$53.2 Billion In QE Lite: Fed Concludes First Repo In A Decade Amid Liquidity Panic

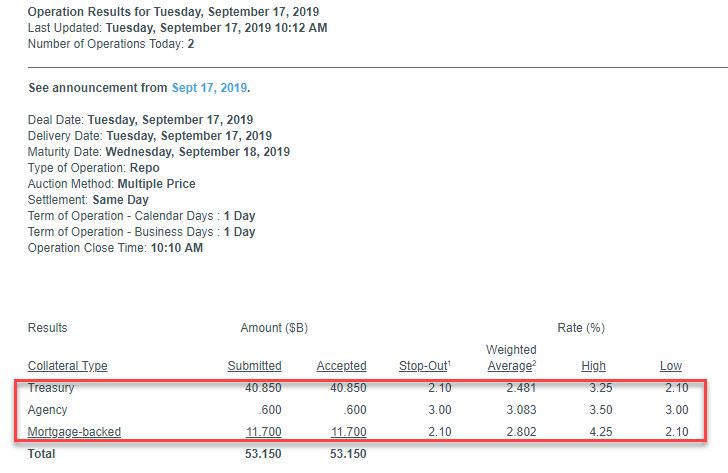

Update 4: It’s over: after a torrid 30 minutes in which the NY Fed first announced a repo operation, then announced the repo was canceled due to technical difficulties, then mysterious the difficulties went away just minutes later, at precisely 10:10am, the Fed concluded its first repo operation in a decade, which while not topping out at the $75 billion max, was nonetheless a significant $53.15 billion, split as follows:

- $40.85BN with TSYs as collateral at a 2.1% stop out rate

- $0.6BN with Agencies as collateral at a 3.0% stop out rate

- $11.7BN with Mortgage-backed securities as collateral at a 2.1% stop out rate.

While the Fed did not disclose how many banks participated in the operation, it is safe to say it was a sizable number. Worse, the result from today’s unexpected repo operation, we can now conclude that in addition to $1.3 trillion in ‘excess reserves’, a Fed which is now cutting rates and will cut rates by 25bps tomorrow, the US financial system somehow found itself with a liquidity shortfall of $53 billion that almost paralyzed the interbank funding market.

Oh, and for those wondering why the Fed did a repo, the answer is simple: it did not want to launch QE just yet. But make no mistake, once repo is insufficient, the Fed will have no choice but to escalate to the next step which is open market purchases.

Which brings us to the bigger question of how long such overnight repos will satisfy the market, and how long before the next repo rate spike prompts the Fed to do the inevitable, and restart QE.

At least president Trump will be delighted.

* * *

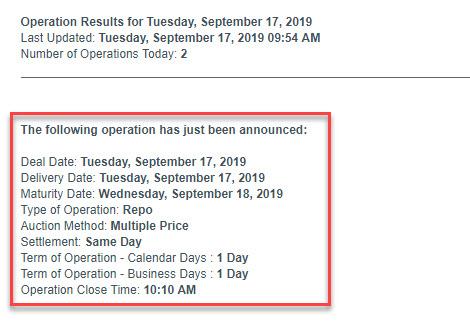

Update 3: The chaos is just getting worse, and minutes after the Fed announced that it would cancel today’s repo operation due to technical difficulties, it announced that it would hold a repo after all, with a closing time of 10:10am.

We now look forward to the results to see just how many counterparties were in desperate need of funding.

Which brings up an interest question: remember the discount window stigma? How many organizations will be willing to admit they were caught in a funding squeeze and needed repo access? We will find out in minutes.

* * *

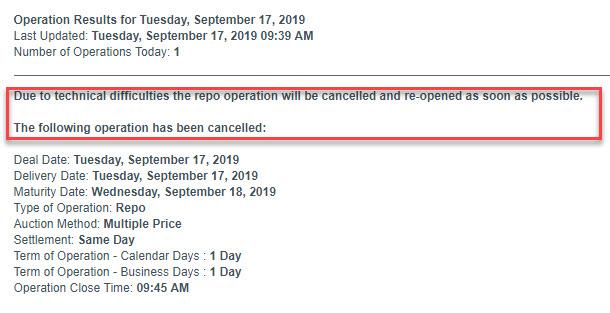

Update 2: Total chaos – just 15 minutes after the Fed announced it would conduct the first repo in a decade to calm markets after overnight repo rates exploded, sending repo rates back to 0%, the Fed was forced to cancel the repo operation “due to technical difficulties.” This is taking place just a week after the Fed inexplicably suffered similar technical difficulties during a recent POMO operation, which forced only the second ever POMO delay in history.

