“Sea Of Green” As Trade Deal, Brexit Optimism Send Futures, World Markets Soaring

So far, Friday has been a rerun of the Thursday session, where early “trade war” gloom turned to euphoria with the market convinced a mini trade deal between the US and China will be announced momentarily, just as soon as Trump and Liu He are scheduled to meet at 2:45pm in the White House. Throw in some Brexit optimism and there’s your reason why US equity futures jumped over 30 points overnight…

… and why global stock markets were a sea of green.

The MSCI world index jumped 0.8% to head toward its first weekly gain in four weeks. The broader Euro STOXX 600 surged 2.5%, led by a 3.4% surge in the German DAX. Tech shares led European gains, with the Stoxx 600 Technology Index surging 3.2%, most since April 24, led higher by SAP. Banks also rose, with the index rising 2.4%, most in a month, while S&P 500 futures jumped 0.9% Asian shares had rallied earlier, with an index of Asia-Pacific shares outside Japan climbing 1.3%.

The improvement in appetite for riskier bets came after U.S. President Donald Trump on Thursday called the first day of trade talks with China in over two months “very, very good.” Trade optimism was bolstered overnight after a Chinese state newspaper said on Friday that a “partial” trade deal would benefit China and the United States, and Washington should take the offer on the table, reflecting Beijing’s aim of cooling the row before more U.S. tariffs kick in.

China’s top trade negotiator, Vice Premier Liu He, said on Thursday that China is willing to reach agreement with the United States on matters that both sides care about so as to prevent friction from leading to any further escalation. He stressed that “the Chinese side came with great sincerity”.

Adding to that, the official China Daily newspaper said in an editorial in English: “A partial deal is a more feasible objective” adding that “Not only would it be of tangible benefit by breaking the impasse, but it would also create badly needed breathing space for both sides to reflect on the bigger picture.”

Additionally, and not coincidentally, hours ahead of an expected meeting between China’s Liu and U.S. President Donald Trump at the White House, China’s securities regulator unveiled a firm timetable for scrapping foreign ownership limits in futures, securities and mutual fund companies for the first time, suggesting that professional US gamblers will be welcome to invest, and lose, other people’s money in Chinese fraudcaps. China previously said it would further open up its financial sector on its own terms and at its own pace, but the timing of Friday’s announcement suggests Beijing is keen to show progress in its plan to increase foreigners’ access to the sector, which is among a host of demands from Washington in the trade talks.

Chinese officials are offering to increase annual purchases of U.S. agricultural products as the two countries seek to resolve their trade dispute, the Financial Times reported on Wednesday, citing unidentified sources. The U.S. Department of Agriculture (USDA) on Thursday confirmed net sales of 142,172 tonnes of U.S. pork to China in the week ended Oct. 3, the largest weekly sale to the world’s top pork market on record.

A (very unlikely) U.S.-China currency agreement is also being floated as a symbol of progress in talks between the world’s two largest economies, although that would largely repeat past pledges by China, currency experts say, and will not change the dollar-yuan relationship that has been a thorn in the side of Trump.

There were also overnight reports that the White House is reportedly mulling Public Company Accounting Oversight Board (PCAOB) dispute over access to China audits, according to reports. Officials are fixating on why Chinese companies can sell shares in the US when American regulators are prohibited from inspecting their books.

Analysts have noted China sent a larger-than-normal delegation of senior Chinese officials to Washington, with commerce minister Zhong Shan and deputy ministers on agriculture and technology also present. Separately, the SCMP reported that China’s Vice Premier Liu has a letter from President Xi, which may or may not be given to US President Trump in their meeting today.

The sudden optimism about a potential de-escalation is in stark contrast to much more gloomy predictions in business circles just days ago on the heels of a series of threatened crackdowns on China by the Trump administration. On Tuesday, the U.S. government widened its trade blacklist to include Chinese public security bureaus and some of China’s top artificial intelligence startups, punishing Beijing for its treatment of Muslim minorities. Surprised by the move, Chinese government officials told Reuters on the eve of talks that they had lowered expectations for significant progress.

Friday’s China Daily editorial also warned that “pessimism is still justified”, noting that the talks would finish just three days before Washington is due to raise tariffs on $250 billion worth of Chinese imports. The negotiations were the “only window” to end deteriorating relations, it added.

