Zimbabwe Hikes Rates To 70% To Halt Hyperinflation 2.0

A week after the death of Robert Mugabe, and just a few months after the re-introduction of the ZimDollar, Zimbabwe faces another hyperinflation scare as inflation soars and the central bank hikes rates drastically to stall the currency’s collapse.

Just three months ago, The Reserve Bank of Zimbabwe (RBZ) issued a directive banning cash withdrawals from all Foreign Currency (FCA) Nostro Accounts following the promulgation of Statutory Instrument 142 of 2019, which reintroduced the local Zimbabwe Dollar and scrapped the multi-currency regime. Nostros/FCA holders will have to liquidate their balances to be usable in Zimbabwe. As Pindula News noted at the time, what this essentially means is that if one earns USD, deposited into their Nostro account, they can’t draw the cash but will have to get it in Zim Dollar using that day’s interbank rate.

And it hasn’t helped as the black market ZimDollar has collapsed since…

Source: Bloomberg

The economy is at risk of contracting this year for the first time since 2008. Zimbabwe’s woes date back to Mugabe’s rule, when he allowed ruling party-backed militants to violently seize thousands of white-owned commercial farms starting in 2000. Agricultural exports and tax revenue collapsed, the central bank began printing banknotes so the government could pay its workers, and inflation skyrocketed to the point where prices were doubling every day.

And in an effort to counter that soaring inflation, Zimbabwe’s central bank said on Friday it had raised its overnight borrowing rate from 50% to 70%.

The central bank added, in a monetary policy statement, that it was introducing dollar-denominated savings bonds to try to stimulate greater saving.

As Bloomberg notes, Mugabe’s successor as president, Emmerson Mnangagwa, has failed to deliver on his promises of a revival.

The southern African nation suffers from spiraling inflation and chronic shortages of foreign exchange, bread and electricity, prompting protests that have been brutally repressed.

But, as Bloomberg reports, in his latest attempt to stabilize an economy in freefall, Zimbabwean Finance Minister Mthuli Ncube established a Monetary Policy Committee. The introduction of the MPC will help provide oversight of the central bank, though its mandate remains unclear, said Lloyd Mlotshwa, head of equities at brokerage IH Securities Ltd. in Harare, the capital.

“Until their terms of reference are clarified, it’s difficult to gauge how effective the monetary policy committee will be,” he said. “For example, if there is a vote on interest rates, does each member have one vote?”

Ncube reintroduced the Zimbabwe dollar, which the country had abandoned in 2009, and banned the use of foreign currency in June.

While Ncube has suspended the release of annual inflation statistics until February, economists estimate that the rate is between 230% and 570%. The nation’s 400,000 civil servants are demanding increased pay after the devaluation decimated their spending power.

Ncube’s other plans include entering into an International Monetary Fund-supervised program to reduce debt, as well as winning debt relief from the so-called Paris Club of creditors, the World Bankand African Development Bank.

Widespread frustration over rampant unemployment and poverty has boiled over into strikes and demonstrations. The round of protests in August, called by the main opposition party in the capital, Harare, saw police arrest at least 128 people and use tear gas and batons to disperse others.

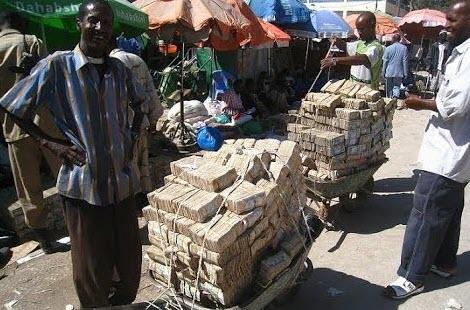

Get long wheelbarrows…

And pitchforks.

Bloomberg offers some hope.

Zimbabwe has enormous economic potential, which could lift the entire region. It was a leading producer of grain before Mugabe’s rule, which began after it won independence from the U.K. in 1980. Mugabe devastated commercial farming with his expropriations, but the country remains a large tobacco producer. It also has reserves of gold, platinum, diamonds and other metals and minerals. And its 14 million people are among Africa’s best educated, although many of those with skills have emigrated to neighboring South Africa and the U.K. About a quarter of the population has gone into exile.

Tyler Durden

Fri, 09/13/2019 – 12:39

via ZeroHedge News https://ift.tt/2UQBC5U Tyler Durden