And while it is unclear if the NY Fed’s infamous “interns” are now in charge of the Open Market Operations desk, and it is also unclear if the NY Fed’s incompetent academic head, John Williams – who recently fired former PPT head Simon Potter – will be fired with cause, it is certainly unclear what will happen to the repo rate which tumbled on the repo news, and will now likely surge higher as it is unknown if and when the Fed will be able to do the repo operation, and more importantly, just what the technical difficulties were that led to this failure.

* * *

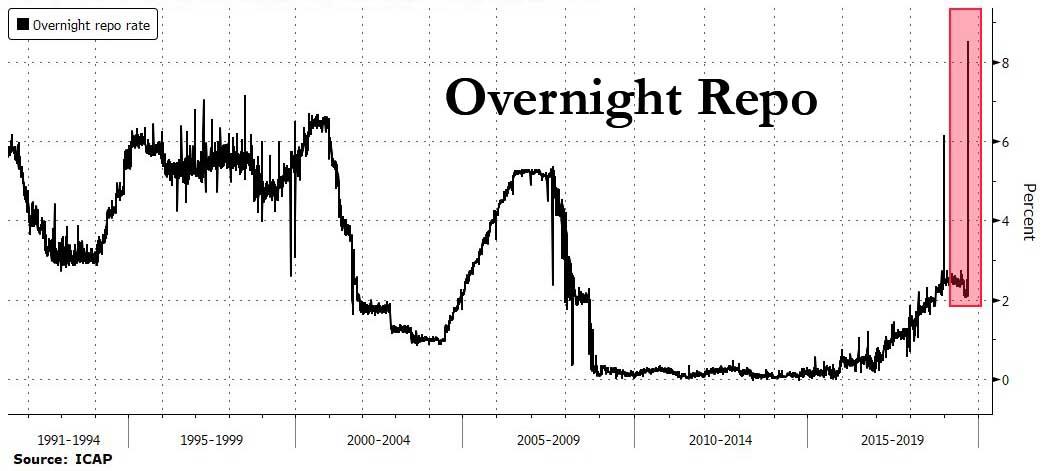

Update: Not long after we hinted that today’s action in the US repo market is similar to what took place in 2013 China, when an explosion in funding rates nearly destroyed the local banking system before the PBOC intervened, the Fed has done just that, and as everyone – finally – began to realize this morning that something was very broken in the short-term liquidity markets, as overnight general collateral repo exploded to 10%…

… the New York Fed announced it will conduct its first overnight repo operation (for up to $75 billion) for the first time in a decade.

In accordance with the FOMC Directive issued July 31, 2019, the Open Market Trading Desk (the Desk) at the Federal Reserve Bank of New York will conduct an overnight repurchase agreement (repo) operation from 9:30 AM ET to 9:45 AM ET today, September 17, 2019, in order to help maintain the federal funds rate within the target range of 2 to 2-1/4 percent.

This repo operation will be conducted with Primary Dealers for up to an aggregate amount of $75 billion. Securities eligible as collateral in the repo include Treasury, agency debt, and agency mortgage-backed securities. Primary Dealers will be permitted to submit up to two propositions per security type. There will be a limit of $10 billion per proposition submitted in this operation. Propositions will be awarded based on their attractiveness relative to a benchmark rate for each collateral type, and are subject to a minimum bid rate of 2.10 percent.

This is precisely what we said last Friday would be the Fed’s first line of defense, when we laid out what may happen after the dollar funding shortage arrives:

- repos, i.e. temporary ad hoc reserve adding open market operations,

- Treasury purchases, i.e. permanent open market operations, similar to outright UST QE only without a clear QE mandate (for now), and

- standing repo facility (SRF), i.e. a new facility that could “automatically” add reserves to the banking system when GC or fed funds reaches a threshold above IOER.

We are now at 1. If and when repo rates continue to rise even with the Fed’s repos in market, the Fed will have no choice but to launch either QE or start a standing repo facility.