Investors cautioned that markets were hoping for, at best, a deal limited in scope, and they noted that sunny rhetoric had in the past failed to translate into more meaningful moves. “I would caution that we have been here before, where we have seen positive talk,” said Mike Bell, global market strategist at J.P. Morgan Asset Management. “It’s possible they will be able to do a smaller deal around tariffs, where there is some room for movement.”

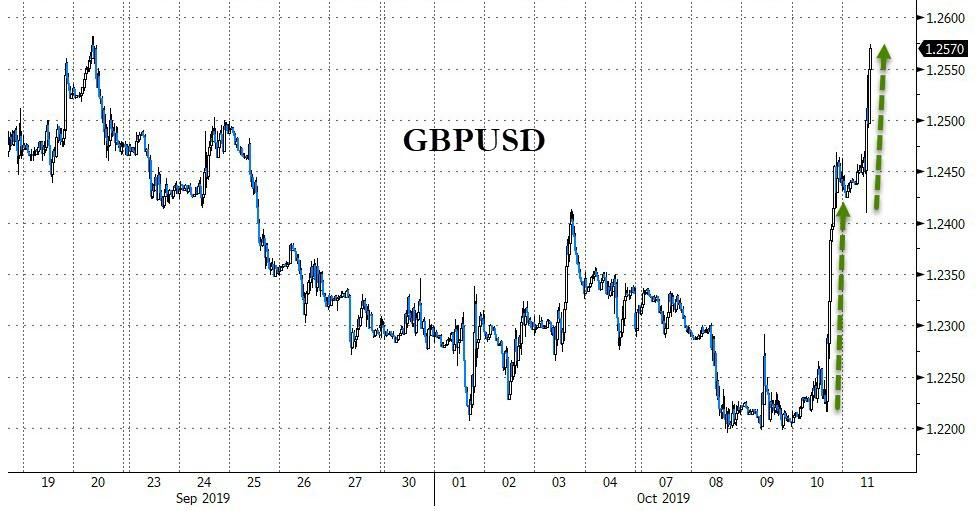

Elsewhere, Brexit optimism was also rampant and the pound soared higher on Friday – its largest daily percentage gain in seven months and biggest 2-day jump since June 2016 – after Donald Tusk, EU council president, said he had seen “promising signals” about the chance of a fresh Brexit agreement between the UK and the EU, even if the country hasn’t come forward with a workable, realistic plan. Optimism that a deal could be reached has been increasing following a meeting between Boris Johnson, UK prime minister, and Leo Varadkar, Irish taoiseach, on Thursday, after which the two said they could see a “pathway” to a possible Brexit deal.

After meeting British Prime Minister Boris Johnson for talks, Irish Prime Minister Leo Varadkar said on Thursday that a deal to let Britain leave the European Union in an orderly fashion could be sealed by the end of the month. Varadkar called the talks “constructive,” while the two leaders said in a joint statement that they could “see a pathway to a possible deal”. But it remained unclear what the pair agreed on.

But with Britain due to leave the world’s biggest trading bloc on Oct. 31, the fate of Brexit is still in the balance. Market players said investors remained skittish. Moves in sterling reflected a tendency to jump on any signs of progress.

“We are moving to a glimmer of hope, rather than strong expectation that things will get done,” Tim Drayson, head of economics at Legal & General Investment Management. Yet Drayson said that any deal struck between Dublin and London would then face the hurdle of the British parliament, even after securing agreement from the European Union. “I think the odds are that we don’t reach an agreement, but I’m not expecting a crash out on October 31.”

“We still think that markets are probably underpricing the likelihood of a hard Brexit scenario,” said Salman Baig, a cross-asset investment manager at Unigestion whose pound short appears to have been steamrolled by a backbreaking short squeeze.

In geopolitics, US House Republicans said they will introduce sanctions against Turkey in response to its offensive against Kurds in Northern Syrian, according to newswires. Subsequent reports indicate European response could be debated as early as next week

In commodities, oil prices jumped by 2% after Iranian news agencies said a state-owned oil tanker was struck by two missiles in the Red Sea near Saudi Arabia, raising the prospect of supply disruptions from a crucial producing region. Brent crude was up around 2.1% at $60.36 per barrel.

