WeDone: Goldman Cuts Its Loan Exposure To SoftBank’s Vision Fund

In the aftermath of the WeWork IPO fiasco, which has not only sent the valuation of the glorified office subletter crashing from $47 billion to a number in the single digits but also cost the company’s messianic CEO, Adam Neumann, his ambition to become the world’s first immortal trillionaire, markets are increasingly shifting their attention over to the man that made this clownshow possible in the first place: Japan’s richest man, Masayoshi Son.

Caught in the crossfire is the increasingly amorphous entity controlled by Son, the venture capital giant SoftBank, whose Vision Fund over the past few years unleashed a furious investing spree, pumping tens of billions in dozens of startups whose valuations have been suddenly put into question.

And while the largest US bank, JPMorgan, now has its hands full cleaning up the mess resulting from its close relationship with Neumann and WeWork, Goldman Sachs is already anticipating the inevitable next step – which is a full-scale market revulsion to Softbank – and as Bloomberg reports is seeking to offload a portion of its stake in a $3.1 billion credit line it helped arrange for SoftBank Group Corp.’s Vision Fund.

According to the report, over the past few months, Goldman has been approaching other financial institutions “to take on some of its lending commitment to decrease its risk.” Needless to say, the key word in the previous sentence is “risk”, and suggests that at least according to Goldman, a shitstorm is about to hammer SoftBank all the way to its secured debt.

The bridge facility, which Goldman and Mizuho International began arranging last year, enables the behemoth investment vehicle to more quickly pounce on transactions. The loan was syndicated to other banks including Standard Chartered Plc, Citigroup Inc., Barclays Plc and Royal Bank of Canada, according to a SoftBank presentation in May.

As part of its stealthy liquidation of its SoftBank exposure, Goldman is selling the secured debt at prices slightly below par.

Also notable: while Goldman already reduced some of its exposure in May by bringing in additional lenders, the firm is now looking beyond the existing group, and at least one of the original 10 lenders isn’t interested in boosting its exposure, a Bloomberg source said. To entice interest, Goldman is offering to sell the credit line in pieces as small as $50 million, one of the people said; at this rate it will soon cut it down to $1,000 and open it up to clients on its retail, Marcus, platform.

Naturally, the fact that Goldman – which has deep ties to SoftBank and has been working with the company to raise a second Vision Fund and advising founder Masayoshi Son’s businesses on several deals in recent years – is seeking to trim its exposure can only be seen as bad news for both SoftBank, and the indicative value of its portfolio companies, which in addition to WeWork also include Uber where SoftBank is now said to be underwater following the company’s dismal post-IPO performance.

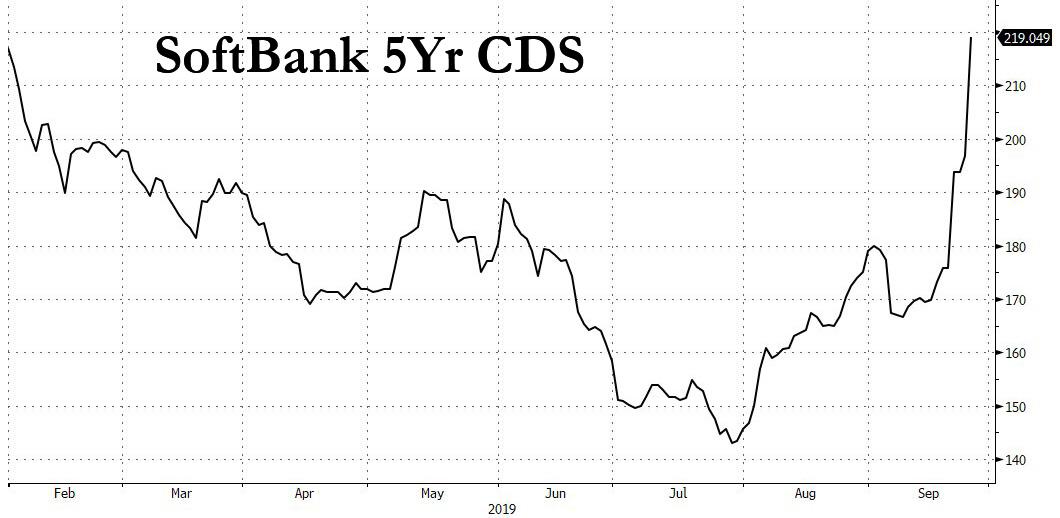

It’s not just Goldman though: in addition to sudden market concerns over its entire venture capital operation, SoftBank has also been plaued by doubts over the sale of its debt-laden mobile phone company, Sprint. But nowhere is the market’s growing skepticism to SoftBank’s future prospects more obvious than in the level of its CDS which has soared in recent weeks to 9 month highs.

What happens next? Here opinion is naturally divided: some think that the WeWork storm will quickly blow over, and things at SoftBank will quietly return to normal. Others, like outspoken unicorn critic, professor Scott Galloway,beliefe the SoftBank’s Vision Fund will shutter within 12 months.

#WeWork & #Peloton prediction #hottake 🔥

Vision Fund will shutter within 12mo

Now Peloton IPO in danger of not getting out — via @section_four pic.twitter.com/3QqreKK9kv

— Scott Galloway (@profgalloway) September 25, 2019

That said, to some the endgame is already clear.

When is the BOJ’s bailout of Softbank?

— zerohedge (@zerohedge) September 5, 2019

Tyler Durden

Wed, 09/25/2019 – 15:27

via ZeroHedge News https://ift.tt/2l8cr1j Tyler Durden