For those who may have forgotten how repos work – which is to be expected in a world where all the excess funding was provided by QE – here is the explainer we provided last week:

1. Old school funding pressure lessons: repos & outrights

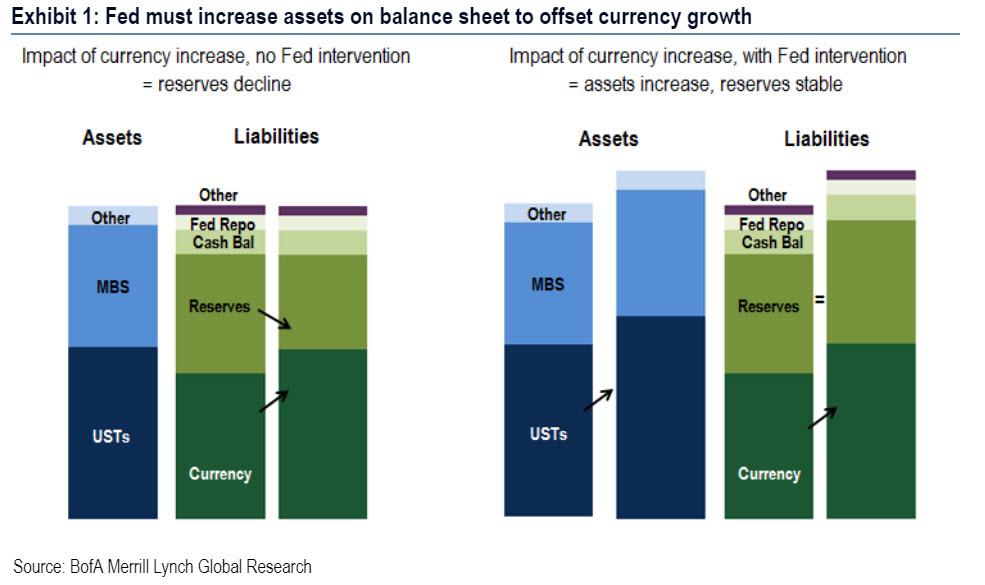

Pre-crisis the Fed relied on two types of open market operations to manage funding markets and their balance sheet: (1) temporary repo or reverse repo operations (2) outright UST purchases. Repo operations were used to “fine tune” the amount of reserves in the banking system to hit the fed funds target rate while outright UST purchases were used to offset currency in circulation growth. As a reminder, currency growth – of which we have seen a dramatic increase in recent years as the amount of $100 bills in circulation has soared – eats away at reserves in the banking system; this would pressure fed funds higher if the Fed did not growth their balance sheet to offset this (Exhibit 1).

- Reserve adding operations: both repos and outright UST purchases have the same impact on the Fed’s balance sheet: on the asset side they increase SOMA holdings and on the liability side they increase reserves (Table 1). The only difference is that repos are relatively short-lived and unwind on an overnight or short-term basis; outright Treasury purchases have a permanent impact on the Fed’s balance sheet.

- Reserve draining operations: pre-crisis the Fed only ever engaged in open market operations to drain reserves as a “fine tuning” fed funds management exercise. Prior to 2008 the Fed never engaged in any permanent open market operations to drain reserves (such as UST sales) since they only ever used this tool to offset currency growth.

Next, Cabana provides some historical perspective on each of the temporary repo and permanent UST purchase open market operations focuses on those operations that add reserves. As funding pressures begin to emerge and likely worsen in Q4, the BofA rates strategist expects the Fed to step in and use both sets of tools to contain these pressures and keep the fed funds in its target range.

Temporary repo operations

Temporary open market operations were a common practice prior to the crisis, when the Fed was in a scarce reserve regime. The New York Fed conducted frequent repo operations to fine tune the amount of reserves in the system and to ensure that the fed funds effective hit its target point. Below is a review of the mechanics of such repo operations as well as historical activity from 2000-2008. If the Fed conducts repo operations again to offset funding pressures, there will likely be parallels to their historical operations.

