Morgan Stanley Makes A Stunning Observation: 28% Of The US Population Has FICO Score Below 650

Authored by Morgan Stanley strategists Vishwanath Tirupattur and Ellen Zentner

The strength of the US consumer has been the bedrock of the current economic expansion. Just a few weeks ago, in a CNBC interview, Fed Vice Chair Clarida said that “I cannot think of a time where in the aggregate the consumer has been in better shape.” With unemployment at 3.5%, the household savings rate ticking up to 8%, the aggregate debt-to-income ratio hovering around 40-year lows and consumer delinquencies at or near post-crisis lows, policy-makers’ comfort with the strength of the US consumer seems well grounded. As our US economics team has shown, Fed easing has lent support to consumer spending and home buying while sparking a mortgage refinancing wave that should add to disposable income over time. Annualized real consumer spending growth is tracking at 2.9% in 3Q19, and residential investment has turned upward after six straight quarters of declines.

So focusing on aggregate metrics, the strength in the US consumer seems patently obvious. But could this top-down analysis be overlooking potential sources of weakness? Since the household experience is quite different across income groups, we take a bottom-up approach to see where cracks may be appearing.

Let’s start by delving into the low aggregate consumer debt-to-income ratios and delinquency rates. Mortgages constitute about 70% of consumer debt. It’s worth noting that, post-crisis, mortgage debt has been highly constrained, producing an upward shift in mortgage credit quality – the current median FICO score of mortgage originations is over 750 versus ~700 pre-crisis. Unsurprisingly, delinquencies are low when lending in the largest segment of consumer debt is limited to high-quality borrowers. Furthermore, as homeownership rates plummeted from a pre-crisis high of 69.2% to 64.1% currently, the share of households with mortgage debt has declined. Add in sustained low interest rates, and it’s no wonder that debt-servicing rates relative to median incomes sit at multi-decade lows.

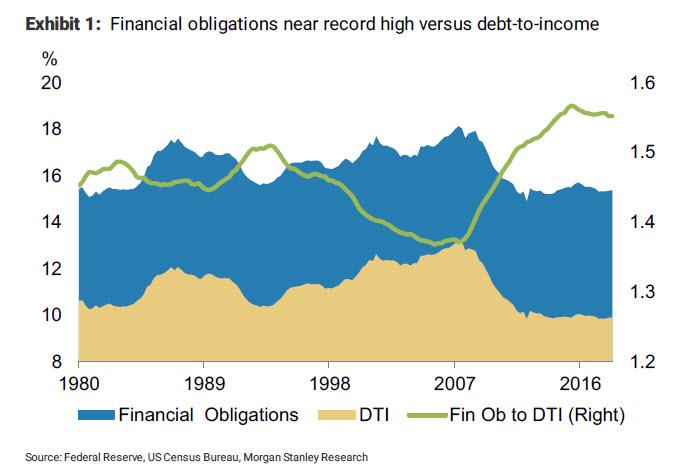

But the New York Fed’s financial obligations ratio tells a different story, as our residential credit strategists have recently demonstrated. With the decline in homeownership, the share of rental households has risen, as have rents, which are not included in aggregate debt-servicing costs. In addition to standard debt payments, the financial obligations ratio includes payments towards rent, auto leases, homeowners’ insurance and property tax payments, with rents representing the bulk of these non-standard obligations. Looking at this ratio together with debt-to-income, we can tease out the impact that increasing numbers of rental households paying progressively higher rent is having on the health of the consumer. The spread between these two ratios stands at the widest level since 1980. Renters generally tend to be younger, and at the lower end of the income spectrum versus homeowners. Aggregate consumer metrics fail to capture the growing stress on rental households.

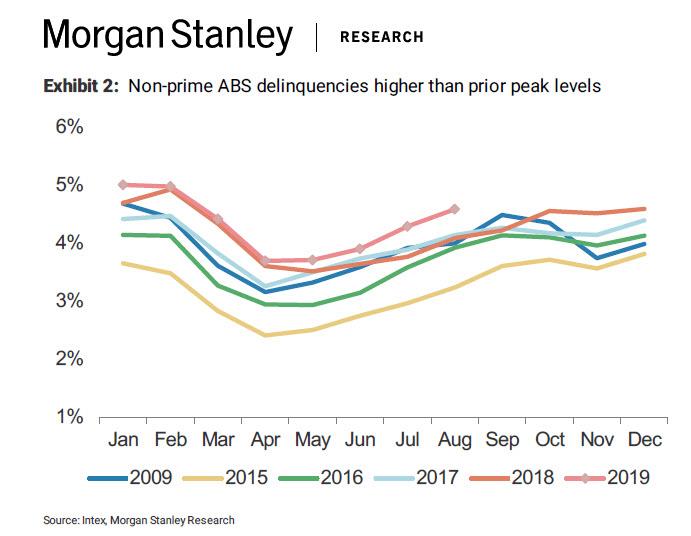

For a window into lower-income households’ finances, we focus on auto loan delinquencies in ABS pools. Lower-income households also tend to correlate well with lower credit scores. Within consumer debt, student and auto loans have grown significantly over the last several years, and the share of lower-credit borrowers getting auto loans has seen a meaningful increase. Prime auto delinquencies are at their lows for this time of year since 2014-15, as expected, but non-prime delinquencies are above crisis-era peaks. This suggests another crack in the strength of the consumer at the lower end of the credit and income spectrum.

The bottom line: While the US consumer’s balance sheet is in fine shape overall, mainly because levels of debt and debt-servicing costs remain low, there’s a segment whose income statements are under stress –rental households with lower income and lower credit scores. How big are they? Not small, at least on one metric: borrowers with FICO scores below 650 account for about 28% of the population. If the direction of gains in employment reverses, look for the cracks highlighted by our US economics, cross-asset and equity strategy teams to widen.

These cracks tend to lead an overall downturn in household creditworthiness, so we’re keeping a careful watch to see if they spread to other segments of consumer debt and eventually creep up the income chain.

Tyler Durden

Sun, 10/13/2019 – 16:51

via ZeroHedge News https://ift.tt/2VFry06 Tyler Durden