Why An Elizabeth Warren Presidency May Not Be Catastrophic For The Market

Back in the summer and fall of 2016, one of the recurring bogeyman the liberal media used to try and scare the public into voting for Hillary Clinton – in addition to poll after rigged poll showing Clinton is a 100% guaranteed winner, meant to suppress voter turnout – was that the stock market would instantly crash and never recover. How can one ever forget the blatant idiocy such as the following pablum from Nobel-prize winning economist Paul Krugman who hours after the Trump victory wrote “It really does now look like President Donald J. Trump, and markets are plunging. When might we expect them to recover?… we are very probably looking at a global recession, with no end in sight.”

Coming from the person who once said the internet would have the same impact on the world as a fax machine, one wouldn’t expect more from the NYT op-ed writer, but his opinion did accurately represent what the mainstream was “thinking” at the time.

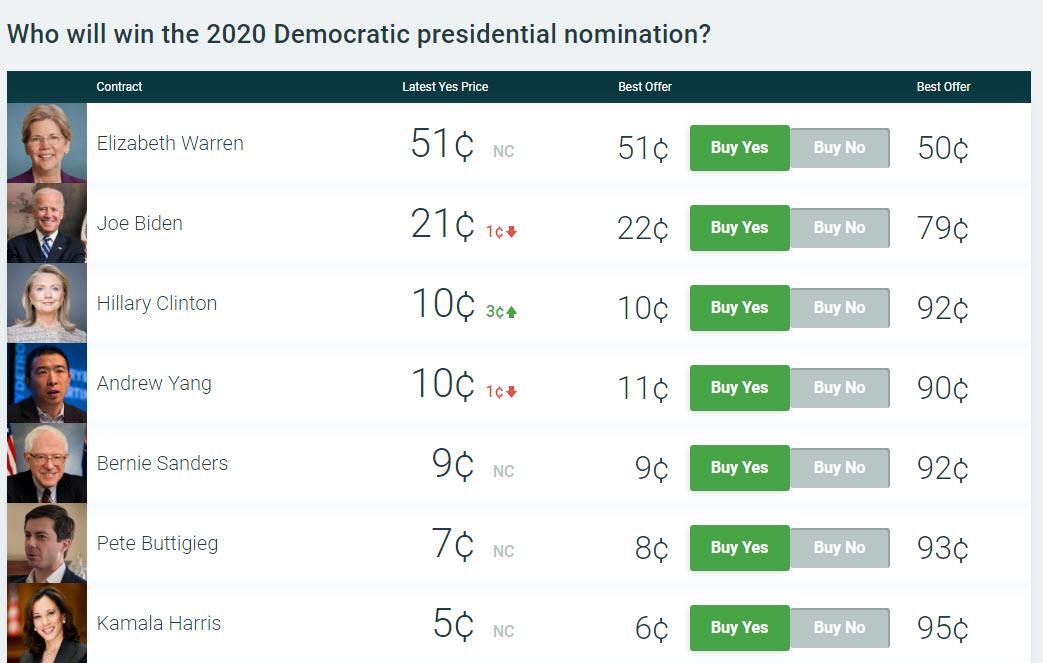

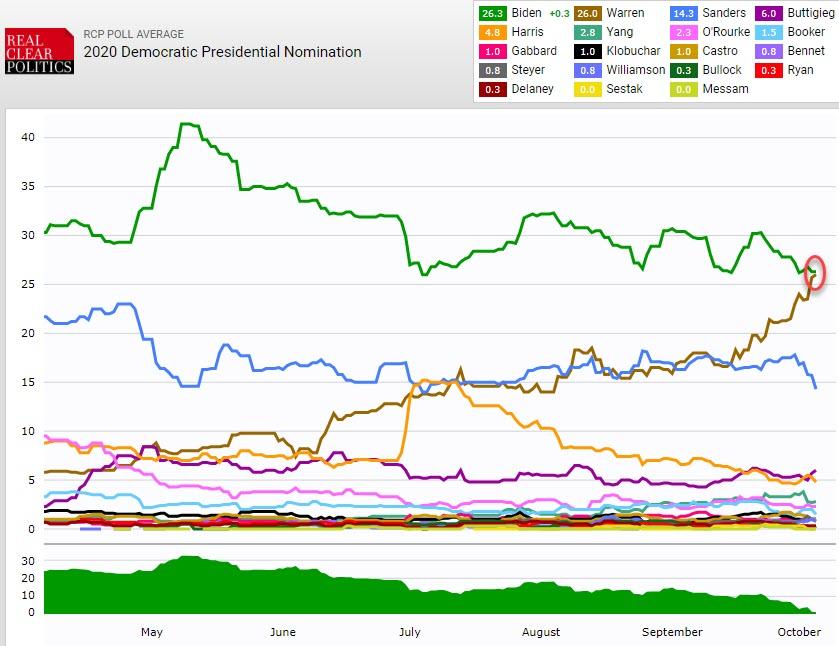

Which brings us to today and the growing odds that Elizabeth Warren will not only be the Democratic candidate, but may also be the next US president… and yes, Hillary Clinton has somehow managed to sneak into 3rd place after Joe Biden.

