Russia, China Continue “Massive Substitution” Of Dollar Assets By Gold

“I think it’s clear to everyone now” exclaimed Russian President Vladimir Putin, (and French President Macron recently said so publicly), “that the leading role of the West is ending. I cannot imagine an effective international organization without [Russia], India and China.”

And while most politicians are all talk, in the case of both Russia and China, their actions speak louder than their words.

China‘s foreign exchange reserves jumped to $3.1072 trillion despite the falling yuan and escalating trade war with the US, while raising its gold holdings by nearly 2.89 million troy ounces (99 tons) in nine months. That’s nearly five percent more since the end of last year.

Source: Bloomberg

As Bloomberg reports, that buying spree likely to persist in the coming years, according to Australia & New Zealand Banking Group Ltd.

Trade war restrictions, in the case of China, or sanctions, as with Russia, give “an incentive for these central banks to diversify,” John Sharma, an economist at National Australia Bank Ltd., said in an email.

“Also, with increasing political and economic uncertainty prevailing, gold provides an ideal hedge, and will therefore be sought after by central banks globally.”

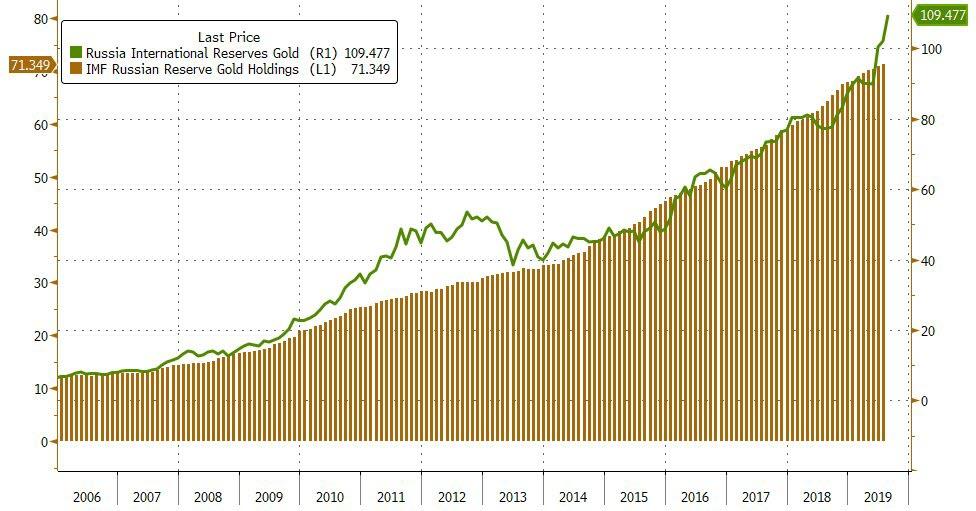

But China is not alone. Figures released by the Central Bank of Russia (CBR) on Friday show Russia’s gold bullion holdings have reached $109.5 billion as the nation continues to shift its growing international reserves away from the US dollar.

As Bloomberg reports, Russia’s central bank has been the largest buyer of gold in the past few years…

Source: Bloomberg

“Russia prefers to cushion its macroeconomic stability through politically neutral tools,” said Vladimir Miklashevsky, a strategist at Danske Bank A/S in Helsinki.

“There is a massive substitution of U.S. dollar assets by gold – a strategy which has earned billions of dollars for the Bank of Russia just within several months.”

In fact, globally, the trend is clear…

Source: Bloomberg

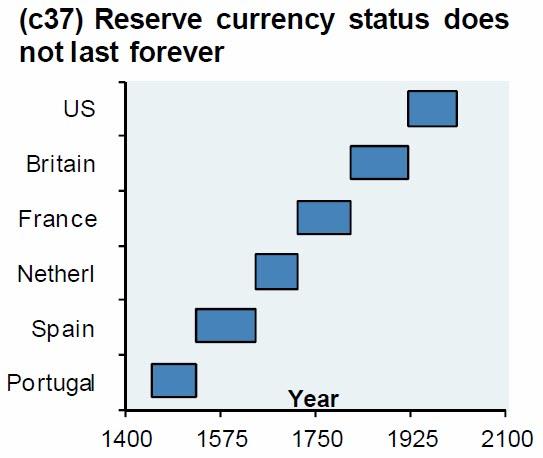

Remember, nothing lasts forever…

Tyler Durden

Mon, 09/09/2019 – 12:30

via ZeroHedge News https://ift.tt/2Q2dDC3 Tyler Durden