Spectacular 7-Year Auction To Close The Week

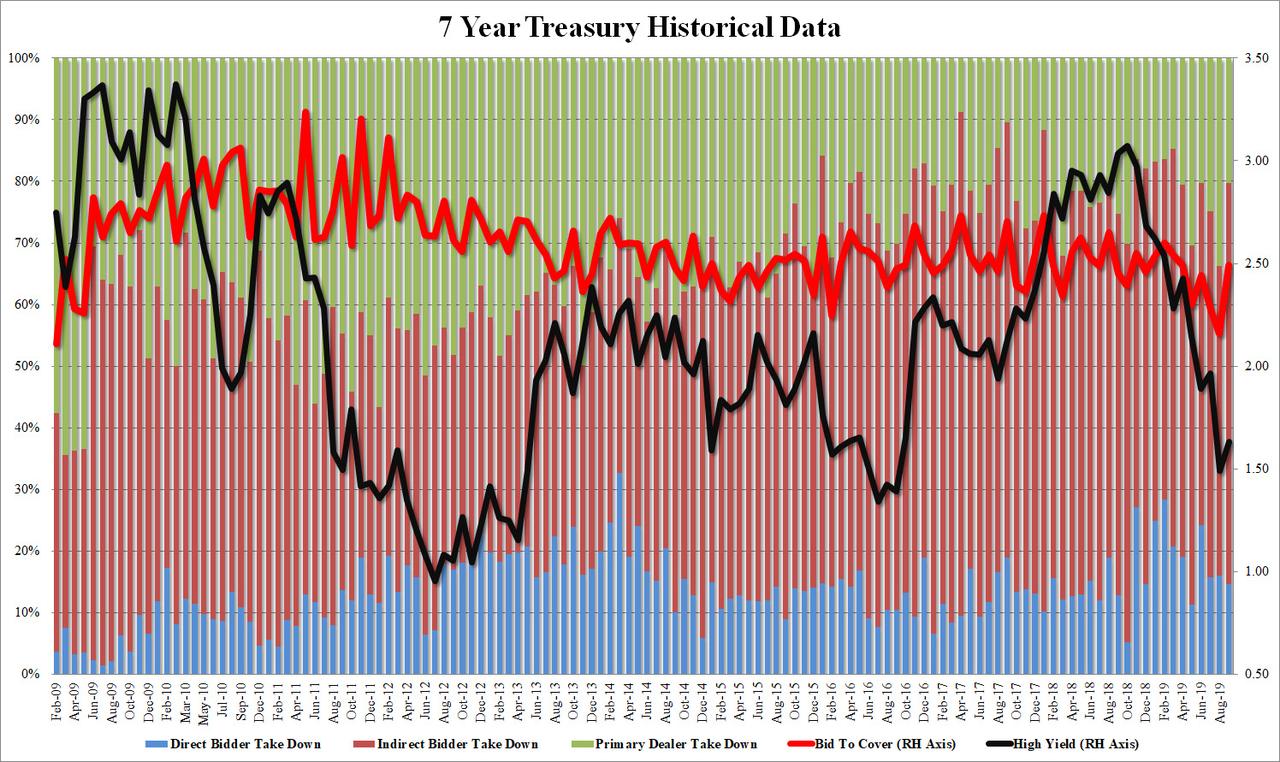

After a strong 2-Year, and poor, tailing 5-Y auction, moments ago the US Treasury concluded the last coupon auction for the week, selling $32 billion in 7 year paper in what was no less than a spectacular auction, with a high yield of 1.633%, which while above last month’s 3-year low yield of 1.489%, stopped through the When Issued by a solid 0.5bps, the biggest stop through since March.

Confirming the strong demand for today’s paper was the impressive surge in the bid to cover, which jumped from a ten year low of 2.159 in August to 2.492, the highest since March, and far above the 2.37 six auction average.

But it was the internals that were most impressive, with the Indirects taking down a whopping 65.2%, the highest since December, and far above the 58.0% recent average. And with Directs allotted 14.6% of the auction, Dealers were left holding just 20.22%, the lowest Dealer allocation since March. On the other hand in this time of severe repo deficiencies, perhaps Dealers should have held on to more of the paper just so they can convert it to liquidity with the Fed when the need arises.

Overall, a very strong auction, and one which pushed the yield on the 10Y back to 1.68%, near session lows.

Tyler Durden

Thu, 09/26/2019 – 13:14

via ZeroHedge News https://ift.tt/2m1M51t Tyler Durden