Stocks Chop On Repo Ramp, Kudlow Comments, Trade Trouble, & Warren Woosh

An ugly open overnight – on limited China trade deal – was auto-bid my the machines to make things look a little better as US trader walked in this morning. But three notable events triggered swings in stocks (as underlying it all was Washington chaos).

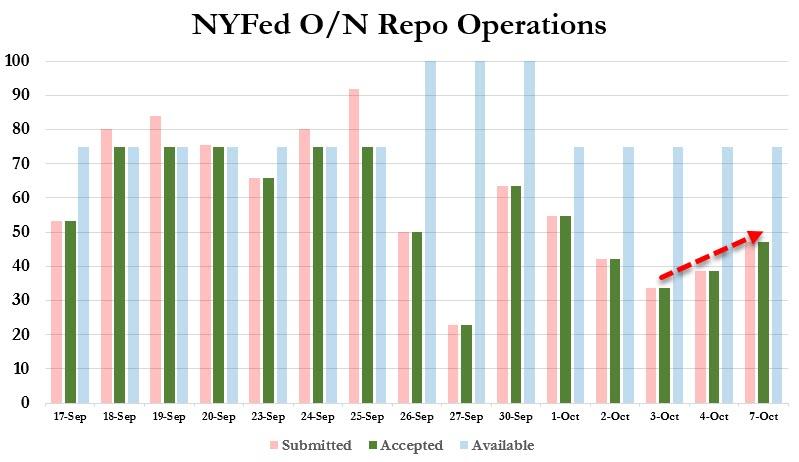

First, Fed repo demand picked up again – not what was expected after month-/quarter-end.

Source: Bloomberg

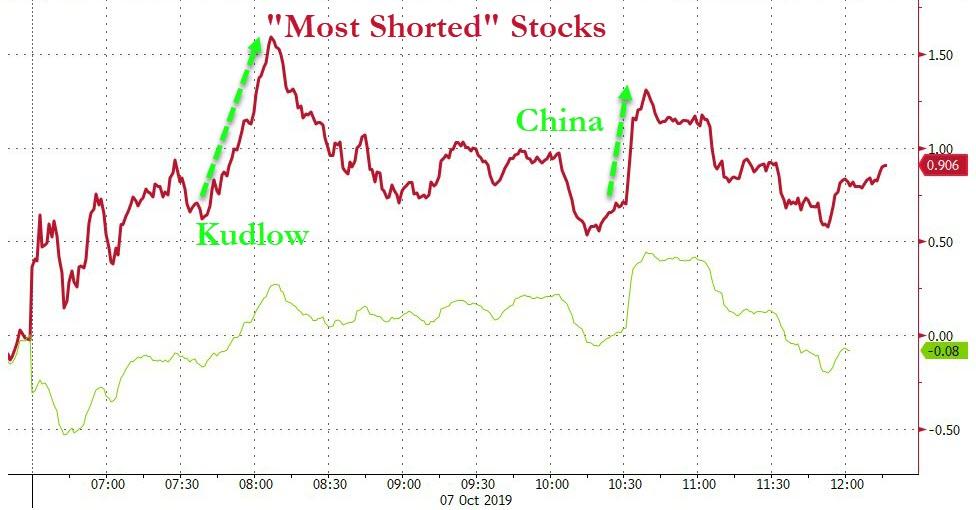

Second, Larry Kudlow commented that delisting China stocks was “off the table” – igniting momentum and sending stocks back to unchanged.

Third, China made headlines confirming nothing but what it said over the weekend that a partial deal was possible, sparking another impulse higher (despite Navarro and Trump dismissing it as potentially a deal).

