Back in July, following the John Williams communications debacle in which the controversial NY Fed president made a huge mistake hinting at a 50bps rate cut, the Fed scrambled to advise the investing public that it had no intention of cutting that much. Back then it used the WSJ to convey its message.

Fast forward to today, when the WSJ’s new Fed whisperer Nick Timiraos – now that Jon Hilsenrath was moved on to WSJ Pro – doubled down and spelled out exactly what is coming at 2pm on Sept 18 when this month’s FOMC meeting concludesl, to wit: “officials are gearing up to reduce interest rates at their next policy meeting in two weeks, most likely by a quarter-percentage point, as the trade war between the U.S. and China darkens the global economic outlook.”

The reason for the trial balloon – the make it clear to investors that those doves pushing for a 50bps cut such as Kashkari and Bullard, have failed to convince the majority of FOMC voters and as a result “the idea of an aggressive half-point cut to battle the slowdown hasn’t gained much support inside the central bank.”

Perhaps having learned from his unprecedented July mistake, even NY Fed president John Williams on Wednesday admitted that “the economy is in a good place, but not without risk and uncertainty,” adding that “our role is to navigate a complex and at times ambiguous outlook to keep the economy growing and strong.”

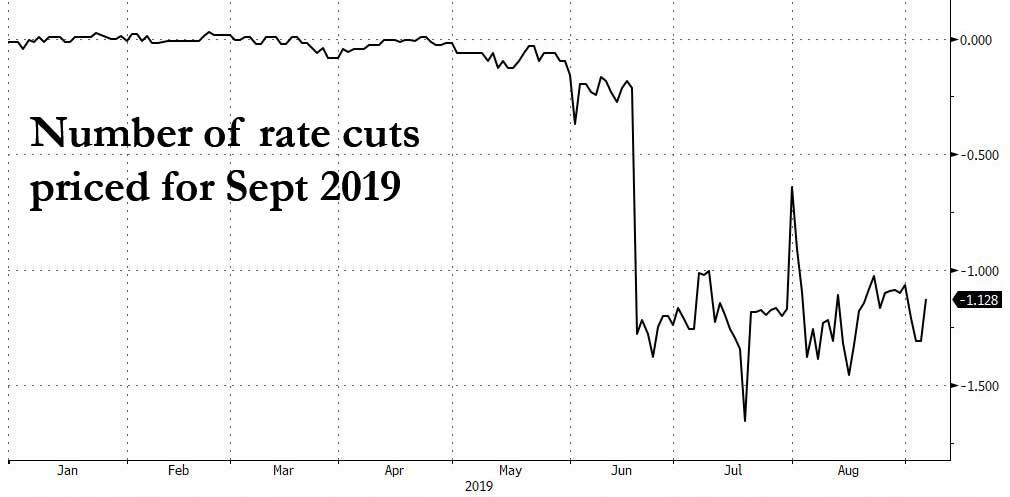

Arguably one reason for today’s WSJ article is that while markets already expect the Fed to cut interest rates by at least 25bps at the Sept. 17-18 policy meeting – as investors place an 87% probability of a quarter-percentage-point rate cut – the concern is that markets are pricing in a total of 1.12 rate cuts in two weeks, suggesting a 13% probability of a larger, half-point cut, according to Bloomberg data. It is the risk of disappointing the doves here that is what the Fed wants to intercept, especially since Williams didn’t push back against those expectations in his speech. Increased uncertainty, he said, called for “vigilance and flexibility.”

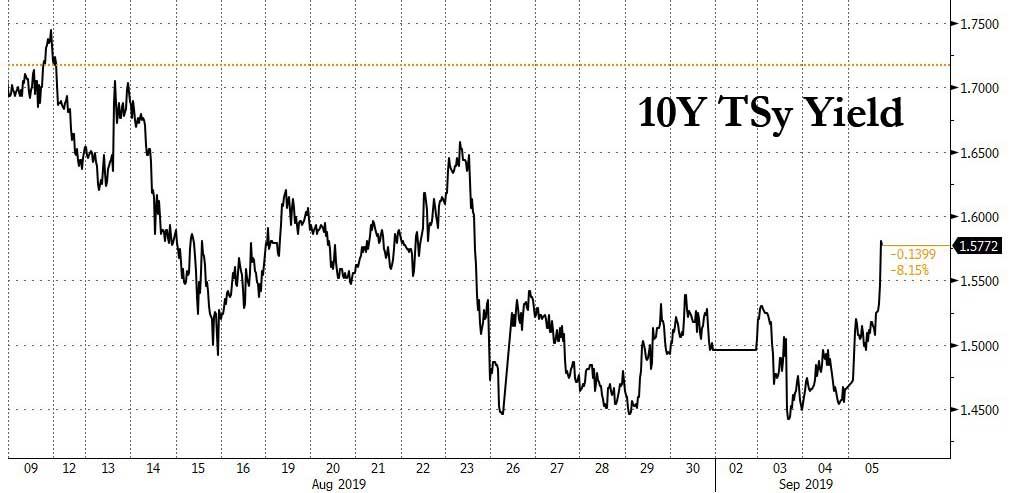

While the global growth and trade outlook has deteriorated since the July FOMC meeting, with U.S. government bond yields dropping sharply after President Trump’s decision to increase tariffs on Chinese imports last month, and Beijing’s response with retaliatory measures, prompting Mr. Trump to announce further increases in tariffs – the recent news that talks will resume in October have sent yields sharply higher, with the 10Y yield back to 1.58%, the highest level since August 23.

And after today’s far stronger than expected ADP private payrolls and ISM non-manufacturing report, markets now look ahead at tomorrow’s payrolls update, plus new readings on retail sales and inflation next week, all of which could reshape officials’ outlook. Fed Chairman Jerome Powell will also update the public on his outlook in a discussion Friday with the head of the Swiss National Bank.

And since US – if not German – economic data appears to be improving, most Fed officials have dismissed Bullard’s alarmism demanding for a 50bps rate cut, and instead have said the Fed shouldn’t overreact to market signals absent stronger evidence that weakness from the global economy or the manufacturing sector is spreading to the services sector or consumer spending. Judging by the strength of the US consumer – at least until the strong data is revised away – that evidence has yet to appear.

via ZeroHedge News https://ift.tt/2MXgDNE Tyler Durden