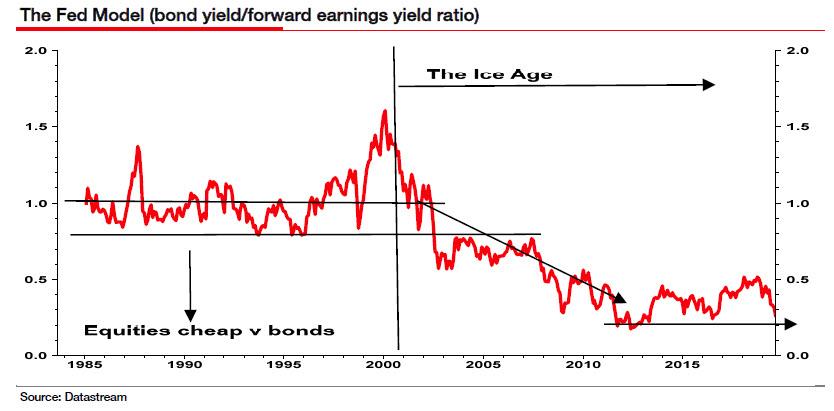

But if everyone buys bonds, won’t stocks also be bid? After all, that’s the basis of the Fed model, is it not? Well, here too Edwards has something to say.

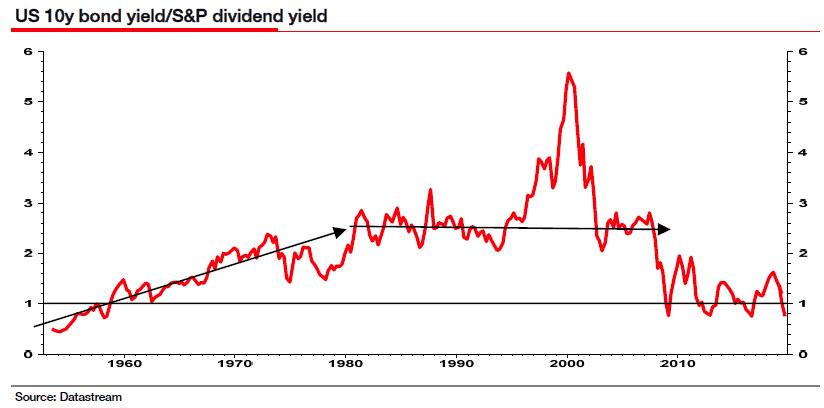

The so-called Fed Model (below) was an essential asset allocation reference tool in the 1980s and 1990s. It was thought that this ratio of 10y US bond yield and forward earnings yield (inverse of PE) enjoyed some sort of equilibrium level at 1.0, as for most of that period the ratio oscillated above and below 1.0 (until the Nasdaq/TMT bubble).

We said in 1996 that there was no fundamental reason why there was any mean-reverting properties to this valuation ratio, and that indeed in the Ice Age the ratio would fall lower and lower as equities de-rated versus bonds. And indeed it did, with valuation support at 0.8 prior to 2000 becoming valuation resistance to the upside after the Nasdaq bubble burst. Then we saw another lurch down in the ratio until Fed QE stabilised the situation in 2012. We expect yet another vicious lurch downwards in this ratio during the next recession.

Indeed you see from the chart below that the nominal bond yield/equity yield was not ever stable in the long run if you go back to the 1950s (this chart uses dividend rather than forward earnings yield). The 1982-2000 period was an anomaly in the longer-term context. A fundamentally important Ice Age forecast was that we were going to return to a world where the equity dividend yield would rise above the bond yield and stay above it. It was the 1965-2000 period that I thought was the anomaly. So while market commentators have recently noted that the US 30y bond yield has fallen below the dividend yield I believe that is the natural order.

That said, one thing that the always humble Edwards admits he did not account for, and understandably so, was perpetual QE, i.e., the takeover of markets by central banks, to wit:

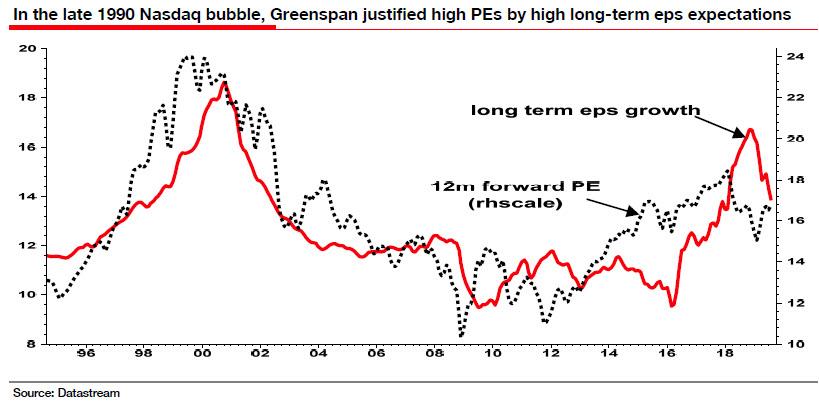

My key Ice Age contention was that lower bond yields that had pushed PEs higher during the 1990s (all else equal), would no longer do the same job. In a post-bubble Ice Age world, despite continued falls in bond yields, PEs would decline on a secular basis.

