September Container Shipping Rates Collapse 43% Forcing Carriers To Slash Capacity

Container shipping rates continue to move lower into the fourth quarter of 2019, according to FreightWaves. The drop in price comes as a result of the most recent round of tariffs discouraging U.S. importers from front loading orders. As a result, ocean carriers are looking to cut even more shipping capacity in hopes of meeting tepid demand into the back end of the year.

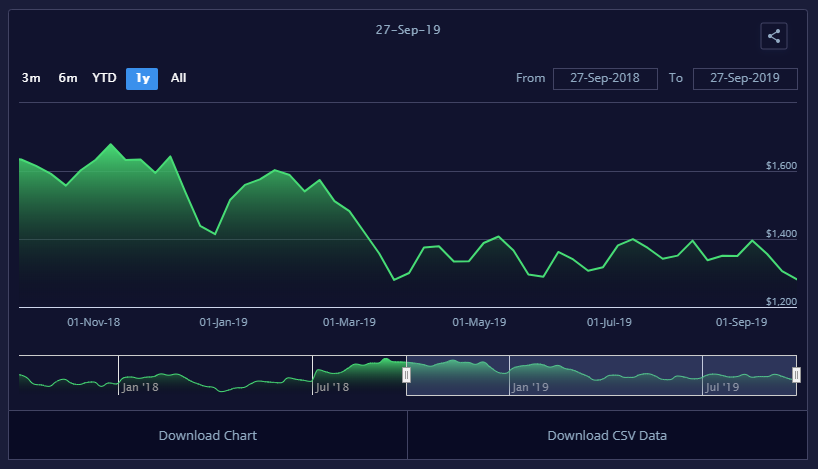

Spot rates on the Freightos Baltic Daily Index for China-North America West Coast were down 8% from last week, falling to $1,327 per forty-foot equivalent unit. Container rates are down 34% since the beginning of the year, despite the industry now being in peak season.

The drop is even steeper when compared to last year’s peak season, which had the tailwind of container front-loading from China ahead of tariff increases. September spot rates are down 43% year over year and are down 14% from 2017.

Freightos Chief Marketing Officer Eytan Buchman says the collapse is likely due to a “tepid response” to the latest round of tariff increases. The increases were supposed to start on October 1, but have been delayed until October 15. The U.S. is set to meet with China for trade talks on October 10. The next round of tariff increases will come on $200 billion in Chinese goods and will see tariffs rise to 30% from 25%.

Tariffs on $188 billion in goods that are slated for December could help revive shipping demand, however.

Buchman said:

“Trans-Pacific pricing remains at the mercy of the trade tariff war. The most recent tariff change carries less clout than predecessors due to the short, five week notice and the limited scope of goods affected.”

He continued:

“Given the weak peak season prices, carriers will be banking on post-Golden Week increases, as well as the December 15 tariff change, to shore up prices. With a significantly longer four month notice, there’s a better chance that this tariff increase will lead to increased shipping – and freight rates – come October and November.”

The drop in demand is forcing shippers to cut more capacity. For example, Ocean Alliance plans to cut up to seven sailings between October 15 and December 2 in order to meet the poor demand. This news comes after nine weekly sailings between Asia and the West Coast of the U.S. were cancelled during China’s Golden Week celebration.

According to FreightWaves, the cancelled sailings include:

-

Two, 8,830 TEU sailings for the Port of Long Beach at the end of November and start of December

-

Two weekly services into the Port of Los Angeles in December, one with 13,940 TEU in capacity, one with 6,680 TEU of capacity

-

A Seattle sailing of a 10,800-TEU capacity service in December.

-

A 9,940 TEU service into Prince Rupert

-

A 5,580 TEU service into Vancouver

Tyler Durden

Fri, 09/27/2019 – 13:15

via ZeroHedge News https://ift.tt/2lGq1cF Tyler Durden