Watch Out Below: Why Earnings Expectations Are About To Plunge

It may come as a surprise to some, but as we first pointed out in late July when Q2 earnings season was peaking, the earnings recession – traditionally a harbinger to the broader, economic recession – is already here as a result of two consecutive quarter of declining earnings Y/Y. And, with Q3 earnings season on deck, its set to get worse.

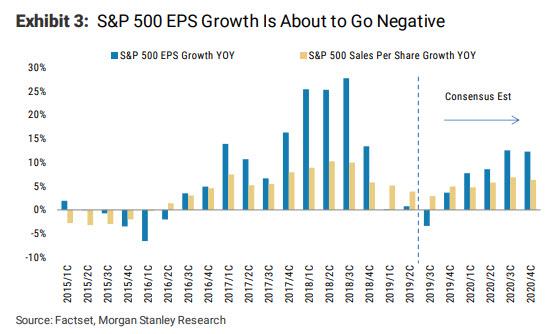

As Morgan Stanley calculated, S&P 500 y/y EPS growth came in at roughly zero in 1Q and 2Q…

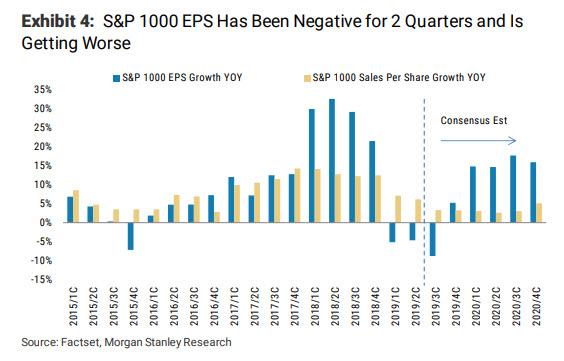

… while the much broader S&P 1000 EPS growth is closer to -6% for 1Q and 2Q.F

Worse, the recession is set to get far worse with consensus now estimating Q3 y/y EPS growth for the S&P 500 will be -4% and S&P 1000 will be closer to -9%. And while some investors have dismissed this as either ‘old news’ or a temporary trough before a reacceleration, the problem with that argument, in the view of Morgan Stanley’s Michael Wilson, is that the same one was proposed in April and then again in July, “yet 3Q EPS growth estimates are now lower than 2Q and 4Q looks vulnerable to further revisions.“

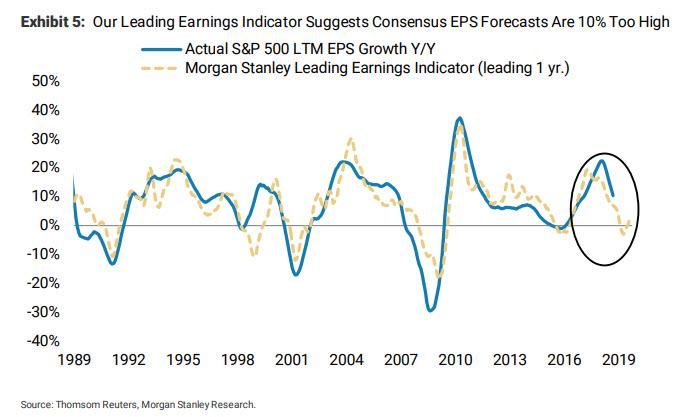

And yet, as Wilson pointed out, “the S&P 500 seems not to care either and so we have to acknowledge that perhaps the market knows something we do not.” To this, the Morgan Stanley strategist counters that the market is once again blissfully complacent, and his own earnings model has proven to be accurate this year, and over time, and is still indicating that next year’s consensus estimates of $181 are about 10 percent too high.

Wilson’s take: it is “hard to believe the market won’t care if next year’s EPS potentially falls $20 over the next few quarters.“

Sarcasm aside, of course the market will care, unless the Fed finds some way to boost P/E multiples by 2-3 additional turns (coughQE4cough). Alternatively, perhaps the market has some uncanny ability to see the future better than the most accurate sellside strategist of 2018. While Wilson briefly considers this possibility, he then quickly dismisses it noting that one key market limitation is that “it has a difficult time thinking beyond 12 months.”

