US Futures Drift Higher On Chinese Invitation To Bagholders, Trade And Central Bank Optimism

There wasn’t the usual trade talk optimism overnight, nor central bank trial balloons that record low interest rates will be dragged even deeper into negative territory.

Instead, what helped send European equity markets and US equity futures back in the green after an overnight slump that pushed the Emini from 2,985 to 2,965, was news that China removed one more hurdle for foreign investment into its capital markets almost 20 years after it first allowed access, when Beijing scrapped quotas for approved foreign institutional investors in domestic bond and equity markets. This means that all those WeWork bagholders who may have lost a majority of their investments, can no go ahead and lose the other have by investing in China, where the auditors have a habit of “community adjusting” everything.

In any case, the news helped send the Emini back in the green from overnight session lows just after the European open..

… with global markets back to unchanged.

Meanwhile, what we said about no central bank trial balloons, well we were kidding, because just after 7am, Reuters leaked that the BOJ “may be open to debate additional easing”, because apparently the existing easing has worked so well. According to the report, the BOJ is considering taking rates further into negative territory if it decides to ease, but other options – such as tiering – also remain on the table, Reuters reports, citing unidentified people familiar. The BOJ’s decision on whether and when to ease is expected to be a close call; conclusion may not be final until the last minute which will be just after the Fed’s own rate cut announcement. Ultimately, the BOJ’s thinking is driven by the bank’s growing less confident about early pickup in global growth

Actually, it turns out that we were also kidding about the lack of trade optimism: according to Bloomberg, China’s Premier Li said that US and China should find a solution to the ongoing trade dispute, adding that he hopes (there’s that word again) that trade talks make progress. In response there was an immediate “risk on” move as European equity indices spiked higher as a result of these headlines with the DAX Sep’ 19 futures spiking higher to 12,265 from 12,235, while the crude complex and USD/JPY also saw positive ticks. That said, the sharp move higher in US equities was less pronounced and quickly faded.

The Stoxx Europe 600 Index dropped a second day, led by financial services and health-care shares, although it rebounded following the China Li and BOJ more easing news. The pound fluctuated as embattled British Prime Minister Boris Johnson insisted he won’t ask for another Brexit delay, while U.K. wage and unemployment data beat estimates. Most euro-zone sovereign bonds nudged lower as European Central Bank officials prepare to meet.

Earlier in the session, Asian stocks fluctuated, with energy producers advancing and health-care firms retreating. Markets in the region were mixed as investors assessed the global growth outlook and China-U.S. trade negotiations with South Korea up and Thailand down. The Topix climbed 0.4%, as Japanese banks contributed most to gains following a rebound in long-term U.S. Treasury yields, which in turn pushed JGB yields modestly higher as well. The Shanghai Composite Index edged down 0.1%, snapping a six-day rising streak, with Kweichow Moutai and Ping An Insurance Group among the biggest drags. The big news out of China, as noted above, is that global funds no longer need approvals to purchase quotas to buy Chinese stocks and bonds, the State Administration of Foreign Exchange said in a statement on Tuesday. It removed the $300 billion overall cap on overseas purchases of the assets, about two-thirds of which remain unused.

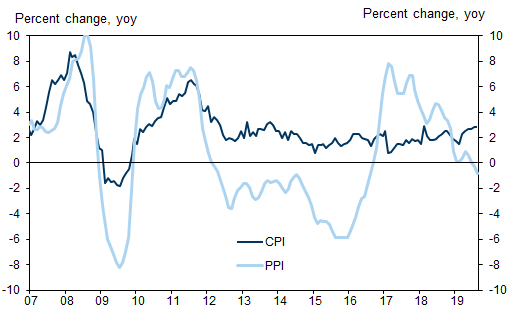

Also overnight, China reported that its headline CPI inflation was flat at 2.8% year-on-year in August, just above consensus expectations and close to the 3% policy target; in month-on-month terms, headline CPI inflation moderated to +2.9% in August from +3.5% in July. A bigger problem was the second consecutive print of negative year-over-year PPI inflation, which moderated further to -0.8% yoy in August, on both a high base (PPI up 3.6% mom s.a. ann in August 2018) and a sequential decline of 2.8% mom s.a. ann in August. Inflation in the ferrous metals sector slowed the most, followed by petroleum industry, suggesting corporate profits will be further depressed in coming months.

