If Michael Burry Is Right, Here Is How To Trade The Coming Index Fund Disaster

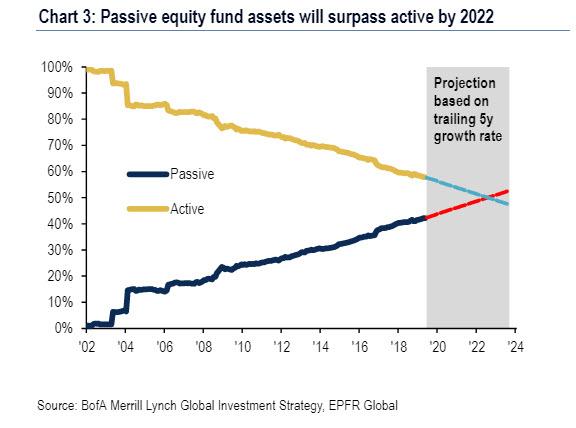

Last week, the Big Short’s Michael Burry sparked a fresh wave of outrage among the Gen-Z and algo traders (if not so much the handful of humans who have actually witnessed a bear market) on Wall Street, by calling the darling of modern capital markets – passive, or index/ETF, investing – the next CDO bubble. Echoing what many skeptics before him have said, Burry argued that record passive inflows, coupled with active fund outflows which suggest passive equity funds will surpass active by 2022 according to BofA…

… are distorting prices for stocks and bonds in much the same way that CDOs did for subprime mortgages. Eventually, the flows will reverse at some point, and when they do, “it will be ugly.”

“Like most bubbles, the longer it goes on, the worse the crash will be,” Burry told Bloomberg.

This nascent passive bubble is also why Burry had avoided large caps and was focusing entirely on small-cap value stocks: to Burry, they tend to be underrepresented in index funds, or left out entirely, which is why they are i) cheap and also why ii) when the passive bubble bursts, they will be the few names left standing.

To be sure, Burry’s strategy is hardly new: we first profiled that exact threat in April 2017, when we quoted One River’s Eric Peters who warned to “expect enormous losses in the next correction”… as “there is no such thing as price discovery in index investing”… either on the upside, or on the downside, and as a result “the stocks that have been blindly bought on the way up will be blindly sold.” He continued:

“When these markets do finally have a correction there will be no bid for many of these stocks…. “The people who are indexing now are the same ones who were selling in 2009,”

“I just spoke at a conference filled for wealth advisors from all the major players. They say the same thing – today’s buyers are not long-term investors.” They’re guys who put $1mm into index ETFs.

His dire conclusion preceded Burry’s by more than 2 years:

“I don’t know when the next major crisis will hit, no one does,” admitted VICE. “But I do know that even in the next normal correction, the market’s losses will be amplified enormously by this move away from active management.”

At roughly the same time, we also reported that “the world’s most bearish hedge fund”, Russell Clark’s Horseman Capital had revealed a new “investing” strategy using ETF flows as a catalyst for positioning and bets.

Citing the transition from active to passive as a catalyst that makes markets increasingly more inefficient, Clark lamented that there “are complaints from some quarters about it being harder to short sell as flows of money push up stocks.” So what is his new shorting philosophy? This is how he explained it, using his biggest short at the moment, retail REITs:

The biggest short sector in the fund are REITs. In the US, they are mainly retail REITs, and there are two reasons for this. One is that we have guaranteed sellers in the Japanese US Reit fund. The other reason is the appalling performance of the major tenants. However, as an aside, I like them as a short area as they have the highest exposure to ETFs of any sector.

Bloomberg allows you to find the biggest ETFs and open ended funds which are invested in US Real Estate Sector. The top 28 funds have total assets of 187bn USD, of which 13.3bn USD invested in Simon Property Group, that is 24% of Simon’s market cap. However, Real Estate passive funds are not the only passive fund invested in Simon. When all passive funds weights are added together I get over 50% of Simon Property Group shareholders are passive. I wonder who will become the buyer if all these funds start to see redemptions if there are some problems in US commercial real estate?

His conclusion:

The long bull market in passive investment has made them wilfully blind to the liquidity risk that they are running. Passive investments are concentrated in the US market…

And if Eric Peters is right, “when these markets do finally have a correction there will be no bid for many of these stocks”, so all Clark has done is tighten the universe of ETF unwinds from the entire market to a market sector or subset of stocks, in this case the retail REIT space.

