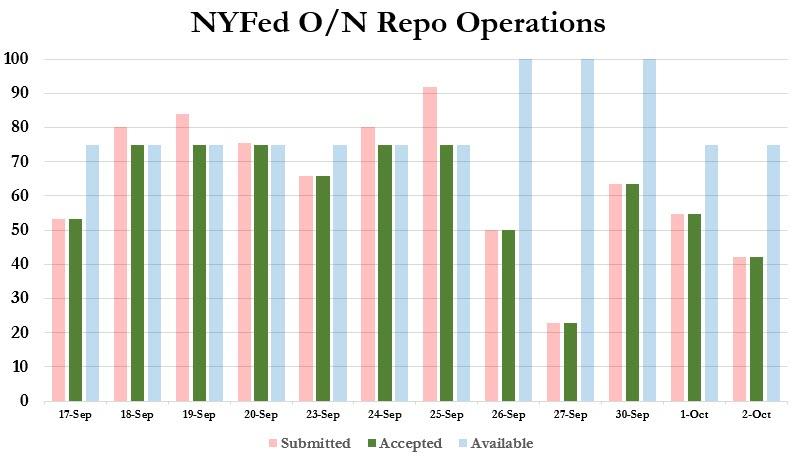

Fed Takes $42BN In Second October Repo As Funding Pressures Ease

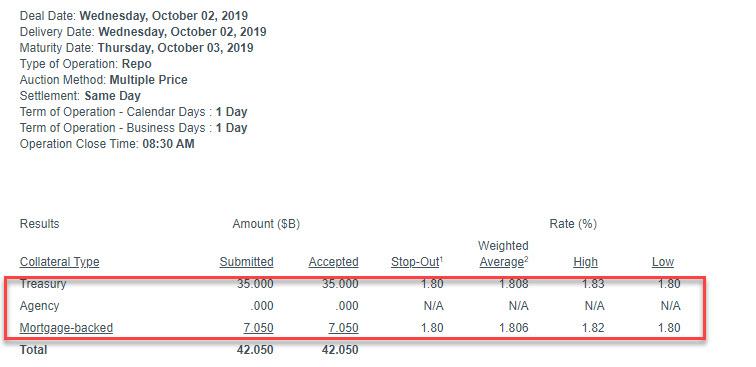

One day after the Fed raised eyebrows when it accepted $55BN in collateral in its first repo operation after the notorious quarter-end liquidity crunch, an amount that was just higher than the first repo op the Fed concluded in mid-September after a 10+ year hiatus ($53.2BN) and which some saw as too high for a new month with $139BN still locked up in 2-week term repos, moments ago the Fed concluded the second overnight repo operation for October, one which confirmed that the recent repo turmoil appears to again be easing, as $42.05BN in collateral was submitted (and accepted) in the $75BN operation, a $13BN decline from the $54.85BN repoed yesterday.

The composition of the repo showed that while Treasury collateral declined from $50BN to $35BN, MBS actually increased modestly from $4.75BN to $7.05BN, with no Agency use again.

While the drop in total repo use was certainly an improvement from yesterday’s operation, the continued demand for reserves, even with $139BN in liquidity locked up in 2-week term repo which expire in the second week of October, suggests that the funding shortage is anything but a calendar event, and confirms that there is an acute reserve shortage, one which the Fed will have to address, most likely by resuming POMO operations to the tune of roughly $20BN per month… which for all the QE denialists, will be the same size as QE1.

Tyler Durden

Wed, 10/02/2019 – 08:53

via ZeroHedge News https://ift.tt/2mQIfZo Tyler Durden