WTI Tumbles After Bigger Than Expected Crude Build

Oil prices have erased the immediate gains following last night’s surprise crude draw reported by API as global growth scares accelerate and weigh on energy demand forecasts.

“Demand fears are overriding supply fears,” Phil Flynn, senior market analyst at Price Futures Group Inc., said by telephone.

API

-

Crude -5.92mm (+2.25mm exp)

-

Cushing +373k

-

Gasoline +2.133mm

-

Distillates -1.741mm

DOE

-

Crude +3.104mm (+2.25mm exp)

-

Cushing -201k

-

Gasoline -228k (+600k exp)

-

Distillates -2.418mm

After last week’s huge surprise builds in Crude stocks (and at Cushing), last night’s API-reported big draw goes against analyst expectations of another build, but the analysts were right as DOE printed a 3.1mm barrel build. This is the 3rd weekly build in a row…

Source: Bloomberg

“There’s a possibility that exports were super-sized” and after the Saudi Aramco attacks, “some customers were worried about their flows and wanted a more reliable flow, which would make the export number higher,” says Bob Yawger, director of the futures division of Mizuho Securities USA

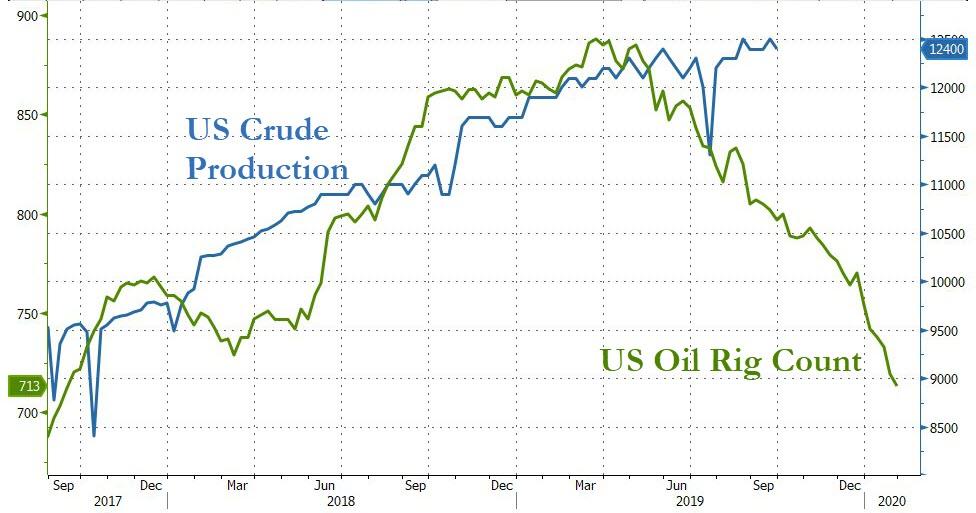

As the oil rig count continues to collapse, traders are watching avidly for signs that US Crude Production is topping out

Source: Bloomberg

Notably, WTI is now well below pre-Saudi-attack levels…

And has erased the post-API gains overnight, hovering around $53.50 ahead of the DOE data.

“In view of subdued global economic prospects and rising U.S. oil production, any concerns” about oil supply tightening have evaporated, said Carsten Fritsch, an analyst at Commerzbank AG in Frankfurt.

Tyler Durden

Wed, 10/02/2019 – 10:34

via ZeroHedge News https://ift.tt/2nO4QGs Tyler Durden