Remember, Remember, Last September

Authored by Sven Henrich via NorthmanTrader.com,

Replay

Are markets setting up for a replay of last fall or we just drifting higher on hopium and coming successful central bank intervention?

I remember last September very well. All our technical charts were screaming sell, yet markets kept levitating higher. Everybody was screaming bullish, GDP growth was rising, companies were showering buybacks on the market and analysts were shouting over each other calling for ever higher price targets. Index price targets, stock price targets. $DJIA went on to make a new all time high on October 2nd following the $SPX highs in September of 2018:

Positioning for the fade was difficult, volatility was non existent and people voicing bearish opinions were viewed as absolute morons. I had written Lying Highs on September 2nd and my analysis looked dead wrong.

Yet it turned out to be the best selling opportunity since 2011. We all know what happened after that:

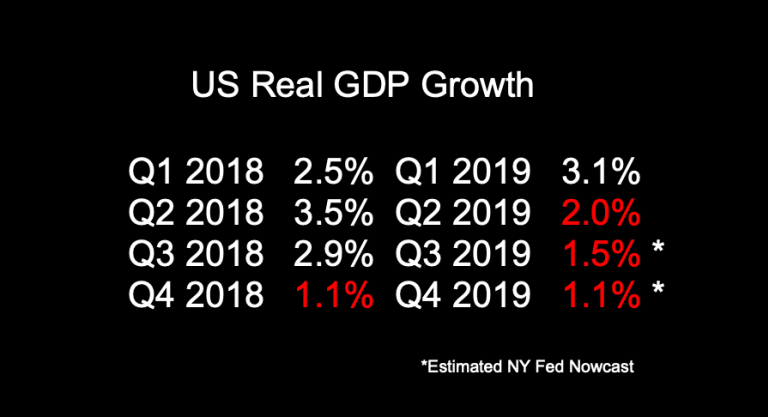

Why am I mentioning all this? Because here we go again in September and markets are drifting higher ironically from the same base as last year. 2900. We haven’t gone anywhere in a year, yet things are objectively worse than last year.

Growth is worse, earnings growth is worse, buyback growth is shrinking, as is capex and employment growth. What is different? Central banks of course and that is again the curveball that makes any bear feel stupid as nothing matters when central banks are in charge and to me it remains the biggest risk to the bear case.

Intellectually I can rage against the insanity of it all, but that won’t change market direction. Yes I can argue the ECB cutting rates this week and relaunching QE only 9 months after ending is pathetic, but nevertheless they are going to do it anyways no matter the consequences or the efficacy of it all.

And then the Fed doing the same rate cutting gig no matter how wrong they were last year forecasting 2019. And bulls totally wrong about 2018 on equities and totally wrong on yields and growth for 2019 get to get bailed out again and look right.

And so yes, I get it, there is a building sense that bears are running out of time here. After all they’ve had every excuse to make something happen in August beyond a 4% pullback.

That’s how weak bears are, or rather that’s how the strong the pull toward central bank meetings is. Central banks remain in full control despite all their mistakes. They keep being wrong yet face no consequences by markets, after all bad news doesn’t matter all, we’re back to within 1.5% of all time highs. One more magic headline and we’re at new highs. Who cares about earnings or growth or valuations. None of it matters is the impression one is left with.

And I get the argument that bears may be running out of time.

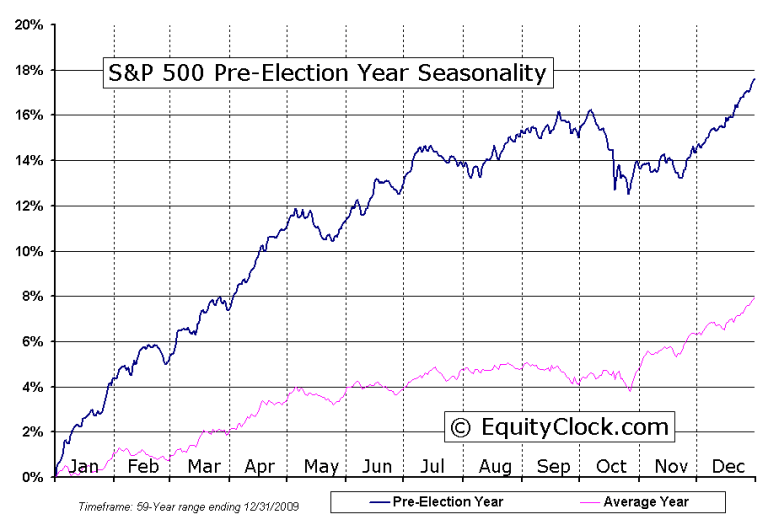

For one, the 2019 market keeps running on that pre-election year seasonal chart we discussed in The Bull Case:

Ironically that chart also says to sell strength in September/October for another larger pullback into October/November and then buy that for that big year end rally.

And be clear most years are like this. Last December was a rare fluke. Only happened once before in 2000. All other years have seasonal strength into year end. The question is from where and when.

And so here we are again signals and warning signs are being ignored and markets levitate higher, indeed you can get a glimpse of this debate in my discussion on CNBC this morning:

My crooked tie aside (we were fiddling with mic placement just before I got on air is my excuse and I’m sticking with it 😉 I found the discussion insightful as it’s perhaps reflective of sentiment.

