As SoftBank Urges WeWork To Shelve Its IPO, It’s Time To Think The Unthinkable

Once upon a time, SoftBank was best known for making happy slides, such as the one below, which showed a variety of multi-colored unicorns jumping into the stratosphere, to summarize it investing strategy.

Those days are gone, and instead they have been replaced with very stormy weather in community-adjusted EBITDAville.

And the weather is only getting worse, because one day after the WSJ reported that in the days after WeWork decided to slash the valuation of its IPO to as low as $20 billion – a whopping 60% off the last funding round which valued the company at $47 billion – the company was contemplating further trimming its valuation to below $20 billion, the FT reported late on Monday that SoftBank, the biggest outside investor in WeWork, is now urging the lossmaking office space lessor to shelve its (not so) hotly anticipated initial public offering after its disastrous reception from investors.

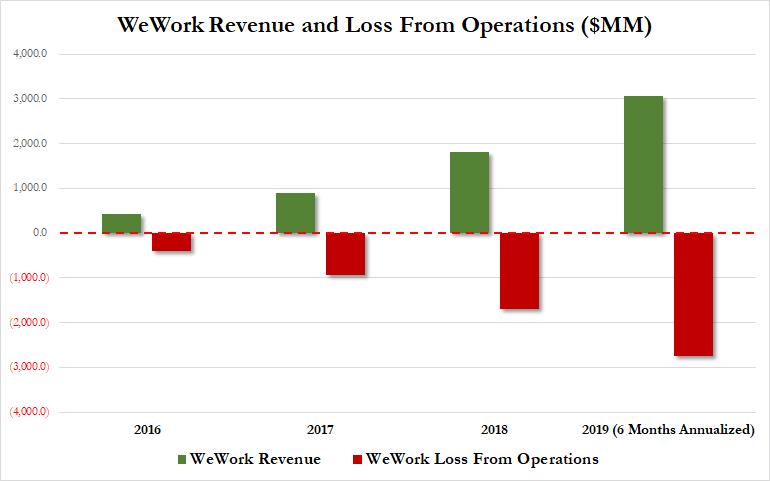

While WeWork’s parent company, the We Company, whose stated aspiration is to “elevate the world’s consciousness” was to raise between $3 and $4 billion in the IPO, it has faced an unexpected backlash from investors and analysts on Wall Street over its governance, payments made to co-founder and chief executive Adam Neumann and its use of a complicated corporate structure. Also, the fact that the company has seen its loss grow as fast as its revenue has hardly ispired confidence.

WeWork’s sponsor – Masayoshi Son’s SoftBank – is facing two key problems: the first is that together with its Saudi-backed Vision Fund, it has invested $10.4 billion into the office space provider. The issue is that at a the latest valuation that is being cited of around $15-$20 billion, the Japanese venture capital conglomerate would be hopelessly underwater (it invested $2 billion this year at a $47 billion valuation), which explains SoftBank’s waning enthusiasm for a listing. Softbank’s second major problem is that its other mega-investment, Uber, is also perilously underwater, at a cost of $7.7 billion, as the stock has tumbled almost 30% since its May 10 IPO.

And just to make matters worse, both investments are 50% levered (thanks to Saudi money yielding 8%), which means that as Ian Sigalow noted, “they are going to need an incredible deal to dig out of that hole.”

Only that deal is not going to be selling the stock to greater fools in the open market as apparently such concepts as “community-adjusted” EBITDA no longer make an impression on the investing public. This is a problem, as Harris Kupperman vividly explained earlier:

Ever since this transaction was disclosed, I’ve seen people attack the absurdity of it all. In fact, I saw so much coverage that I felt that I’d let this one pass—what else did I have to add? Then they failed to find buyers for the IPO. The valuation started a few months ago at $65b, then $50b, then $40b (…still no one?), $30b (…uhh guys, think of the kegerators?), $25b (does anyone care at roughly half of what SoftBank paid?), now $20b is looking like a long-shot.

It’s like one of those charity date-auctions in college where no one wants the fat chick. The price keeps dropping and everyone is looking at each other, seeing who’ll step up. “At least it’s for a good cause, right?” Well, the WeWork IPO does nothing other than prop up a Masayoshi Scheme (which is just a sophisticated Ponzi Scheme). Letting WeWork fail would actually be the “good cause.” It would stop innocent retail investors from getting hosed—while the scam artists take the beating for a change.