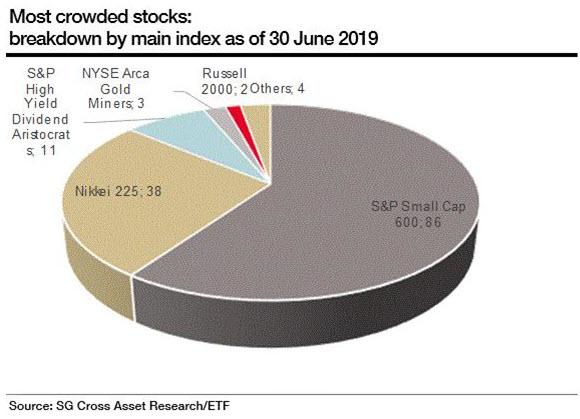

Fast forward to today, when this idea of selectively trading ETFs received a much needed refurbishment courtesy of SocGen’s Andrew Lapthorne, who writes that the French bank’s ETF Research team – which monitors ETF stock ownership and the potential for overcrowding – looked at overcrowding in Bond ETFs and more recently updated their analysis of overcrowding in equity ETFs.

According to the SocGen observations, the greatest risk of crowding in ETFs is with non-market cap weighting schemes (i.e. Nikkei 225) and where there is significant liquidity in the ETF relative to the underlying (US Smallcaps and Gold ETF are two areas they highlight). However “despite getting the usual pushback from ETF providers on this topic” on the whole the bank does not see significant overcrowding risk, although we will let readers look at the chart below and make their own conclusions.

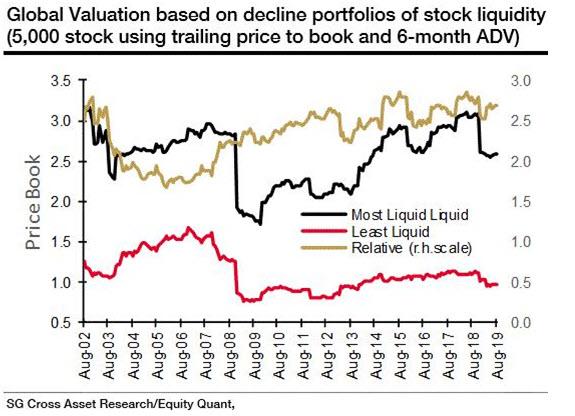

Meanwhile, as Lapthorne adds, the more interesting point of Michael Burry’s comments related to cheapness in smaller, less liquid stocks that were less likely to be included in a passive index. The SocGen strategist reminds readers that he highlighted in July “that there is an ever increasing cohort of cheap but small global stocks, but we also know from experience that whenever we create systematic equity strategies we leave significant “alpha” on the table through an inability to easily trade these names.” Of course, to Burry this misplaced alpha – the result of a liquidity mirage – is precisely the reason why one should be buying these stocks, if perhaps not so much for the upside, as much as the lack of downside once the next correction hits and all ETF constituents are liquidated at the same time as the bath water.

The result is visualized in the chart below which creates portfolios of roughly 500 names, based on a decile ranking of their average daily traded volume over the prior 6 months. As Lapthorne concludes, “the liquid portfolio performance has been easily outstripping the illiquid over the last couple of years and there is a clear valuation discrepancy.” The bottom line: “for those with genuinely patient capital, globally illiquid small caps are increasingly an interesting fishing ground.”

As a reminder, the reason why the world remembers the name of Burry is not so much his insight into the last financial crisis – many others had also warned about the coming Global Financial Crisis – it was his ability to remain patient in the face of client redemption demands as his thesis was bleeding to death, only to be validated overnight.

For now, the real question is which contrarian will have a similar patience this time around? While our money is on Horseman, the fund’s AUM is starting to drop to existentially dangerous levels as we observed just two weeks ago. It will be painfully ironic if when the market finally does crash there are no shorts left to finally profit.

Tyler Durden

Mon, 09/09/2019 – 11:50

via ZeroHedge News https://ift.tt/2PUUYrF Tyler Durden