It feels like desperation to keep stocks higher…

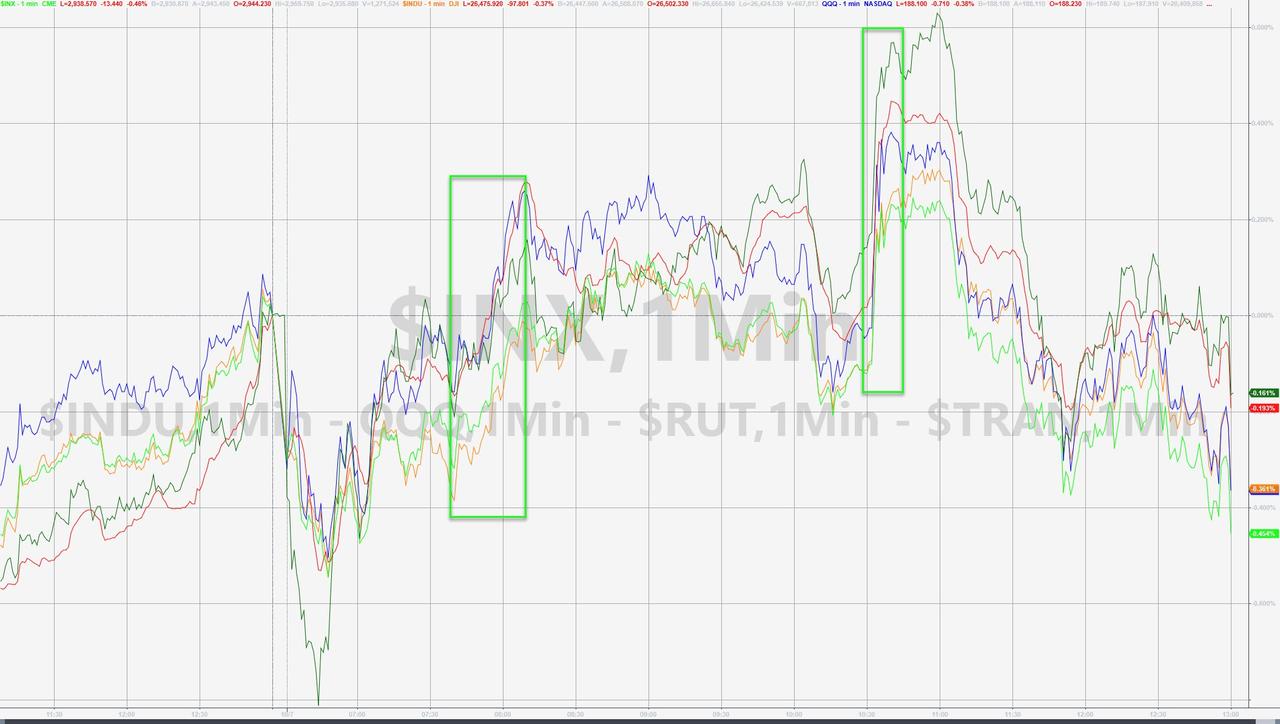

A look at futures (ignoring Friday’s bad-is-good squeezefest for a second) shows the pump and dumps…

Thanks to two short-squeezes…

Source: Bloomberg

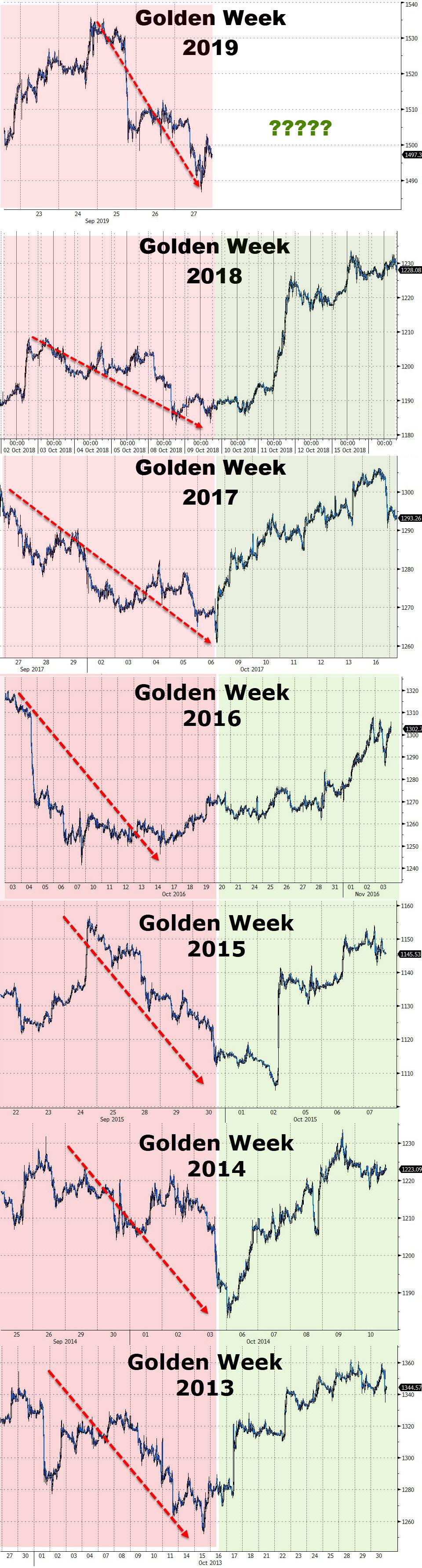

And Yuan is even more sensitive as markets await the end of Golden Week…

Source: Bloomberg

European stocks ended higher, lifted considerably once US opened…

Source: Bloomberg

US equities chopped around all day but ended with an ugly close in the red… S&P was weakest on the day