Expected data include the University of Michigan Consumer Sentiment Index. Fastenal is reporting earnings

Market Snapshot

- S&P 500 futures up 0.7% to 2,962.75

- STOXX Europe 600 up 1% to 386.50

- MXAP up 1.2% to 157.15

- MXAPJ up 1.4% to 504.43

- Nikkei up 1.2% to 21,798.87

- Topix up 0.9% to 1,595.27

- Hang Seng Index up 2.3% to 26,308.44

- Shanghai Composite up 0.9% to 2,973.66

- Sensex up 0.9% to 38,227.49

- Australia S&P/ASX 200 up 0.9% to 6,606.81

- Kospi up 0.8% to 2,044.61

- German 10Y yield fell 1.4 bps to -0.483%

- Euro up 0.05% to $1.1010

- Italian 10Y yield rose 8.7 bps to 0.616%

- Spanish 10Y yield fell 3.3 bps to 0.194%

- Brent futures up 1.5% to $59.96/bbl

- Gold spot up 0.4% to $1,499.17

- U.S. Dollar Index down 0.2% to 98.52

Top Overnight News from Bloomberg

- Trump said the first day of high-level trade negotiations between the U.S. and China on Thursday went “very well” and that he plans to meet with the top Chinese negotiator Friday

- The U.K. and the European Union took a step closer to agreeing the terms of Brexit after a positive meeting between the British and Irish leaders identified a “pathway” to a potential deal. The pound jumped by the most in seven months. No-Deal Brexit to cost Ireland 73,000 jobs, central bank Says

- The “jury is out” on whether the current slowdown in the U.S. economy will turn more severe amid weaker global growth and uncertainty over trade policy that’s chilling investment, according to Federal Reserve Bank of Dallas President Robert Kaplan. Federal Reserve Bank of Cleveland President Loretta Mester says U.S. central bankers should wait for fresh economic information before deciding their next policy move

- The Bank of Japan’s promise to keep pumping extra money into the economy will eventually clash with its efforts to control interest rates, according to Hiromi Yamaoka, the former head of the central bank’s financial markets department. Yamaoka said the pledge to expand the monetary base until inflation is above 2% should be changed to make it easier for the BOJ to keep yields where it wants them

Asian equities took their cue from the rally on Wall Street which saw the DJIA close just below 26,500 as US President Trump said he will meet with Chinese Vice Premier Liu He. ASX 200 (+0.9%) was supported by energy and mining names, whilst Nikkei 225 (+1.2%) felt tailwind for a weaker Yen. Elsewhere, Hang Seng (+2.4%) outperformed as heavyweight financials and oil-related stocks bolstered the index amid a high-yield and firmer oil price environment. Meanwhile, Shanghai Comp. (+0.9%) swung between gains and losses with the mainland remains on-guard as sticking points remain between the two largest economies. Hong Kong Protesters reportedly are mulling whether to scale back on vandalism and violence as it risks alienating more moderate supported, according to reports. Japanese Typhoon Hagibis is forecast to be the most powerful typhoon to hit Tokyo since 1958, according to the meteorological agency.

Top Asian News

- Malaysia Widens Budget Deficit Target to Weather Trade War

- Tencent Gets ‘Wakeup Call’ From China’s Assertions of Patriotism

- Violent Typhoon Heads for Japan, Canceling Over 1,000 Flights

Major European bourses are firmer thus far this morning as US-China newsflow remains light ahead of Trump and Liu He’s meeting at 19:45BST today; and following a positive Asia-Pac session where sentiment remained buoyed going into day two of talks. Sectors clearly illustrate the mornings heavy newsflow. With IT the notable outperformer following SAP (+7.6%) reporting earnings which were above Prev. and news that the CEO is to step down with immediate effect being well received. Also, firmer this morning are energy names following an Iranian tanker incident this morning, which is outlined in the Commodity section below. However, consumer discretionary names are suffering on the back of Hugo Boss (-13.3%) cutting their FY19 EBIT target citing persistent macroeconomic uncertainties; alongside, a number of downgrades at brokerages. Elsewhere, the FTSE 100 is this morning’s clear laggard given the recent upside in Sterling on positive Irish/UK PM comments regarding Brexit. However, in-spite of the index’s weakness the upbeat Brexit commentary has lent support to politically sensitive Co’s such as housebuilders and banks; although most recent comments from EU Council President Tusk have brought yet more urgency into the talks stating if there are no sufficient proposals today then he will have to announce there is no chance for a deal at next week’s summit. International Air Safety Panel have faulted the FAA for their certification of the Boeing (BA) 737 Max; FAA failed to sufficiently assess the MCAS system, did not sufficiently consider now design features of the craft, some regulations are out of date.

