“The Greatest Economy (N)Ever”: Gundlach’s Full Webcast Slides

Speaking during a webcast for his $54 billion DoubleLine Total Return Bond Fund, Jeff Gundlach repeated what we said earlier, namely that the spike in overnight repurchase agreements may prompt the Federal Reserve to expand its balance sheet, and in fact used the very phrase we did in our description of today’s repo operation: QE Lite.

“Is it an imminent disaster? No. The Fed is going to use this warning sign to go back to some balance sheet expansion,” Gundlach said, calling it a way of “baby stepping” to more quantitative easing while making it clear that today’s freeze up can only be viewed as a negative. Of course, if and when said baby step fails – and already banks are predicting that overnight repo will open at 4% tomorrow – the small step will become one giant leap for asset-holding kind as the Fed is “forced” to launch QE, just as ICAP’s clients said they expect it to do.

On Tuesday morning, for the first time in a decade, the Fed injected billions of dollars in cash into the markets Tuesday to stem the explosion in rates on one-day repos, which briefly peaked as high as 10%. The Fed is likely to start expanding its balance sheet to “try to free up the plumbing of the banking system,” Gundlach said.

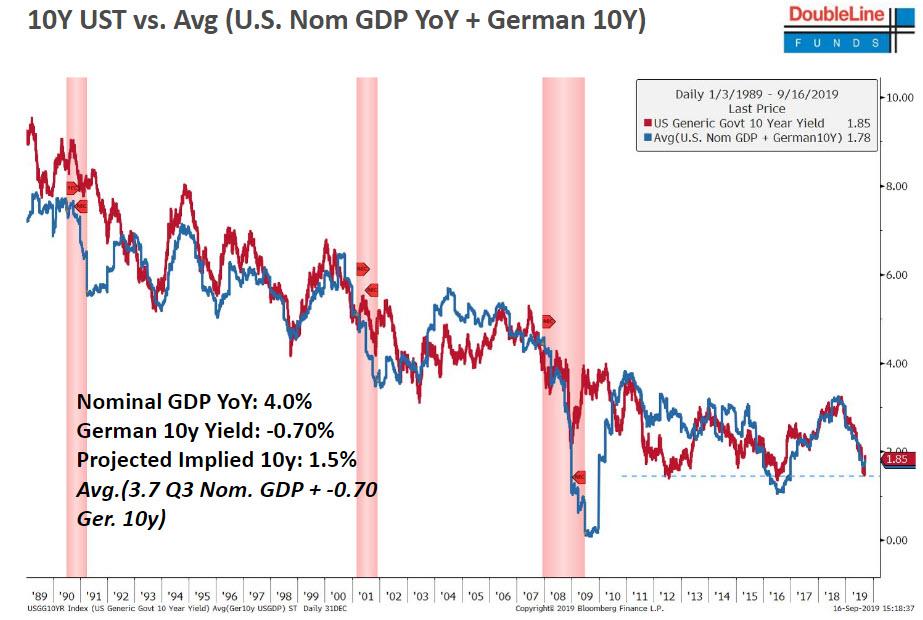

That said, and even as the market is 100% certain the Fed will cut rates by 25 bps tomorrow, Gundlach warned that “it’s not a great idea to be betting on lower interest rates”, adding that investors have probably seen the low of the year in benchmark 10-year yields, which on September 3 plunged to near record low of 1.42%. When asked if he would buy 10-year Treasuries now, his response was clear: “Absolutely not”, instead recommending to stay in shorter-duration, higher-quality assets.

Gundlach also said to hold off on buying more gold, and to wait for a price retracement, even as he sees 75% odds of a recession before the 2020 election.

In any event, Gundlach is certain of one thing: after the last communication debacle, where his “mid cycle adjustment” designation sent stocks tumbling, Powell – who Gundlach said reminded him of a “junior trader” and advised him to stop changing his message every six weeks – will probably say as little as possible at Wednesday’s meeting.

