NY Fed Starts New Quarter With Unexpectedly High $55BN Repo Operation

Many expected the funding shortage sweeping across the US financial community to be mostly a function of one-time mid-September items coupled with traditional quarter-end liquidity: it explained why in addition to three term repos, on the last day of the quarter, the Fed conducted an overnight repo which saw a surprisingly high, $63.5BN uptake on Monday.

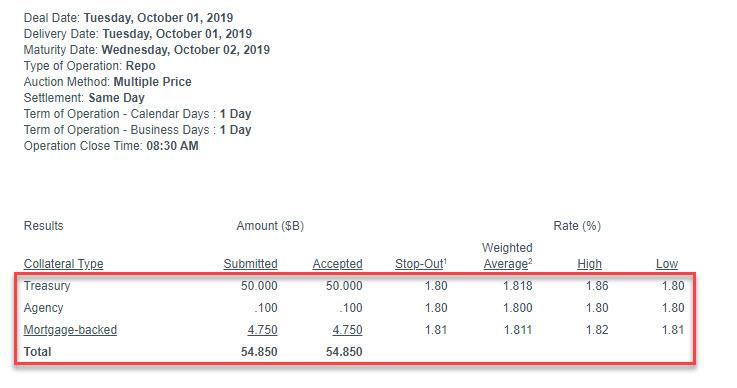

Well, it’s now the new quarter… and contrary to clearly erroneous conventional wisdom, the funding shortage still persists. Moments ago the NY Fed reported that in the first overnight repo operation of the quarter, one which saw the maximum allotted size shrink from $100 billion to $75 billion, dealers submitted a surprisingly high $54.85BN in collateral, all of which was accepted by the Fed.

Specifically, dealers tendered $50BN in TSYs and $4.75BN in MBS, as well as a $100MM in Agencies, to boost their liquidity.

The continued demand for reserves, even with $139BN in liquidity locked up in 2-week term repo which expire in the second week of October, suggests that the funding shortage is anything but a calendar event, and confirms that there is an acute reserve shortage, one which the Fed will have to address, most likely by resuming POMO operations to the tune of roughly $20BN per month… which for all the QE denialists, will be the same size as QE1.

Tyler Durden

Tue, 10/01/2019 – 08:46

via ZeroHedge News https://ift.tt/2o93beE Tyler Durden