Decision Time

Authored by Sven Henrich via NorthmanTrader.com,

Well Friday was fun. Big nasty drop and a vicious rally back up. Standard script right? After all we’ve all become accustomed to drops not lasting more than a few hours or days no matter what happens in the world.

I’ve received a lot of questions about the rally at the end of last week in particular as a lot people expressed surprised that it happened and happened so vertically again especially in light of the weak data points that came in throughout week. Let me assure you the rally made perfect technical sense as did the drop before that.

And hence in today’s technical video I’ll focus a bit more on the granular aspects of navigating through these moves technically to help address some of these questions and also to show how important and useful technicals are in adjusting positioning to take advantage of these moves. After all, at the end of the day, this is what this is all about. Figuring how to take advantage of the volatility and how to identify turning points.

Before I do that a few comments on the larger backdrop. Let there be no doubt that this week is shaping up to a major event week for stock markets around the globe. It’s decision time. Trade deal or no trade deal, interim deal, easing of tensions, or another pushback with no specific results. The implications for markets are profound.

There is a reason markets reacted initially poorly to weak economic data this week. One was of course technical, but while US markets have largely ignored the malaise of the global slowdown underway the weakening data points coming in throughout the year, it’s now become clear that the slowdown is increasingly spilling into the US as well, not only in manufacturing, but also now into the services sector. And while markets took comfort in the jobs report on Friday, without a trade deal, that comfort will not last long as employment growth is slowing along with everything else. My view remains that markets will soon run out of patience and want to see a specific measurable result.

For now bulls keep taking comfort in the Fed and hence bad data still doesn’t have a lasting impact, a message that was advertised in advance:

A 3rd rate cut will fix it all https://t.co/WnQ21UCo9W

— Sven Henrich (@NorthmanTrader) October 3, 2019

But there is a sense emerging that central banks may be pushing on a string here. After all the two rate cuts by the Fed so far this year have resulted in market selloffs raising the prospect of a potential market double top and bulls have no choice but make sustained new highs or face the technical consequences of a double top.

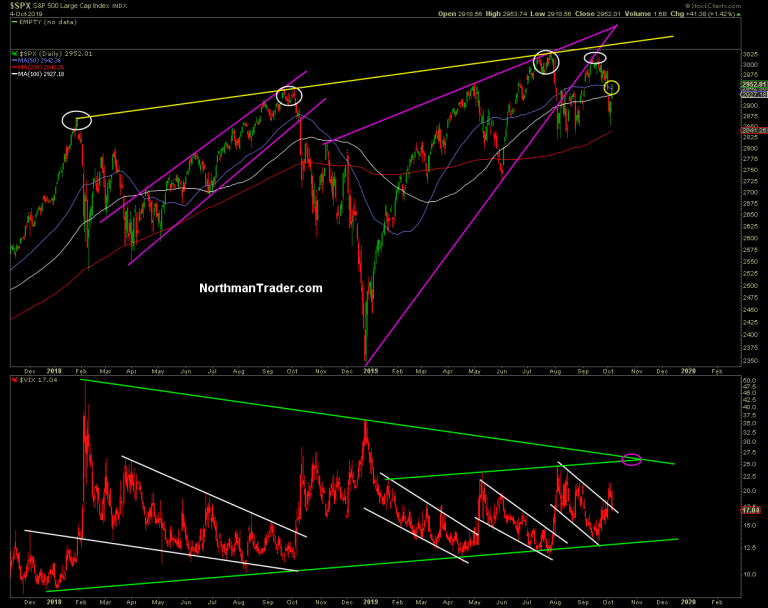

In September I made the case for another market drop to come (Bear Case) and for another volatility spike ($VIX getting jiggly) setting up and we got both this week:

$VIX jumped to 21.5 this week and $SPX ended up dropping 166 handles from the September highs. The speed of the drop this week again showing how little support there is in markets when the action turns as all of September gains were wiped out in hours. At the same time we again see the bid re-emerging just as furiously following a sell-off.