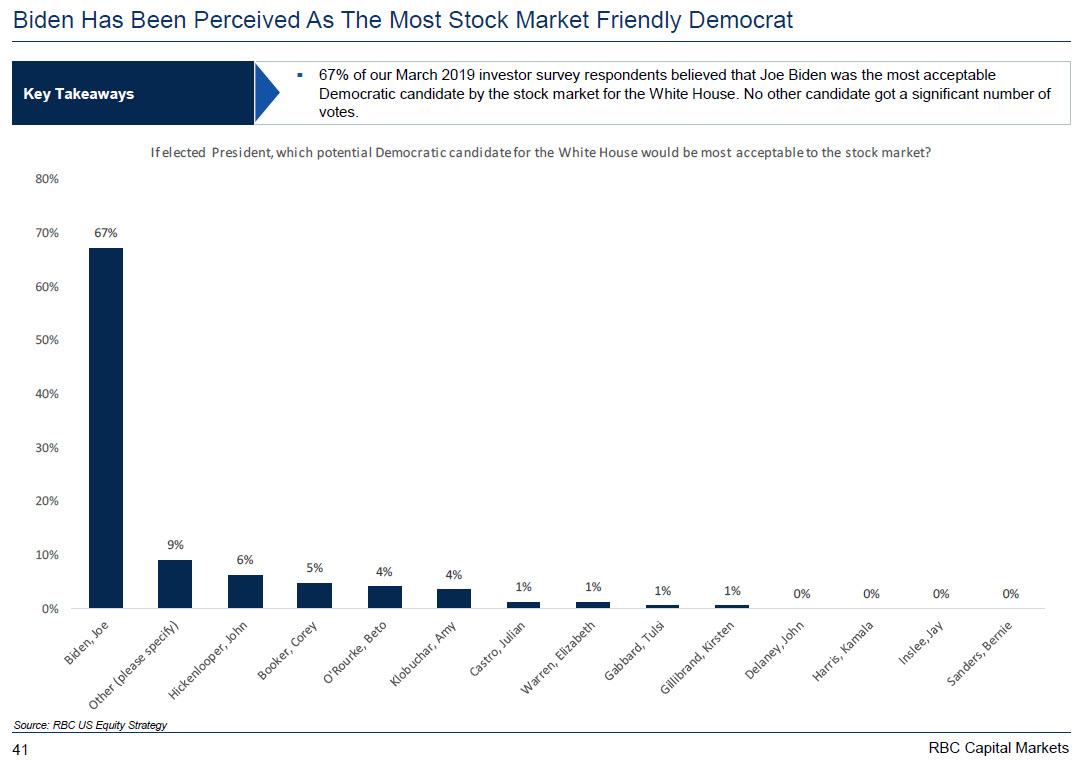

It will hardly come as a surprise to anyone, that unlike Joe Biden…

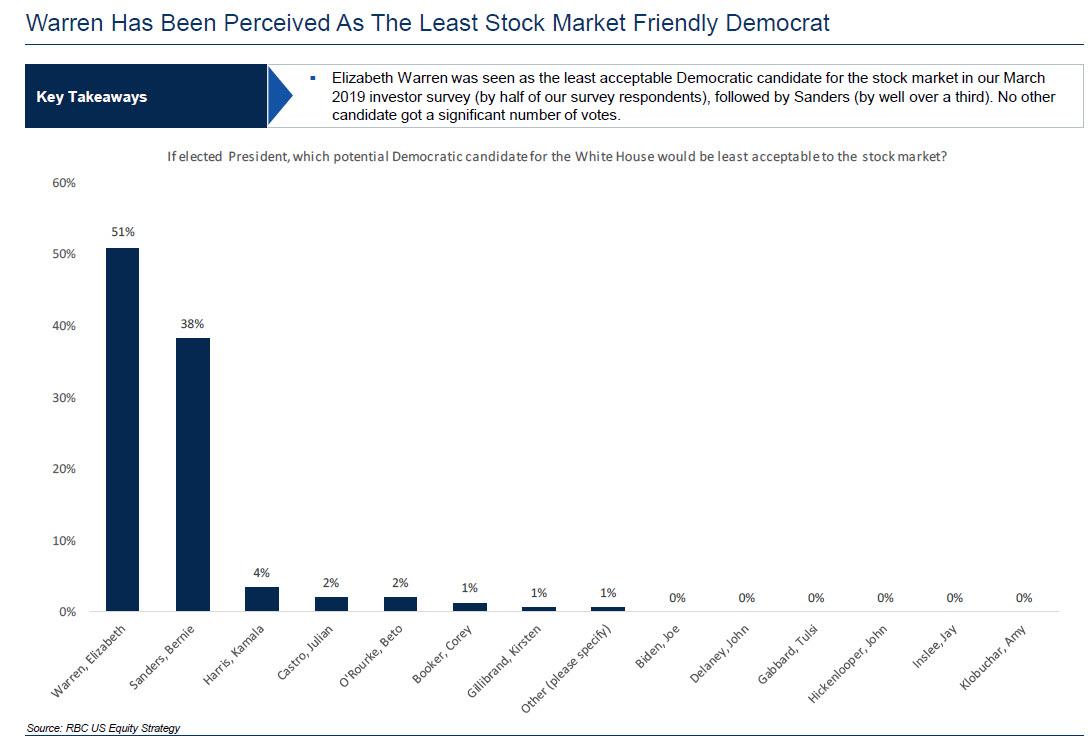

…. Elizabeth Warren is widely seen as the most market unfriendly potential democratic president.

Warren’s recent surge in the polls is also why last week Bank of America cautioned that “investors can’t ignore election risk any longer.”

Commenting on the possible consequences of a Warren victory, BofA said that the most straightforward is higher volatility, although the uniqueness of this scenario “also implies there is not a readily available trading playbook investors can rely upon.” The bank also cautioned that financials and health care companies will likely be the biggest “president Warren” casualties, as these two sectors stand to lose the most if Warren were to be elected, at least based on her track record and rhetoric.

In particular, Financials are likely to weaken on the risk of an increase in regulation (“The real cause of the crash was not some inevitable cycle; this crash was the direct consequence of years of deliberate deregulation…”, Apr 2014 – Elizabeth Warren). Arguably, Financials would also be hurt by falling yields if markets were spooked and a textbook flight-to-safety type of sell-off played out. The Health Care sector is also at risk given Warren’s push for Medicare-for-All (“I spent a big chunk of my life studying why families go broke. One of the number-one reasons is the cost of health care, medical bills. [..] Medicare for all solves that problem”, Jun 2019 – Elizabeth Warren).

