US Futures, Global Markets Slide As Europe Careens Into A Recession

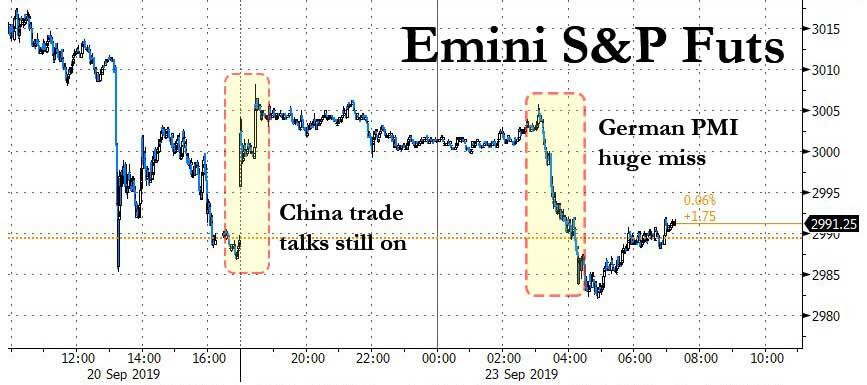

The overnight trading session has been a tale of two halves, with the start of the session marked by sharply higher futures, following this weekend’s news that China’s canceled trip to Montana and Nebraska was made at the request of the US, and not as traders first assumed, by a negative turn in the lower-level discussions held in Washington last week. However, the early optimism quickly crashed after Germany reported the latest PMI data, which missed across the board, printing at 7 year lows, and was – in the words of Phil Smith, Principal Economist at IHS Markit, “simply awful.” (And it’s not just Germany: French PMIs were ugly too, missing across the board).

The result was an instant shift in risk sentiment, as not only is the German manufacturing recession getting worse, but the Services PMI also dropped, dragging the composite below 50 for the first time in seven years…

… slamming US equity futures, which hit session lows shortly after the German print…

… sending most global markets promptly into the red.

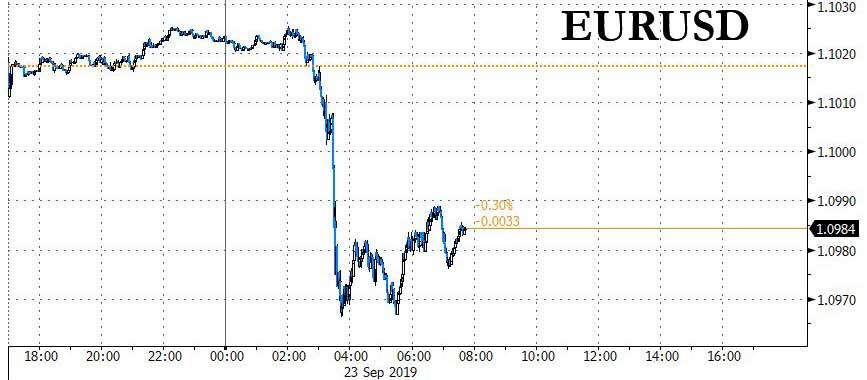

… and slamming the EURUSD back under 1.10

The Stoxx Europe 600 Index extended losses and European bonds rallied. Monday’s abrupt sentiment reversal followed the worst session for US equity indexes in about two weeks on Friday – ending a three-week run of gains – after a Chinese agriculture delegation canceled a visit to Montana, dampening optimism about the trade talks. Stock markets had been buoyed earlier in the week by the Federal Reserve’s decision to cut interest rates for the second time in 2019, joining other central banks around the world in easing monetary policy.

The gloomy European data was a stark reminder to investors of the fragility of the global economy. While markets remain on edge ahead of next month’s planned high-level trade talks between the U.S. and China, they’re also fixated on any action or messaging from the world’s major central banks that could support growth. A slew of policy makers will speak this week.

“Global growth risks are rising,” Beverley Morris, director of rates and inflation at QIC Ltd. in Brisbane, told Bloomberg TV. “It’s certainly not panic stations at this stage, but certainly in terms of our portfolio actions, we are being more cautious.”