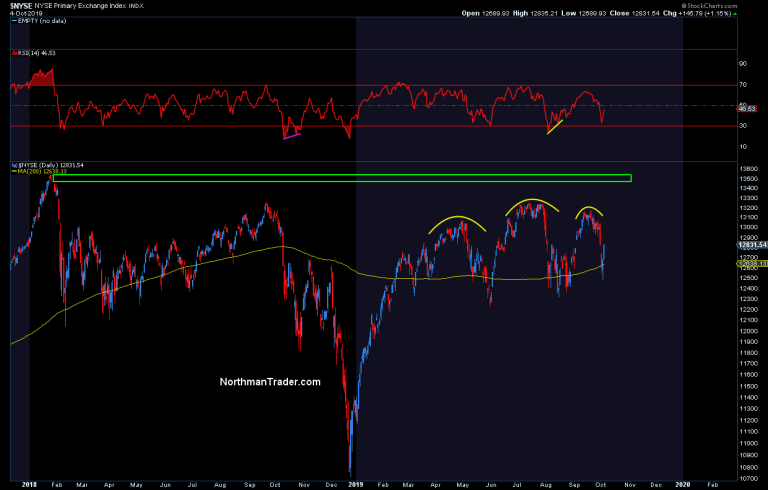

I re-iterate that the action is not unlike what we saw in September/October 2018. Highs into September options expiration, then a vicious drop into early October followed by an aggressive bounce. It’s way too soon to tell whether last year’s script continues on a similar path, but let’s note that for now markets have been following a similar path and last year aggressive rallies were selling opportunities.

As it stands many indices have not gone anywhere in over a year and are below key previous highs.

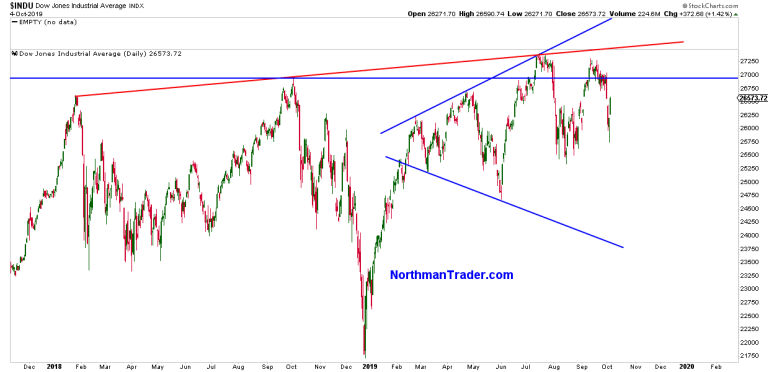

Take the $DJIA:

Lower high in September versus July and, despite Fridays bounce, now below the October 2018 highs and just below the January 2018 highs.