What else did Gundlach say in the presentation that was sarcastically titled “The Greatest Economy Ever”?

Among many other things – see his full presentation below – the DoubleLine CEO commented on the ongoing trade war with China, and put the chances of a U.S.-China trade deal before the 2020 U.S. presidential election at almost zero, saying that China has no incentive to do so before the election.

On rates, Gundlach said the bond market reflects two more Federal Reserve cuts in 2019 and one in 2020. As noted above, and as the market is well aware by now, he said there’s a high probability that the Fed cuts Wednesday.

Having long bashed the US dollar, Gundlach once again took aim at the greenback, saying that the next big move for the currency is down, and warned that when the next recession occurs the U.S. dollar and stocks will be in trouble, recommending investors to diversify into other currencies and markets.

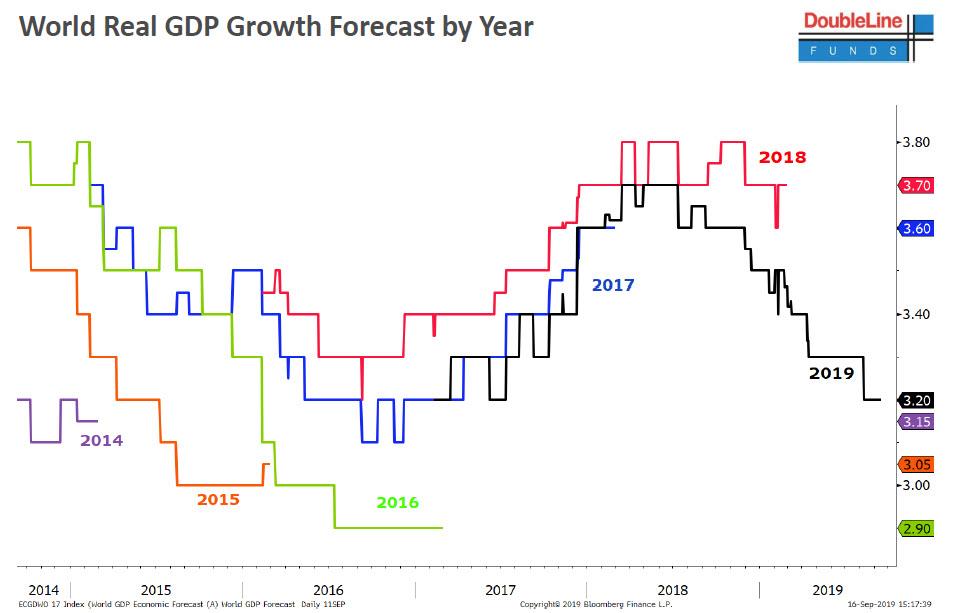

And since his view on the economy is that it is anything buy the “Greatest ever”, pointing out the sharp slump in 2019 global GDP projections…

… Gundlach put the odds of a recession before the 2020 election at 75%, predicting that once the recession hits, there will be an explosion in the national debt.

Additionally, as noted above, the fund manager has turned far less positive on gold in the short-term, although he did say that for a permanent portfolio position, gold should be held, even if “now is the time to be looking for a better buying opportunity in gold.”

Gundlach was far more pessimistic of corporate debt, which he once again said was the most vulnerable asset class, highlighting BBB-rated corporate bonds, i.e. soon to be fallen angels, as the most at risk (see Ford’s recent downgrade to junk), while adding that short-term sovereign debt is likely the least vulnerable.