Asian stocks edged lower, led by technology firms, as investors gauged South Korea’s export slump as well as the twists and turns of China-U.S. trade talks, with Tokyo shut for a holiday. Markets in the region were mixed, with India jumping and China retreating. The Shanghai Composite Index dropped 1%, dragged by large banks and insurers. China’s cancellation of a planned visit to farms in the American heartland was done at the request of the U.S., people familiar with the matter said. Equities in India continued a surge, with the Sensex surging as much as 3.8%, set for its biggest two-day rally in 10 years, amid optimism that the government’s $20 billion company tax cut will revive growth. HDFC Bank and ICICI Bank were among the biggest boosts. The Kospi closed little changed, as South Korean exports headed for a 10th monthly slide amid flagging chip sales

In FX, the Bloomberg Dollar index climbed then pared gains as the U.S. and China continued to engage in discussions to overcome trade differences. The euro fell sharply and global bonds rallied after German manufacturing suffered its worst downturn since the financial crisis. Sterling slipped as U.K. Prime Minister Boris Johnson cautioned against the chances of a Brexit breakthrough when he meets with key European leaders in New York. The onshore yuan fell amid caution in the run-up to next week’s national holidays. The Korean won sank as exports continued to deteriorate.

In rates, U.S. Treasuries advanced for a sixth day with the 10-year yield sliding to its lowest since Sept. 12, dropping to 1.68%.

Oil fluctuated following a report that full repairs to Saudi facilities hit by a drone attack may take many months. Brent fell below $64 a barrel on Monday, reversing an earlier gain, pressured by the prospect of a faster-than-expected full restart of Saudi Arabian oil output and by fresh signs of European economic weakness. It was up earlier in the session, supported by scepticism over how fast output would come back.

“Oil prices are tracking European markets lower this morning, understandably knocked by the woeful manufacturing data from the bloc and the implications for global growth and demand,” said Craig Erlam, analyst at OANDA. Brent has still gained about 18% this year, helped by a supply-limiting pact led by the Organization of the Petroleum Exporting Countries, although concern about slowing economic growth has limited the advance.

Expected economic releases include PMIs. Cantel Medical is reporting earnings. Also on the radar is a speech by Federal Reserve Bank of New York President John Williams at the 2019 U.S. Treasury Market Conference at 9:50 a.m. ET.

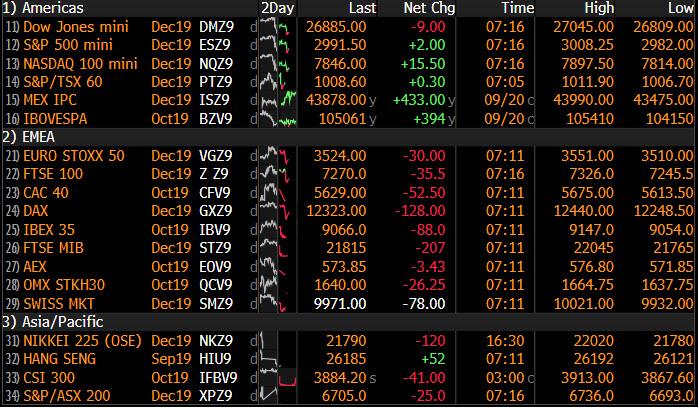

Market Snapshot

- S&P 500 futures down 0.2% to 2,983.00

- MXAP down 0.06% to 159.29

- MXAPJ down 0.3% to 509.64

- Nikkei up 0.2% to 22,079.09

- Topix up 0.04% to 1,616.23

- Hang Seng Index down 0.8% to 26,222.40

- Shanghai Composite down 1% to 2,977.08

- Sensex up 3.1% to 39,197.38

- Australia S&P/ASX 200 up 0.3% to 6,749.72

- Kospi up 0.01% to 2,091.70

- STOXX Europe 600 down 1% to 388.85

- German 10Y yield fell 5.9 bps to -0.58%

- Euro down 0.3% to $1.0980

- Italian 10Y yield rose 3.7 bps to 0.582%

- Spanish 10Y yield fell 7.3 bps to 0.163%

- Brent futures up 0.4% to $64.51/bbl

- Gold spot up 0.2% to $1,519.44

- U.S. Dollar Index up 0.2% to 98.74

Top Headline News from Bloomberg

- Germany’s private sector is suffering its worst downturn in almost seven years as a manufacturing slump deepens, raising pressure on the government to add fiscal stimulus; a Purchasing Manager’s Index fell to 49.1 in September from 51.7 a month earlier, according to IHS Markit; the reading was worse than economists predicted and the lowest since October 2012

