Frazzled Traders Fade Futures, Buy Bonds Ahead Of Repo Injection, Fed Decision

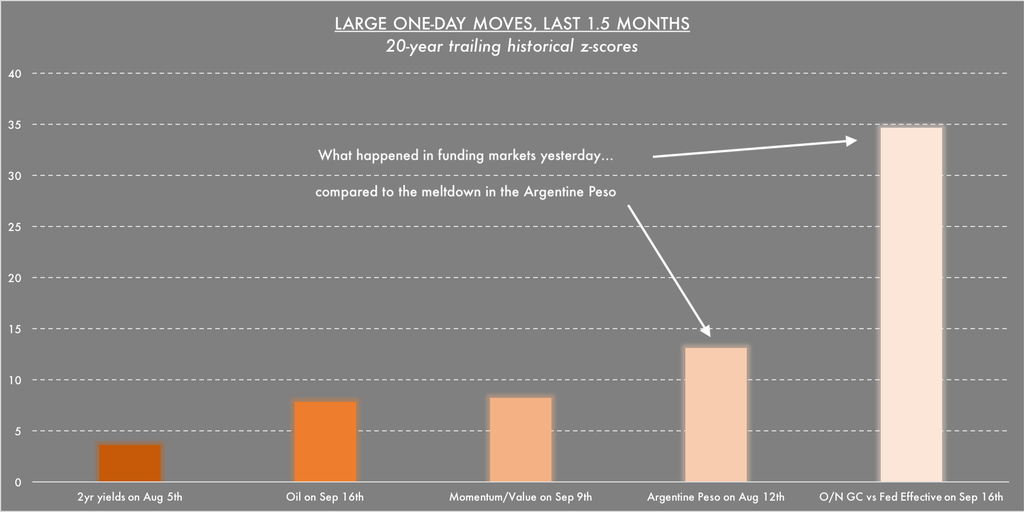

Soaring, then tumbling oil prices; soaring, then sliding repo rates; unprecedented factor volatility as crowded positions exploded – it sure has been quite a week headed into today’s Fed decision which quickly lost the top spot as the most market-moving event of the week amid a barrage of six sigma, exogenous shocks.