As a reminder, Warren has pitched ideas like “accountable capitalism,” and advocated for consumers and employees over shareholders and investors. Her recent surge in key state and national polls has stoked concern about sectors such as biotechnology, for-profit schools, health insurance, and even the U.S. dollar. Some market players have voiced unease.

To be sure, we have covered all of this previously, and over the weekend JPM also issued a “Warren warning” writing that “Investor concerns about Elizabeth Warren’s tax and regulatory policies especially regarding banks, big tech, energy and healthcare are well known. So sustained increases in the likelihood of her running for the Presidency after winning the nomination could unnerve markets.”

But just like in the case of the Trump warnings in 2016, is it possible that Warren’s ascendancy to the presidency won’t be such a shocking event for the market as it has been portrayed?

That is the argument made by RBC’s head of US equity strategy, Lori Calvasina, who today published “four thoughts” on the implications for the US equity market if Warren wins the White House in 2020, in which she writes that “any pain from a Warren win is likely to be temporary,” noting that “most of the sectors at high risk under a Warren presidency from a policy perspective (Financials, Energy, Health Care, Industrials) are already deeply undervalued versus the broader market” (both Morgan Stanley and Bank of America would wildly disagree with this).

Not only does Calvasina think that the downside is limited, she also believes that there is much more upside for what else, the market’s latest virtue signalling darling, ESG investments, noting that the election of a progressive Democrat could be “supportive of the already growing popularity of ESG as an investment approach.”

The RBC strategist also predicted that small caps might outperform larger stocks, as they may have less direct risk from policy changes in a time when anti-trust threats are swirling around the tech giants; Indeed, any breakups of big technology companies “would be a problem” for a few stocks with “mega” market capitalizations, though it could be a positive for retailers and others that have suffered from the rise of Amazon.com, she wrote. And regional banks might be hurt less than the bigger financials.

In summary RBC is confident that just like with the Trump election, the market response would be far more muted than consensus expects: “the stock market tends to go up over time, regardless of who occupies the White House. This is true even when Democrats control the White House and both chambers of Congress.”

Calvasina ends on an optimistic note: “ultimately we think Corporate America and U.S. equity investors would learn to adapt to new political leadership, as they always do.”

Below we represent RBC’s “four thoughts” on what the implications for the stock market will be if Warren wins in 2020:

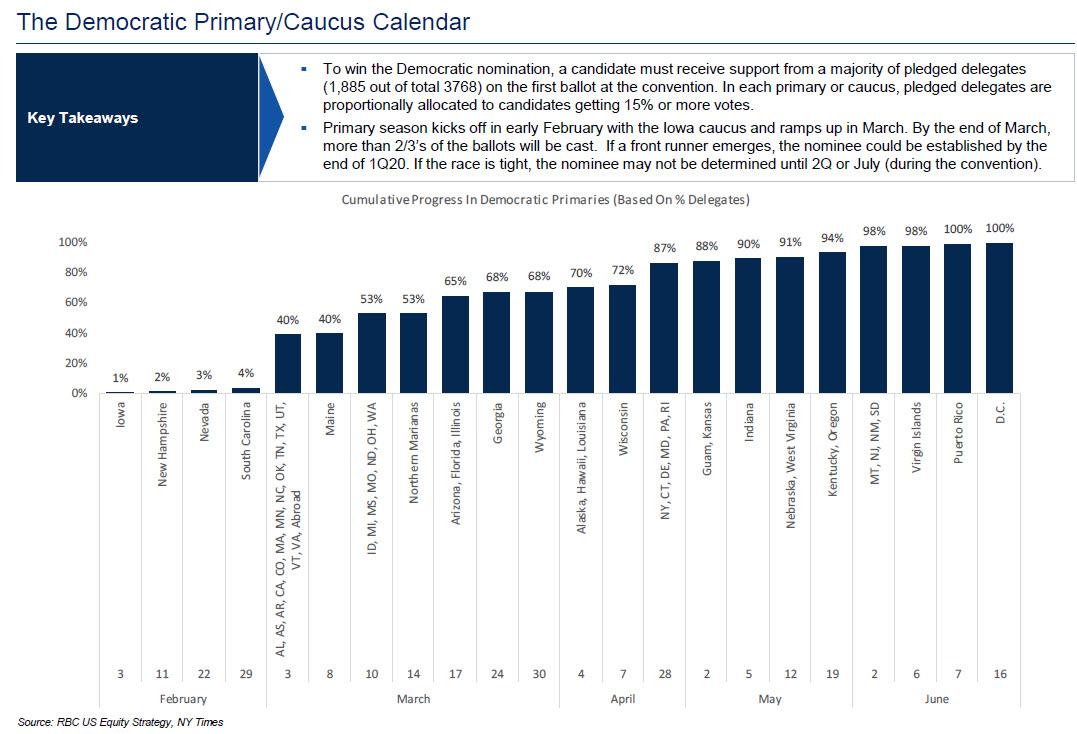

- 1. This risk could play out in the equity market well before Election Day. Though impeachment is pulling some of the impact into 4Q19, we have expected fears of a Warren win to be a headwind for the stock market in the first half of 2020 (particularly 1Q20), and that continues to be our view today. The timeline of events is key. The Iowa caucus takes place on February 3rd. Across all states, forty percent of the Democratic delegates will be assigned by early March, and roughly 2/3’s will be assigned by the end of March. If Warren wins the nomination, we expect most of the pain associated with a White House victory to occur well ahead of Election Day.

