Tesla, Musk Omitted Key Aspects Of SolarCity Acquisition From Ernst & Young, Shareholder Lawsuit Claims

Newly unsealed court documents published by PlainSite on Monday reveal that shareholders are accusing Tesla of improperly valuing its acquisition of SolarCity, providing “flawed analysis and misleading investors”, according to CNBC. They also allege that Tesla withheld key information about its acquisition of SolarCity from Ernst & Young.

The lawsuit was filed in 2016 and is one of the more notable legal actions proceeding against Tesla and Elon Musk, who also face lawsuits regarding solar panel fires and Autopilot deaths – in addition to the ongoing defamation lawsuit by Vern Unsworth.

Tesla commented that the allegations lodged against it are: “…based on the claims of plaintiff’s lawyers looking for a payday, and are not representative of our shareholders who support our mission and ultimately voted in favor of the acquisition.”

The company continued, stating: “The accusations made in the plaintiff’s brief are false and misleading, as Tesla and SolarCity published all material information in its proxy and other public filings for all shareholders to consider before deciding on the transaction. Providing clean, renewable energy generation through solar has been a critical part of our mission ever since 2006, and our acquisition of SolarCity has enabled and continues to enable a significantly faster path to achieve our goals.”

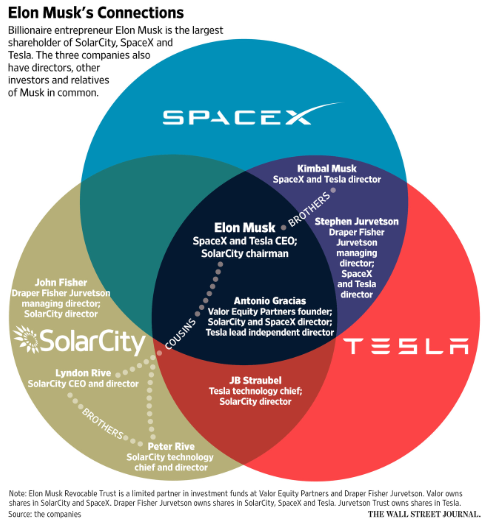

But the newly unredacted documents show a “tangled” personal and financial relationship between Musk and his investments.

The suit alleges:

“Prior to the Acquisition, Musk described Tesla, SolarCity, and SpaceX as a ‘pyramid’ atop which he sat; it was ‘important that there not be some sort of house of cards that crumbles if one element of the pyramid . . . falters.’”

As a reminder, Musk had invested SpaceX money in SolarCity. Notable aspects of that investment were “hidden” from auditors Ernst & Young before the acquisition, shareholders claims.

The brief says that SpaceX had put about $165 million into SolarCity as non-recourse bonds and that SolarCity failed to disclose to Ernst & Young how quickly they would have to make two substantial payments related to these bonds back to SpaceX.

Shareholders also claim that even though Musk recused himself, he was never separated from the dealmaking process. To make that point, they argue that Musk and his first cousin, Lyndon Rive, spent time “hatching out a plan to save the solar company from a liquidity crisis while on vacation in Lake Tahoe in early 2016”. Shortly thereafter, Tesla’s CFO put together a proposal to acquire SolarCity.

The filing stated: “The Board did not reject Musk’s proposal, as represented in the Proxy. Instead, the Board ‘authorized management to gather additional details and to further explore and analyze’ a SolarCity acquisition.”

Ernst & Young went on to claim that the solar company was insolvent shortly after Tesla closed its $2.6 billion acquisition.

The brief also claims that a “majority” of Tesla’s board members had financial interests on both sides of the deal. Elon and Kimbal Musk, Antonio Gracias, and Steve Jurvetson, for example, were all Tesla board members at the time of the acquisition and were also early backers and board members of SpaceX.

As CNBC also points out:

Ira Ehrenpreis, a long-time Tesla board member, held a board seat at SolarCity after funding it via his venture firm, Technology Partners. Kimbal Musk is Elon Musk’s brother. And Lyndon and Peter Rive, co-founders of SolarCity, are first cousins of Elon and Kimbal Musk.

Court filings also claim that a “fairness committee” put together at Evercore, who was hired to analyze the deal, failed to issue an opinion on the deal. Filings also claim that Lazard, another financial adviser, solicited bids for SolarCity and couldn’t find a single one. PlainSite has also sought to unseal additional redacted court documents relating to the case.

Recall, just yesterday we documented a Colorado resident who had their solar panels catch fire on top of their home.

We had already documented how Walmart is suing Tesla for solar panels that allegedly caught fire on the roofs of not one, not two – but seven different Walmart stores. We also documented how Amazon followed suit with complaints about its solar panels spontaneously igniting.

Last month we noted several homeowners who reported horror stories about their residential solar panels catching fire.

Finally, in early September, we posted a podcast with a solar panel expert who explained exactly how SolarCity’s panels work and what he believes is making them defective, along with his analysis of the Tesla acquisition and ongoing lawsuit.

Tyler Durden

Tue, 09/24/2019 – 10:55

via ZeroHedge News https://ift.tt/2mT8L47 Tyler Durden