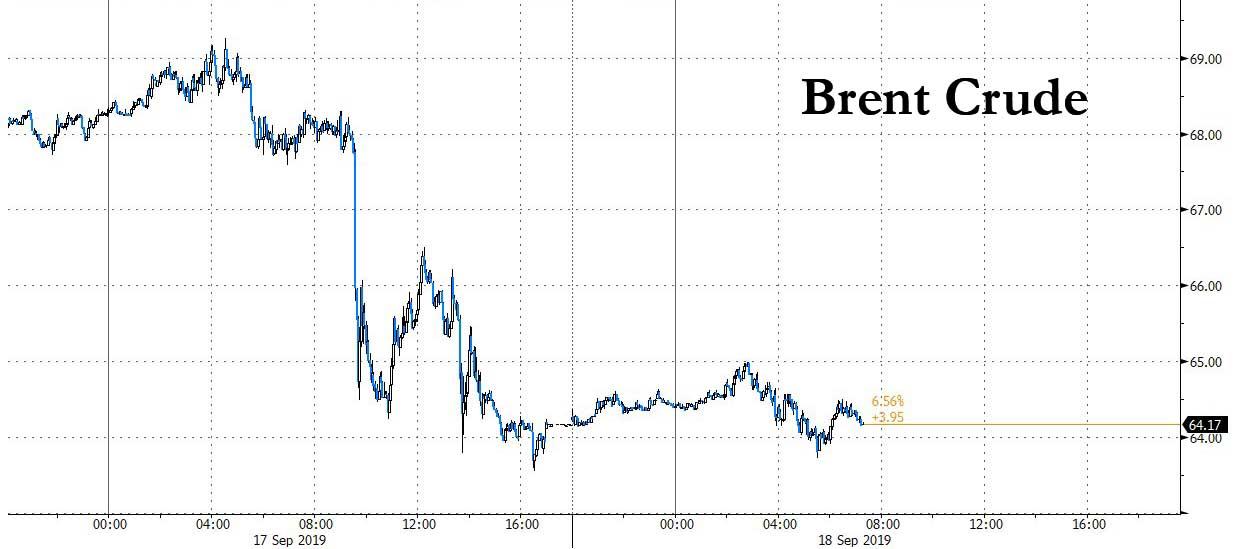

While everyone’s attention slowly turned to see how much the Fed would cut today, how Powell would justify easing even as the US economy is once again rebounding, and how the US central bank would respond to the unprecedented liquidity shortage in the repo market, traders were still on edge over this week’s record move in crude even as oil prices cooled further Wednesday after Saudi Arabia said full oil production would be restored by month’s end as it had already revived 41% of capacity. As a result, Brent futures dipped 0.28% to $64.34 a barrel, having conceded about 65% of its gains made after the weekend attack on Saudi Arabia’s oil facilities.

Saudi Energy Minister Prince Abdulaziz bin Salman on Tuesday sought to reassure markets, saying the kingdom would restore its lost oil production by month-end having recovered supplies to customers to the levels they were prior to weekend attacks. “I would think a spike in oil prices will likely prove to be short-term given that the global economy isn’t doing too well,” said Akira Takei, bond fund manager at Asset Management One.

Still, heightened geopolitical tensions underpinned oil as well as some safe-haven assets such as U.S. bonds. A U.S. official told Reuters on Tuesday the United States believes the attacks originated in southwestern Iran, an assessment that could further increase the rivalry between Tehran and Riyadh. Adding to uncertainties in the Middle East were exit polls from Israel’s election, which showed the race too close to call suggesting Prime Minister Benjamin Netanyahu’s fight for political survival could drag on.

At the same time, now that the record barrage of investment grade issuance is finally over, as are hedging rate locks, bonds rallied globally while stocks struggled for traction ahead of Wednesday’s Fed decision, as the dollar rose.

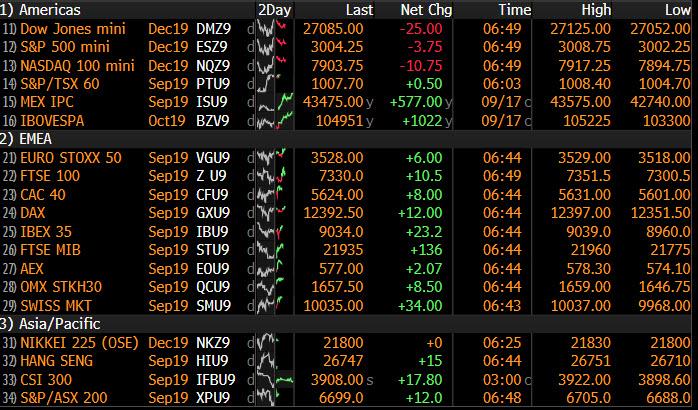

In equities, European stocks traded without direction, with the Stocks 600 index swinging from a loss to a modest gain, led by utilities and oil companies.

A similar drift was observed earlier, when Asian stocks traded little changed as investors awaited the Fed’s decision. Shares rose in China, but declined in Japan and Australia. The Topix dropped for the first time in nine days, ending its longest winning streak in almost two years. Electric appliance makers slid, with Sony Corp. being the biggest drag on the benchmark. Elsewhere, China’s Shanghai Composite Index gained as much as 0.6%, boosted by consumer stocks including Kweichow Moutai Co Ltd. and Foshan Haitian Flavouring & Food Company Ltd. India’s Sensex gained as much as 0.6% as market fears of higher oil prices were assuaged on signs Saudi Arabia is restoring production. The U.S. central bank is broadly expected to cut rates by 25 basis points Wednesday.

