“This Is The Most Alarming Trend In The Market”: 1 In 4 Luxury NYC Apartments Remain Unsold Over The Past 5 Years

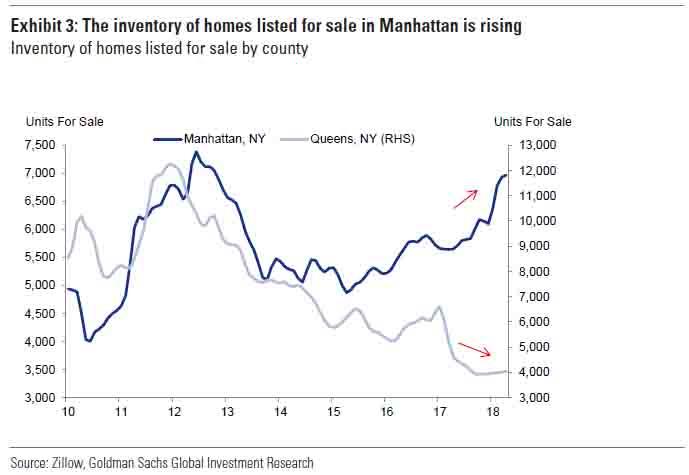

Across the US, but especially in coastal cities like New York and San Francisco, the ultraluxury property market increasingly looks like a buyers’ market. Ever since the market for condos peaked three years ago, it has been rapidly cooling off across the most popular urban markets.

We’ve been documenting this trend for a few years now, and according to a new report by the website StreetEasy that was cited by the New York Times this week, there are now more than 16,200 condo units across 682 new buildings completed in New York City that have appeared since 2013, and 25% remain unsold, roughly 4,050, most of them in luxury buildings.

The biggest difference between the the last recession and the conditions in today’s market are that projects aren’t stalling out today, perhaps due to the overabundance of cheap credit that has made virtually every unprofitable company into a “corporate zombie” which can continue existing largely thanks to record low interest rates.

“I think we’re being really conservative,” said Grant Long, StreetEasy’s senior economist, noting that the study looked specifically at ground-up new construction that has begun to close contracts. Sales in buildings converted to condos, a relatively small segment, were not counted, because they are harder to reliably track. And there are thousands more units in under-construction buildings that have not begun closings but suffer from the same market dynamics.”

Projects have not stalled as they did in the post-recession market of 2008, and new buildings are still on the rise, but there are signs that some developers are nearing a turning point. Already the prices at several new towers have been reduced, either directly or through concessions like waived common charges and transfer taxes, and some may soon be forced to cut deeper. Tactics from past cycles could also be making a comeback: bulk sales of unsold units to investors, condos converting to rentals en masse, and multimillion-dollar “rent-to-own” options for sprawling apartments — a four-bedroom, yours for just $22,500 a month.

In a city where brokers are accustomed to selling condos months, and even years, before construction is finished, this sudden freeze has left many confused as to the cause.

“That to me is the most alarming trend here,” said Mr. Long. “That’s the group of folks that could go away at any minute – if there’s a recession, people just want to put their money in Treasury bonds,” he said, referring to a lower-risk investment strategy.

What’s worse, a growing share of condos sold in recent years have been quietly re-listed as rentals by the investors who bought them, the NYT reports. Just how reluctant are buyers to try their hand at flipping? Of the 12,133 new condos sold in NYC between January 2013 and August 2019, 38% have appeared on StreetEasy as rentals.

But so far, the most impacted elements of the housing downturn in markets like NYC have been in the ultraluxury market. Over the past few years, Manhattan in particular kick-started the trend toward bigger, fancier apartments, which afforded foreign oligarchs and billionaires an easy, “no questions asked” way to park their ill-gotten gains. However, following a recent crackdown on anonymous purchases of trophy real estate coupled with the depressed market in commodities which has elimanted the Arab and Russian buyers, not to mention China’s aggressive crackdown on foreign outflows, Manhattan is now hurting the most.