The mechanics

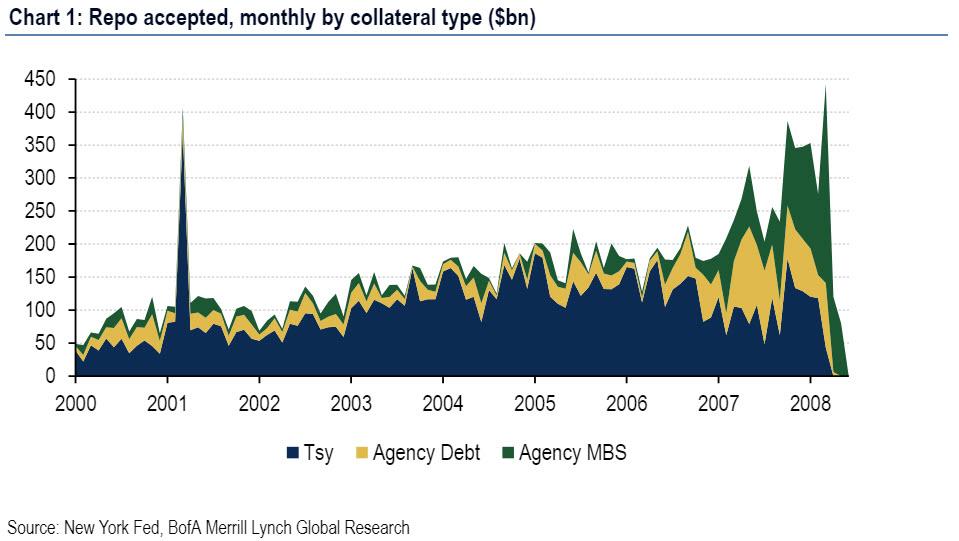

Temporary repo operations were executed in the tri-party market and were conducted only with primary dealers. Historically, repos were

- multiple price and fixed amount

- announced only at the outset of the open market operation

- executed across Treasury, agency debt, & agency MBS collateral types (Chart 1).

The Fed provides data on repo operations starting in July 2000. An increase in Fed repo operations corresponds to a similar increase in reserves, all else equal (Exhibit 1).