S&P 500 Index nudged lower, once again hugging the 3,000 line as Fedex shares plunged in pre-market trading after the company slashed its profit outlook, blaming a global economy weakened by trade tensions.

Looking at today’s main event, in which Fed officials are widely expected to cut their benchmark rate by a quarter-point, some investors such as DoubleLine Capital’s Jeffrey Gundlach are saying the central bank may also boost its balance sheet launching what we dubbed “QE Lite” to stabilize the volatile repo market. Traders also are keeping an eye on whether a potential oil shortage weighs on the global economy, and on preparations by the U.S. and China for top officials to meet on trade in October.

“Markets are currently almost pricing in three more rate cuts by the end of next year, including one by the end of this year, but the chances are that the Fed’s stance will be more hawkish than markets and we could see a rise in bond yields in the near term,” said Masahiko Loo, portfolio manager at Alliance Bernstein.

“Markets want to hear that the Fed is there if needed, the Fed is a backstop,” Alec Young, managing director for global markets research at FTSE Russell, told Bloomberg TV. “There is concern, obviously, from trade, manufacturing, and we’re seeing that bleed into some job-growth weakness, and these are all the big questions that Chairman Powell is going to be getting.”

Further complicating the Fed’s discussions, short-term U.S. interest rates shot up this week, with overnight repo rates rising to 7%, due largely to seasonal factors such as huge payments for taxes and bond supply. That prompted the New York Fed to conduct its first repo operation in more than a decade to inject funds to stressed money markets.

The New York Federal Reserve said late Tuesday it would conduct a repurchase agreement operation early on Wednesday “in order to help maintain the federal funds rate within the target range of” 2.00% to 2.25%. Jeffrey Gundlach, chief executive of DoubleLine Capital, said on Tuesday that the repo market squeeze makes it more likely that the Federal Reserve will resume expansion of its balance sheet “pretty soon.”

In FX, the dollar gained against all peers, paring most of Tuesday’s losses, as money markets remained on edge and traders awaited Wednesday’s Federal Reserve policy decision. The pound retreated from the almost two- month high reached Tuesday; the currency was hit by inflation data and increasing pessimism of the Brexit deal being reached before the Oct. 31 deadline. The Norwegian krone was at the center of attention in the G-10, given that it risks volatility around its central bank decision on Thursday. Sterling traded at $1.2483, down 0.1% so far on the day, having hit a two-month high of $1.2528 as investors reversed their bets against the currency on fear of a no-deal Brexit at the end of next month.

Gold was mostly flat at $1,502.10, while the 10-year U.S. Treasuries yield fell to 1.799%, compared with Friday’s 1-1/2-month high of 1.908% ahead of the Fed’s policy announcement on Wednesday.

Expected data include mortgage applications and housing starts. General Mills will report earnings.

Market Snapshot

- S&P 500 futures down 0.1% to 3,003.25

- STOXX Europe 600 up 0.08% to 389.66

- MXAP down 0.1% to 158.87

- MXAPJ up 0.06% to 511.04

- Nikkei down 0.2% to 21,960.71

- Topix down 0.5% to 1,606.62

- Hang Seng Index down 0.1% to 26,754.12

- Shanghai Composite up 0.3% to 2,985.66

- Sensex up 0.3% to 36,576.19

- Australia S&P/ASX 200 down 0.2% to 6,681.59

- Kospi up 0.4% to 2,070.73

- German 10Y yield fell 2.2 bps to -0.496%

- Euro down 0.2% to $1.1053

- Italian 10Y yield rose 7.7 bps to 0.581%

- Spanish 10Y yield fell 1.9 bps to 0.267%

- Brent futures down 1% to $63.91/bbl

- Gold spot little changed at $1,501.66

- U.S. Dollar Index up 0.2% to 98.41

Top Overnight Headlines from Bloomberg

- The Fed bought $53.2 billion of U.S. securities on Tuesday to quell a liquidity squeeze, and said it would conduct another overnight repo operation of up to $75 billion Wednesday morning; the moves had markets reeling and underscored just how deep the structural problems in U.S. money markets have become