In emerging markets, a four-day rally in equities stalled and the risk premium on sovereign debt rose as investors marked time before the resumption of trade talks between China and the U.S. as well as central-bank meetings in coming days. Developing-nation stocks climbed almost 4% in the previous four days after China and the U.S. announced face-to-face negotiations aimed at ending the tariff war would be held in Washington next month. China, meantime, removed one more hurdle for foreign investment into its capital markets almost 20 years after it first allowed access, when it said Tuesday that global funds no longer need approvals to purchase quotas to buy Chinese stocks and bonds.

With the European Central Bank announcing its policy decision in Thursday and the Federal Reserve next up, investors are hoping on increased monetary stimulus to prop up markets. A gauge of emerging-market currencies gained for a fifth day, the longest streak since June, with South Africa’s rand leading the advance.

“Markets were oversold, rebounded and without any genuinely positive catalysts are faltering again,” said Julian Rimmer, a trader at Investec Bank in London. “Funds were clearly bearishly positioned over the summer with the salami slicing of global growth expectations, low volumes and the worldwide hunt for yield. Some of that negativity has diminished slightly so we had some short-covering and a bit more risk-on, but fundamentally nothing has changed and all those concerns are still apparent.”

In rates, European bond markets inched lower while the region’s stocks declined for a second day ahead of Thursday’s ECB policy announcement. Bear steepening resumed in the German curve although the long-end claws back some initial weakness to trade back at 0%. Peripheral spreads widened to core, with the long-end of the Spanish curve underperforming. Gilts drifted lower after robust domestic employment and wages data, but as ever, Brexit keeps any hawkish repricing in check.

The recent pullback in the bond rally “is a correction to an outsized move in yields during August, not a turn in the trend,” Kit Juckes, chief global FX strategist at Societe Generale SA, wrote in his daily note. “Last Friday’s U.S. labor market data show, clearly enough for me, that the U.S. economy is slowing slowly but steadily as the global trade slowdown infects it.”

In geopolitical news, North Korea launched 2 projectiles; a Japanese Defence Ministry official later commented that the latest North Korea missiles pose no immediate threat to Japan’s national security. Pakistani Foreign Minister has told UN Human Rights council that India’s “illegal Kashmir military occupation” raises spectre of “genocide”. Additionally, Pakistan’s Qureshi says that he sees ‘no possibility of a bilateral engagement with India’.

In FX, the Bloomberg Dollar Spot Index halted a five-day slide Tuesday as the yield on 10-year U.S. Treasuries fell 2bps, its first decline in five days. The only G-10 currency to climb against the dollar was the Swiss franc but moves were limited; meanwhile, the largest losses were seen by the Swedish krona, as the currency weakened by almost 1% to the dollar and the euro after Swedish inflation unexpectedly slowed to its lowest in three years, in more bad news for the Riksbank which is keen to increase interest rates. Finally, the Norwegian krone tumbled alongside its Swedish peer after similarly disappointing inflation reading.

Elsewhere, oil extended gains to the highest level in almost six weeks as Saudi Arabia’s new energy minister signaled his commitment to production cuts ahead of an OPEC+ meeting later this week. Gold headed for its fourth day of declines, sinking to around $1,495 an ounce. Sweden’s krona tumbled after the country’s inflation unexpectedly slowed.

Expected data include NFIB Small Business Optimism. HD Supply and Zscaler are reporting earnings