It gets worse. If WeWork does follow the advice of its equity sponsor, it may soon find itself in a liquidity crisis as it will also lose access to a $6 billion loan from a group of banks, including JPMorgan Chase and Goldman Sachs, that was contingent on the IPO raising at least $3bn in new investment.

The sudden loss of more than $9 billion in new capital which had already been factored into the company’s growth trajectory, would force a dramatic change in the We Company’s corporate strategy according to the FT; it would also crippled its aggressive expansion strategy that has seen it open 528 locations in more than 110 cities.

And considering the company’s gargantuan cash burn – by the end of 2019 the company will have burned through $6 billion since 2016 – it might, as some have speculated, even lead to the company’s bankruptcy, which brings up even more pertinent questions: what happens to the US commercial real estate sector?

What happens to the US CRE market when We files for bankruptcy

— zerohedge (@zerohedge) September 8, 2019

Here is the problem: while the collapse and/or bankruptcy of WeWork would hardly lead to a personal finance disaster – SoftBank’s Masayoshi Son is already Japan’s richest man and with a net worth of over $20 billion could easily stomach losing $10 billion on WeWork – it would send shockwaves across US commercial real estate, as the company is already the single biggest tenant in New York City, as well as Chicago, Denver and central London.

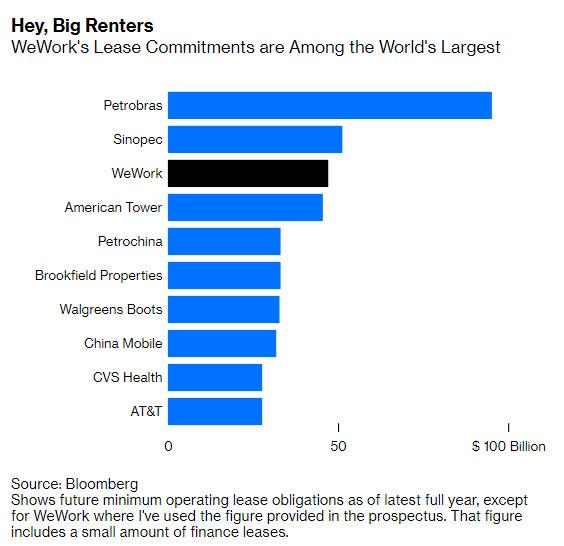

In fact, with over $47 billion in lease liabilities, WeWork is already one of the world’s largest lessees, trailing only oil exploration giants Petrobras and Sinpec, an astonishing feat for the flexible office space provider “which was founded less than a decade ago, bleeds cash, and doesn’t plan to become profitable any time soon.”

As Bloomberg recently noted, “anyone weighing whether to buy shares in WeWork’s IPO cannot ignore the fact that the company will have to find $47 billion from somewhere in coming years to meet its contractual obligations – including about $10 billion in just the next five years. Right now, its own very negative cash flows won’t cut it.”

Of course, in a bankruptcy, all those obligations would be frozen and squeezed among all the other pre-petition claims, which of course means that the commercial real estate market of cities where WeWork is especially active – like New York and London – would suddenly find itself paralyzed, as a deflationary tsunami is unleashed among one of the strongest performing markets since the financial crisis.

Whether that will in fact happen remains to be seen: after all, with so much hanging on whether the WeWork lunacy can continue, one – the CEO for example – could argue that the company is too big to fail; it also remains to be seen if WeWork’s CEO Adam Neumann also trademarked the word “bankruptcy”, which he may capitalize on very soon. As is well-known by know, Neumann infamously received a $5.9 million payment from the company for his rights to the trademarked word “we.” He has since returned the money, but for his company which went from a $47 billion CRE juggernaut to the laughing stock of the bursting IPO bubble, and which at the current rate it is burning cash will be bankrupt very soon, Neumann’s act of “charity” was too little too late.

Tyler Durden

Mon, 09/09/2019 – 19:55

via ZeroHedge News https://ift.tt/2QbmW2S Tyler Durden