Top European News

- Equinor Green-Lights $550 Million Subsidized Floating Wind

- European Equities To Fall 8% in No-Deal Brexit Scenario: BofAML

- Two Out of Three Options Trades Now Look for a Stronger Sterling

- EU Will Discuss Sanctions Against Turkey Next Week: Syria Update

In FX, Aud/Usd has extended gains beyond 0.6750 and through the 50 DMA (0.6778) to within a whisker of 0.6800 on a wave of US-China trade optimism after day one of talks in Washington and generally positive updates from both sides on the status of trade negotiations thus far.

- GBP – Yet another white knuckle ride for Sterling after a more pronounced short squeeze on Irish backstop breakthrough hype inspired by Thursday’s meeting between UK PM Johnson and Ireland’s Varadkar, and the latest catalyst came via EU’s Tusk rather Britain’s Brexit Minister Barclay or EU kingpin Barnier that have now completed their rendezvous to discuss the situation. In short, Tusk said the deadline for alternative border/customs proposals is today and as yet they have not been submitted, prompting an abrupt/sharp Pound plunge, but then revived bullish momentum by noting that promising signs from the Irish PM mean a deal can still be done. In terms of market moves, Cable collapsed to almost 1.2400 before regrouping and flying back up to 1.2500+ awaiting the debriefing from Barnier to EU states and fading just short of 1.2550, while Eur/Gbp has whipsawed between 0.8867-0.8789 and is poised just above 0.8800, but below the 200 DMA (0.8830).

- NZD/EUR/CAD – All firmer vs a flagging Greenback (DXY only just holding above 98.500), with the Kiwi piggy-backing its Antipodean counterpart and climbing towards 0.6350, Euro consolidating above 1.1000 and Loonie maintaining a bid over 1.3300 ahead of Canadian jobs data and as oil prices rally in wake of an Iranian tanker missile attack . Back to Eur/Usd, decent option expiries at the 1.1000 strike may figure (1.4 bn), while tech levels could also influence trade/direction given Fibs at 1.1021 and 1.1055 and DMAs at 1.1054 and 1.0987 (55 and 21 respectively).

- CHF/JPY – More safe-haven unwinding has nudged the Franc a bit nearer parity vs the Dollar and a test of 1.1000 against the single currency, while the Yen has slipped under 108.00 to expose September’s peak a fraction below 108.50.

- EM – The Cnh is also anticipating good news from the President Trump-VP Lui He date at the White House that will officially close the latest round of talks, with the offshore Yuan hovering around 7.0900, but the Try has retreated in wake of US sanctions over Turkey’s military actions in Syria awaiting the EU’s response at next week’s summit – Lira back down towards 5.8750.

In commodities, Brent and WTI have been lifted this morning to gains of over USD 1/bbl at best on the back of early geopolitical newsflow that a Iranian tanker was on fire after a explosion near Saudi’s Jeddah port which led to heavy tanker damage and reports that oil was leaking into the Red Sea. TankerTrackers believe this tanker could be the SINOPA tanker which was on route to Syria and had a cargo of 1mln barrels on board. Subsequently, newsflow noted that the explosion was due to missiles and there were some reports that this originated from Saudi Arabia; however, Iran’s National Tanker Co. have denied reports that they said the missiles originated from Saudi Arabia though the Foreign Ministry confirm two hits on the tanker. The updates evidently led to a crude bid on further geopolitical tensions, particularly as reports note this is the 3rd Iranian tanker to be hit in around 6-months in this area; focus now turns to clarity on where the missiles originated from. Separately, today’s IEA report marked the end of the monthly trio where they cut their demand forecast form 2019 in stead with the other two reports. In terms of metals, spot gold was lifted above the USD 1500/oz mark on the middle-east geopolitical premium with the upcoming US-China trade talks also in focus; although it has since dropped back below.

US Event Calendar

- 8:30am: Import Price Index MoM, est. 0.0%, prior -0.5%; Import Price Index YoY, est. -2.1%, prior -2.0%

- 8:30am: Export Price Index MoM, est. -0.05%, prior -0.6%; Export Price Index YoY, prior -1.4%

- 10am: U. of Mich. Sentiment, est. 92, prior 93.2; Current Conditions, est. 109, prior 108.5; Expectations, est. 82.5, prior 83.4; 1 Yr Inflation, prior 2.8%; 5-10 Yr Inflation, prior 2.4%

- 11:45am: Bloomberg Oct. United States Economic Survey

DB’s Jim Reid concludes the overnight wrap

What does or doesn’t happen over the next few days could have major ramifications for global politics for years to come. At the start of the week things looked bleak on prospects of any kind of US/China trade deal and even bleaker on the prospect on a Brexit deal. However we close out the week with renewed hopes on both of these with the latter being the more surprising of the two.