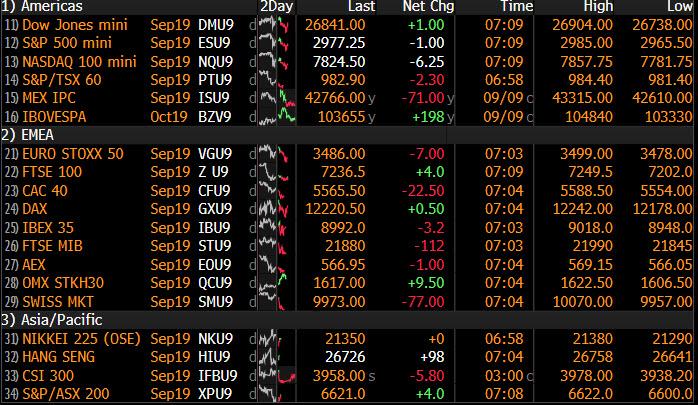

Market Snapshot

- S&P 500 futures down 0.1% to 2,973.75

- STOXX Europe 600 down 0.5% to 383.96

- MXAP down 0.01% to 156.79

- MXAPJ down 0.2% to 507.06

- Nikkei up 0.4% to 21,392.10

- Topix up 0.4% to 1,557.99

- Hang Seng Index up 0.01% to 26,683.68

- Shanghai Composite down 0.1% to 3,021.20

- Sensex up 0.4% to 37,145.45

- Australia S&P/ASX 200 down 0.5% to 6,614.06

- Kospi up 0.6% to 2,032.08

- Brent futures up 0.2% to $62.74/bbl

- Gold spot down 0.2% to $1,496.06

- U.S. Dollar Index up 0.1% to 98.41

- German 10Y yield rose 0.6 bps to -0.579%

- Euro down 0.05% to $1.1043

- Italian 10Y yield rose 6.6 bps to 0.603%

- Spanish 10Y yield rose 1.5 bps to 0.233%

Top Overnight News from Bloomberg

- After Parliament blocked his Brexit strategy, and then refused to give him the election he wanted, U.K. Prime Minister Boris Johnson is promising to work for a deal with the EU. Monday night saw him suffer his sixth consecutive defeat in a vote in the House of Commons, after his attempt to get approval for a snap poll was rejected for a second time

- The U.K. economy continued to create jobs over the summer and wages jumped, despite the escalating turmoil over Brexit. The jobless rate fell to the lowest since the 1970s but jitters weighing on the wider economy were appearing. Employment growth was weaker than forecast; vacancies slipped to the lowest since 2017

- Mario Draghi needs to go out with a bang if he’s to renew a surge in bond prices that sent yields to unprecedented lows. Markets have factored in the ECB slashing interest rates and restarting QE, so it will take a multi-faceted stimulus package in his penultimate meeting Thursday to impress investors

- Germany’s worship of fiscal discipline is being challenged by a looming recession and tantalizingly cheap credit — and a silent revolution is under way at the finance ministry to shed its economic dogma

- Executives of WeWork and its largest investor, SoftBank, are discussing whether to shelve plans for an initial public offering of the money-losing co-working company, said people with knowledge of the talks

- China removed one more hurdle for foreign investment into its capital markets almost 20 years after it first allowed access

Asian equity markets traded mixed as they followed suit to the indecisive tone seen on Wall St amid a sell-off in treasuries and as the region also digested ambiguous inflation figures from China. ASX 200 (-0.5%) was negative with gold miners frontrunning the declines in Australia after the precious metal slipped below the psychological key USD 1500/oz level but with further losses in the index stemmed by strength in the energy sector following the recent rally in oil prices, while Nikkei 225 (+0.4%) was kept afloat by favourable currency moves. Elsewhere, Hang Seng (Unch.) and Shanghai Comp. (-0.1%) gave back initial gains despite the liquidity efforts by the PBoC and firmer than expected Chinese inflation data, as the figures were largely influenced by a 10% increase in food prices amid the swine fever epidemic and also showed PPI at its sharpest contraction in 3 years. Finally, 10yr JGBs were lower following the bear-steepening seen in US and broad declines across global bonds, while the absence of the BoJ from the market today also added to the lacklustre demand.

Top Asian News

- North Korea Tests More Weapons After Floating Fresh U.S. Talks

- Hong Kong Leaders Grow More Frustrated by Leaderless Protesters

- Hong Kong Dollar Peg Questions Seen Fading One Way or Another

- Chinese Exporters Cut Currency Hedges in Sign of Yuan Pessimism

European equities are modestly softer [Eurostoxx 50 -0.3%] following on from a mixed Asia-Pac session as participants remain on standby ahead of Thursday’s ECB monetary policy decision. Sectors are mixed with underperformance in the IT sector, whilst energy names outperform as the oil complex holds onto its recent gains and banking names remain supported by yesterday’s surge in yields (RBS +4.4%, UBS +3.4%, Barclays +4.5%). In terms of stocks on the move, EDF (-7.5%) share fell from the open after the Co. noted deviations in technical standards governing the manufacture of nuclear-reactor components. On the flip side, Subsea 7 (+2.7%) shares opened higher after the Co. announced its current COO as the new CEO effective January 1st 2020, additionally the Co. were awarded an offshore contract in Saudi Arabia. Finally, JD Sports (+3%) shares are supported post earnings after H1 sales rose 47% Y/Y and the Co. forecasts FY results to be at the mid-point of their previously guided range.