In a nutshell, from a simple discounted cash flow calculation, a more volatile and uncontrollable post-bubble economic cycle would drive the equity (cyclical) risk premium higher (driving PEs lower) and deflationary conditions would drive long-term eps expectations to be more in line with anaemic nominal GDP growth (also driving PEs lower). In the Ice Age the PE compressing force from falling long-term eps expectations and rising cyclical risk premiums would outweigh the PE expanding influence from falling bond yields. That is it in a nutshell.

But experience has shown us that in a post-bubble world a cyclical recovery could lead to a pause or even reversal of the two PE depressing drivers. And the longer the economic recovery continues the more the markets will believe there is a return to Great Moderation normality and the more it can ignore the Ice Age. That is exactly what has happened, aided by QE.

Indeed the chart below shows that US long-term earnings expectations have done exactly what they did during the late 1990s Nasdaq bubble. The echoes of that time are unerringly similar. Belief in this equity market has been centred around the new large technology, growth stocks typified by the large-cap FAANGs (Facebook, Apple, Amazon, Netflix and Alphabet’s Google), rather than TMT generally.

Assuming that Edwards is correct that QE has merely recreated another tech bubble, what happens next then should be obvious: “We will find out in the next recession which of the currently designated growth stocks are simply deep cyclicals masquerading as growth stocks. We just dont know and neither do they! But one thing I know from our experiences in the 2000 Nasdaq collapse: if a company valued as a growth stock on eye-wateringly high multiples gets found out to be a deep-cyclical imposter, that stock collapses as both its earnings and cyclical risk premium get rapidly reappraised.”

And finally, there is the issue of a decade of accumulated non-GAAP gimmickry to catch down to:

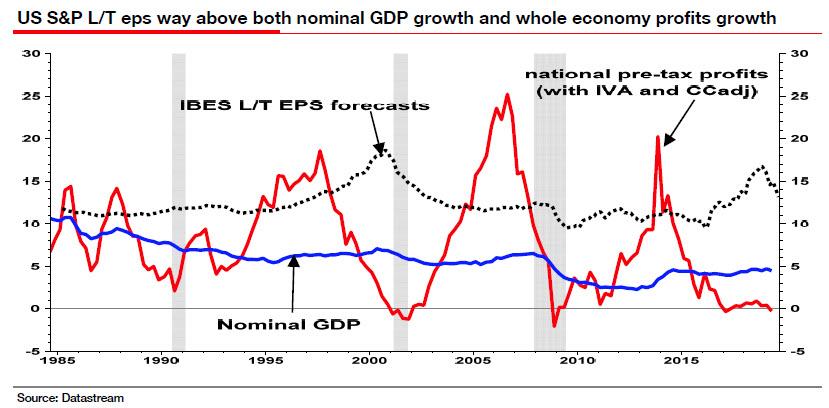

Despite the recent downtick, S&P Composite long-term eps expectations are still way out of line with both nominal GDP and particularly whole economy profits growth (see chart below, both 5y trailing to match the 5y projection for long-term eps expectations). In a recession, expect the dotted line in the chart below to lurch down sharply as it did in both the last two recessions (shaded areas). That is when you will see equity prices melt away.

Which brings us back to Edwards’ cataclysmic forecast, that the S&P will tumble below the 666 “generational low” of March 2009. Here is the SocGen strategist’s defense of that extremely controversial claim:

How can we possibly believe that the S&P could fall back below its 666 March 2009 low. Simple: I believe the 12-month forward PE will decline to a new lower low compared to the profits nadirs of 2002 (15.5x) and 2009 (10.5x). At the height of a bear market, during the eye of the storm, the equity market does not trade like an auto stock or a copper stock. It does not go to peak PEs of infinity at the bottom of the earnings cycle. Quite the reverse – the market in its panic goes to trough PEs on close to trough earnings.

Which brings us to the doom and gloom conclusion: how Albert envisions the next recession. In a nutshell, it will be right out of Dante’s inferno:

In the next recession, as the secular forces of the Ice Age thesis combine with the cyclical chaos of another deep GFC-like event, I would expect the S&P 12m forward PE to collapse from a QE inflated 16½x currently to around a 7x trough eps – while forward earnings fall something like 40% to $100/sh, just as they did in the last recession. Add in the impact of a loss of confidence in the Fed (just as there was a loss of confidence in the BoJ and MoF in Japan), and there is a realistic prospect of a decline below the March 2009 666 low. And with that I must stop.

It took about 20 years but Albert Edwards was eventually proven correct in his bond forecast. For the sake of civilization, one can only hope that his equity forecast is wrong.

via ZeroHedge News https://ift.tt/2UyuY4f Tyler Durden