Liquidity Shortage Eases: Fed Accepts Only $49BN In Final, Underscubscribed Term Repo

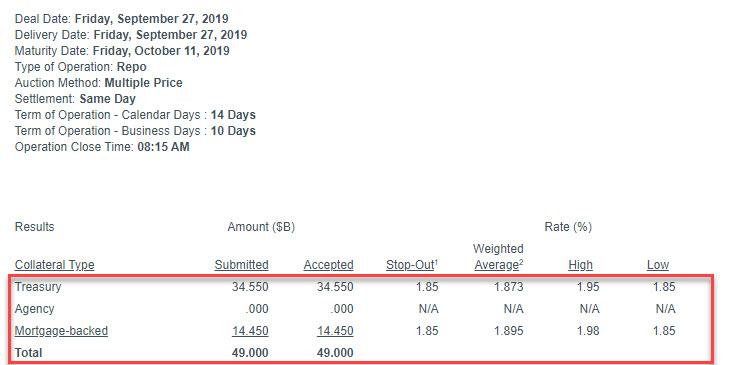

One day after the Fed concluded its 2nd upsized, $60BN term repo on Thursday and which was notably oversubscribed – which sparked fresh concerns about dealer funding needs heading into quarter end – moments ago the Fed released the results of the final, third term repo which indicated that while funding tensions remain, they appear to have eased as the Fed accepted “only” $49 billion in the undersubscribed operation, which accepted all $34.55BN in Treasuries and $14.450BN in MBS that were tendered.

Why is this good news? Because some had feared that the third repo would also be oversubscribed, hinting that some dealers would not be able to find all the liquidity they need into quarter end. That, however, did not happen and instead as of this moment, all dealers who were concerned about their quarter-end funding needs should have the appropriate liquidity needed.

Now the only question is what the results for today’s overnight repo operation will show. If funding stress is indeed easing this too should be well below the full $100BN allotment.

Tyler Durden

Fri, 09/27/2019 – 08:30

via ZeroHedge News https://ift.tt/2miEGLo Tyler Durden