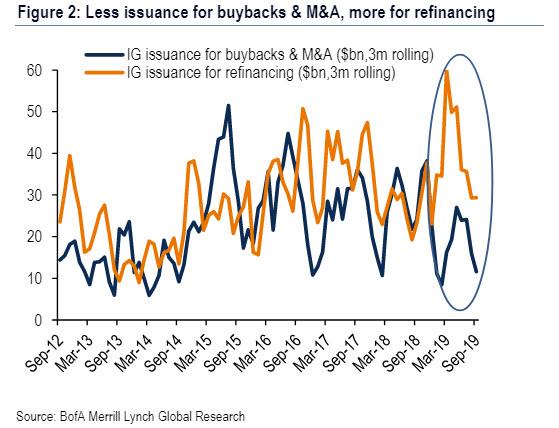

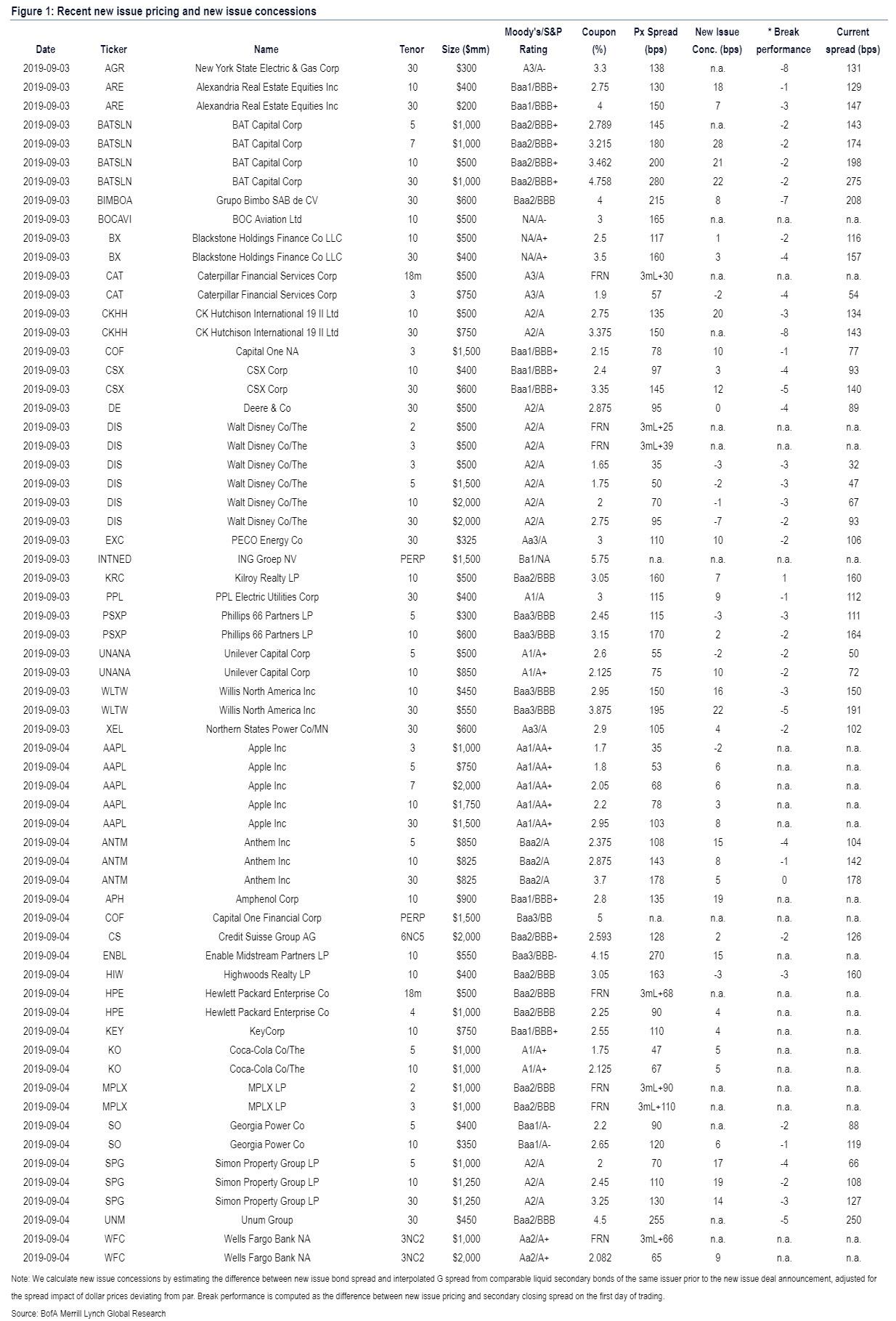

Yesterday, we first reported that as I-bankers and corporate treasurers returned from vacation only to find record low bond yields, there was a veritable stampede to the corporate bond market, as a record 20 issuers sold over $26 billion in “cheap debt” on the first business day of September. The motive behind this scramble to access the market: according to BofA, it wasn’t to add incremental leverage, such as prefunding buybacks or M&A, but rather to refinance existing debt into cheaper coupons and longer maturities.

Whetever the reason, after yesterday’s whopper of a new issuance day, on Wednesday new investment grade issuance accelerated even more, rising to $28.8bn across 15 deals today, bringing the total for the two days of the week to a whopping $54.3 billion, as refinancing trades continued to dominate with $21.1bn of today’s issuance partially towards commercial paper, credit revolver, term loan, short and long-term debt repayments, according to BofA’s Hans Mikkelsen.

Furthermore, as we pointed out late on Wednesday, one company that will not be refinancing but certainly prefunding more buybacks…

Apple to sell $7 BN in bonds so it can buyback $7 BN in stock

— zerohedge (@zerohedge) September 4, 2019

… was Apple, which surprised the market by issuing $7 billion in a 5-part deal including a 30Y tranche, despite being the most cash rich company in the country, and no longer having its offshore cash inaccessible for domestic purposes following Trump’s tax reform.

Furthermore, as BofA notes, following two very busy days in the new issue market, dealer inventories rose by about $1.5bn on Thursday as buyer indigestion set in. And in line with this, one reason for today’s blow out in Treasury yields could well be delayed rate locks, as dealers scramble to hedge rate risk by shorting tens of billions in matched maturity Treasuries in line with this week’s bond avalanche.

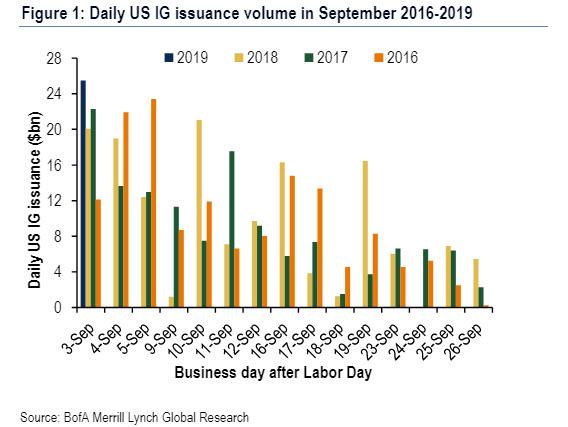

Will the bond flood slow? If prior September seasonals are indication, after a deluge of new paper in the first 2-3 days of the month, the remainder of September should resort back to normal.

via ZeroHedge News https://ift.tt/32zLHqL Tyler Durden