- China’s cancellation of a planned visit to farms in America was done at the request of the U.S., people familiar with the matter said, indicating it wasn’t caused by a negative turn in the lower- level discussions held in Washington last week; trade groups from the two nations held “constructive” talks during Sept. 19-20, China’s Ministry of Commerce said Saturday

- Thomas Cook Group Plc collapsed under a pile of debt after talks with creditors failed, forcing the British government to charter planes to bring home more than 150,000 of the storied travel provider’s stranded customers; trading in Thomas Cook’s stock was suspended in London and its euro bonds plunged 72%

- Deutsche Bank AG completed a deal with BNP Paribas SA to transfer its prime brokerage business to the French bank as part of the German lender’s biggest overhaul in recent history

- U.K.’s Johnson will start a week of intense diplomacy on Monday, as he tries to push for a Brexit deal on the sidelines of the United Nations General Assembly in New York

Asian equity markets were mixed following the negative close last Friday on Wall St. amid temperamental US-China trade headlines, while the absence of Japanese markets also contributed to the lacklustre tone. ASX 200 (+0.3%) was positive with the index led higher by the commodity related stocks after gold advanced above the USD 1500/oz level and with oil underpinned by reports it could take 8 months for Saudi output to return to normal, while India’s NIFTY (+2.9%) outperformed again after the recent corporate tax cut announcement. Conversely, weakness in Hang Seng (-0.8%) and Shanghai Comp. (-0.8%) dampened sentiment in the region with underperformance in the mainland as ongoing trade uncertainty overshadowed the liquidity efforts by the PBoC. This followed conflicting reports in which US President Trump stated Chinese agricultural purchases will not be enough and reiterated that he does not need a deal before the 2020 election although it was also reported the US granted temporary tariff exemptions on over 400 types of Chinese products, while China’s delegation cancelled its US farm visit but this was later attributed to concerns it could turn into a media circus or may be misconceived as meddling and was not due to a breakdown in trade talks

Top Asian News

- Bond Traders in India Caught Out by Surprise Fiscal Flip Flop

- Israel Arabs Back Bid by Netanyahu’s Rival to Unseat Premier

Major European bourses are lower (Euro Stoxx 50 -1.0%), after disappointing PMI data stoked further concerns about the slowdown in Eurozone growth. The DAX (-1.2%) is the notable underperformer, slipping briefly below last week’s low and recent support at 12300, after German manufacturing PMI data pointed to the sector falling further into contractionary territory. Amid the risk off sentiment, utilities (+0.1%), consumer staples (+0.2%) and health care (unch.) sectors are supported, while materials (-1.6%), financials (-1.7%) and tech (-1.4%) are softer. Bucking the general risk tone are European airlines, including TUI (+7.5%), Ryanair (+1.1%) and easyJet (+3.5%), who are higher after rival Thomas Cook ceased trading activities and filed for bankruptcy. In terms of individual movers; William Hill (-4.0%) reversed early gains, despite premarket news that the Co. is looking for US broadcaster deals in an attempt to promote its brand. Elsewhere, K+S (-5.7%) sunk after being downgraded at Pareto Securities. Ocado (+0.2%) managed to reverse losses on triggered by news that the Co’s Chairman stated they “will go to any length” to protect their intellectual property, amid a court battle with a co-founder. Finally, ABN AMRO (-3.5%) is under pressure after being downgraded at Santander.

Top European News

- Germany May See No Growth This Year as Manufacturing Slumps

- Euro- Area Economy Comes Close to Stalling as Factories Suffer

- Vonovia Becomes Sweden’s Biggest Landlord With $1.3 Billion Deal

- Has Poland’s Government Become a Threat to Business?

