Fed Begins Repo Operation With Funding Rates Ominously Elevated Across The Board

Yesterday’s Fed repo operation – the first direct liquidity injection in a decade – was an unmitigated disaster, with the NY Fed forced to cancel it in the middle due to “technical difficulties” which nobody still know what they were, only to resume it moments later. All we can say is that today the Fed better not fuck this up again, especially with New York Fed President John Williams, senior vice president of market operations Lorie Logan and first vice president Michael Strine all expected to be in Washington for the Fed’s two-day central bank meeting.

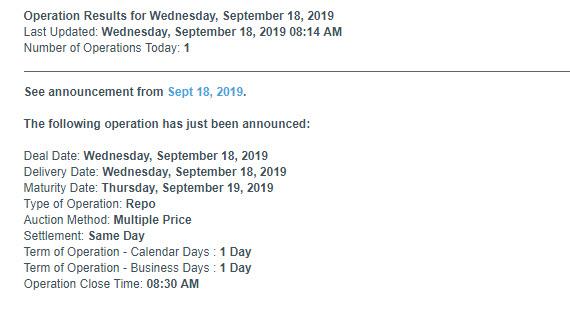

In any case, moments ago the NY Fed announced that, as expected, today’s repo operation started at 8:14am as expected, with the repo rate trading quite elevated around 2.80% and the SOFR trading bizarrely above 5%

- Overnight U.S. Funding Rate at 2.8%, Elevated for a Third Day

- *SECURED OVERNIGHT FINANCING RATE JUMPS TO 5.25%

With such mindboggling volatility, SOFR will certainly make a “great” LIBOR replacement.

Check back here at 830am ET for the results; it will be interesting if the total uptake today is over yesterday’s $53BN – that will suggest that the problem is getting worse, not better…

Tyler Durden

Wed, 09/18/2019 – 08:24

via ZeroHedge News https://ift.tt/309EFfk Tyler Durden