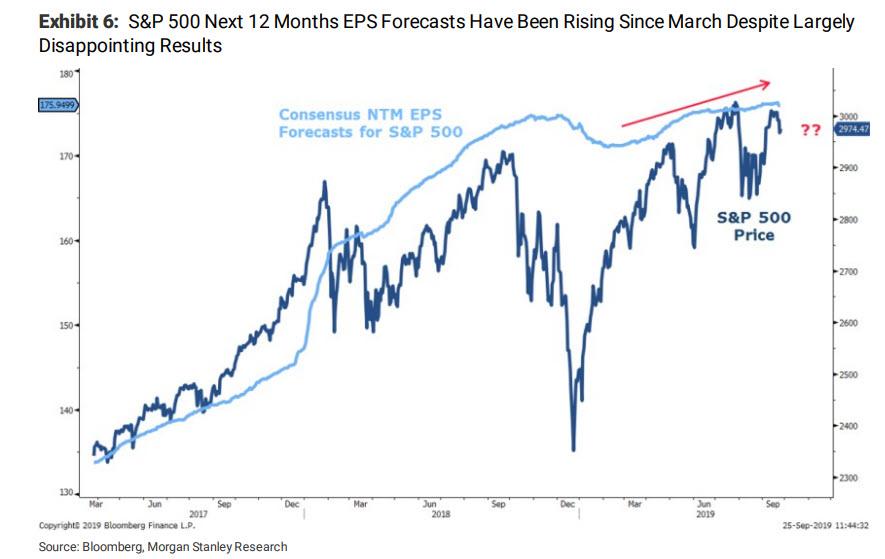

This is also why the MS equity team uses next 12 months EPS rather than calendar year forecasts when looking at valuations; the bank explains that it has found this time period to have the highest efficacy to predicting stock prices, but herein lies a problem, too: “Over the past 20 years, we believe the investment community has become over reliant on company guidance for its earnings forecasts. Therefore, earnings forecasts tend to be more tightly clustered today for the time periods for which there is “company guidance.”

But most companies don’t provide guidance beyond their current fiscal year, which means the following year tends to be an extension of the longer term averages and/or current trends, which is where we find ourselves today.

Indeed, as we have moved through 2019 and watched earnings guidance drop every quarter, the estimates have followed… “but the numbers haven’t changed as much for2020 because companies don’t guide that far out, leaving 2020 estimates unrealistic.“

As a result, today consensus bottom up forecasts 10.4% EPS growth for the S&P 500, allowing the forward 12 months EPS to remain flat and even rise this year as we have gone forward in time. According to Wilson, “it is very unusual for the index to sell off much when next 12 months EPS is rising, as it has been this year. Quite frankly, this was a bit of a miss on our part as we just assumed these numbers would follow the 2019 cuts, but they haven’t.”

Why is thie relevant? Because as Wilson concludes, the trend in forward EPS forecasts is about to turn down again, much like it did last fall, for three reasons:

First, this is the time of the year when companies may have to give up any furtherexpectation of a rebound for the year if it has not emerged yet. As a reminder, the second half of 2019 is when many companies expected we would see an earnings recovery; instead this has failed to materialize and another disappointing quarter of results and guidance would seal the deal on 2019.

But what about 2020? While most companies likely will not guide on 2020 until January, some will start to lower the bar if they know it is unachievable to avoid further disappointment, particularly if stocks fall on bad earnings results.

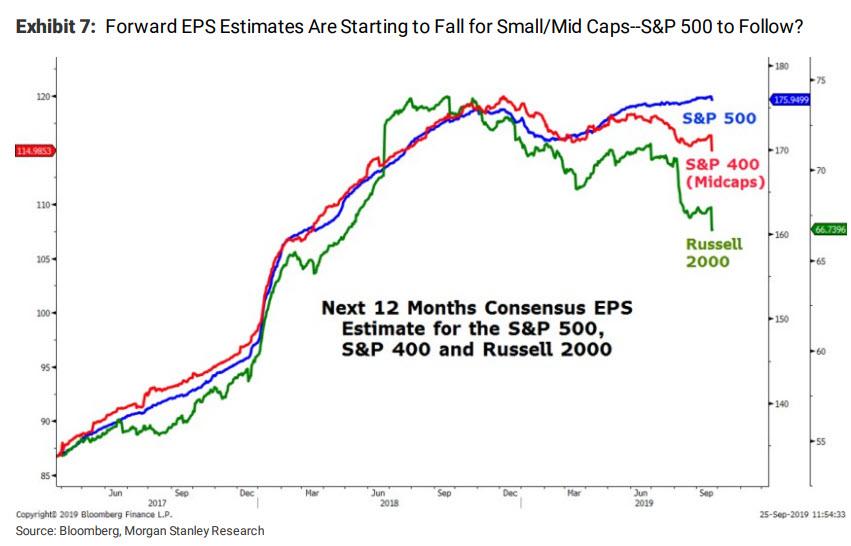

Finally, and perhaps more importantly, we ares tarting to see the forward estimates come down now for the mid caps and small caps which have been leading the S&P 500 lower in this earnings recession (chart below). It is also worth pointing out that small / mid caps have underperformed materially this year which makes sense given the material deterioration in NTM EPS that has been going on all year.

The bottom line on the deteriorating earnings recession is that according to Morgan Stanley, the market (at the index level) has generally ignored the poor results to date simply because the 12 month forecasts have yet to fall. This is largely a technical issue related to stale 2020 estimates that will soon be cleaned up as we go through October and November, much like lastyear.

That, as Michael Wilson concludes, “should put downward pressure on the index like it has for the small and mid cap indices all year”, and lead to the S&P swinging from trading near Morgan Stanley’s upper price target band…

… to the lower one. The only question is when.

Tyler Durden

Thu, 10/03/2019 – 15:27

via ZeroHedge News https://ift.tt/2Mhbspk Tyler Durden