All the US majors ended below critical technical levels…

And we note that Small Caps (Russell 2000) confirmed a death cross (50DMA crossing below the 200DMA)…

Source: Bloomberg

The odds of a US-China trade deal continue to slide…

Source: Bloomberg

Treasury yields were all higher on the day with the short-end underperforming…

Source: Bloomberg

The yield curve flattened…

Source: Bloomberg

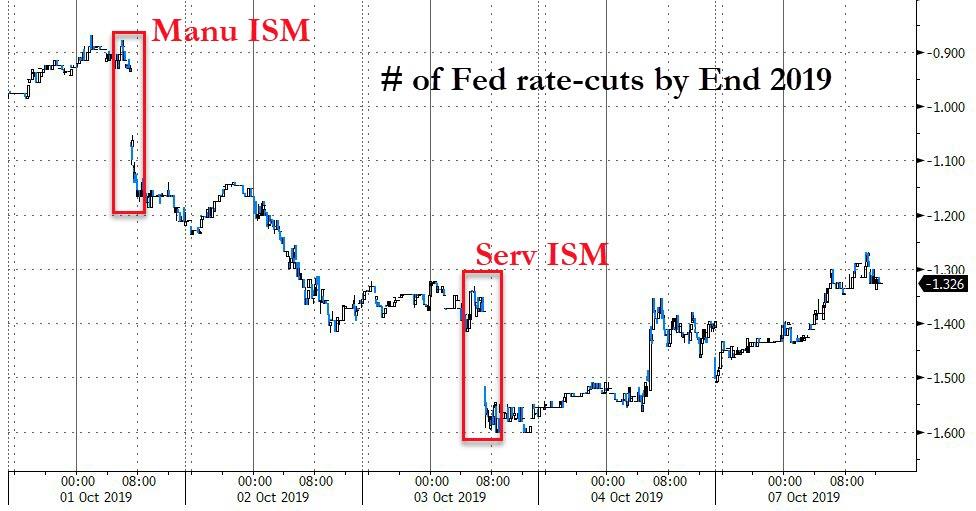

The market shifted a little more hawkish today – erasing ISM Services dovish bias…