Top European News

- EDF Flags Issues in Reactor Parts in Blow to Nuclear Industry

- Spanish Banks Risk Setback in Fight Over Unfair Mortgage Claims

- Germany Doesn’t Need to Splurge to Address Slowdown, Scholz Says

- Sweden Inflation Slows to 3-Year Low in Blow to Riksbank

In FX, the major underperformers in wake of softer than forecast Swedish and Norwegian inflation data that calls into question hawkish guidance from the Riksbank and Norges Bank. Eur/Sek has rebounded from sub-10.7000 levels through 10.7500 and breached several technical resistance points in the process, including 10 and 21 DMAs plus a Fib retracement, while Eur/Nok is back above 9.9000 from almost 9.8500 and also taking on board the latest Norges Bank regional network survey showing that contacts envisage slightly slower growth in the coming 6 months.

- USD – The Dollar is mixed to marginally firmer awaiting this week’s top-tier US data for more input ahead of the September FOMC after last Friday’s rather inconclusive BLS report and broadly upbeat comments from Fed chair Powell, on balance. However, the DXY remains rangebound between 98.260-463 and well within near term chart support and resistance not to mention recent highs and lows for the index.

- CHF/NZD/AUD – The Franc has pared some losses vs the Greenback and single currency as risk appetite wanes/falters and selling abates into key technical psychological markers, like 0.9950 in Usd/Chf and 1.1000 in Eur/Chf. Meanwhile, the Aussie and Kiwi have lost some momentum, with Aud/Usd drifting back towards 0.6850 in wake of a downturn in NAB business sentiment and dip in conditions overnight, and Nzd/Usd fading ahead of 0.6450 as Aud/Nzd meanders between 1.0645-85.

- GBP/CAD/JPY/EUR – Sterling staged another attempt to hunt out stops around 1.2385 vs the Buck and briefly crossed the 100 DMA against the Euro (0.8930), but failed to sustain momentum again amidst the ongoing UK political and Brexit paralysis. However, the ensuing Pound pull-back was arrested by more encouraging data as earnings beat consensus on a headline basis and the jobless rate eased to 3.8% from 3.9%. Note also, 2 bn option expiries in Cable at the 1.2300 strike have provided a buffer. Elsewhere, trade has been considerably more rangebound with the Loonie straddling 1.3175, Yen holding within 107.19-49 parameters and Euro stuck in a 1.1037-59 band awaiting Thursday’s ECB policy pronouncements for more direction.

- EM – Contrasting fortunes again for the Rand and Lira, as Usd/Zar continues its deep reversal from 15.0000+ towards 14.6900 regardless of more SA ratings warnings from Moody’s, but Usd/Try elevated above 5.7500 in the run up to this week’s CBRT rate verdict and heeding even more dovish calls (-500 bp touted in a Turkish paper) alongside the persistent threat of US sanctions.

In commodities, WTI and Brent futures are holding onto most of its recent gains with the two benchmarks around 58.00/bbl and 63/bbl respectively at the time of writing. News-flow for the complex has been light, although reports stated that Russia’s Energy Minister Novak will be meeting with newly appointed Saudi Energy Minister Abdulaziz in Jeddah later today to discuss the energy market alongside strengthening Saudi-Russia cooperation ahead of Thursday’s JMMC meeting. Meanwhile, Nigeria’s Finance Ministry notes of strong indications of an oil glut next year, and thus lowered its benchmark forecast to 55/bbl from 60/bbl. This evening will also see the release of EIA’s Short-Term Energy Outlook with focus on global demand growth forecasts. Looking further ahead, participants will also be eyeing the weekly API crude inventory data with markets expecting a headline drawdown of 2.5mln barrels. Elsewhere, gold prices are largely unchanged below the 1500/oz mark amid the undecisive risk tone in the market ahead of this week’s key events. Meanwhile, copper prices have seen a more pronounced downside compared to yesterday with the red-metal flirting with 2.60/lb to the downside at the time of writing. Finally, Dalian iron ore prices advanced as much as 4% amid expectations that China will ratify further economic stimulus that would boost steel demand.