In FX, further concerns about the European economy have weighed on the Euro in early trade as the latest flash PMIs out of the region deteriorated significantly vs. expectations. Germany’s release took EUR/USD below the 1.100 level with IHS noting that on its current trajectory, Germany may not see any growth before year-end, whilst VDMA added further pessimism to the German economic outlook. Further, the EZ release did little to immediately sway asset classes as participants anticipated a softer pan-release, but IHS highlighted that Q3 EZ GDP growth looks set to rise just 0.1%. Analysts at CapEco highlighted concerns regarding manufacturing contagion on the services sector whilst noting that a continuation in the employment component could lead to further easing in wages. Thus, the analysts believe that “there is little reason to think that GDP growth will pick up as the ECB and the consensus forecasts assume”. EUR/USD took out Friday’s low and a Fib level around 1.0995-97 to print a base at 1.0967 ahead of support at 1.0966 and 1.0950 (YTD low at 1.0924). Next up, participants will be eyeing ECB President Draghi’s final testimony to the European Parliament at 1400BST. Meanwhile, the Buck has derived support in light of a weaker Single Currency as DXY extends its gains above 98.50 to a high of 98.84 and ahead of the psychological 99.00 and resistance at 99.10. On the docket State-side, traders will be on the lookout for a few Fed speaks including Williams (voter, neutral) at the US Treasury Market Conference at 1450BST, Bullard (voter, dove, dissenter) on monetary policy at 1800BST and Daly (non-voter, neutral) on supporting US economy in urban & rural communities.

- GBP, CAD – Weaker on the day, albeit more on the back of a firmer USD with Brexit-watchers still on the lookout for the Supreme Court’s decision on PM Johnson’s parliament prorogation. If ruled against (as legal experts expect), then the PM could be forced to recall MPs back to parliament. Cable remains marginally softer below the 1.2450 level (vs. high of 1.2490) after finding a base at 1.2424, which marks the lowest since 17th September (although that day saw a low of 1.2393). The Loonie also takes a spot as a G10 laggard, but mostly pressured by a retreat in oil prices as the post-PMI sentiment seeped into the energy complex. USD/CAD hovers around the 1.3300 handle (vs. low of 1.3257) with resistance seen to the upside at 1.3305 (200 DMA), 1.3346 and the psychological 1.3350 levels.

- CHF, JPY – Marginally firmer amid a weakening EUR and flights to safety post-EZ PMI with USD/JPY back below the 107.50 level to a low of 107.30 ahead of support at 107.10, whilst EUR/CHF trades flat on the day but fell from an intra-day high of 1.0930 (50 DMA) to a base just above 1.0850 (with support and YTD low at 1.0809). Attention remains on the 1.08 level amid the recent rise in SNB total sights deposits with TD noting that the data suggests the SNB may be defending the level.

- AUD, NZD – The antipodeans remain above water with the Kiwi outperforming its Tasman-peer ahead of this week’s RBNZ Monetary Policy Decision amid consensus for an unchanged Cash Rate at 1.00%, following its unexpected rate cut at its prior meeting, whilst the Shadow Board also recommends no change in policy. The currencies seem to have also derived some support from the US-China trade saga with Chinese state media noting that talks are constructive, and that the cancelled China visit to US farms was not a sign of deteriorating talks. NZD/USD hovers near intra-day highs (0.6277) after finding a base at 0.6250 whilst its Aussie counterpart remains above 0.6750, albeit off highs (0.6780).

In commodities, oil prices continued to come off its earlier highs, as focus shifted from the prospect of a more protracted disruption to Saudi Aramco supply than expected (which helped prices over the weekend) to concern over global growth, after more abysmal Eurozone PMI data triggered a bout of selling in the complex. Downside was exacerbated soon thereafter on source reports that Saudi Arabia’s Khuraris and Abqaiaq facilities are to fully restore oil production early next week (form current production levels of around 4.3mln BPD), contrary to WSJ reports over the weekend that repairs could take up to 8 months. WTI Nov’ 19 futures slumped through last week’s lows around the USD 58/bbl handle, before finding a base at USD 57.40/bbl, while Brent Nov’ 19 fell below the USD 64/bbl handle, although last week’s USD 63.06 low is still some way off. Gold prices are higher, despite opening on the back foot (on weekend reports that Chinese agriculture officials didn’t end their US trip early due to trade talk difficulties) and a firmer buck, with negative risk sentiment exacerbated by the aforementioned Eurozone PMIs helping to lift the precious metal; spot gold continues to climb from its recent USD 1500/oz base. On the flip side, global demand concerns are keeping copper prices under pressure.

US Event Calendar

- 8:30am: Chicago Fed Nat Activity Index, est. 0, prior -0.4

- 9:45am: Markit US Manufacturing PMI, est. 50.4, prior 50.3

- 9:45am: Markit US Services PMI, est. 51.5, prior 50.7;

- 9:45am: Markit US Composite PMI, prior 50.7

DB’s Jim Reid concludes the overnight wrap

As astronomical autumn arrives today in the Northern hemisphere its apt that I got my wellies out yesterday for the first time in a few months after a fair bit of rain. Winter is coming. Also on ordering groceries online last night I got a bit of a shock as they have now started to sell mince pies in time for Xmas. Only 92 days left and just under 8 million seconds. It’ll be here before you know it.

