S&P Says Global Auto Sales To Fall 2-3% This Year

The global automotive industry has been nothing short of a full fledged wreck over the last 12 to 18 months, with major markets like China, Europe and the U.S. all slipping as overextended consumers struggle to find the means necessary to purchase vehicles – even with interest rates worldwide near all time lows.

And according to S&P, it’s going to get far worse before it gets better.

S&P predicts that global light vehicle sales will fall by 2%-3% in 2019 and, to add insult to injury, there will be “no growth” throughout 2020 and 2021.

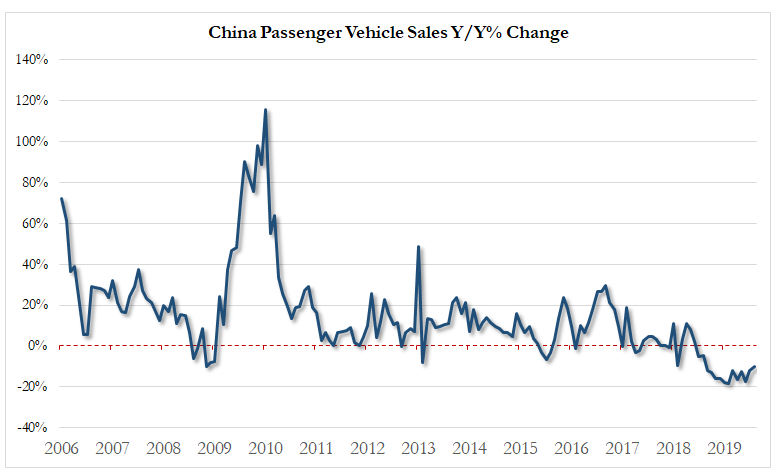

In a new research note out Tuesday, S&P says that sales in China will decline by 7%-9% this year and that U.S. sales will see a 3% decline. It also predicts a 2% drop for European sales for 2019.

The note’s base case assumptions for 2020 and 2021 are 0% to 1% growth in global light vehicle sales. S&P also expects weakness in “all market regions except China, which may see a modest rebound, not before 2021”.

S&P believes that manufacturers will grapple with margin erosion in the mass market segment and will struggle to pass through increased costs of connectivity, electrification and autonomous driving.

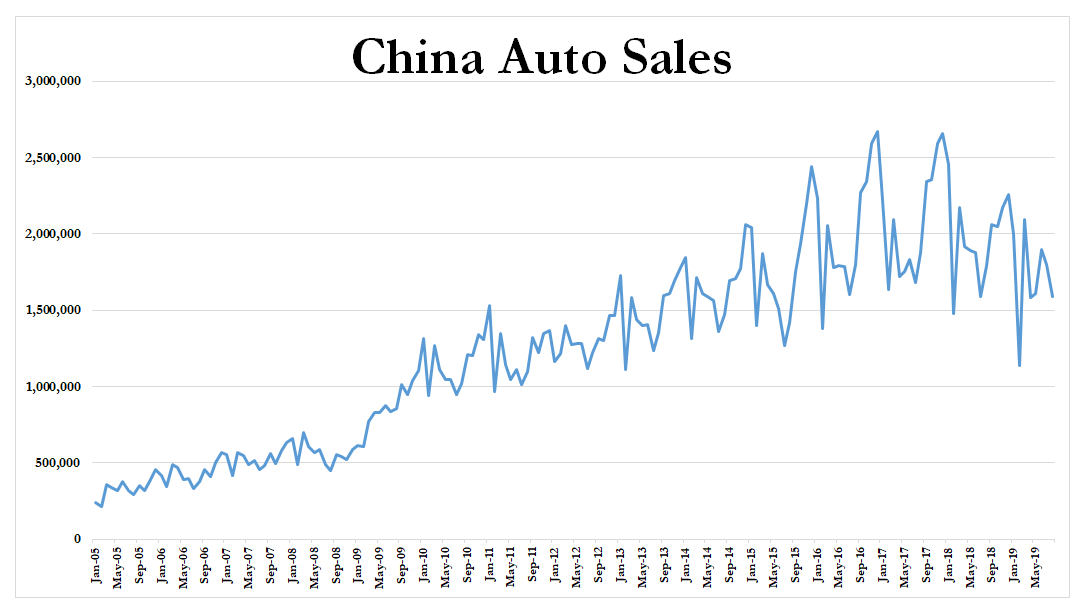

Days ago, we just noted that the world’s biggest auto market, China, plunged deeper into recession, with the country’s China Passenger Car Association releasing preliminary data for August that in no way indicates that the trend could be slowing.

The CPCA reported last week that sales of sedans, SUVs, minivans and multipurpose vehicles in August fell 9.9% to 1.59 million units.

It has been the industry’s largest downturn in three decades. China has tried to roll out several stimulus measures to help the industry, including loosening car purchase restrictions, but they have done little to encourage consumption thus far.

Top Chinese SUV maker Great Wall Motor Co. saw its first half profit lower by an astounding 59% and SAIC Motor Corp., China’s biggest automaker, also cut its sales forecast recently and predicted its first annual sales decline in at least 14 years. Geely Automobile Holdings Ltd. saw sales fall 19% in August.

U.S. auto sales have followed suit and are expected to continue to fall (formerly 2.2%, now 3%) in the back half of 2019. General Motors has found itself dealing with its first UAW strike in 12 years and now, the warning bells are also starting to be audible from Mexico. We noted this week that Mexico’s total export volume for August was crushed 12.7%.

It marks a sharp drop for one of the biggest exporters of vehicles in the world, according to new data from FreightWaves. Companies like Ford, Honda, Fiat-Chrysler, Toyota, BMW, GM, Kia, Mazda, Nissan, Volkswagen, and Audi all have manufacturing plants in Mexico.

Tyler Durden

Tue, 09/17/2019 – 21:25

via ZeroHedge News https://ift.tt/2LBeAgE Tyler Durden