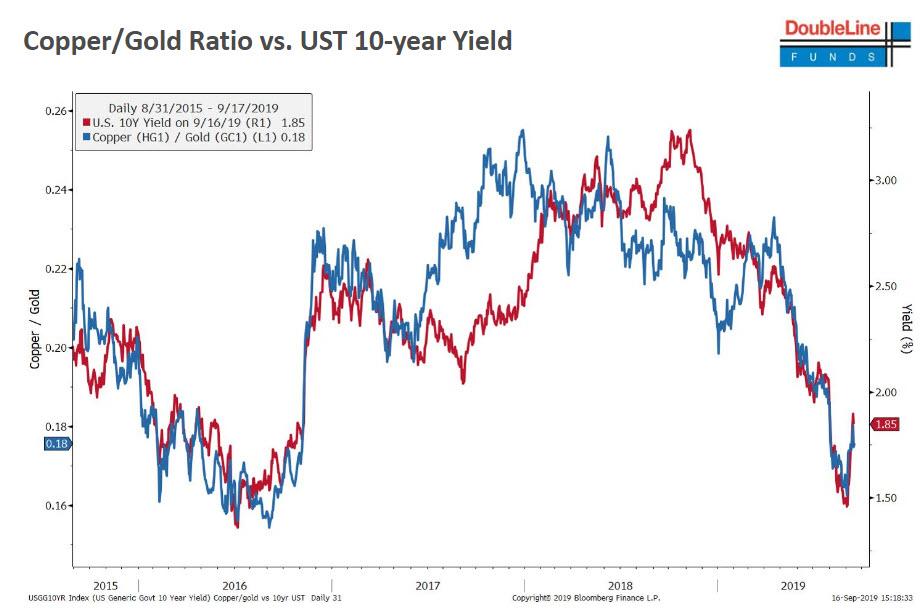

Gundlach also saved some space for his two favorite correlation trades: the copper/gold ratio vs the 10Y TSYs…

… and German/US GDP vs 10Y TSY yields.

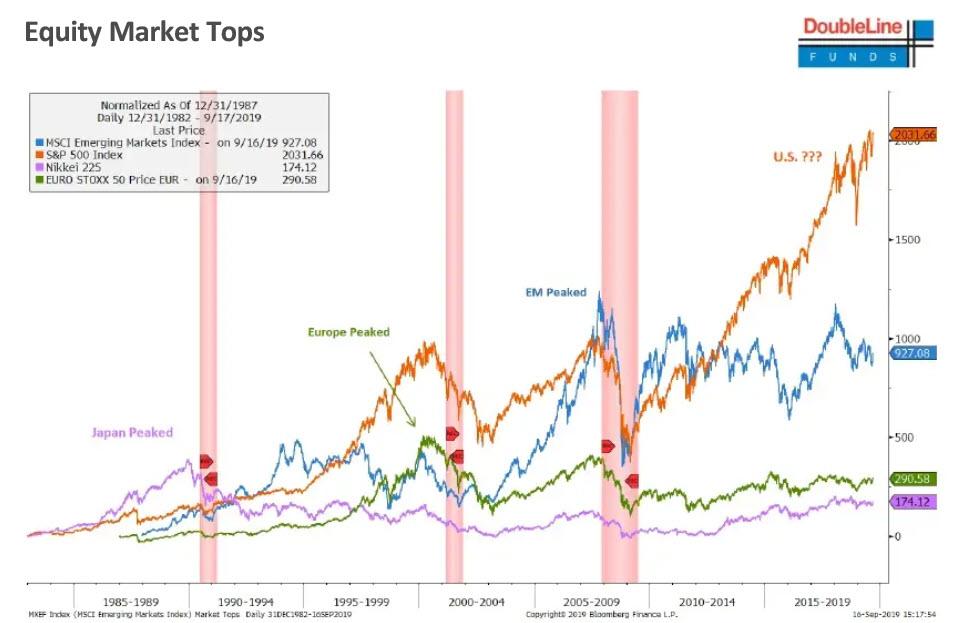

There was also the obligatory market doom slide:

Finally, he also touched on politics, where he took aim at his nemesis, Joe Biden, saying that if the primaries were held today, Elizabeth Warren would win the Democratic presidential nomination, and making it quite clear that “It’s not going to be Joe Biden.”

His full webcast presentation is below

Tyler Durden

Tue, 09/17/2019 – 20:25

via ZeroHedge News https://ift.tt/2QhNNKt Tyler Durden