- Under pressure from Wall Street and President Donald Trump, the Fed is widely expected to reduce interest rates, but its sharply divided policy panel may be reluctant to forecast further cuts

- Saudi Arabia reassured anxious customers that crude exports will keep flowing as normal and its industry can recover quickly from the worst attack in its history; the kingdom restored about half of pre-attack capacity at the crucial Abqaiq facility

- European Commission President Jean-Claude Juncker said the risk of a no-deal Brexit on Oct. 31 is now “palpable,” sparking a drop in the pound; he said the main sticking point continued to be the so-called backstop to avoid a hard Irish border and demanded that the U.K. provide its proposals for an alternative in written form as soon as possible

- Benjamin Netanyahu’s gamble to hold elections for a second time this year backfired after a stunning deadlock left Israel rudderless and convulsed by a new wave of political turmoil

Asian equity markets traded tentatively following the cautious gains on Wall St amid positioning heading into a flurry of central bank activity including the FOMC decision where the Fed are expected to deliver a consecutive 25bps cut. ASX 200 (-0.2%) and Nikkei 225 (-0.2%) were indecisive ahead of the looming risk events and with Australia subdued by losses in the energy sector after an aggressive pullback in oil prices due to reports Saudi oil output will return to normal levels quicker than initially anticipated, while the Japanese benchmark remained at the whim of a choppy currency amid somewhat inconclusive data which showed Exports contracted for a 9th consecutive month albeit at a narrower than expected decline. Hang Seng (-0.1%) and Shanghai Comp. (+0.3%) conformed to the holding pattern seen across regional and global counterparts after the PBoC opted for a net neutral position in its liquidity operations and after President Trump reverted back to a blasé approach on US-China trade in which he suggested a deal could come soon, possibly before the 2020 election or after. Finally, 10yr JGBs initially continued to oscillate around the 154.00 level as the BoJ kick-started its 2-day policy meeting, although prices eventually gained traction after tripping stops through this week’s resistance levels and largely ignored the mostly weaker 20yr JGB auction results.

Top Asian News

- An Army of Japanese Salarymen Is Rocking Global Currency Markets

- Vietnam Becomes a Victim of Its Own Success in Trade War

- Profiting From Trade War, China Fund Jumps 54% in First Year

- London Trading More Rupee Than India Shows What Modi Needs to Do

- Thai Court Rejects Petition Seeking to Disqualify Prime Minister

Major European bourses are flat (Euro Stoxx 50 +0.1%), following on from a tentative AsiaPac session, amid cautious trade ahead of this evening’s FOMC meeting. IBEX 35 (+0.2%) was mildly softer after the open, although has since turned around, amid more political uncertainty, after the King stated there was no candidate for a parliament investiture vote; meaning Spaniards will return to the polls in November for the fourth time in four years. In terms of sector performance; Energy (+0.4%) has managed to shrug off yesterday’s fall in oil prices, while Telecoms (u/c), Consumer Discretionary (-0.4%), Consumer Staples (-0.2%) and Industrials (-0.1%) are the laggards. Luxury names, including Richemont (-4.1%) and Swatch Group (-2.6%), are under pressure after UBS downgraded the sector, with downside in Moncler (-4.5%) exacerbated by cautious comments from the co.’s CEO, who expressed concern about the situation in Hong Kong. In the lead are utilities (+0.4%), with gains in EDF (+3.7%) helping to prop up the sector (the Co. reported weld issues in six reactor units relating to 16 steam generators but does not believe they pose a significant adverse effect now), while materials (+0.2%) and Tech (+0.4%) are also higher. In terms of other notable individual movers; Kingfisher (-2.4%) is lower after sales disappointed (GBP 6.0bln vs. Exp. GBP 6.02bln and like-for-like sales down 1.8%). Elsewhere, Wirecard (+3.1%) took a leg higher on the news that the co. has signed a strategic co-operation agreement with Japan’s Softbank. Finally, Beiersdorf (-1.0%) is under pressure after being downgraded at Goldman Sachs.