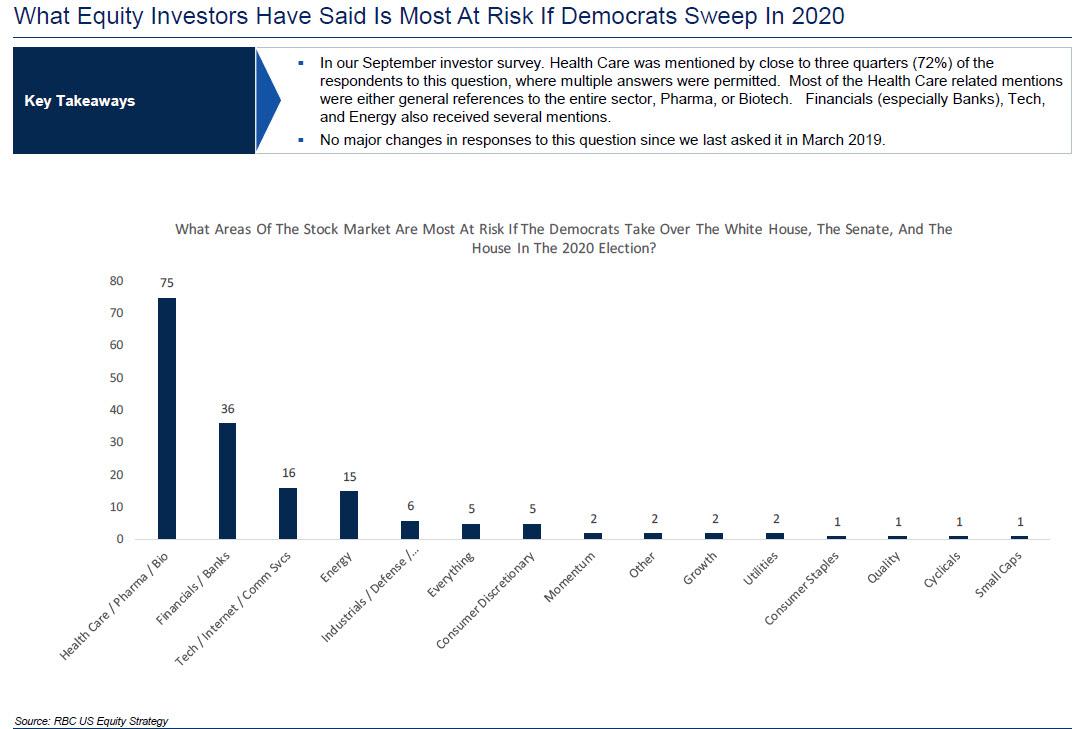

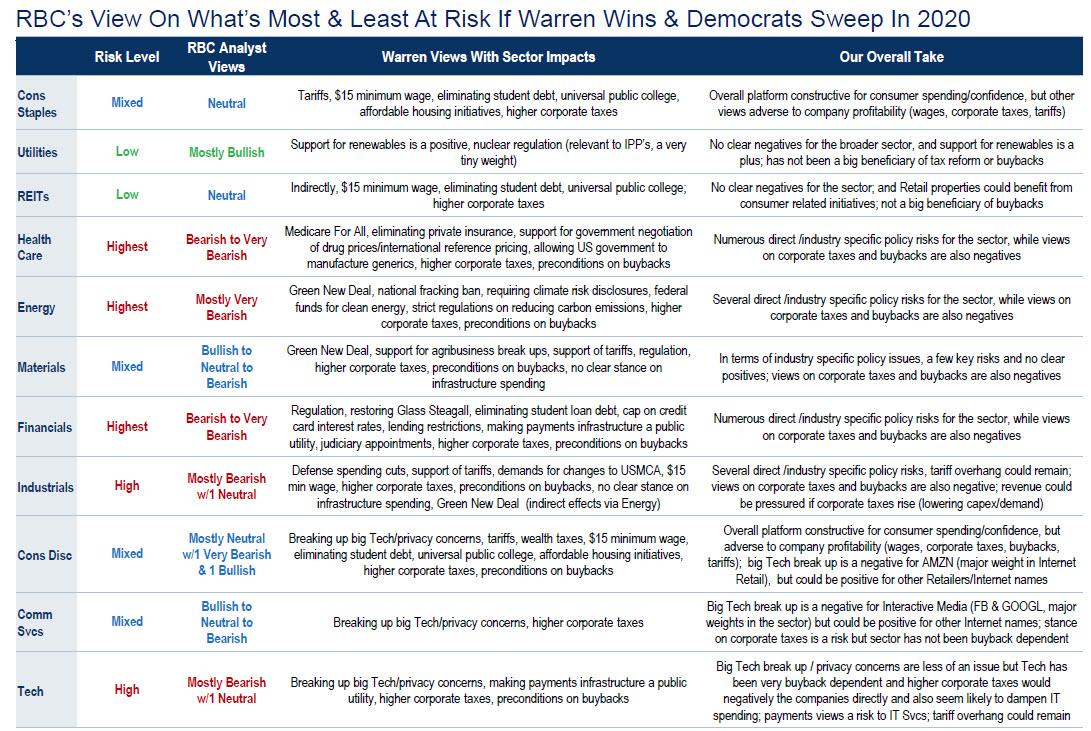

- 2. The combination of a Warren White House and Democratic Congress would be extremely challenging for stocks from a bottom-up perspective. So far, Warren has distinguished herself in the primary through policy. The sheer multitude of her plans leaves US equity investors with few safe havens. Interestingly, the participants in our September investor survey highlighted Health Care as the primary sector at risk if Democrats sweep the White House and Congress in 2020.