Source: Bloomberg

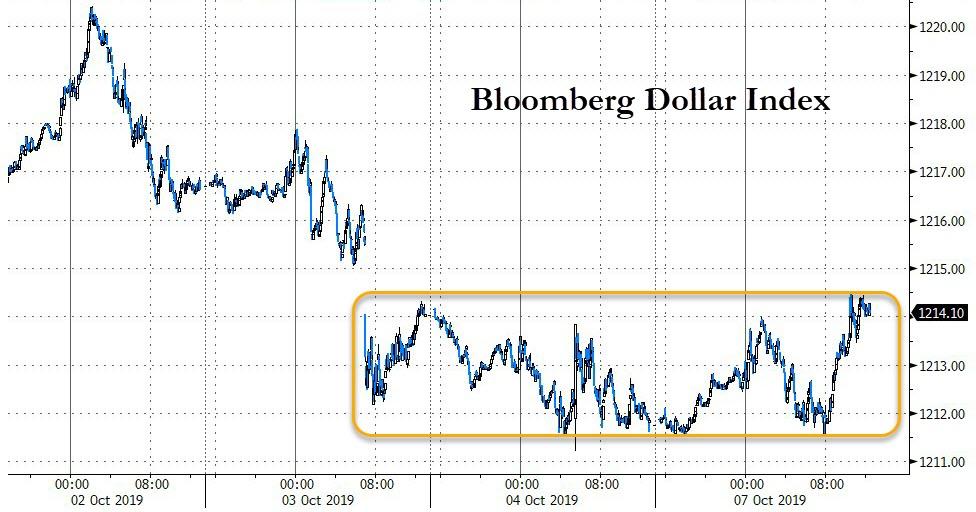

The dollar ended marginally higher on the day, but remained in a tight range…

Source: Bloomberg

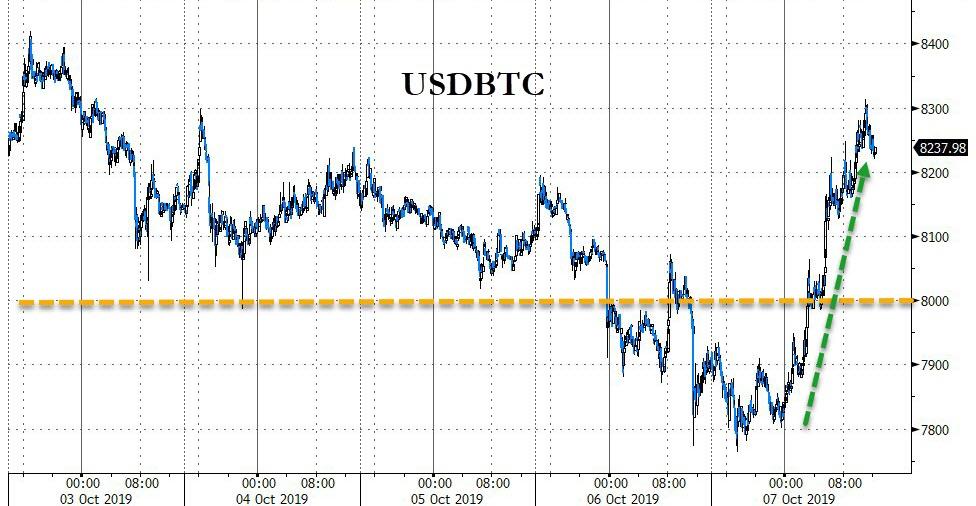

Cryptos rallied throughout the day, led by Ripple…

Source: Bloomberg

As Bitcoin scrambled to get back above $8000…

Source: Bloomberg

PMs were lower on the day, oil pumped’n’dumped…

Source: Bloomberg

WTI managed to tag a $54 handle before tumbling back to unch…

Source: Bloomberg

Gold opened higher on the China ‘limited’ deal disappointment, was dumped at the European open, then dumped again on the China headlines later in the day – but didn’t reverse like stocks…

Source: Bloomberg

But don’t forget, Golden Week is almost over…

Source: Bloomberg

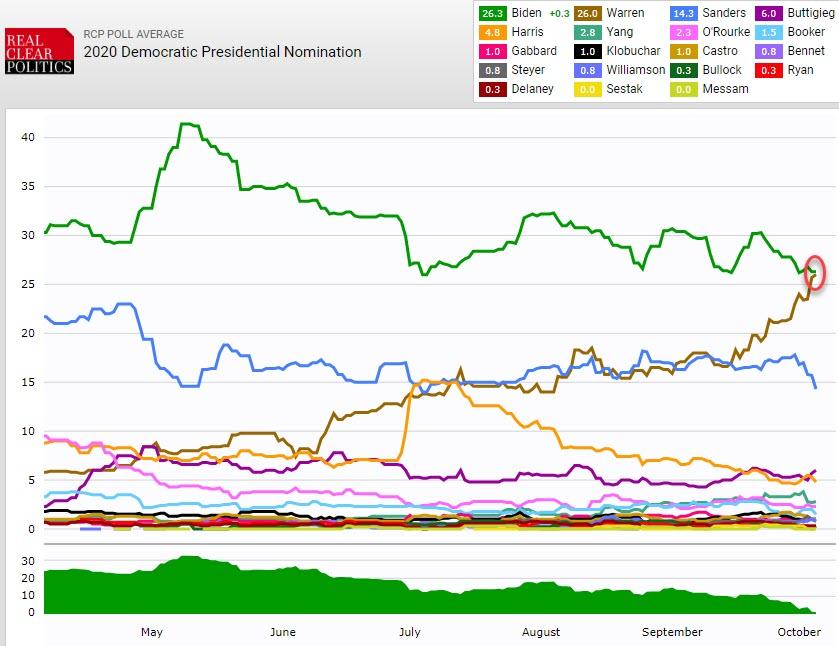

Finally, some are starting to wonder if this is having an impact on stocks…

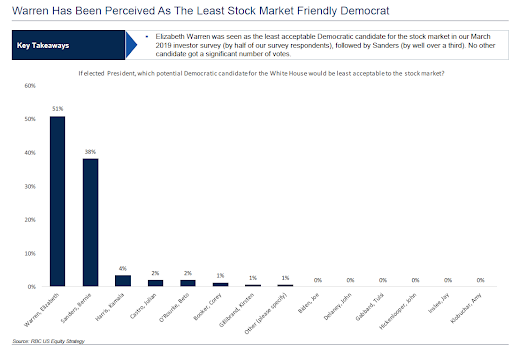

And here’s why that is overall negative for stocks… Warren is the least stock market friendly Democrat…

Which really shouldn’t be a huge surprise as money has been leaning that way for a while – OR…

As it the fact that Hillary is now in 3rd place (at PredictIt) that really freaked the markets out?

— Zr1Trader (@ZR1Trader) October 7, 2019

Tyler Durden

Mon, 10/07/2019 – 16:01

via ZeroHedge News https://ift.tt/2AT7Owt Tyler Durden