Top European News

- U.K. Inflation Rate Falls to Lowest Since 2016 on Games, Clothes

- Comcast’s Sky Moves Beyond BT’s Network in U.K. with Fiber Deal

- Cobham’s $5 Billion Sale to Advent Sparks U.K. Security Probe

- EDF Rises on Belief That Reactor Weld Issues Don’t Need Fixing

In FX, the DXY seems to have established a firm base above 98.000 and Fib support just above the big figure, partly due to weakness in the Greenback’s G10 counterparts, but also on the back of recent firmer than forecast US data/surveys, increased demand for short term Usd funds and a marked change in Fed rate expectations going into September’s policy meeting (odds between another 25bp hike and no change much closer to even from around 90% for +1/4 point only a few days ago). The index is currently just shy of 98.500 and considerably closer to nearest resistance (98.744 yesterday) than the aforementioned downside chart retracement level (98.034).

- GBP/NZD/AUD – The major underperformers, with Cable already retreating after another 1.2500+ sortie and failure to sustain gains above the 100 DMA (1.2501) amidst relatively negative Brexit remarks from EU’s Barnier and Juncker, but then extending its pull-back through 1.2450 at one stage in wake of significantly softer than expected UK CPI on the eve of retail sales and the BoE rate convene. Meanwhile, the Kiwi is back under pressure alongside the Aussie after overnight releases showing a decline in Westpac’s LEI and mixed NZ Q2 current account metrics, with Nzd/Usd under 0.6350 again and Aud/Usd sub-0.6850. Note, Aud/Nzd is still pivoting 1.0800 following this week’s dovish RBA minutes and eyeing NZ Q2 GDP later today, while Aud/Usd appears capped by decent upside option expiry interest at 0.6860-65 (1 bn) and 0.6895-0.6900 (2.6 bn).

- JPY/CAD/CHF/EUR – Also weaker against their US peer, albeit on a sliding scale as the Yen contains losses over the 108.00 mark with the aid of a narrower than anticipated Japanese trade gap and with expiries also in close proximity (1.1 bn at 108.25-40 and then 1 bn at 108.75 if Tuesday’s multi-week peak and 108.50 are breached) ahead of the FOMC and BoJ tomorrow. Meanwhile, the Loonie has regained some poise and traction having held just above 1.3300 yesterday to meander around 1.3250 awaiting some independent impetus from Canadian CPI in advance of the Fed. Elsewhere, the Franc remains anchored near 0.9950, but has weakened vs the Euro to 1.1000 into the SNB on Thursday even though the single currency has lost momentum against the Buck following another approach towards 1.1100. Indeed, Eur/Usd has pulled back below 1.1050 amidst downbeat commentary from ECB’s de Guindos and the headline pair may gravitate further given more downside option expiry interest compared to upside (1.6 bn at the 1.1000 strike and 1 bn between 1.1020-30 vs 1.7 bn from 1.1100 to 1.1115).

- EM – The Rand is also awaiting the Fed before turning attention to tomorrow’s SARB meet, and Usd/Zar has largely taken in stride slightly firmer than forecast SA CPI ahead of retail sales within a 14.7080-6325 band, though mostly trading near the base.