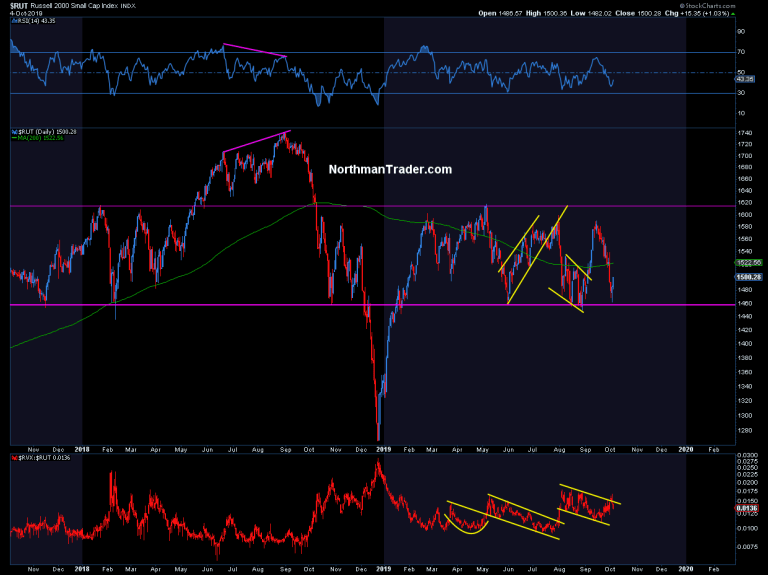

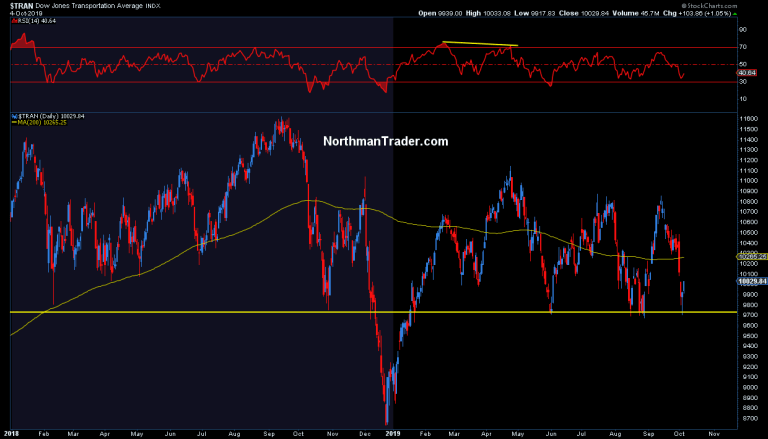

Small caps and transports remain in a disastrous chop zone barely hanging on to support:

These charts remain one sell-off away from breaking multi month support and as $NYSE shows there are potential pattern structures out there that point to vast potential downside:

But, be clear, nothing has broken and support continues to hold hence all eyes will be on the trade meetings next week. It’s decision time, time to put up or shut up.

Earnings are just a round the corner and they will not be immune to the global slowdown. While bulls keep pointing to the Fed as their savior the Fed has yet to prove its measures, repo, balance sheet expansion, rate cuts or otherwise, are showing a meaningful impact on expanding growth, either in the economy, nor in markets.

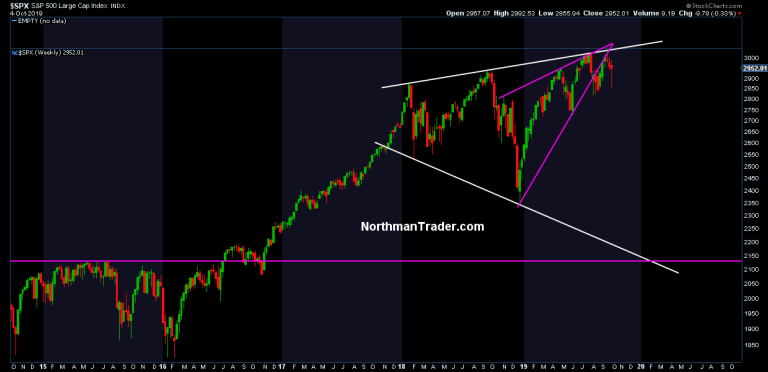

Structurally markets remain inside the larger megaphone pattern with a broken uptrend in place:

The outcome of trade meetings this week will likely serve as a key decision point for markets. Manage new sustained new highs into later October to come or see a larger breakdown in markets to come.

As none of us can’t control the outcome of this week’s meetings nor the reaction of markets, our focus has to be on the technicals to guide us through the larger moves, and this is really the intent of this week’s video, to show how technicals can help identify direction, targets and changing risk/reward.

Note: The audio is a bit of different quality than usual as, genius that I am, forgot to plug in the microphone when recording it, only to realize it after I was done recording. I trust you can cope, from my perch the audio is ok, it’s just a bit boomier sitting in a room:

* * *

To get notified of future videos feel free to subscribe to our YouTube Channel. For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Mon, 10/07/2019 – 11:20

via ZeroHedge News https://ift.tt/30PEtNP Tyler Durden