Stocks Soar On Report Trump Advisors Consider “Interim China Deal” To Delay Tariffs

With the ECB bazooka turning out to be a water pistol, the onus on getting stocks in the green was back on the Trump administration, and some new source of “optimism” on a trade deal with China. And miraculously, with the market sliding red, that’s precisely what Bloomberg delivered with a report that Trump admin officials “have discussed offering a limited trade agreement to China that would delay and even roll back some U.S. tariffs for the first time in exchange for Chinese commitments on intellectual property and agricultural purchases.”

While the report, sourced to five unnamed “people familiar with the matter” did not say if China would agree to commitments on intellectual property – because it won’t, or at best it will promise to comply but then resume stealing US tech – it noted that Trump’s top trade advisers in recent days have discussed the plan in preparation for two rounds of face-to-face negotiations with Chinese officials in Washington, due to take place in coming weeks.

Oh, and just in case the market reaction is a total dud, the plan is so preliminary that “Trump has yet to sign off on it.”

Luckily, for now the plan to boost stocks is working, and US stocks are surging…

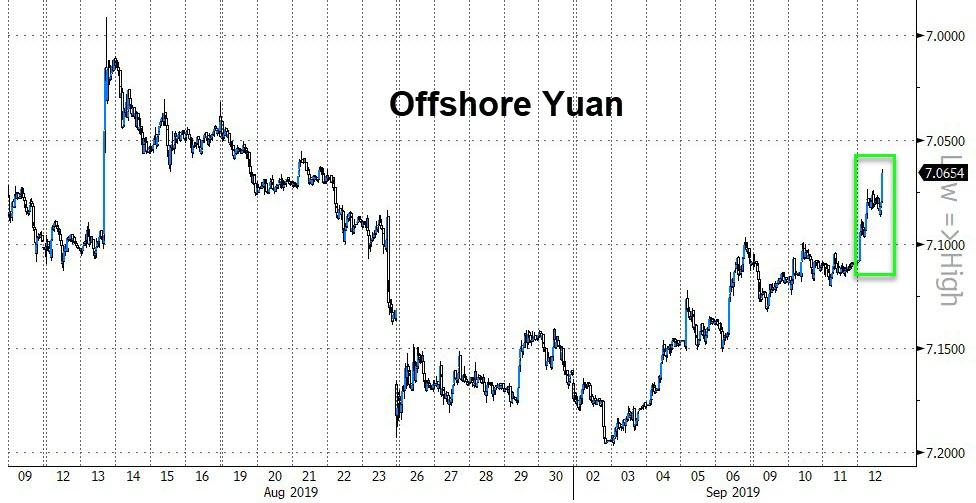

… as is the Yuan, which is trading at new session highs:

Some more details from the report: according to Bloomberg, the effective temporary ceasefire proposal would also be an interim deal, which would freeze the conflict, rather than bring a final resolution to a trade war that has cast a shadow over the global economy.

In short: the whole point of the report is to push stocks higher, while the trade war is deferred until Trump’s reelection, with the market supposedly hitting new all time highs around Nov 2020 allowing Trump to extend his term for another 4 years.

Besides the usual stock market considerations, why would Trump seek to capitulate now?

Well, for one, the plan reflects concerns within the White House over the recent escalation in tariffs and their economic impact on the U.S. going into an election year. Polls show the trade war is not popular with many voters and farmers are increasingly angry over depressed commodity prices.

This means that a key goal of the delay is to strike a deal that would allow the administration to avoid going ahead with more tariffs in December that would hit consumer products ranging from smartphones to toys and laptop computers. Also in play is a further delay in a tariff-rate hike due to take effect in October.

Late Wednesday, Trump tweeted that he was putting off the 5% increase in tariffs on Chinese goods, originally set to take effect the first day of next month until Oct. 15 — out of respect for the celebration of the 70th anniversary on Oct. 1 of the revolution that brought the communist government to power.

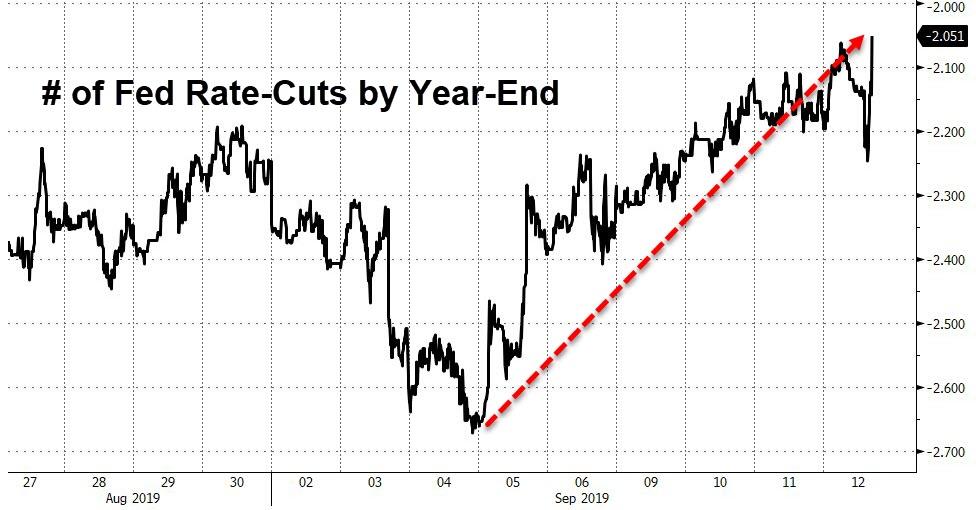

And while this is all fine and good, the flipside is that a trade deal now would all but crush any hopes for aggressive rate cuts by the Fed, and sure enough, the number of rate cuts by year ends is suddenly sliding.

At the end of the day, traders have to pick their poison: stocks up on trade war prompting more recession fears and rate cuts by the Fed, or stocks up on the end of trade war and economic “green shoots.” The good news is that, for whatever reason, stocks are up right now. Whether this persists is a different question.

Tyler Durden

Thu, 09/12/2019 – 10:25

via ZeroHedge News https://ift.tt/31gyrqN Tyler Durden