“Billionaires Shouldn’t Exist”: Bernie Proposes Tax To Cut Billionaire Wealth In Half

After spitting venom at millionaires until he became one, Sen. Bernie Sanders (I-VT) has a new target: billionaires.

On Tuesday, Sanders rolled out an ‘ambitious’ plan to tax the nation’s ultra-rich, going far beyond his Democratic primary rival Elizabeth Warren’s proposed wealth tax with what Sanders says would cut American billionaires’ fortunes in half over 15 years.

while Ms. Warren came first, Mr. Sanders is going bigger. His wealth tax would apply to a larger number of households, impose a higher top rate and raise more money.

Mr. Sanders’s plan to tax accumulated wealth, not just income, is particularly aggressive in how it would erode the fortunes of billionaires. His tax would cut in half the wealth of the typical billionaire after 15 years, according to two economists who worked with the Sanders campaign on the plan. Mr. Sanders would use the money generated by his wealth tax to fund the housing plan he released last week and a forthcoming plan for universal child care, as well as to help pay for “Medicare for all.” –NY Times

Sanders’ plan would impose a graduated tax of 1% on assets over $32 million, 2% for households worth $50 – $250 million, 3% from $250 million to $500 million, 4% from $500 million – $1 billion and finally 8% on wealth over $10 billion. Over a decade, the tax would raise an estimated $4.35 trillion (less whatever can’t be recovered from all the money quickly funneled into offshore trusts).

Moreover, the estate tax rate would begin at 45% for assets over $3.5 million, rising to 77% for those with over $1 billion – a proposal which Sanders says would apply to 0.2% of the population.

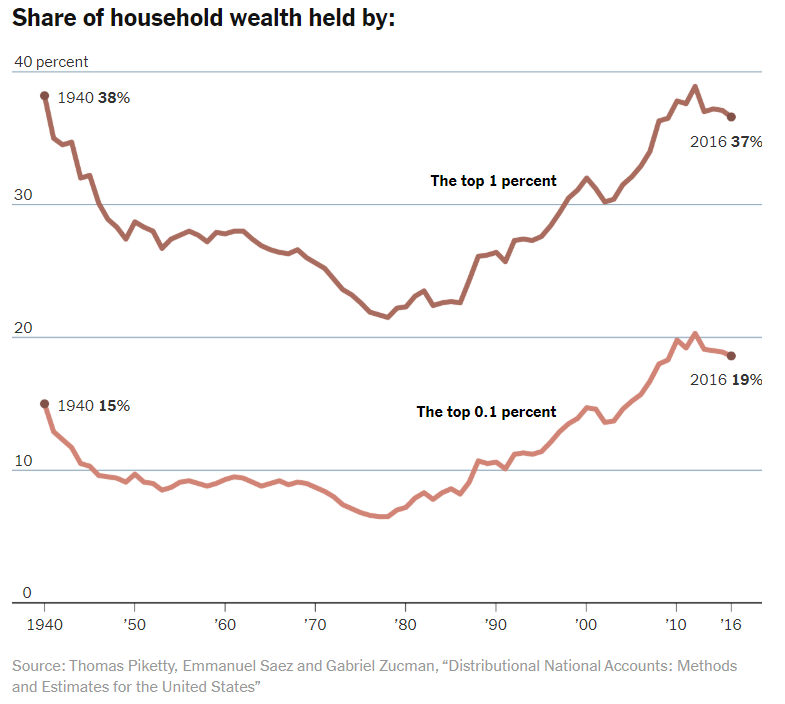

Sanders’ campaign said his wealth tax would slash U.S. billionaires’ wealth in half in 15 years, “which would substantially break up the concentration of wealth and power of this small privileged class.”

“Enough is enough,” Sanders, a Vermont senator, said in a statement. “We are going to take on the billionaire class, substantially reduce wealth inequality in America and stop our democracy from turning into a corrupt oligarchy.” –Bloomberg

“Let me be very clear: As president of the United States, I will reduce the outrageous and grotesque and immoral level of income and wealth inequality,” Sanders told the Times, adding “What we are trying to do is demand and implement a policy which significantly reduces income and wealth inequality in America by telling the wealthiest families in this country they cannot have so much wealth.”

Asked if he thinks billionaires should exist in America, Sanders said “I hope the day comes when they don’t,” adding “It’s not going to be tomorrow.”

2015: MILLIONAIRES ARE EVIL

2016: MILLIONAIRES AND BILLIONAIRES ARE EVIL

2017: MILLIONAIRES AND BILLIONAIRES ARE EVIL

*becomes millionaire*

2019: BILLIONAIRES ARE EVIL pic.twitter.com/qS6dmL8VIN

— Razor (@hale_razor) September 24, 2019

As the Times notes, “As appealing as a wealth tax might sound for the party’s liberal base, enacting it would pose major challenges. Anyone lucky enough to be in its sights has access to top tax lawyers and accountants who can sift through the tax code for a way out, or at least a means of minimizing the hit.”

Warren’s proposal, meanwhile, would impose a 2% tax on wealth over $50 million – or the top 70,000 families in the country. For someone with $100 million in assets, Warren’s plan would cost them $1 million per year. Fortunes over $1 billion would be subject to an additional 1% annual surcharge. Her plan also includes expanding the estate tax – which would begin at 55% and rise to 75%.

Tyler Durden

Tue, 09/24/2019 – 15:50

via ZeroHedge News https://ift.tt/2kSKs5D Tyler Durden