In commodities, the crude complex is largely in consolidation mode ahead of key risk events (FOMC) amid a lack of fresh catalysts and following yesterday’s declines, triggered by news that Saudi oil output will return to normal levels faster than originally assumed; Energy Minister Abdulaziz said oil supply is fully back online and resumed as before after more than half the oil output was resumed in the past few days and that it will keep full oil supply to its customers this month. Losses were later exacerbated by a surprise build in API inventories. Brent Nov’19 futures sit just above the USD 64/bbl handle, just above yesterday’s USD 63.50/bbl lows, with WTI similarly lacklustre just above the USD 59.0/bbl mark. In terms of geopolitical developments, the pace appears to have slowed somewhat; the Trump administration is reportedly considering a range of options to retaliate against Iran including cyberattack or physical strike on Iran’s oil facilities or Revolutionary Guards assets, meanwhile, the Saudis continue to point the finger at Iran, who have doubled down in denial. Looking ahead, IEA Birol will conduct a press conference today at 14.00BST alongside a press conference from the Saudis who are expected to show evidence of Iran’s involvement and that Iranian weapons were used in Aramco attacks. Separately, lacklustre trade in the metals complex reflects cautious sentiment, with gold holding on to the USD 1500/oz level for now and copper a touch lower.

US Event Calendar

- 7am: MBA Mortgage Applications, prior 2.0%

- 8:30am: Housing Starts, est. 1.25m, prior 1.19m; Housing Starts MoM, est. 4.95%, prior -4.0%

- 8:30am: Building Permits, est. 1.3m, prior 1.34m; Building Permits MoM, est. -1.29%, prior 8.4%

DB’s Jim Reid concludes the overnight wrap

I write this from Paris this morning but there’s only one place to start and that’s in Washington ahead of the Fed meeting this evening. Not long ago this FOMC was perhaps gearing up to be closer to a 50/50 call between a 25bp or 50bp cut however the latter looks a lot less likely now with markets only pricing in about a 15% chance of that happening. That fits with the view of our US economists who also expect a 25bp cut which mirrors the consensus.

The bigger focus will be on what the Fed signals about the expected policy trajectory in the coming months. Our US economists note that a continued dovish bias should be evident in the statement language, Summary of Economic Projections and Chair Powell’s press conference. The latter in particular should echo the narrative that, while the baseline outlook for the economy remains favorable, officials are attuned to significant risks emanating from softer global growth and elevated trade uncertainty. As in July, Powell should stop short of detailing the likelihood and timing of any future actions, but the signal should be that the bar is set relatively low for further rate reductions with the Committee intent to “act as appropriate to sustain the expansion”.

Our colleagues do not expect the September rate cut to be the last of this cycle though. With accumulating evidence that the economy is slowing amid greater sensitivity to the trade turmoil, they recently adjusted their call to reflect a further cumulative 75bps of rate cuts after this meeting, specifically at the October, December and January get togethers. All eyes on 7pm BST/2pm EST.

In an ideal world the Fed was probably hoping that markets would go into today in a relative state of calm however the mini sell-off across bond markets over the last couple of weeks and the biggest daily climb for oil in over a decade put an end to that. You can also add panic in the US funding market to that list after the overnight repo rate touched as high as 10% intraday yesterday and one of the highest levels on record. Notwithstanding a technical delay, the NY Fed did move to calm the market by conducting an overnight repo operation – the first in a decade – for $53bn which helped to push the rate back down however another operation is planned for today for up to $75bn.

There appeared to be various schools of thought on what caused the explosion in overnight funding rates with bulging treasury supply, a mismatch of cash liquidity tax payments, regulatory constraints, bloated dealer sheets, banking seasonals and investors selling bonds back to dealers all cited as possible reasons. We remained confused about the real cause!! Whatever created the tensions it’s not gone unnoticed that we’ve had two huge moves in different asset classes this week, in addition to the rates’ selloff of the prior two weeks.