But our own analysis, which relies heavily on a survey that we conducted of RBC industry analysts in early October plus our review of which sectors have been benefiting the most from lower corporate taxes and share buybacks, tells us that the combination of a Warren White House and Democratic Congress is also an extremely high risk for Energy and Financials. There is also a significant degree of risk for Industrials and Tech (though a bit lower than the three previously mentioned sectors). The implications for Consumer Discretionary, Communication Services, Materials, and Consumer Staples are mixed, while risks are lowest for Utilities and REITs. See page 15 for our 2020 election sector heat map, in which we outline which Warren policy positions seem likely to affect each of the major GICS sectors, as well as our overall take on the implications of the election for each sector.

- 3. Despite the myriad challenges at the sector level, we envision a number of investable themes that US equity investors would be able to focus on under this scenario. First, the election of a progressive Democrat seems supportive of the already growing popularity of ESG as an investment approach, since issues like climate change and fair pay could be in the spotlight. Second, dividends seem likely to become a more popular use of cash, since buybacks would be out of favor politically. This benefits the two sectors that we believe have the least direct policy risk (Utilities and REITs) but could also offset some of the pain in Financials and Energy, other major dividend payers which are already deeply undervalued relative to the broader US equity market. Other sectors also seem likely to shift their attention from buybacks to dividends, and we note that dividends were already in greater focus among S&P 500 companies in 2Q19 reporting season. Third, our initial assessment is that Small Caps may have less direct policy risk than Large Caps. Big Tech break ups would be a problem for a select few Mega Cap Internet names (affecting Large Cap Consumer Discretionary and Communication Services) but could be a positive for other Internet names along with Retailers that have suffered from the dominance of AMZN (many of which are Small Caps). Our SMID cap Banks analyst also sees a Warren presidency as a bit less of a negative for regional names than their big cap counterparts.