Indeed the Irish and U.K. PM’s joint statement “agreed that they could see a pathway to a possible deal.” The Irish Times suggested that there had been “significant movement” from the UK on the customs issue. If there has been a concession on NI customs this could very easily alienate the DUP and they’ve suggested they won’t back it. However where this would become clever is if Mr Johnson agreed to back down on this and agree a deal only on the basis that the EU refuse to back an extension if U.K. MPs vote this deal down. In this scenario ironically the very people who forced the government into the Benn Act (that takes no deal off the table) would be the ones responsible for a no deal if they voted the deal down. This calculation does rely on the ERG group staying with PM Johnson and not going back to rebelling but their bar to rebel seems to be higher under Johnson than May. So far we’ve got no details from the U.K. side and only cautious positive soundbites from the Irish (a big improvement relative to where we’ve been though). However no leaked news is probably good news for now and it’s remarkable that I’ve woken up this morning with nothing on the wires to flesh out the progress. Sterling rallied +1.97% against the dollar yesterday – the most in 7 months. In terms of next steps, the UK’s Brexit Secretary Stephen Barclay will be meeting the EU’s chief negotiator Michel Barnier today as the two sides look to move closer towards a deal ahead of Thursday’s EU Council summit. A long long way to go but unexpected hope after yesterday.

Prior to the Brexit developments the mood in markets started to pick up after a tweet from President Trump just after the US open, as he confirmed he would meet with Vice Premier Liu He at the White House today at 2:45pm. The fact that the President is meeting the Vice Premier directly can be seen as a positive sign for the path of negotiations, offering hope that some sort of ‘partial deal’ of the sort that has been briefed out might be possible. After US markets had closed, Trump said that the discussions were going “very well,” helping S&P 500 futures to trade +0.37% higher this morning. As part of this reported partial deal, Bloomberg reported that the White House is looking at rolling out a currency agreement with China that they’d previously agreed before the talks broke down earlier in the year, while not going ahead with the tariff hikes planned for October 15. For their part, China is reportedly asking for no further tariff hikes, as well as the elimination of sanctions on their national champion shipping company, COSCO. The US had barred American firms from doing business with the Chinese shipping giant last month, accusing the firm of transporting Iranian crude oil.

As a final point on the trade war, it’s worth reading this report (link here ) from our US economists from earlier this week. They delve into regional data to show that the trade war has had an outsized negative effect on counties that rely more on manufacturing. Interestingly, those counties also tended to be the ones which supported President Trump more in the 2016 election, meaning there are clear political implications to the current trade war.

Trade-sensitive stocks saw the biggest gains for the second consecutive day, with the Philadelphia semiconductor index up +0.97%, while the S&P 500 and the NASDAQ closed up +0.64% and +0.60% respectively. Meanwhile bonds continued their earlier sell-off following the tweet, with 10yr Treasuries +7.9bps, and we saw another slight steepening of the curve, with the 2s10s closing +0.3bps, its 3rd consecutive move steeper. Bunds (+7.8bps) and BTPs (+8.9bps) also lost ground, with 10yr bund yields closing above -50bps for the first time in in over 3 weeks. Gilt yields rose +12.7bps, their biggest one-day increase in over a year.

The initial catalyst for the Euro government move seemed to be the FT story we mentioned as we went to press yesterday that the ECB monetary policy committee was at odds with the governing council. As we’ll see below the minutes backed up the splits at the ECB but nothing that came out yesterday should be a surprise. The market just decided to react to it more yesterday, and the selloff was given further boosts by the improvement in risk sentiment and a move higher in oil prices (+2.03%) after OPEC Secretary General Barkindo committed to do “whatever it takes” to prevent a drop in prices.

Asian markets are higher this morning on the more positive trade sentiment with the Nikkei (+1.08%), Hang Seng (+2.19%), Shanghai Comp (+0.44%) and Kospi (+1.00%) all up alongside most other markets. Yields on 10yr JGBs are up +2.7bps to -0.190%. Elsewhere, WTI crude oil prices are also up a further +0.56% and most agriculture (CBT Soybean +0.68%) and base metal (Copper c. 1%) commodity futures are also up.

