Dollar Shortage Eases But Banks Still Signal $66 Billion Funding Shortfall In Fed Repo Operation

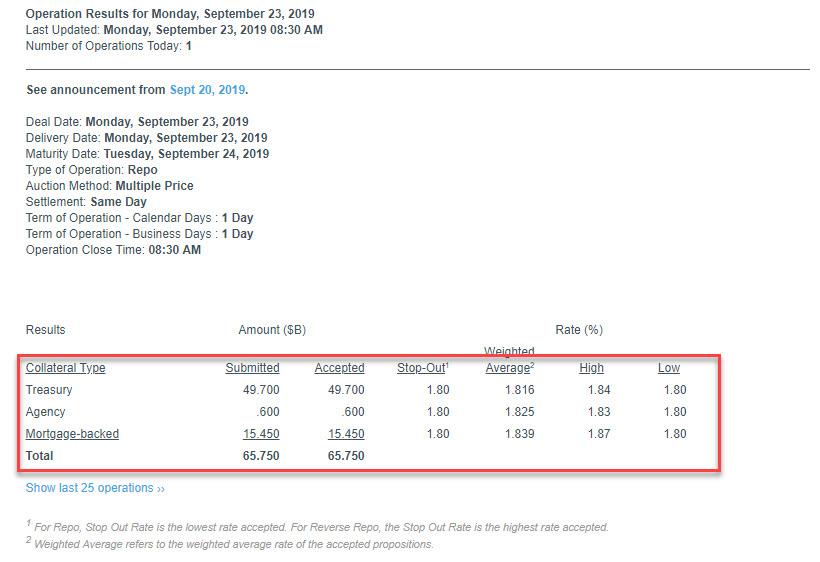

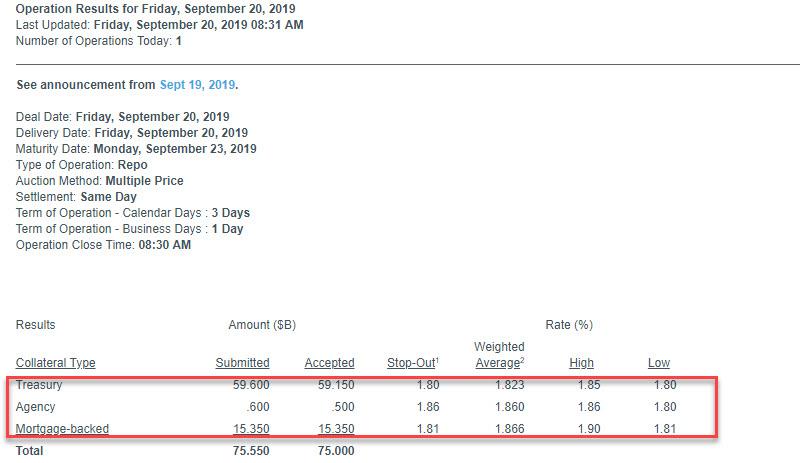

After announcing a barrage of emergency liquidity operations announced by the Fed late on Friday, including daily overnight repo ops, as well as three $30BN term repos to provide funding across quarter end – traditionally a time funding shortages – and into Q4, this morning’s $75BN repo operation showed clear signs of stabilization in the overnight funding market, when “only” $65.75 billion in collateral was accepted by the Fed in exchange for reserves, marking the first non-oversubscribed repo operation since Wednesday.

Specifically, the NY Fed announced that it had accepted $49.7BN in Treasurys, $0.6BN in Agency paper and $15.45BN in MBS all at the 1.80% IOER stop out rate (with the rate however rising as high as 1.84% on TSYs and 1.87% on MBS).

This was just under $10 billion less than Friday’s repo op, driven by a $10 billion drop in Treasury collateral parked at the Fed.

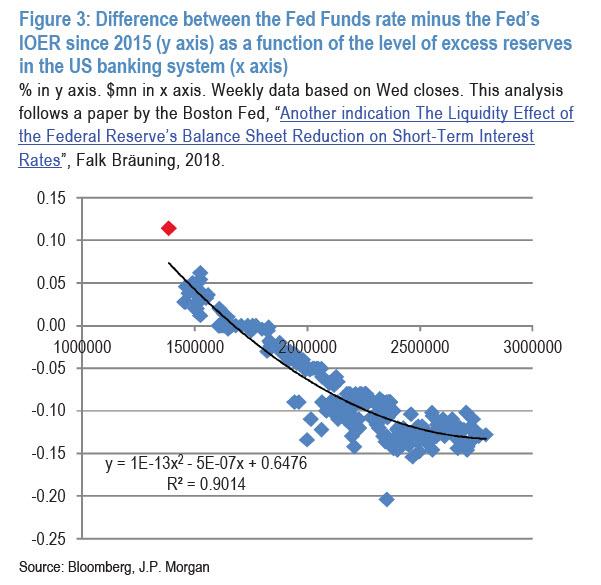

Still, what is worrisome is that almost a week after the widely cited catalyst of tax payments, and with the Treasury’s general account at the Fed already having been boosted to over $300 billion, the liquidity shortage persists even though numerous “experts” said this temporary phenomenon would faded entering this week. This, in turn, suggests that the troubles in the repo market are indeed a function of reserve scarcity, a topic we discussed extensively last night when we suggested that the Fed will need to inject about $400 billion in reserves, pushing the total up to $1.8 trillion, to normalize the Fed Funds -IOER spread.

And while there was no term repo operation scheduled today, one is coming tomorrow, which may indicate that the funding shortage will get worse as dealer will likely anticipate a shortfall of funding exiting the quarter.

Commenting on the ongoing turmoil in the repo market, Citi strategist Steve Kand said in a Friday note that while the Federal Reserve’s open market operations may help to alleviate funding market stress in the near-term, the plan is an “imperfect one” to shield against a rise in repo rates at quarter-end. Similar to our calculations, Citi estimated the in total the repo market needs roughly $200BN to reduce GC volatility over quarter-end and offset the effects of a decline in reserves, Treasury auction settlements and quarter- end netting, reminding that these same three issues were in play in December 2018, when GC rose above 5%.

Looking ahead, Citi expects reserves to decline by around $100BN on Sept. 30, as Treasury’s cash balance will increase by $50b, the Fed’s RRP facility tends to increase by around $40b, and foreign RRP balances have been rising, with Citi estimating another $10b increase. Meanwhile, on Sept 30, the gross Treasury supply is expected to be $113bn.

In short, the quarter-end rate will likely climb, as DTCC GC repo demand rises in lieu of tri-party, given the increase in netting needs.

Finally, Citi joined the bandwagon consensus spearheaded by Bank of America, Nomura, JPMorgan, Goldman and, last but not least, Simon Potter, in concluding that the Fed is likely to transition to permanent open market operations after the October FOMC, which depending on one’s semantic disposition may or may not be defined as QE4; until then, the central bank will experiment with “flexible OMOs” to get a better sense of the amount of “necessary intervention.”

Tyler Durden

Mon, 09/23/2019 – 08:52

via ZeroHedge News https://ift.tt/2kQlzrs Tyler Durden