A couple of points I couldn’t make on air: “if you’ve been short for the past 300 handles how much more convincing do you need”? The segment ended there so I couldn’t respond but my response is that this is a bit of red herring, sorry Jeff. I don’t know anybody that’s been short for 300 handles, not sure that’s even possible, but I would point out that’s not an analytical point predictive of future market direction. It’s a hypothetical at best.

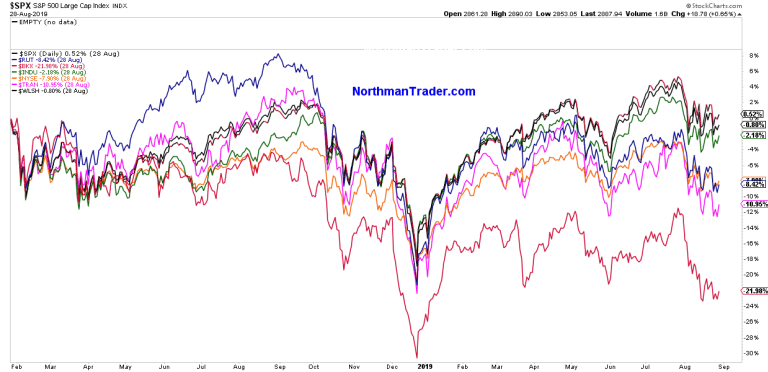

Perhaps there is a running myth that people critical of markets are always holding short from much lower and hence they are made to look wrong. We view positioning as a flexible exercise long or short depending on the set-up, but let’s face it, these markets haven’t gone anywhere on a broader basis since January 2018:

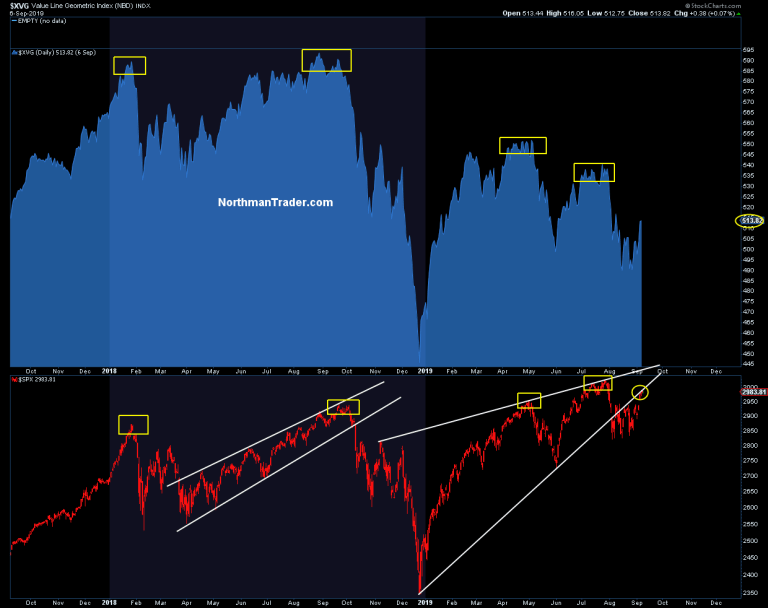

So I could make the corollary argument (also not predictive of future direction) and say that if you’ve held long small caps, banks and transports since January 2018 how much more convincing do you need as you’re down significantly on these? Which of course is the point I tried to highlight in the segment with $XVG:

The broader market is not participating and rallies keep being drive by flows going into large cap stops via buybacks and passive allocations.

But Jeff is right, the ECB going full Super Mario this week could certainly be a trigger that pushes $SPX above 3,000 and that’s also reflective of the Measured Move we discussed. All possible.

But I don’t know where Jeff sees ‘booming’ growth, I get that this may be the impression he has from meetings, but the data shows differently for now. This is not booming growth:

So I get it and I agree with Brian Sullivan, you can moan about central banks all you want, but that doesn’t make you money and hence flexibility remains the name of the game.

From my perch nothing is proven, either from the bear or bull side. Yes you may point to this year’s year to date gain, but know of course it was mainly driven by the vast oversold readings in December of 2018 and has been a free money carrot since then, not a growth expansion story.

These next 2 weeks will be of great interest. Can markets break out in earnest based on central bank intervention or will they get disappointed or again move toward new highs that won’t be sustained?

We keep analyzing structures and technical patterns and, for now, these suggest that bears still have sizable potential room to play in 2019 as signals are once again ignored and hopium is the primary price discovery mechanism of this market. I can’t say that this will not be enough, it may well be, but watch out if it isn’t.

For there to be confidence in new highs we would need to see the market to broaden out. Otherwise, new highs remain selling opportunities as they have been for the past 18 months. Note also the recent 2019 trend break on $SPX. Bulls need to repair that technical break and start showing rallies based on fundamental improvement as opposed to intervention hopium alone.

Bottomline: Investors are reliant on hope that central bank efficacy remains control over the market construct and that a trade deal will reflate investment growth and at risk that disappointment on these fronts can lead to larger sell-offs.

And as long as markets are reliant on hopium versus fundamental driven growth markets are at risk of a replay of last year as technical signals currently do not confirm or support the sustainability of any new highs should they come about as a result of central bank intervention.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Mon, 09/09/2019 – 13:30

via ZeroHedge News https://ift.tt/2UIRTtC Tyler Durden