Overnight we also got some Fed speak with Cleveland Fed President Loretta Mester, a hawk, saying that US central bankers should wait for fresh economic information before deciding their next policy move. She also said that she did not support the central bank’s decision to cut interest rates in July and September as her preferred strategy “was to take action only if there were evidence of a material deterioration in the outlook and not merely on heightened risks”. Meanwhile, on the Fed’s ongoing framework review, she said that she understands the argument for a so-called make-up strategy, like average-inflation targeting, for addressing below-target inflation, but says the Fed would be challenged to commit credibly to such an approach and added that it would be better for the Fed to not overreact to variations of inflation around the 2% target. Elsewhere, in an interview with the WSJ, Minneapolis Fed President Neel Kashkari, a dove, said that if data continues to come in the way it has, he will support another rate cut of 0.25%.

Back to yesterday and the positive sentiment also supported European equities, with the STOXX 600 up +0.65% and bourses across the continent ending in the green. Amidst the sterling rally, the FTSE 100 underperformed other European bourses rising only +0.28% despite the positivity in the air. Brexit sensitive stocks like U.K. financials were strong after the joint statement with the more domestically-focused Lloyds and Barclays gaining +3.89% and +2.90% respectively, while the more international and sterling-exposed HSBC retreated -1.09%.

In terms of the data yesterday, there were signs that the UK might have avoided a recession this quarter. Although monthly GDP data for August showed a -0.1% contraction (vs. unch expected), the July figures were revised up a tenth to +0.4% mom. After the -0.2% contraction in Q2, there has been nervousness that the economy would enter a technical recession, but the quarterly growth for the 3 months to August was at +0.3% qoq (vs. +0.1% expected). In spite of this, a number of the sector readings disappointed, with industrial production contracting by -1.8% yoy, the biggest yoy contraction since August 2013.

This contraction in industrial production was a theme elsewhere in Europe, with data from France also disappointing. Industrial production fell -1.4% yoy (vs. +0.1% expected), which is the biggest contraction of 2019 so far. It was a similar story in Italy, where industrial production fell -1.8%, as expected, but also the biggest yoy fall this year so far.

Turning to the US, CPI came in slightly below forecasts, with the September reading showing no mom change in prices (vs. +0.1% expected), which meant that the yoy reading remained at +1.7% (vs. +1.8% expected). Core inflation was also slightly below expectations, +0.1% mom (vs. +0.2% expected), with the yoy reading remaining at +2.4% (vs. +2.4% expected). Meanwhile weekly initial jobless claims were better than expected at 210k last week (vs. 220k expected), with the 4-week moving average ticking up slightly to 213.75k (vs. 212.75k previously).

Back to Europe, and the release of the minutes from September’s ECB meeting confirmed much of what we already knew, in that a number of members on the Governing Council had been opposed to the package of easing the ECB unveiled. Although the account revealed that “a few members” had been prepared to cut the deposit facility rate by 20bps, “in particular as part of a package that would exclude net asset purchases”, there were others who were against even the smaller 10bp cut, “as they were concerned about the possibility of increasingly adverse side effects from additional rate cuts.” With President Draghi departing at the end of the month, there’s going to be work to do in bringing unanimity back to the Governing Council under the ECB’s next leadership.

Speaking of EU leadership, France’s candidate for the next European Commission, Sylvie Goulard, was rejected by the European Parliament yesterday. She currently serves as the Deputy Governor at the Banque de France, and is the 3rd candidate for the next Commission to have been rejected so far in the confirmation hearings.

The Eurogroup of finance ministers also met yesterday, and agreed on a new common budget instrument, the budgetary instrument for convergence and competitiveness or BICC. However, this instrument is small at around 0.2% of GDP and draws its funding from the EU budget, so it does not represent a new fiscal commitment by European authorities. Also, Commissioner Moscovici, who has been watched for signals that the EU would allow countries to loosen their purse-strings this year, said “if there is a more marked downturn, we should not tighten our policies.” That’s an extremely tentative signal that the Commission would allow for easing if growth deteriorates further.

Looking at the day ahead, the data highlights include the final September CPI readings from Germany, while the main US release will be October’s preliminary University of Michigan sentiment indicator. Elsewhere, we’ll have the US import price index for September, as well as the Canada’s unemployment rate for September. Central bank speakers include the Fed’s Kashkari, Rosengren and Kaplan, along with the ECB’s de Guindos, Hernzndez de Cos and Costa. Finally, the winner of this year’s Nobel Peace Prize will be announced.

Tyler Durden

Fri, 10/11/2019 – 07:38

via ZeroHedge News https://ift.tt/2nB9I1B Tyler Durden