After the central bank frenzy of the last 10 days, the next few days should be somewhat lighter for news flow for markets. Data highlights include the preliminary global September PMIs (today), the German IFO (tomorrow), and the US Conference Board’s consumer confidence reading (tomorrow) and UoM equivalent (Friday) with the spread between the two of notable interest as it has been a lead indicator of the cycle in the past (see below). From central banks, we have ECB President Draghi’s final “Monetary Dialogue” before the European Parliament’s Economic and Monetary Affairs Committee (today), along with a number of other key speakers, especially from the Fed. Finally, we should hear the outcome of the UK Supreme Court Case on the prorogation of Parliament, while world leaders will be gathering at the UN General Assembly.

In a little more detail now, the key data highlight this week will be the preliminary September PMIs today (Japan tomorrow due to a holiday) with the big question continuing to be how and when the divergence between manufacturing and services will end. As an example the Euro manufacturing PMI has been in contractionary territory since February, while the services PMI has shown consistent growth over that period. The consensus expectation is for this divergence to narrow modestly, with the manufacturing Euro PMI rising three-tenths to 47.3, with the services PMI falling two-tenths to 53.3. The German manufacturing PMI will be of particular interest, which last month was at 43.5, and has been below 50 for the entire year so far.

Speaking of Germany, another key highlight will be the Ifo business climate survey tomorrow. In August, the indicator fell to 94.3, its lowest level since November 2012, while the expectations reading fell to 91.3, the lowest since June 2009. Nevertheless, the consensus expectation is for a rebound in both this month, with the business climate indicator expected to rise to 94.6.

With respect to US economic data, Tuesday’s consumer confidence report (132.0 forecast vs. 135.1 previously) and Friday’s University of Michigan consumer sentiment survey (92.0 final vs. 92.0 preliminary) will provide further information on the consumer outlook. As our economists have pointed out, as of August, the spread between the level of the two surveys was at an all-time high, which as their recent research has highlighted, may be sending a concerning signal even though on the surface the levels of both series remain elevated (see ” Yield curve inversion signals recession…(consumer) surveys say? ” ).

Another one to also watch out for is the third estimate of Q2 US GDP, although expectations are for the annualised rate to remain unchanged from the second estimate, at +2.0%. Meanwhile on Friday we’ll also see personal income and personal spending data for August, along with the preliminary durable goods orders reading.

There are a number of central bank speakers this week kicking off today with ECB President Draghi appearing before the European Parliament’s Economic and Monetary Affairs Committee, in his last “Monetary Dialogue” before his eight-year term ends on 31 October Other speakers this week include Bank of Japan Governor Kuroda and Federal Reserve Vice-Chairs Quarles and Clarida, while the Bank of Mexico will be making its latest policy decision. Within the Fed Bullard (voter/dove – wanted 50bps last week) and Daly (nonvoter/dove) will also be making appearances later on today, and Chicago’s Evans (voter/dove) will follow on Wednesday.

Turning to politics, the UK Supreme Court is expected to rule on the case over the prorogation of Parliament early this week according to the Supreme Court President. An update on timing is likely today. It’s also the Labour Party Conference, which is taking place currently until Wednesday, ahead of the Conservative Party Conference the subsequent week. The Labour Party are still fighting over a coherent Brexit strategy which further complicates potential scenarios going forward as it doesn’t seem to be working for them in recent opinion polls. Labour party leader Corbyn said that his party is pledging to hold a second referendum on Brexit if it’s elected to government, pitting ‘Remain’ against a “credible” deal he negotiates with the EU but without saying which side he’d campaign for. Elsewhere in politics, the annual General Debate of the UN General Assembly begins on Tuesday, with a number of world leaders expected to appear.

Overnight we got some fresh trade headlines with Bloomberg reporting that Chinese Vice Premier Liu He plans to visit Washington in the second week of October to meet Lighthizer and Treasury Secretary Steven Mnuchin for high-level negotiations while adding that the two sides are aiming for a high-level meeting around 10th October. Earlier, the USTR’s office said in a statement that the US and Chinese negotiators held “productive” talks on Thursday and Friday in Washington with China’s Ministry of Commerce also calling the meetings “constructive,” and said both sides agreed to continue communications on relevant issues. On Friday, President Trump said he wasn’t interested in “a partial deal” with China based on Beijing increasing its purchases of US agricultural products. Trump added that he wouldn’t relent without reaching a “complete deal” with China.