Historical repo operations

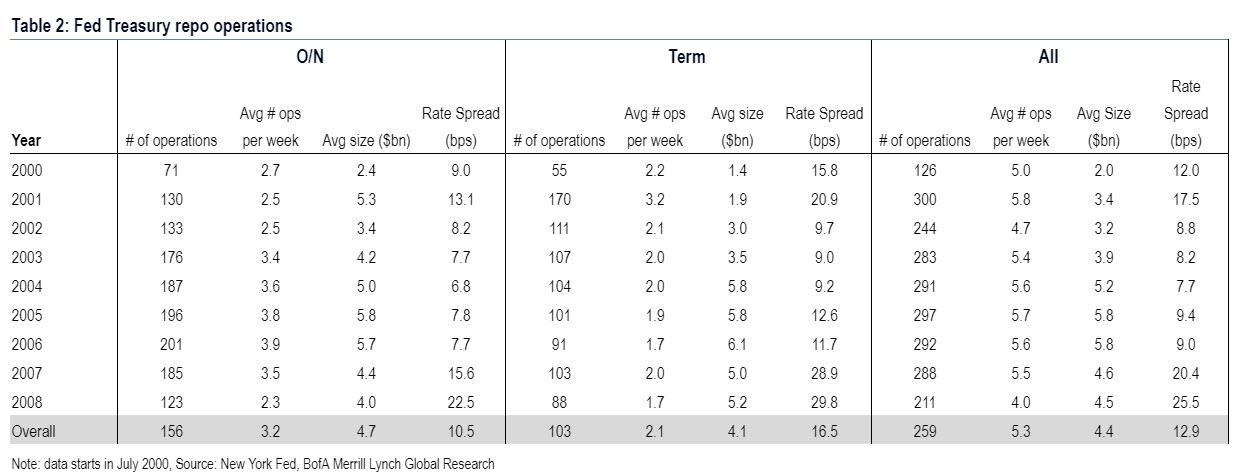

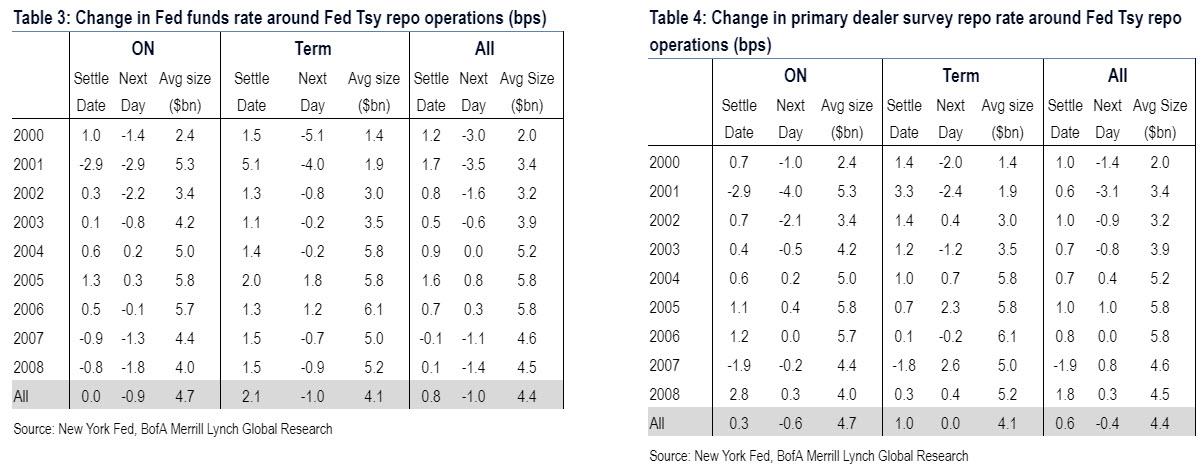

From mid-2000 to the end of 2008, the NY Fed conducted 5 UST repo operations on average each week. Overnight operations averaged around $5bn in size while term operations averaged around $4bn (Table 2). Fed repo operations were all fixed quantity and multiple price, which means that dealers were able to submit varying rates at which they would underwrite the repo operation. The Fed reports the high and low rate that dealers showed into the Fed: the range of rates averaged 13bps and was unsurprisingly wider for term rates. Operations were typically conducted between 8:30 and 10:00AM.

What to expect this time

If funding markets face stress in the next few months – which Bank of America expects will happen – the Fed could easily conduct repo operations to stem upward pressure. Since the recession, the NY Fed has periodically conducted small repo operations in order to “test operational readiness.” There have been 21 operations in total since 2012 – which is somewhat bizarre considering there are well over $1 trillion in reserves floating around the financial system – and the last set of Fed test repo operations was conducted in May. In the past few years the repo tests have been very small (around $23mn in size for USTs), were multiple price, and were overnight or matured in 2-3 business days. The tests have also been across UST, agency debt, & agency MBS collateral. The tests indicate that the NY Fed is prepared to conduct such repo operations at any time and that this is a readily available solution for any sharp increase in funding markets.