Just on oil, WTI and Brent both sold-off around 6% yesterday – and thus gave up about half of Monday’s gains – after Reuters reported that Saudi Arabia is supposedly close to restarting 70% of the lost oil production following the weekend attack. The same story also suggested that output would be fully back online in the next couple of weeks, citing a “top Saudi source”. The Kingdom later confirmed that they will ensure this month’s supply by drawing on reserves. Aramco’s CEO also confirmed that the Abaqiq facility should be back to pre-attack levels of output by the end of September. Gasoline (-7.73%) and Heating Oil (-9.42%) also fell in tow however the end result for equities was fairly muted. Indeed the S&P 500 ended +0.26% while the DOW and NASDAQ ended +0.13% and +0.40% respectively. This was after the STOXX 600 had closed -0.05%. After the US bell, trade bellwether FedEx cut its 2020 profit outlook on a weaker global economy and trade tensions. The shares were down as much as 10% in after-hours trading potentially wiping out gains for the year.

Meanwhile US HY credit spreads finished little changed with energy spreads 4bps wider. As for bonds, 10y Treasuries finished -4.5bps lower with the 2s10s curve flattening 1bp to +7.2bps, while Bunds finished little changed. It was BTPs (+7.9bps) which stood out the most in Europe though following (an albeit expected) confirmation of the news we discussed yesterday morning that former PM Renzi was leaving the PD to form his own party, further complicating the political stability picture in Italy.

This morning in Asia, with the exception of Japan where the Nikkei (-0.13%) is a touch lower, most bourses are flat to slightly higher ahead of the Fed. That’s the case for the Hang Seng (+0.03%), Shanghai Comp (+0.39%) and Kospi (+0.44%). The yen is slightly weaker, following weak trade export data in Japan this morning (albeit not as weak as expected), and the news yesterday that South Korea had removed Japan from its list of most trusted trading partners.

In terms of the data yesterday, in the US the August industrial production print surprised to the upside at +0.6% mom (vs. +0.2% expected), as did manufacturing production (+0.5% mom vs. +0.2% expected). Given that Powell has previously flagged concerns about the manufacturing sector, this was a modest positive. The only other data release in the US was the September NAHB housing market index which rose 1pt to 68.

In Europe the only data worth noting was the September ZEW survey in Germany where the expectations component improved over 21pts to -22.5 (vs. -37.8 expected). That being said the current situation component did weaken over 6pts to -19.9 (vs. -15.0 expected). So a mixed survey.

In other news, it is worth flagging the unveiling of plans for a Dutch national investment fund for the economy. Finance Minister Hoekstra said in the budget that “we are going to investigate the possibilities for further investment in areas such as innovation, knowledge development and infrastructure” with details expected to be presented to parliament in early 2020. Various media reports in Holland suggested that the fund could be as much as €50bn (about 6% of GDP). As Mark Wall noted yesterday, this isn’t just a sign of follow through on Draghi’s plea for fiscal easing by those member states that can most afford it. With a public debt ratio close to 50% of GDP and a current account surplus of nearly 10%, the Netherlands would fit the bill. What’s more striking is that the Netherlands is one of the most fiscally conservative members of the Eurozone. So this could well put more pressure on Germany. Certainly one to watch.

Speaking of which, yesterday our economists in Germany published a report titled “A new ‘fiscal deal’ in Germany”. They note that there is talk that the climate package announced this Friday might amount to €40bn (until 2023 cumulatively). Technically, this might not be all additional spending but could also include higher climate related taxes and levies (possibly, it also includes expenditure items already earmarked elsewhere). Finally, implementation lags and bottlenecks lead the team to expect that expenditures will rise over time resulting in an amount likely below €10bn (at best 1/4 pp of GDP) for 2020. See their report here .

Looking at the day ahead, needless to say that all the focus will be on the Fed this evening. As for data, this morning the data includes August new car registrations for the Euro Area and final August CPI revisions for the UK and Euro Area. In the US the focus will be on the latest housing market data with August building permits and housing starts due. Away from that French President Macron is due to meet Italy’s Conte.

Tyler Durden

Wed, 09/18/2019 – 07:57

via ZeroHedge News https://ift.tt/2V3ZX8I Tyler Durden