US Event Calendar

- 6am: NFIB Small Business Optimism, est. 103.5, prior 104.7

- 10am: JOLTS Job Openings, est. 7,331, prior 7,348

DB’s Jim Reid concludes the overnight wrap

Every year in early September the financial world takes in a new breed of graduates and to you all I say welcome and good luck in your career. If you’d have started as a newbe last Thursday then the whole of your career would have been in a big bond bear market. You’d be excused for wondering if bonds ever actually rally. Indeed yesterday saw another fixed income sell-off, as reports on the German fiscal stance and positive comments on the US-China trade war supported investor sentiment. 10yr Bund yields rose +5.3bps, reaching their highest level in nearly a month at -0.59%, while 30y bunds rose +7.8bps but after spending much of the day in positive territory closed at -0.003%. Nearly but not quite. Lending to the German government out to 2049 will still involve a small haircut. For context the long run return on US equities has been around 9% p.a. over the last couple of hundred years and by my calculations that would mean you would earn 13 times your original investment over an average 30 year period through history. Even at the lower long run return for German equities of c.8% you would earn over 10 times your original investment over the same period. I’m not wildly excited about current equity valuations but this is food for thought for all you new graduates as you invest for your retirement. It’s too late for us but you can save yourselves.

The bond sell-off was global with 10y Treasuries up +7.7bps, BTPs up +6.7bps, and Gilts +8.5bps. Yield curves also steepened, with US 2s10s up +3.2bps to 4.9bps and to its highest level in three weeks. In credit, spreads widened in Europe, with Euro IG spreads +2.0bps and at a 7-week high, while Euro HY spreads were flat. In the US it was a different story as IG and HY spreads tightened further, down -1.3bps and -9bps respectively. Safe havens sold off across the board however, with gold down -0.53%, while the Swis Franc was the worst performing G10 currency, down -0.48% against the dollar, followed by the Japanese Yen (-0.32%).

The sell-off came as Reuters reported that Germany is considering creating a “shadow budget”, which would allow the government to get round the country’s fiscal rules. This would be done by setting up independent bodies, which could take advantage of the country’s low borrowing costs and invest in “infrastructure and climate protection”, but this spending would not count under the debt brake. Meanwhile, the euro strengthened after a letter obtained by Bloomberg News showed Bettina Hagedorn, a deputy finance minister, wrote that the government could change its plans to run balanced budgets if the economic situation required. The reports come ahead of this morning’s debate on the 2020 budget, which will be taking place in the Bundestag. These stories have become more frequent in recent weeks and whilst the market always gets more excited by the headlines than is justified by hard evidence of any change in policy, it’s fair to conclude that market pressure and chatter on this story is building.

Other drivers behind the bond sell-off included data which showed German exports unexpectedly rising by +0.7% (vs. -0.5% expected) in July, while imports fell by -1.5% (vs. -0.3% expected), sending the current account balance for July up to 22.1bn (vs. 16.4bn expected). So good news on exports even if declining imports might be demand led. Meanwhile comments from Secretary Mnuchin further helped things, as he said “we’ve made a lot of progress” in the trade talks, ahead of the planned meeting between China and the US in Washington next month. Ahead of Thursday’s much-anticipated ECB meeting, these positive developments seem to have marginally reduced the implied odds that markets have given to a larger 20bps reduction in the deposit rate, which now stand at 44%, having been at 61% just a week ago.

In equity markets, US stock indices were mixed with relatively high divergence between sectors. The S&P 500 ended just about flat (-0.01%) while the DOW gained +0.14%. Relatively more of the DOW is made up of bank stocks, which performed well (+3.15%) amid the higher yields. Tech lagged, with the NASDAQ down -0.19%. In Europe, the picture was similarly mixed, with the STOXX 600 losing -0.28%. Much of the fall came from UK stocks, with the FTSE 100 -0.72% as it reacted to sterling’s appreciation, but the CAC 40 (-0.27%) also declined, while the DAX and the FTSE MIB only made modest gains. European banks mirrored their American cousins’ positive performance, with the STOXX Banks up +2.72% on rising yields, while energy stocks also saw gains as Brent Crude rose +1.85% to reach a one-month high.