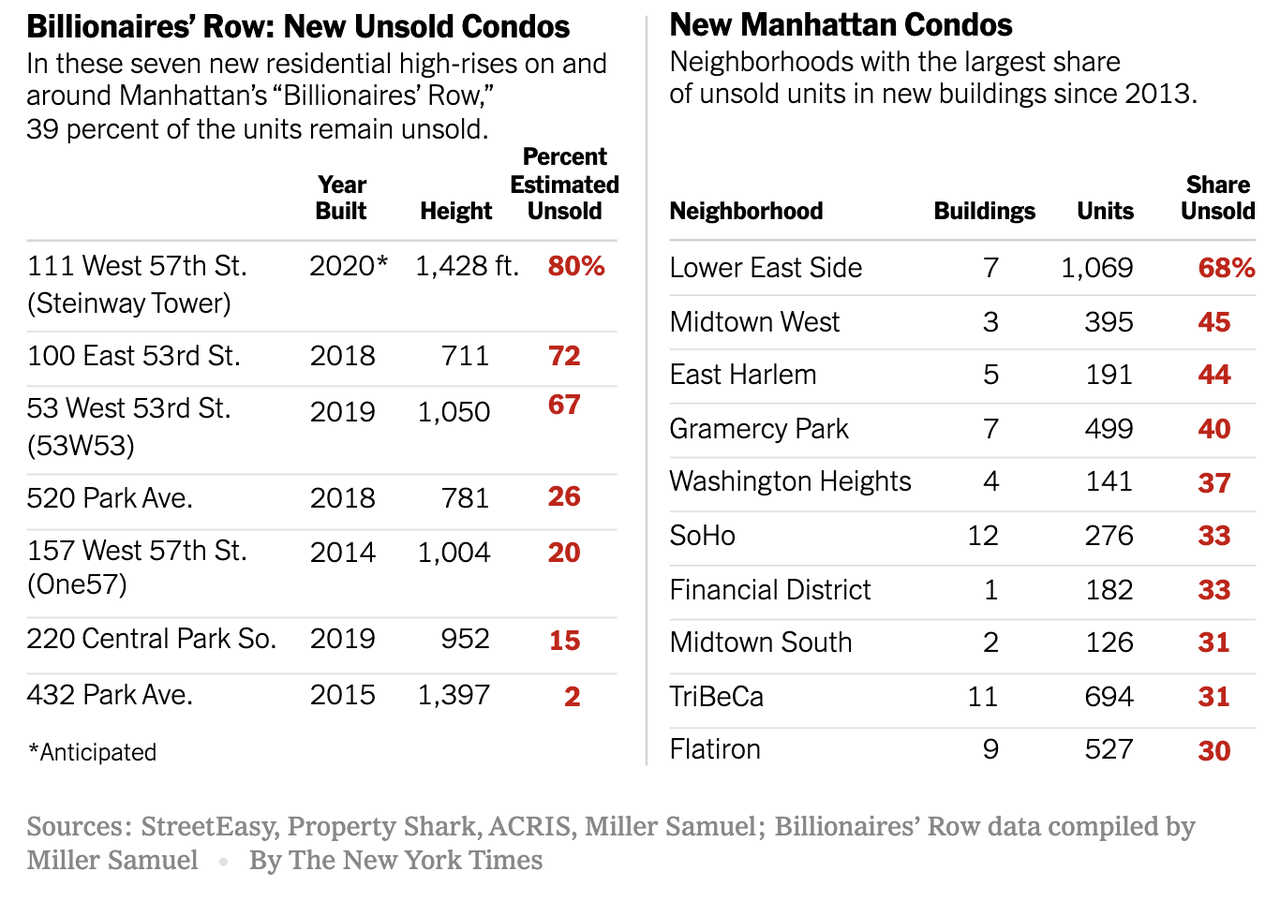

Take the super-tall One57 tower, completed in 2014 and considered the forerunner of Billionaires’ Row, a once largely commercial corridor around 57th Street in Midtown, which remains about 20% unsold, with 27 of roughly 132 multimillion-dollar apartments still held by the developer, according to Jonathan J. Miller, the president of Miller Samuel Real Estate Appraisers & Consultants.

“That’s mind-blowing,” Miller said, because the building actually began marketing eight years ago, in 2011, and a typical building might sell out in two to three years in a balanced market.

In an analysis of seven luxury towers on and around Billionaires’ Row, including pending sales, almost 40% of units remain unsold, Miller said. Another competitor, Central Park Tower, set to become the tallest and, by some measures, the most expensive residential building in New York, has not released any sales data.

One expert said the biggest difference between the last recession and today is that projects aren’t stalling out today. In a city where brokers are accustomed to selling condos months before construction is even finished, this sudden freeze in demand is particularly jarring for sellers.

“That to me is the most alarming trend here,” said Mr. Long. “That’s the group of folks that could go away at any minute – if there’s a recession, people just want to put their money in Treasury bonds,” he said, referring to a lower-risk investment strategy.

By Miller’s count, which includes buildings that are still under construction, there are over 9,000 unsold new units in Manhattan. (His estimate includes so-called “shadow inventory,” which developers strategically do not list for sale to hold off for a stronger market.) At the current pace of sales, it would take nine years to sell them – a daunting timeline that could be reduced if sales were to accelerate, but there are few reasons to expect such a surge in the short term, he said.

Tyler Durden

Sat, 09/21/2019 – 19:15

via ZeroHedge News https://ift.tt/2Nqosfb Tyler Durden