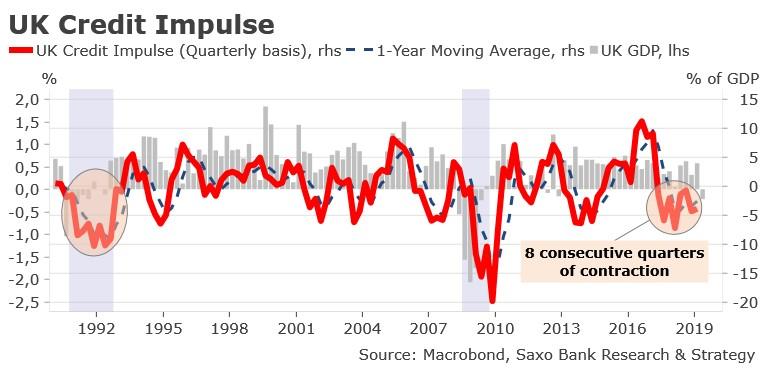

This Is The Longest Contraction In UK Credit Impulse Since The Early 1990s

Submitted by Christopher Dembik of Saxobank

Our favorite macro gauge UK credit impulse, which explains economic activity nine to twelve months forward with an “R2” of .60, is going through its eighth quarter of contraction, the longest period since the early 1990s.

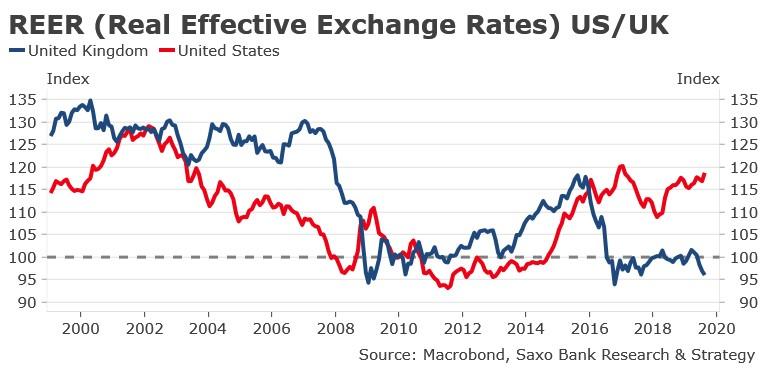

The length of the contraction is similar to that of the period 1990-1992 when the United Kingdom entered into recession due to high interest rates, an overvalued exchange rate and falling house prices.

The current situation is profoundly different since it is Brexit uncertainty that is driving the economic downturn. The uncertainty goes hand in hand with low interest rates, a GBPUSD exchange rate undervalued by 23% (chart below) and lower house prices in real terms.

Recession is only a matter of time: The prolonged contraction in the flow of new credit in the economy and the five straight quarters of contraction in business investment are the two key factors usually leading to a recession.

Strategic view :

- Our central scenario remains the extension of Article 50, that should be requested by October 19th, and new Parliamentary elections that could take place five weeks after the initial Brexit deadline, ie end of November/beginning of December.

- There is still extreme positioning on the GBP. The speculative community remains widely short GBP, though it has slightly compressed since mid-September on the hopes of a new extension. If this scenario is confirmed, it could be immediately followed by a technical rebound of the GBP. However, the long-term view is still gloomy for the British pound as Brexit uncertainty and unsupportive fundamentals (such as the wide current account deficit and negative net FDI flows) remain.

- Based on these assumptions, we expect GBP/USD to re-test for the third time this year the 1.21 level, and EUR/GBP to move back to 0.93.

Tyler Durden

Thu, 10/10/2019 – 05:00

via ZeroHedge News https://ift.tt/321m7Le Tyler Durden