Overnight in Asia, markets are trading mixed with the Nikkei (+0.36%) and Kospi (+0.37%) both up while the Hang Seng (+0.08%) is trading flattish and the Shanghai Comp (-0.36%) is trading down. In Fx, all G10 currencies are slightly weaker against the greenback this morning with the exception of the New Zealand dollar (+0.19%). The onshore Chinese yuan is trading up c. 0.1% at 7.1164. Sovereign bond yields have ticked up in Asia this morning following the global sell-off with 10y JGB yields up +2.9bps at -0.234%. Elsewhere, futures on the S&P 500 are trading flattish (-0.06%) while WTI crude oil is up +0.45% after Saudi Arabia’s new energy minister signaled his commitment to production cuts ahead of an OPEC+ meeting on Thursday in Abu Dhabi to discuss their production pact. In terms of overnight data releases, China’s August CPI and PPI both came in one tenth higher than consensus at +2.8% yoy and -0.8% yoy, respectively.

In other news, top North Korean diplomat Choe Son Hui issued a statement this morning that the country would be willing to hold nuclear talks with the US, “at the time and place to be agreed late in September.” However, shortly after the statement North Korea fired two “short-range projectiles” into its eastern seas. Meanwhile, President Trump was a bit cautious in his response over the North Korean statement, citing the regime’s continued freeze on nuclear weapons testing and added, “We’ll see what happens, but I always say having meetings is a good thing, not a bad thing.”

In the UK, MPs rejected the chance of having a mid-October general election for the second time in a week, as the motion failed to reach anything close to the required two-thirds majority once again (239 to 46; PM Johnson needed 434 to call an early election). Opposition parties mostly abstained as they want Mr Johnson to be forced to ask for an extension he has said he will never do. Parliament has now been prorogued, so it won’t sit again until October 14th, which is also the week of the next European Council Summit. The political chatter now points to a late November election but there will be an incredible amount of water flowing under the bridge between now and then. Mr Johnson seems to have pushed his energy into getting a deal now but that is as far away as it ever has been. I wonder whether he may have one go at passing a deal through Parliament before October 31st just to show the electorate that he did everything he could to deliver Brexit by that date and hope the leave vote feels emboldened to vote for him by Parliament’s likely rejection of it.

DB’s Oli Harvey published his latest Brexit update yesterday (link here ), where his base case is that the government fails to secure agreement with the EU27 at the October Council meeting, leaving Johnson with a choice between requesting an extension, resigning as Prime Minister, or ignoring or circumventing the legislation. Looking at his full probabilities, he maintains his view that the cumulative probability of a no-deal Brexit is 50%, be that either at the end of October or after a general election, and places just a 10% chance on Johnson completing his aim of a successful renegotiation and a ratified Withdrawal Agreement by the end of October.

Earlier in the day, sterling rallied as markets approved of the more conciliatory remarks from Prime Minister Johnson, who described a no-deal Brexit as “a failure of statecraft”, and said that “I would overwhelmingly prefer to find an agreement.” The currency strengthened +0.49% against the dollar to its highest level in over a month.

In terms of data yesterday, as well as the aforementioned German export numbers, UK GDP surprised to the upside, with the economy growing by +0.3% mom in July (vs. +0.1% expected). All sectors outperformed, with services +0.3% (vs. +0.1% expected) and manufacturing production +0.3% (vs. -0.3% expected). Looking at the whole 3 months to end-July the UK economy saw a flat 0.0% growth rate over the previous three months.

Meanwhile the Federal Reserve’s consumer credit numbers showed a $23.29 billion expansion in credit, the largest monthly increase since 2017. Revolving credit, which includes mostly credit card debt, drove the increase as it rose by $10 billion, also the highest since 2017. Separately, the NY Fed’s inflation expectations survey showed 1-year expectations falling to their lowest level on record at 2.4%, while 3-year expectations also fell, by 0.1pp to 2.5%.

Looking at the day ahead, data releases include France’s July industrial and manufacturing production, along with Italy’s July industrial production. In the UK, the monthly employment report, including the unemployment rate and average weekly wage growth will be released, while from the US, we have the NFIB small business optimism index and the JOLTS job openings release.

Tyler Durden

Tue, 09/10/2019 – 07:49

via ZeroHedge News https://ift.tt/34wy0L3 Tyler Durden