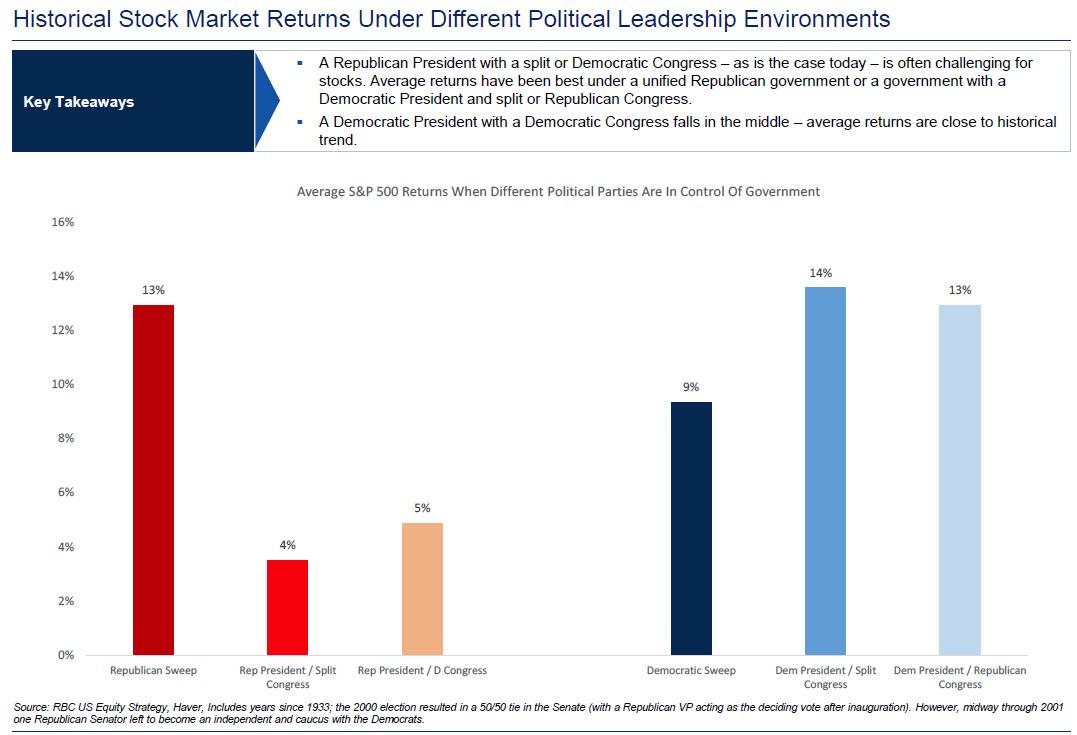

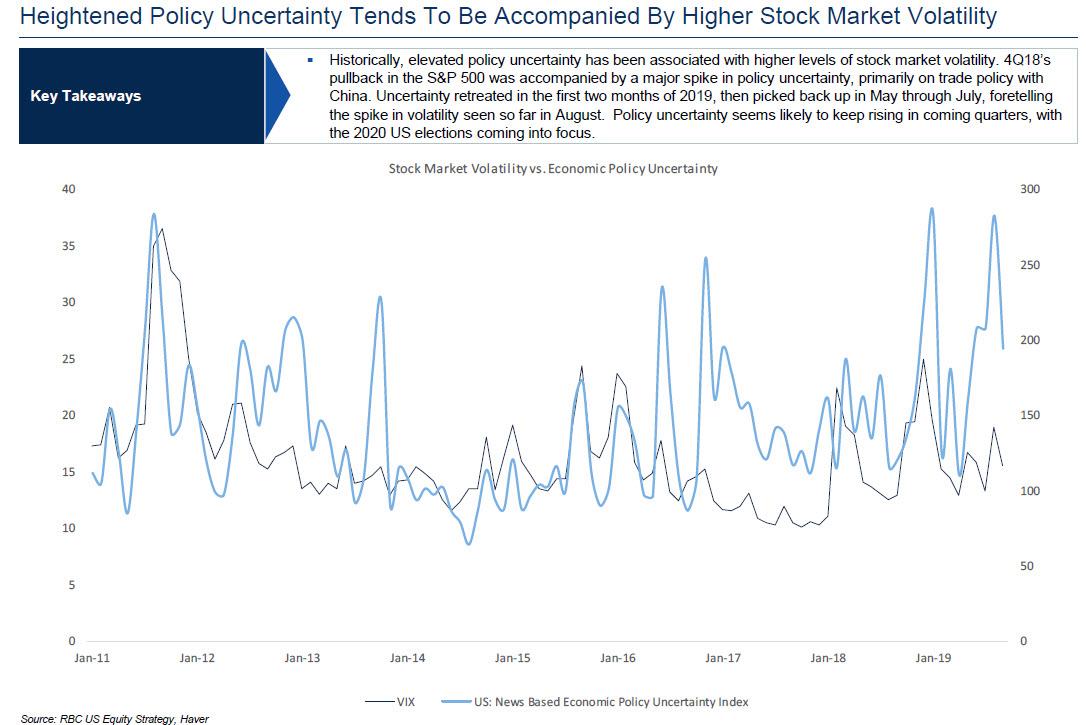

- 4. Any pain from a Warren win is likely to be temporary. While the broader US equity market looks expensive, particularly on non-P/E metrics which have not been pushed down by tax reform, most of the sectors at high risk under a Warren Presidency from a policy perspective (Financials, Energy, Health Care, Industrials) are already deeply undervalued vs. the broader market. More importantly, the stock market tends to go up over time, regardless of who occupies the White House. This is true even when Democrats control the White House and both chambers of Congress. Interestingly, the best historical returns in the S&P 500 have occurred with a Democrat in the White House, when Republicans control at least one chamber of Congress. In the short-term, stocks don’t respond well to heightened economic policy uncertainty.

Ultimately we think Corporate America and US equity investors would learn to adapt to new political leadership, as they always do.

Tyler Durden

Mon, 10/07/2019 – 18:05

via ZeroHedge News https://ift.tt/30Y4SsW Tyler Durden