* * *

Earlier

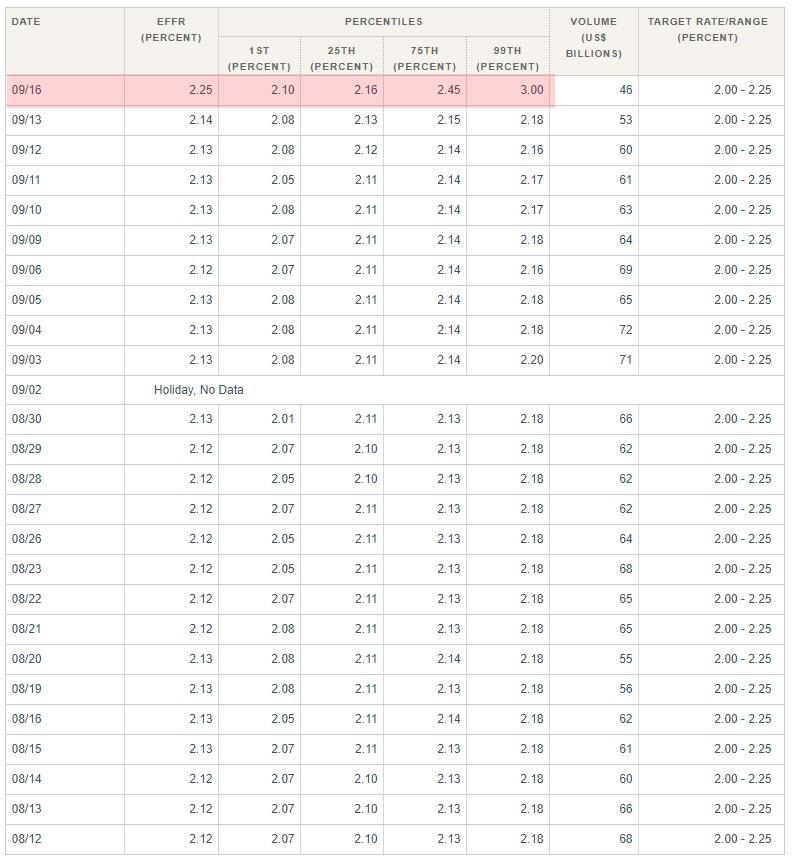

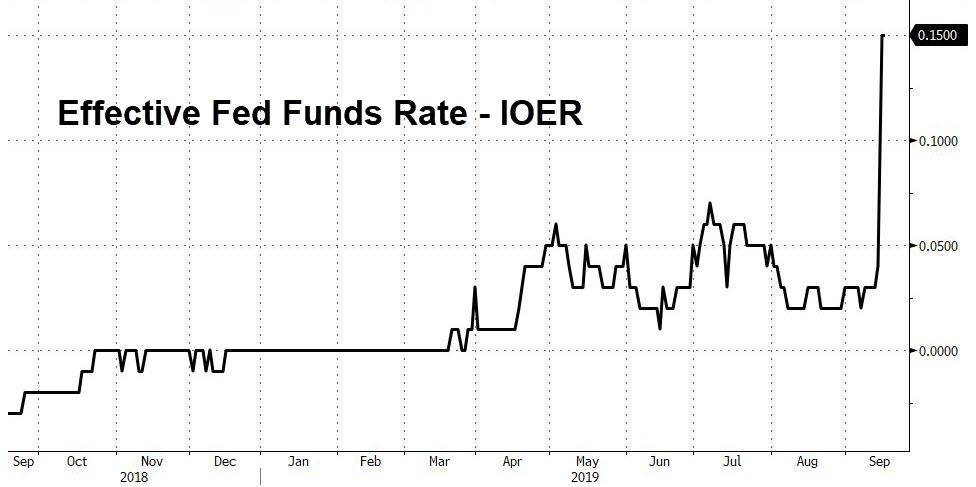

Something critical is going on in overnight funding markets: ever since March 20, the Effective Fed Funds rate has been trading above the IOER. This is not supposed to happen, and it just got significantly worse.

As a reminder, ever since the financial crisis, in order to push the effective fed funds rate above zero at a time of trillions in excess reserves, the Fed was compelled to create a corridor system for the fed funds rate which was bound on the bottom and top by two specific rates controlled by the Federal Reserve: the “floor” for the corridor was the overnight reverse repurchase rate (ON-RRP) which usually coincides with the lower bound of the fed funds rate, while on top, the effective fed funds rate is bound by the rate the Fed pays on Excess Reserves (IOER), which served as the corridor “ceiling.”

Or at least that’s the theory. In practice, the effective FF tends to occasionally diverge from this corridor, and when it does, it prompts fears that the Fed is losing control over the most important instrument available to it: the price of money, which is set via the fed funds rate.

Ever since March 20, this fear is front and center because as shown in the chart below, starting on March 20, the effective Fed Funds rate rose above the IOER first by just 1 basis point. The Fed attempted to technically tamp this down.. and failed. But today the Effective Fed Funds Rate has exploded….

Smashing above the IOER…

Source: Bloomberg

As we noted earlier, no one is sure of what is driving this apparent liquidity shortage

-

elevated UST supply,

-

bloated dealer balance sheets and year-end regulatory constraints

-

a banking system near reserve scarcity,

-

investors selling bonds back to dealers, and

-

banks and money-market funds to make their quarterly tax payment.

The bottom line is simple – The Fed has lost control of its rate-control mechanism.

So what should the Fed do to regain control over interest rates?

According to Barclays to address the expected increase in fed funds volatility, the Fed, having ended the balance sheet runoff this summer instead of waiting until September, could create a standing repo facility – something which has been rumored for months – or conduct standard open market operations, injecting even more liquidity into the system.

But as we noted earlier, the problem for the Fed is that following today’s massive move in repo higher, it now appears that the Fed is once again behind the curve, and this time the funding squeeze could have dire consequences for not only the economy but the market, as the broken repo plumbing means that despite $1.4 trillion in excess reserves, one or more banks are suddenly left without liquidity, which as we explained over a month ago in “Forget China, The Fed Has A Much Bigger Problem On Its Hands”, the only alternative Powell may soon have is to restart QE.

Fun week so far:

-

Monday: biggest ever surge in oil

-

Tuesday: biggest ever surge in GC repo

But stocks are near record highs, because… The Fed.

Tyler Durden

Wed, 09/18/2019 – 04:32

via ZeroHedge News https://ift.tt/2O7ypO0 Tyler Durden