This morning in Asia markets are largely heading lower with Chinese markets leading the declines – the CSI (-1.49%), Shanghai Comp (-1.31%) and Shenzhen Comp (-1.43%) are all down over 1%. The Hang Seng (-0.86%) and Kospi (-0.15% are also down while Japanese markets are closed for a holiday. Indian stock markets are up another 2% this morning after advancing c.5% on Friday, the largest gain in the last 10 years, as the country lowered the corporate tax rate to 22% from 30%. Elsewhere, futures on the S&P 500 are up +0.38% while oil prices are up c. 1% this morning following WSJ reports that full repairs to Saudi oil fields hit by the drone attack may take many months.

To recap last week, the S&P 500 pared gains on Friday to end the week down -0.51% (-0.49% Friday) after Chinese trade negotiators cancelled a visit to US farmers and President Trump also said he didn’t need a deal before the election next November. Over the weekend there were reports that the cancelled trip to US farm states was not due to trade related issues and that the trip will be rescheduled. That news came too late to rescue markets last week as the trade-sensitive Philadelphia semiconductor index was particularly impacted, ending the week down -2.66% (-1.83% Friday), while Treasuries made gains for a 5th consecutive session following the news to end the week -17.4bps (-6.3bps Friday). The moves come ahead of what the US Trade Representative’s Office describes as “principal-level meetings” planned for October. The news came out after the European close, where the Stoxx 600 had gained +0.30% (+0.29% Friday) to advance for the 5th consecutive week.

Of course the other main market moves of last week came from oil, where further developments came on Friday as the US moved to sanction Iran. New measures were announced on the country’s central bank and its sovereign wealth fund, with President Trump describing them as “the highest sanctions ever imposed”. Brent Crude ended the week +6.74% (-0.19% Friday), the biggest weekly advance since January (even if it was up c.20% at Monday’s Asian open), while WTI Oil ended the week up +5.91% (-0.07% Friday). Energy stocks were the major beneficiaries, with the STOXX Oil & Gas index in Europe ending the week +4.46% (+1.69% Friday), its strongest weekly performance since July 2016.

The flight to safety amidst the geopolitical and trade developments supported safe haven assets, with gold snapping a run of 3 successive weekly declines to close +1.91% (+1.19% Friday), while 10-yr bund yields fell -7.3bps (-1.5bps Friday).

Amidst the stresses in US repo markets last week, which saw the effective federal funds rate move well outside the FOMC’s target range at one point, it was announced on Friday that there will be overnight repo operations daily of at least $75bn through October 10, as well as three 14-day term repo operations of at least $30bn each taking place next week. Two-year dollar swap spreads had hit a record low on Thursday, but widened after the New York Fed announced the operations. If you want to read more on this see DB’s Steven Zeng’s note ” Repo stress: a problem of too many collaterals, not a scarcity of reserves “.

A further interesting development on Friday came from Germany, where the government unveiled a €54bn package of measures to deal with climate change, which includes measures such as a carbon price of €10 per ton in 2021 for the transport and heating sector, rising to €35 per ton in 2025. However, Chancellor Merkel said that Germany would stick with the “black zero” policy of no deficit spending. Our German economists (link here ) write that the net fiscal impact next year will be 0.25% of GDP at best, disappointing those who hoped it would have been a “counter-cyclical package by stealth.”

As for the latest on Brexit, sterling weakened -0.18% against the dollar last week (-0.38% Friday) as negative comments on Friday from the Irish foreign minister, Simon Coveney, undermined hopes that a deal would be reached. Coveney said that “we need to be honest with people and say we’re not close to that deal right now.” Furthermore, Sky News reported that a leaked document from the European Commission said that the UK’s proposals failed to offer “legally operational solutions” to the Irish backstop. All this comes as the UK Supreme Court are going to be publishing their ruling this week in the case on the prorogation of Parliament.

Tyler Durden

Mon, 09/23/2019 – 07:59

via ZeroHedge News https://ift.tt/2kwrgup Tyler Durden