Platts: 6 Commodity Charts To Watch This Week

Via S&P Platts’ “The Barrel” blog,

Globalization of natural gas markets, OPEC’s struggle to balance oil supply and price, and platinum coming to the fore as an investment vehicle are all covered in this week’s selection of essential charts from S&P Global Platts editors.

1. Global gas price differentials keep tightening…

What’s happening? Gas spot prices across regions have converged in recent weeks due to the continued gas glut in an increasingly globalized gas market, with surplus LNG cargoes struggling to find homes amid subdued demand in Asia. With limited European storage demand, coal-to-gas switching in Europe maximized and the global LNG surplus growing all the time, prices are now within a small $2/MMBtu range.

What’s next? With more US LNG set to come online over the next 12 months, the global gas glut could become even more severe, with a likely continuation of the gas price convergence into 2021 unless there is a significant supply disruption of some kind. And even then, prices could move together rather than diverge given the interconnected nature of the gas markets.

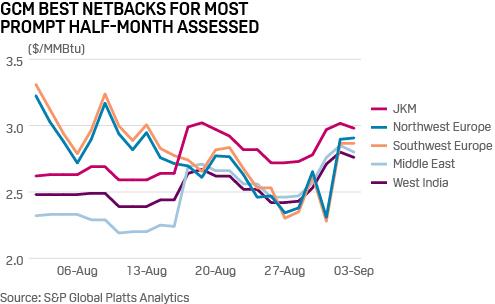

2. …and US LNG export economics start to favor Europe over Asia.

What’s happening? For prompt US Gulf Coast-loading spot LNG cargoes, price signals from Northeast Asia, represented by the Platts JKM, overtook those from Southwest Europe last month, as represented by the Platts SWE marker. US Gulf Coast netback price calculations take into consideration the cost of shipping to destination markets. In recent days, the trend has started to flip, favoring Europe.

What’s next? With six major US terminals now operating – four on the Gulf Coast and two on the East Coast – offtakers will be looking for the best bang for their buck heading into the fall and winter.

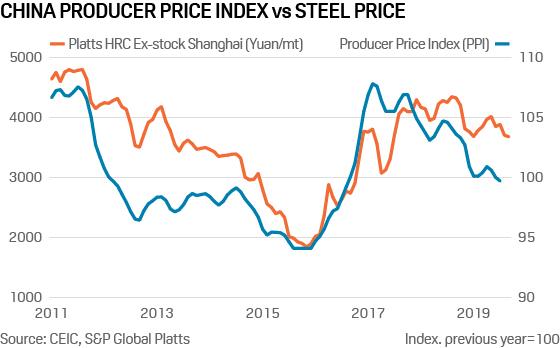

3. China steel prices suggest squeeze on manufacturers’ profits

What’s happening? Look out for the release of China’s producer price index (PPI) on Tuesday. In August, factory prices compared to the previous year fell for the first time in three years last month due to weaker domestic and export demand as a result of a slowing economy and no sign of respite in the ongoing trade tensions with the United States. Steel prices have historically been a good leading indicator and proxy for producer price inflation. If the past if any guide to the future, PPI data could show a further decline in August which is likely to be harbinger of weakening corporate profitability going forward.

What’s next? The Chinese government is determined to avoid the long term risk to the economy of excess credit. That means it’s unlikely we will see a major stimulus to boost demand. However, a modest credit injection in the coming months to offset the impact of weaker external demand, supporting domestic consumption and stabilizing factory gate prices, is a possibility.

Go deeper – China downstream steel segment outlook

4. OPEC struggles to lift oil prices despite cuts discipline

What’s happening? OPEC crude oil production edged up higher in August to 29.93 million b/d but is still 2.34 million b/d lower year on year. The cuts, along with US sanctions on OPEC members Iran and Venezuela, have contributed to tightening supplies, particularly of heavier and sour crudes. But the bloc is still struggling to move oil prices higher, with the market wary of a global economic slowdown.

What’s next? Several key OPEC members and their allies, including Russia, will gather Thursday in Abu Dhabi for a Joint Ministerial Monitoring Committee meeting, where traders will be watching closely for signals on potentially deeper cuts. OPEC, Russia and nine other oil producing countries are in the midst of a 1.2 million b/d in production curb agreement that runs through March 2020.

5. Platinum prices surge as investors look to new safe haven

What’s happening? Platinum has received a boost in recent weeks from the surge in gold prices, with spot bids around $940/oz on September 6. Negative interest rates have bolstered demand for gold and pushed prices sky-high in the process, driving investors towards platinum. In the first half of 2019, investment demand in platinum amounted to 855,000 oz, driven by a surge in exchange traded fund (ETF) holdings, which gained 720,000 oz, the World Platinum Investment Council said last week. That interest comes on top of a market that is much tighter than it was six months ago.

What’s next? Platinum’s fortunes may be closely tied to the outlook for palladium, which faces glaring deficits. In a 10 million oz palladium market, there was an 800,000 oz shortfall this year, and more than a 1 million oz potentially expected next year, according to WPIC. The metal is currently trading at more than $1500/oz The organization believes platinum will be considered as a serious substitute for palladium in ICE vehicles. That could mean there is potential for platinum prices to be pulled upwards.

6. German clean energy targets at risk as wind projects stall

What’s happening? German wind capacity additions have plunged after a record 20 GW was added over the past four years. Onshore wind is at a standstill with 10 GW of projects stuck in the permitting process due to aviation, military or ecological planning restrictions. Local opposition is growing in some regions, while coastal areas are already saturated causing grid bottlenecks.

What’s next? Germany targets a 65% share of renewables in the power mix by 2030 as coal is slowly phased out. Current growth trajectories lag behind that target, with market actors in crisis talks with the government ahead of climate policy decisions September 20. These could see offshore wind targets boosted, planning restrictions eased and the 52 GW solar ceiling cancelled.

Tyler Durden

Mon, 09/09/2019 – 10:35

via ZeroHedge News https://ift.tt/2PY6NxD Tyler Durden