SoftBank’s Vision Fund 2 Likely Shelved After WeWork Blow Up

SoftBank Group founder and CEO Masayoshi Son is having tremendous difficulty attracting new investors to his Vision Fund 2 amid new developments that his current Vision Fund is taking a beating after the WeWork implosion and sliding valuations of its other major investments, according to several of Reuters’ sources.

Despite the implosions of Vision Fund’s investments in the last several months, Son’s top advisors are urging the billionaire to halt Vision Fund 2, two people with information of SoftBank’s internal discussions told Reuters.

SoftBank Group has committed $38 billion to Vision Fund 2, but sources said no other significant commitments are outstanding.

The spectacular implosion of WeWork’s valuation over the last month has severely damaged Son’s reputation and leads Reuters to believe that Vision Fund will experience a significant writedown in the coming quarters.

SoftBank/Vision Fund plowed nearly $10 billion into WeWork, investing some of that capital at a $47 billion valuation in 1Q19. But since WeWork’s IPO was shelved, the startup is now only worth $10-12 billion.

On Tuesday, we noted how Son’s aggressive risk-taking in technology companies left him overlooking valuation metrics in the last several years.

Another terrible judgment call on Son’s part was the announcement of a $5.5 billion share buyback program of SoftBank Group’s shares, earlier this year. The billionaire decided to buyback company stock because valuations of WeWork and other investments, like Uber and Sprint, saw significant valuation increases.

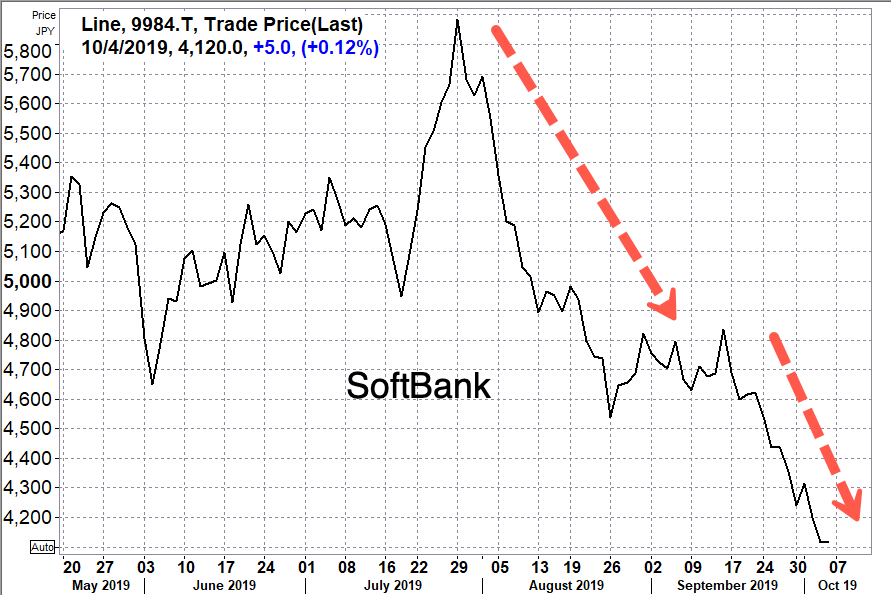

SoftBank’s stock has plunged 30% in the last 46 trading days, as the market has finally figured out Son and Vision Fund made some bad bets.

If macroeconomic headwinds continue to mount in the global economy, Son’s second fund could be scrapped in the near term.

As we’ve highlighted in the last week or so, the global IPO and M&A markets are starting to falter.

We even reported on Tuesday that veteran venture capitalists called an emergency meeting of the technology unicorns in Silicon Valley to advise them on the turbulent times ahead.

Reuters noted that Vision Fund raised $97 billion, capital that was used to invest in unicorn startups. The fund was so large that it had more money than the entire U.S. venture capital industry raised in 2018.

Vision Fund’s investments in Uber, Slack, and WeWork (startups that have seen their valuations implode this year) are warning signs that the proverbial tide is going out, and it’s those who ignored valuations, like Son, are the ones currently swimming naked.

Back in July, Apple, Microsoft, a handful of Japanese banks, and Britain’s Standard Chartered indicated that they would commit to Vision Fund 2. Three months later and several of Vision Fund’s investments deeply underwater, there is no word if these mega-corporations are still committed.

“I think that it’s incredibly likely that they’ll postpone their plans for … fundraising efforts around Vision Fund 2,” said Andrea Lamari Walne, a Silicon Valley-based partner at Manhattan Venture Partners.

And just like that, Vision Fund 2 has likely died, can’t attract the slightest bit of money from investors after Son’s wreckless investing spree in Vision Fund, has left investors with the possibility of significant losses ahead.

Everyone on the funding side is a genius in a synchronized recovery as central banks flood markets with liquidity, but it’s only when the tide goes out, those geniuses become clowns.

Tyler Durden

Fri, 10/04/2019 – 18:45

via ZeroHedge News https://ift.tt/32YKfOG Tyler Durden